In this report, we rank our top 10 dividend-growth stocks that have recently sold off hard. We include stocks that have increased their dividend for at least 10 years in a row, and we have a special focus on the concept of “Yield on Cost” whereby stocks that appear to offer mediocre current yields actually end up paying much more income over the long term. We also share comparative data on over 100 top dividend growth stocks, followed by an explanation on why dividend growth investing is particularly attractive right now (i.e. macroeconomic conditions). After counting down our top 10 dividend growth stocks (starting with #10 and finishing with our top ideas), we conclude with an important takeaway for investors to consider.

What is Yield on Cost?

This is an important concept for long-term income-focused investors to consider. For starters, when you divide the current dividend by the current stock price, that’s the current yield. But when you divide the current dividend by the price you paid for the stock (however long ago that was), that’s yield on cost. Focusing on yield on cost helps many investors avoid yield traps and maximize the income they receive from their investments. Here is an example to help conceptualize:

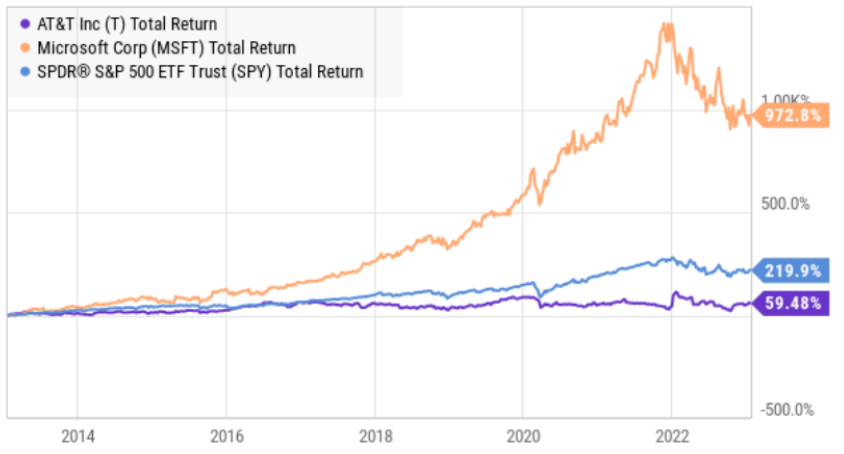

Microsoft’s (MSFT) current yield is only 1.1%, whereas AT&T’s (T) current yield is 5.8%. To some income seekers, AT&T might seem like the obvious better option. But not so fast. Ten years ago, you could have purchased one share of Microsoft and one share of AT&T for about the same price (see chart below), and if you had selected AT&T back then simply because it had a MUCH bigger dividend, you’d actually be receiving MUCH less income today. Specifically, if you bought one share of Microsoft 10 years ago, your current yield on cost would be 9.7% (impressive!), whereas if you bought one share of AT&T ten years ago—your current yield on cost would only be around 5.5%.

Furthermore, dividend-growth investors often benefit from higher total returns (i.e. share price appreciation, plus dividends reinvested) than do investors focused only on current yield. Here is a look at Microsoft’s 10-year total return as compared to AT&T’s and the S&P 500 (SPY). And as you can see, chasing after AT&T’s high yield back then has led to some serious underperformance over the last 10 years.

We tried to warn investors of the dangers of investing in AT&T years ago. For example, here is what we wrote back in 2015 (before the massive dividend cut).

At the end of the day, focusing on healthy dividend-growth stocks (and the important concept of yield on cost) can help you generate more income and better total returns. And with that backdrop in mind, let’s consider some current data.

100 Top Dividend Growth Stocks

For perspective, we’ve provided current data on over 100 dividend growth stocks (see below). The table is sorted by 1-year total returns, and includes only names that are down at least 5% (many of them much more!). Other metrics include 10-year total return, dividend payout ratio, average 10-year dividend growth, current (and forward) P/E ratios, short interest and more. All of the names in the list have increased their dividend payment for at least 10 years in a row (and many of them more).

data as of 24-Jan-23 market close, source: StockRover

A downloadable (and sortable) spreadsheet of this data is available to members here. Also, an expanded list of dividend growth stocks (including those that have posted gains over the last year, is available here.

