A lot of investors still think of this mega-cap stock as a high-growth opportunity. In reality, it’s a stable value stock with an impressive track record of dividend growth, and the shares are trading at a compelling valuation. The current yield remains low because the share price has risen even faster than the dividend over the years. In this report, we review the business, competitive advantages, growth trajectory, cash flows, dividend, share repurchases, valuation and risks. We conclude with our opinion on who might want to invest.

Overview: Apple Inc. (AAPL), Yield: 0.7%

Apple designs, manufactures and markets smartphones (iPhones), personal computers (Macs), tablets (iPads), wearables and accessories (e.g. Beats, Apple Watches, AirPods), and sells a variety of related services (including advertising, AppleCare, cloud services, digital content and payment services). Customers are primarily in the consumer, small and mid-sized business, education, enterprise and government markets.

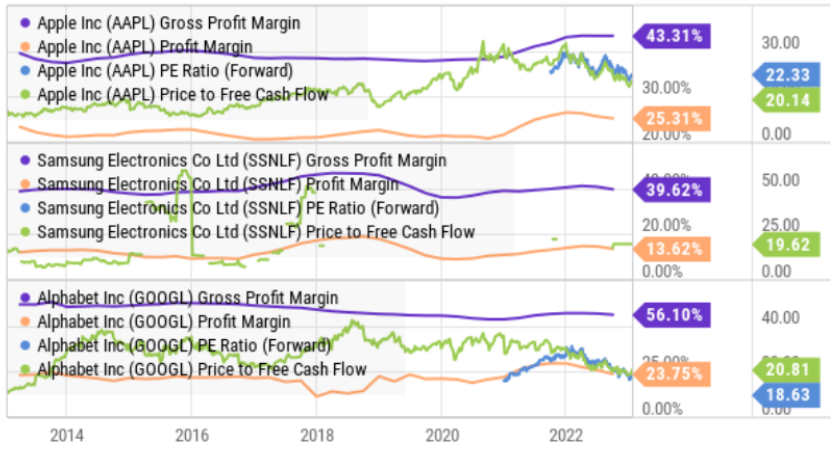

Apple is unique versus competitors because it designs and develops nearly all of its solutions, including the hardware, operating system and software. Competitors, lead in hardware (such as Samsung mobile devices) or Software (such as Google’s Android operating system), but not both.

