With the Fed set to raise interest rates another 75 basis points on Wednesday (following its 2-day open market committee meeting which kicks off today), it’s worthwhile to revisit big-dividend BDC and how they are impacted by rising rates. This note shares data on how many of the most popular publicly-traded BDCs are impacted differently by rising rates depending on the structure of their balance sheets (floating-versus-fixed-rate assets and liabilities, as well as leverage levels). We also highlight a few of our favorite BDCs (two we own and one we are considering) that yield 9.1%, 10.0% and 10.2%, respectively.

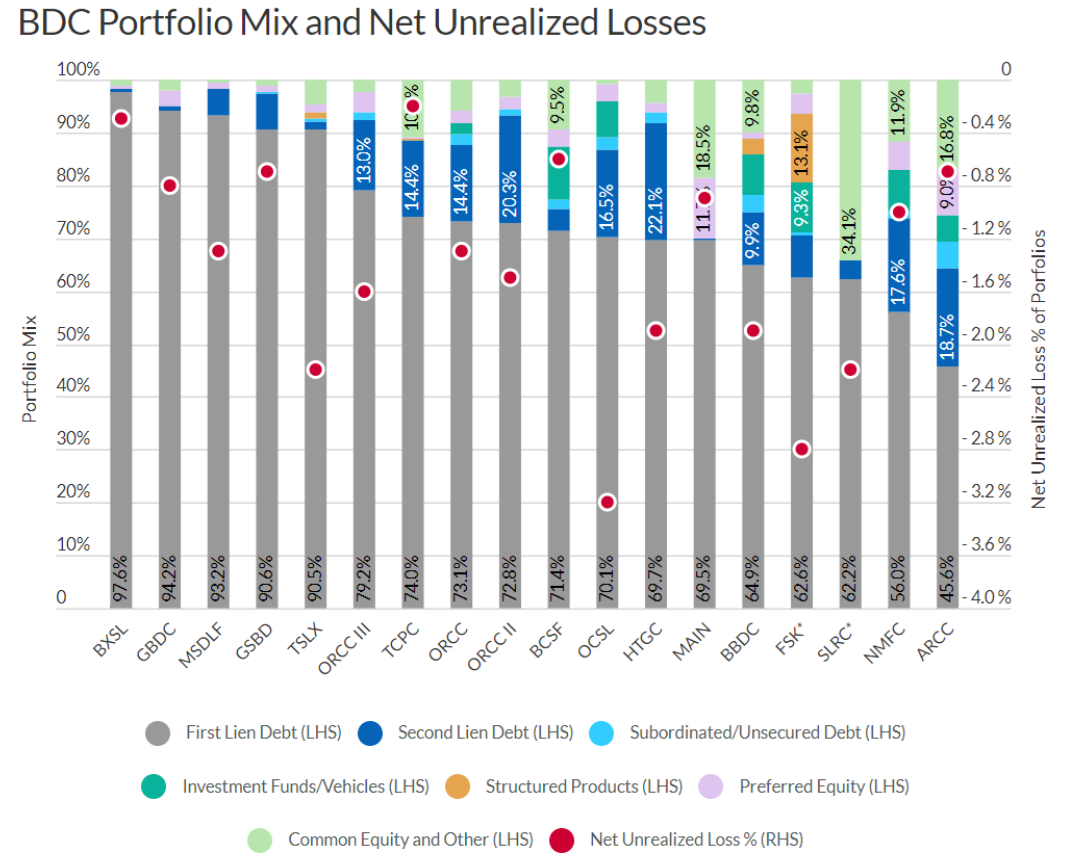

BDC Portfolio Mix

For starters, here is a look at the composition of balance sheet investments owned by many popular BDCs. You likely see many names you know.

For example well-know BDC Ares Capital (ARCC) has among the most diverse types of assets, whereas Blackstone (BXSL) has among the highest level of first lien debt. First lien is safe tan second lien and equity, and can be a good thing during times of increasing market volatility and stress.