Why Dividend Growth Stocks Now?

The pandemic “pure-growth” stock bubble has been bursting hard, and there are reasons to believe the pain is not over (we will explain). Conversely, “dividend-growth” stocks are particularly compelling in the current macroeconomic environment.

For example, pure-growth stocks soared to incredible heights as the Fed set interest rates near 0.0% during the pandemic thereby making its easy to borrow money (at low rates) to fund growth. But now as the Fed keeps hiking rates (to fight inflation), many of the young growth companies that relied on essentially free money to support their businesses are in big trouble. On the other hand, healthy dividend-growth stocks have the mature businesses and steady cash flows to easily support their businesses regardless of the Fed’s interest rate hikes.

We don’t expect interest rates to go back to 0.0% anytime soon, and it’s going to be extremely difficult for many young pure-growth companies to achieve their previous sky-high stock prices anytime soon (or ever). This is one of the big reasons we like dividend-growth stocks now (i.e. they can continue to thrive in a higher interest rate environment). Another reason we like dividend-growth stocks now is because many of them have inappropriately gotten caught up in the recent indiscriminate market sell off, thereby creating select attractive long-term contrarian buying opportunities.

Top 10 Dividend Growth Stocks, Down Big:

We begin our dividend-growth stock rankings with an honorable mention, followed by the countdown starting with #10 and finishing with our top ideas.

Honorable Mention:

H: Medical Properties Trust (MPW), Yield: 8.4%

Medical Properties Trust has been ugly over the last year as the shares are more than 40% below their 52-week high and the short interest (e.g. investors betting against the shares) was recently over 20%! We’re including MPW as an “honorable mention” on this list because it’s annual dividend has increased for the last 10 years in a row, and it does have some attractive qualities (such as a reasonable payout ratio and a very low valuation). However, the shares are NOT appropriate for the most risk averse investors (they’re simply too risky).

If you don’t know, Medical Properties Trust is “the global source for hospital capital.” Basically, it provides cash to hospitals (often those that are struggling financially) by buying their physical properties (hopefully at a low price, for MPW shareholders’ sake) so the hospitals receive the cash they need to continue (and hopefully improve) their operations.

The big problems (risks) for MPW are basically troubled hospital operators (they are struggling mightily to pay their bills) and high debt (especially now that interest rates are higher).

MPW may be worth considering if you can tolerate the volatility and if you hold it within the constructs of a prudently-diversified long-term portfolio, especially considering the improving fundamentals combined with the potential for a massive short-squeeze (i.e. short-sellers may be forced to cover as conditions improve—which would drive shares higher) and the fact that fed interest rate hikes are expected to slow and then cease this year. We recently wrote up MPW in detail (you can access that report here), but the bottom line is that MPW is NOT appropriate for the most risk averse investors, and we are including it only as an “honorable mention” in this report.

10. Digital Realty (DLR), Yield: 4.6%

Digital Realty is a data center REIT that experienced incredible growth as the digital revolution and migration to the cloud gathered tremendous momentum over the last 15 years. However, as the pandemic bubble burst, many companies that were associated with “the cloud” (including Digital Realty) sold off hard (DLR shares are down more than 30% over the last year). Furthermore, big tech companies are increasingly building their own data centers, leaving some investors overly fearful with regards to DLR’s future.

However, the digital revolution and migration to the cloud is still in the very early innings, and DLR has a lot of attractive qualities. For example, DLR’s scale makes it one of the clear leaders in the data center REIT space, and its shift toward colocation services gives it increased momentum, especially considering the company’s wide geographic offerings.

With a dividend yield of 4.6% and 10+ consecutive years of dividend increases, DLR is attractive, especially considering it’s now lower share price and that it trades at only around 18.4x Funds from Operations (“FFO”), plus it still has attractive forward growth estimates and opportunities. Fears of technologies allowing companies to do more with less space are overblow, and DLR’s future remains bright.

9. Bank of New York Mellon (BK), Yield: 3.0%

Bank of New York Mellon is mainly a custody bank, which means investment managers hold their investments at BNY Mellon. However, it also offers various fund accounting and hedge fund administration services, as well as some wealth management / investment management services too. And unlike traditional banks, only around 20% of its revenue is from interest income, thereby making it less sensitive to changing interest rate expectations.