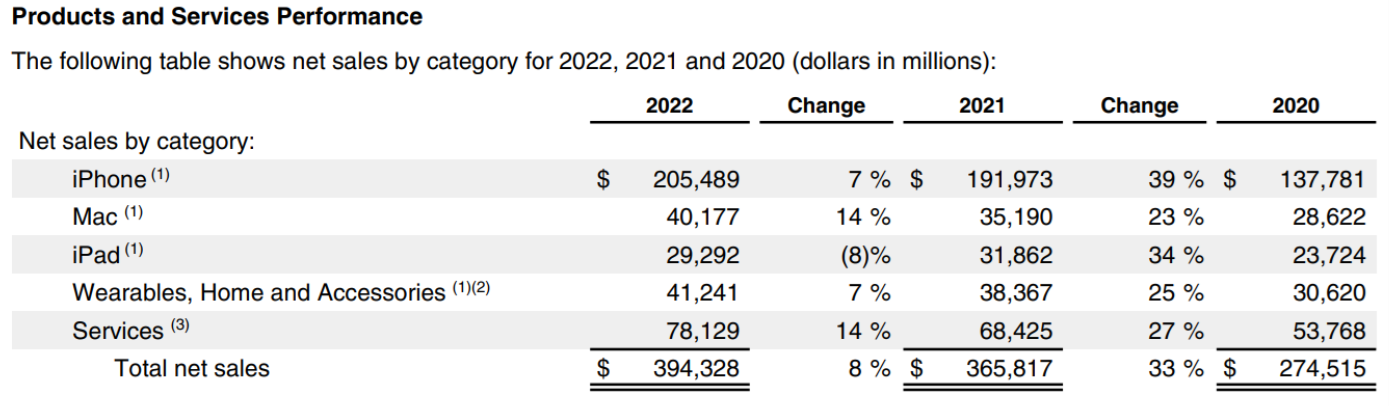

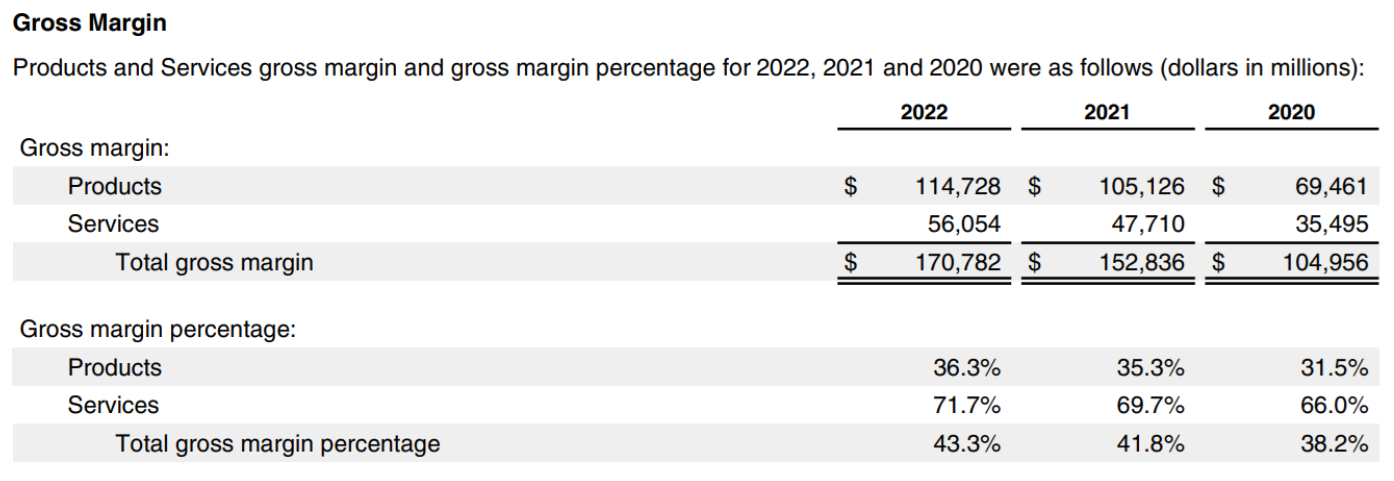

Apple offers premium products (see high margins above), whereas many of its competitors seek to compete primarily through aggressive pricing and very low cost structures. Markets for Apple’s products and services are highly competitive (resulting in downward pressure on margins) and characterized by frequent new product and service introductions, short product life cycles and rapid adoption of technological advancements. Like other large peers, Apple benefits from economies of scale, thereby keeping its R&D, SG&A and total operating expenses relatively low as a percent of its total sales (see below).

Competitive Advantage: Brand, Pricing Power

Apple’s premium brand allows for its products to be sold at a higher price point than competitor products. We believe this premium brand provides a sustainable competitive advantage. Apple customer satisfaction is extremely high, and the ecosystem of products makes it harder for customers to switch to a new brand. We believe this is a sustainable competitive advantage that will benefit Apple for years, thereby allowing it to maintain its high margins (described earlier).

Revenue Growth:

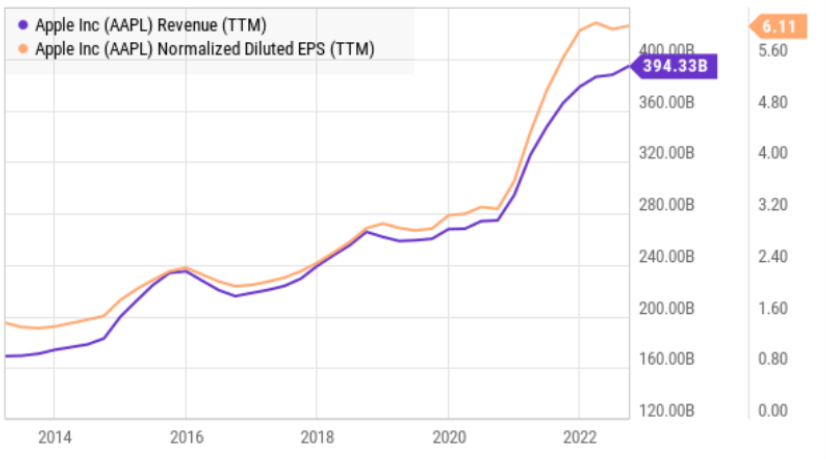

Apple has achieved impressive revenue growth over the years (most recently thanks to the success of the iPhone franchise, as well as constant innovatation and features), however current 2023 estimates are lackluster (coming in at around 2.5% revenue growth).