What is attractive about BNY Mellon is its large scale, even as compared to other custody leaders like State Street (STT) and Northern Trust (NTRS). This gives it an important advantage considering margins in custody are low and economies of scale matter. Secondly, BNY Mellon benefits from an extremely sticky customer base. Specifically, it is an absolute royal pain for investment manager clients to switch custodians because of all the detailed processes and procedures in place (it would take years and be very costly for many large managers to shift to a new custodian). These are great competitive advantages for BNY Mellon.

Furthermore, BNY Mellon offers an attractive dividend yield, an attractive forward P/E ratio and offers healthy ongoing long-term growth. The company’s 10-year yield on cost is around 5.4% (not bad), and if you are an income-focused investor—the recent share price declines makes for an increasingly attractive long-term entry point

8. Apple (AAPL), Yield: 0.7%

A lot of investors still think of this mega-cap stock as a high-growth opportunity. In reality, Apple is a stable value stock with tons of cash flow, an impressive track record of dividend growth, and the shares are trading at a compelling valuation. The current yield remains low (because the share price has risen dramatically over the years), but Apple’s 10-year yield on cost is around 5.7%—impressive!

Going forward, we believe Apple will continue to thrive (and defend its high margins) thanks to its competitive advantages (i.e. premium brand and economies of scale), combined with the uniqueness of its business model (i.e. Apple is unique versus competitors because it designs and develops nearly all of its solutions, including the hardware, operating system and software, whereas competitors lead in hardware—such as Samsung (SSNLF) mobile devices—or Software—such as Google’s Android (GOOGL) operating system—but not both).

With Apple’s shares down more than 20% from their 52-week high, combined with the company’s monstrous cash flows, low dividend payout ratio, ongoing share repurchases, and attractive valuation (forward P/E) as compared to long-term revenue growth opportunities, Apple is attractive. We recently wrote up Apple in detail, and you can read that full report here.

7. Cisco Systems (CSCO), Yield: 3.2%

Founded in 1984, Cisco Systems may seem like a dinosaur to some investors, but in reality this networking company (hardware and software) remains highly relevant (and the market leader) in Internet Protocol networking solutions. In fact, customers pay a premium for Cisco, and the company’s path forward remains bright as a leader in both legacy networking and future networks.

Furthermore, Cisco’s dividend is very healthy (it has been increased for 11 years in a row, and the payout ratio remains low), and the 10-year yield on cost is an impressive 7.3%!

In our view, Cisco is attractive in the current economic environment (i.e. slowing macroeconomic growth) because of its high switching costs, sticky subscription revenue and powerful cash position. Further, it can continue to grow both organically and inorganically as its market opportunity (cloud, hybrid-cloud, security) continues to grow. The dividend adds to security during volatile markets, and the valuation suggests the shares are undervalued (perhaps related to the somewhat indiscriminate sell off in the technology sector). If you are looking for steady dividend income increases and long-term share price appreciation, Cisco Systems is attractive and worth considering for investment. We recently wrote it up in detail and you can view that report here.

6: Accenture (ACN), Yield: 1.6%

Accenture is an attractive business and technology consulting company with an impressive 10-year yield on cost of 6.2%. A lot of screeners miss the fact that Accenture has increased its annual dividend for more than 10 year straight because it switched from a semiannual to a quarterly dividend in 2019. And in addition to the powerful dividend growth, it also has powerful revenue growth and a business that is able to quickly adapt to varying macroeconomic conditions (as a consulting company, Accenture is easily able to increase or decrease its workforce to meet current market demand, plus it has almost no fixed costs—the main expense is the workforce). What’s more, Accenture provides consulting services across market industries and is able to quickly bring on subject matter experts to meet the demands of changing technologies and innovation. Accenture shares have sold off significantly, but remain attractively priced relative to the company’s ongoing long-term growth (view our previous ACN reports here). We’ve been long ACN shares since its IPO in 2001.

5: STAG Industrial (STAG), Yield: 4.2%

Stag is an industrial REIT with an impressive track record of dividend growth (its 10-year yield on cost is 7.2%). However, many industrial REITs that benefited significantly from supply chain disruption after the onset of the pandemic have now sold off hard, especially as economic growth is set to slow (i.e. recession looms).

Stag’s business was initially higher risk as its many single-tenant properties were located in secondary and tertiary locations. However, as the company has grown over the years, so has the strength of its new and existing properties. Trading at a price to FFO (Funds from Operations) of only around 16.2x is impressive relative to its ongoing long-term growth (the industrial REIT outlook is significantly stronger than office REITs and many retail REITs, for example). If you are looking for healthy dividend growth and share price appreciation potential, Stag is worth considering (view our previous Stag report here).

4. Intuit (INTU), Yield: 0.8%

Intuit is the global financial technology platform behind TurboTax, QuickBooks, MailChimp, CreditKarma and Mint. It’s also a dividend growth machine that has increased its annual dividend for 10 years in a row (its 10-year yield on cost is 5.0%), and it currently trades at an attractive valuation relative to its ongoing long-term growth opportunities. Specifically, Intuit has a nearly $300 billion addressable market opportunity (versus twelve trailing months revenue of $13.3 billion) driven by the market shift to virtual solutions, acceleration to online and omnichannel capabilities and even digital money offerings). Despite Intuit’s small current yield, the ongoing dividend growth potential is impressive and so is the ongoing revenue and earnings growth potential. We have written up Inuit multiple times in the past (view reports here), and we are currently long the shares.

3. Microsoft (MSFT), Yield: 1.1%

Despite its already massive market capitalization, Microsoft shares have dramatically more upside potential in the years ahead, and so does its dividend. As mentioned, Microsoft’s 10-year yield on cost is around 9.7%. And considering its already incredible profit margins, amazingly strong balance sheet (its one of only two publicly-traded companies with a AAA credit rating), and growing strength in the cloud (which is a massive long-term growth opportunity) business productivity and personal computing, Microsoft is attractive.

The shares are down more than 23% versus their 52-week high, and the P/E is very low versus its 5-year average, especially considering its powerful forward growth estimates and opportunities. Given its leadership, competitive advantages, dividend and valuation, Microsoft currently presents an extremely attractive long-term investment opportunity. We’ve written up MSFT multiple times in the past, and you can view those reports here. We are currently long shares of Microsoft.

2. Celanese (CE), Yield: 2.3%

Celanese is materials company. It manufactures performance engineered polymers and it is also the world's largest producer of acetic acid (and its chemical derivatives).

Like much of the economy, materials companies were impacted dramatically by pandemic disruption. In particular, lockdowns in the US and internationally caused demand to halt and share prices to plummet. However, with countries and companies continuing to reopen, and the share price still depressed, Celanese presents a highly compelling opportunity.

We recently wrote up Celanese in detail, and you can view that report here. But in a nutshell, if you are looking for an attractively priced contrarian opportunity that also pays a big growing dividend, Celanese is worth considering.

1. Medtronic (MDT), Yield: 3.3%

Medtronic is a highly profitable “wide-moat” business, currently trading at a relatively low valuation multiple, and offering 45 years of dividend increases and a current yield near all-time highs (an indication from management that the shares are undervalued, in our view).

If you don’t know, Medtronic is a medical device company. Specifically, it develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide.

Medtronic shares are more than 25% below their 52-week high as frustrated investors lose patience with the slower-than-expected pace of the post-pandemic recovery (for example, patients put off surgeries during the pandemic). However, the business remains healthy (profitable with tons of cash flow) and growth will return. We recently wrote this one up in detail, and you can review that report here. If you are an income-focused contrarian investor (that likes long-term price appreciation), this impressive dividend grower is absolutely worth considering. We are long.

Conclusion:

Dividend growth investing is often an underappreciated strategy. However, by seeking healthy growing dividends, investors can improve their long-term income (remember “yield on cost”) and total returns. The strategy is particularly attractive right now considering many “pure-growth” stocks will continue to struggle under the weight of higher interest rates, whereas many dividend-growth stocks can continue to thrive.

Every investor needs to select an investment strategy that is right for them, and dividend-growth investing may or may not be right for you. However, at the end of the day, we believe disciplined, goal-focused, long-term investing will continue to be a winning strategy.