In our view, Apple will face challenges in the near-term stemming from slower macroeconomic growth (i.e. recession looming). However, it is somewhat encouraging (from a contrarian standpoint) to see street estimates have already been lowered, thereby keeping expectations relatively tame. For example, over the last three months, earnings revisions have been largely negative (34 down revisions, versus only three upward revisions from Wall Street analysts).

However, over the long-term, we believe the strength of the franchise, combined with plenty of cash flow to easily support R&D, will allow innovation and growth to persist.

Cash, Dividends and Share Repurchases:

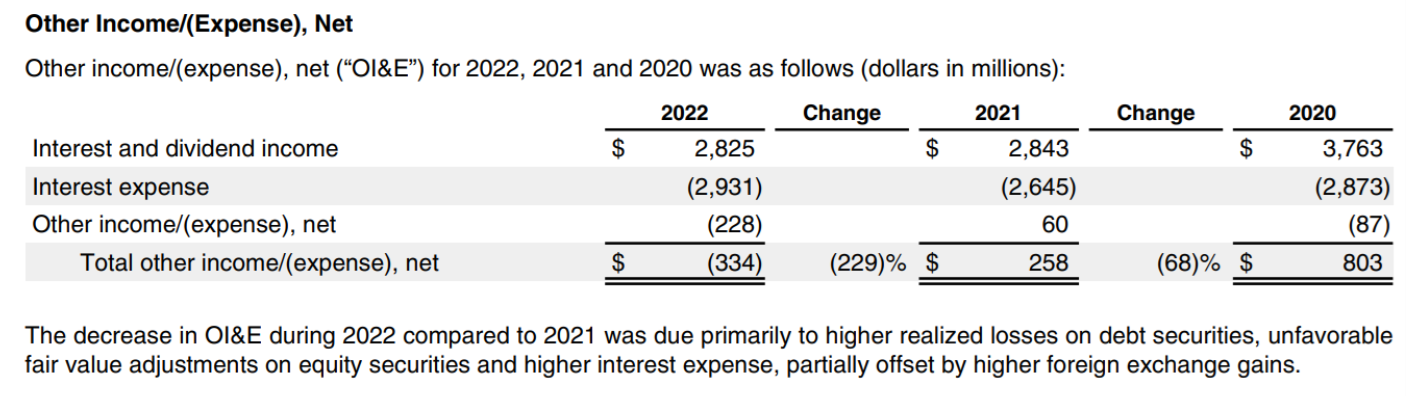

Apple currently has significant cash and liquidity on its balance sheet, including $156.4 billion of cash, cash equivalents and unrestricted marketable securities at the end of fiscal Q4 (versus around $154 billion of current liabilities). Further, the company’s interest expense is largely offset by the interest and dividend income the company receives.

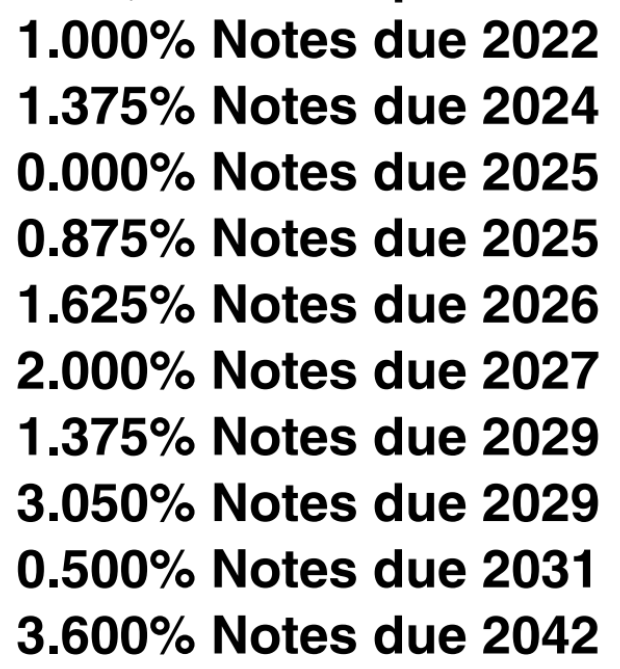

Not to mention, Apple’s AA+ credit rating (from S&P Global) has allowed the company to borrow at very low interest rates (see below).

Apple is positioned much better than many technology sector companies in the current macroeconomic environment (e.g. higher interest rates), particularly better than those with more debt and lower credit ratings (especially considering Apple’s strong cash flows and cash position). Whereas others may struggle with liquidity and higher borrowing costs, Apple is in great shape to thrive.

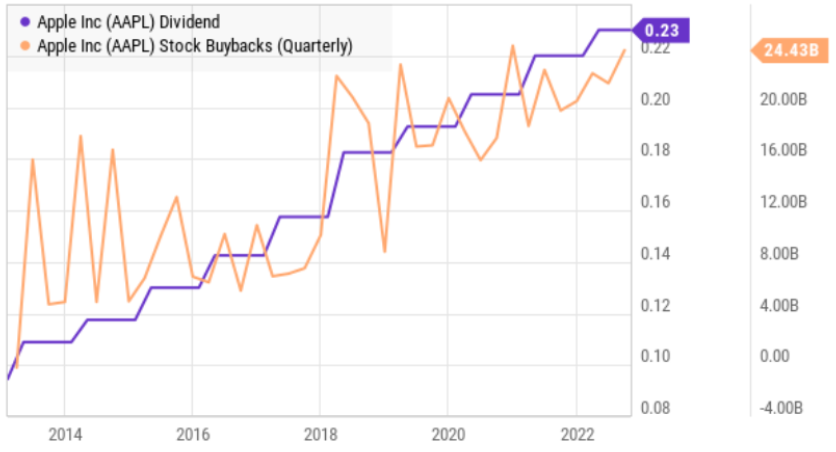

And perhaps one of Apple’s most underappreciated qualities is its powerful dividend growth. Not only has the dividend been increased every year over the last decade, but the actually payout has steadily doubled. The current yield is mathematically low because the share price has also grown rapidly as compared to the growing dividend payout.

Further still, Apple returns more cash to shareholders by buying back shares.

Valuation:

Apple is currently the largest publicly-traded company with a market cap of over $2 trillion. The shares currently trade at 22.3x forward earnings estimates, which is reasonable in the technology sector, especially considering the company’s sustainable competitive advantages (brand, ecosystem and economies of scale).

For some perspective, of the 45 Wall Street analysts covering the shares, 26 rate Apple a “strong buy,” seven rate it a “buy” and eight more rate it a “hold.” And according to a January 20th note from Morningstar Strategist Abhinav Davuluri (Abhinav has a buy rating on the shares):

“Our fair value estimate is $150 per share. Our estimate implies a forward GAAP price/earnings ratio of 24 times. In fiscal 2023, we expect total revenue to be up 3% thanks to strength in iPhone, wearables, and services sales, partially offset by weaker Mac and iPad revenue following multiple strong years associated with work- and learning-from-home trends due to COVID-19.”

Also worth mentioning, Apple continues to generate very strong returns on equity, assets and invested capital.

Risk Factors:

Of course Apple does face risk factors, as we have described below.

Competition: While Apple customers tend to be very loyal and report extremely high satisfaction rates, Apple may still be only a few bad releases away from losing market share to competitors, as customers constantly seek new technological innovation and features. We don’t expect this, but it remains a possibility considering fierce industry competition.

Supply Chain Risks: Essential components for Apple products are generally available from multiple sources, but some are available from a limited or single source. Additionally, commoditized components can be subject to significant market price volatility and swings. Supply chain disruptions would negatively impact the company and remain a risk factor.

International Manufacturing: Substantially all of Apple’s hardware products are manufactured by outsourcing partners that are located primarily in Asia, with some Mac computers manufactured in the U.S. and Ireland.

Conclusion:

In the short-term, Apple may face continued headwinds based on the looming recessionary environment. But over the long-term, we expect the shares are going much higher and the dividend is likely to keep growing significantly too. If you already own shares, hang on. If the shares fall in the short term, buy more. Apple is not a high-growth stock, it’s an attractively valued and significantly underappreciated dividend growth stock with a bright future. We are currently long shares of Apple with no intention of selling anytime soon.