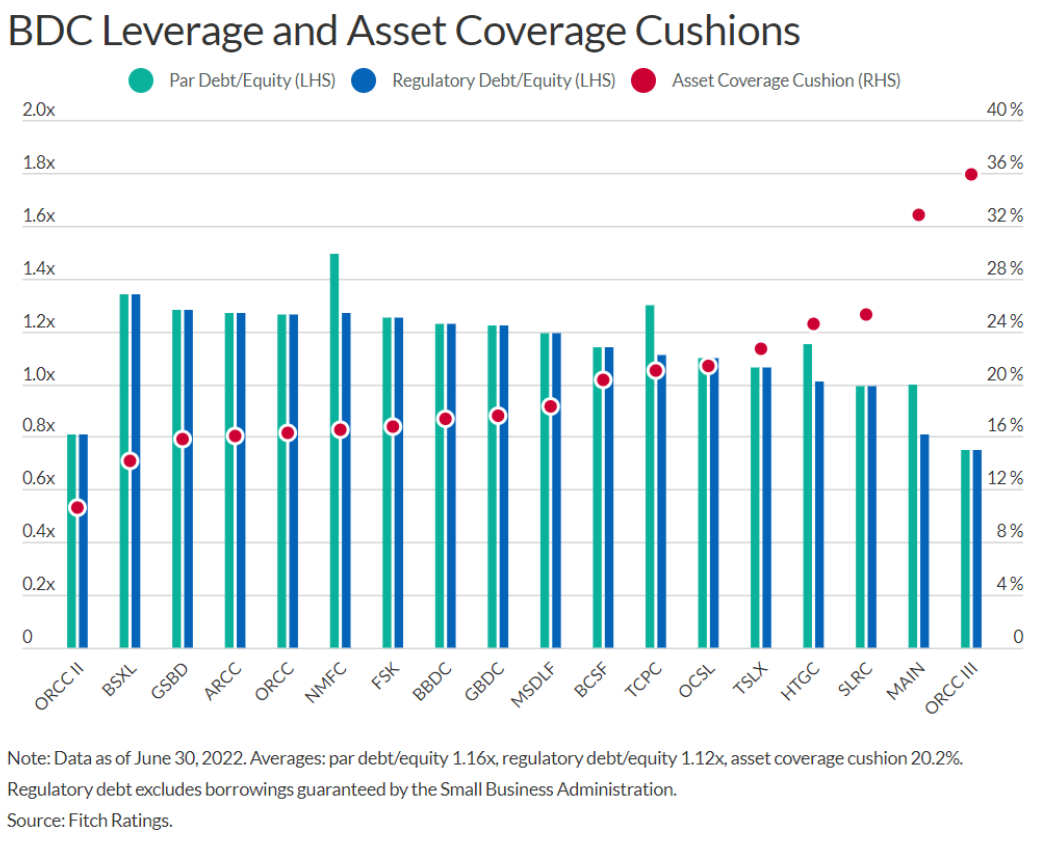

More specifically, you can see in this next chart how much leverage and asset cushion these BDCs have.

There are regulatory leverage limits (around 200%), and if asset values fall during times of market stress then leverage levels rise.

How BDCs are impacted by Interest Rate Hikes

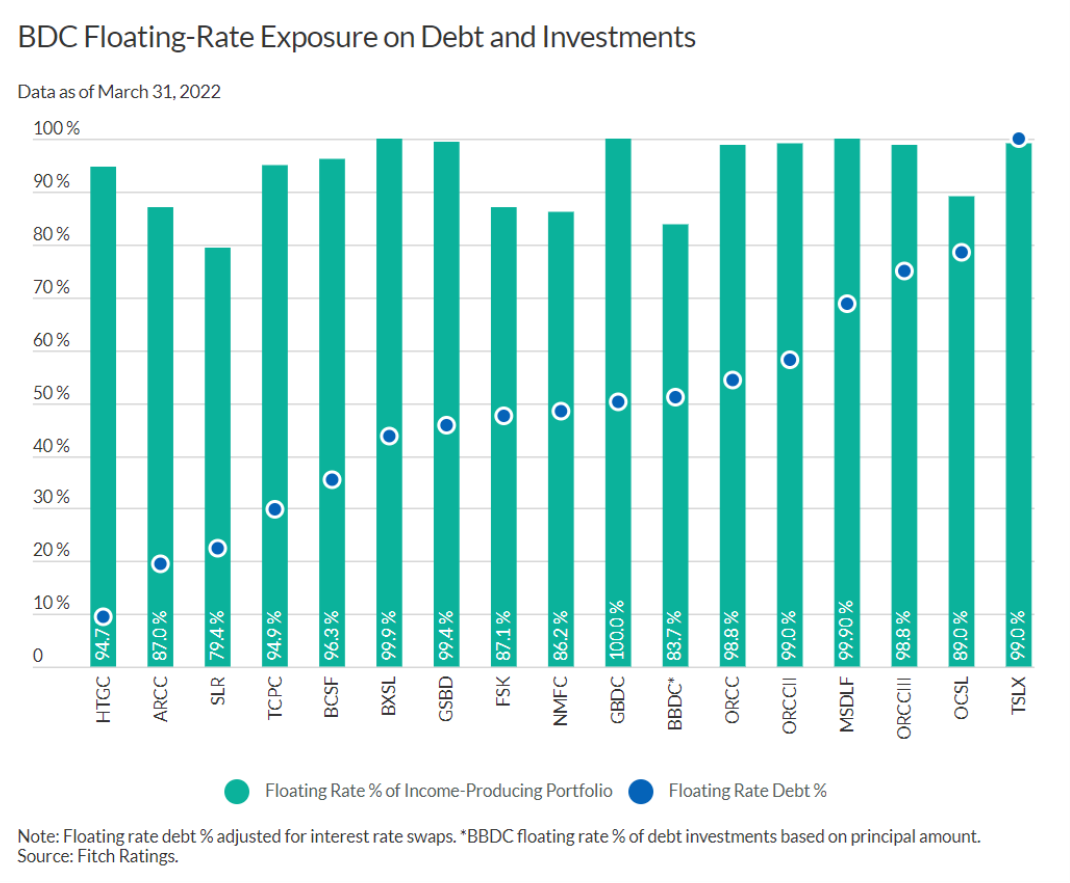

Generally speaking, as interest rates rise, BDCs earn more money because their net interest margins rise (i.e. the rate of return they earn minus the rate they pay to borrow). However, not all BDCs are impacted the same by rising rates, and here is a look at the percentages of floating rate assets versus floating rate liabilities for differing BDCs

As you can see, Hercules (HTGC) has a very low amount of floating rate debt (a good thing as rates rise) and a very high amount of floating rate investments (also a good thing as rates rise).

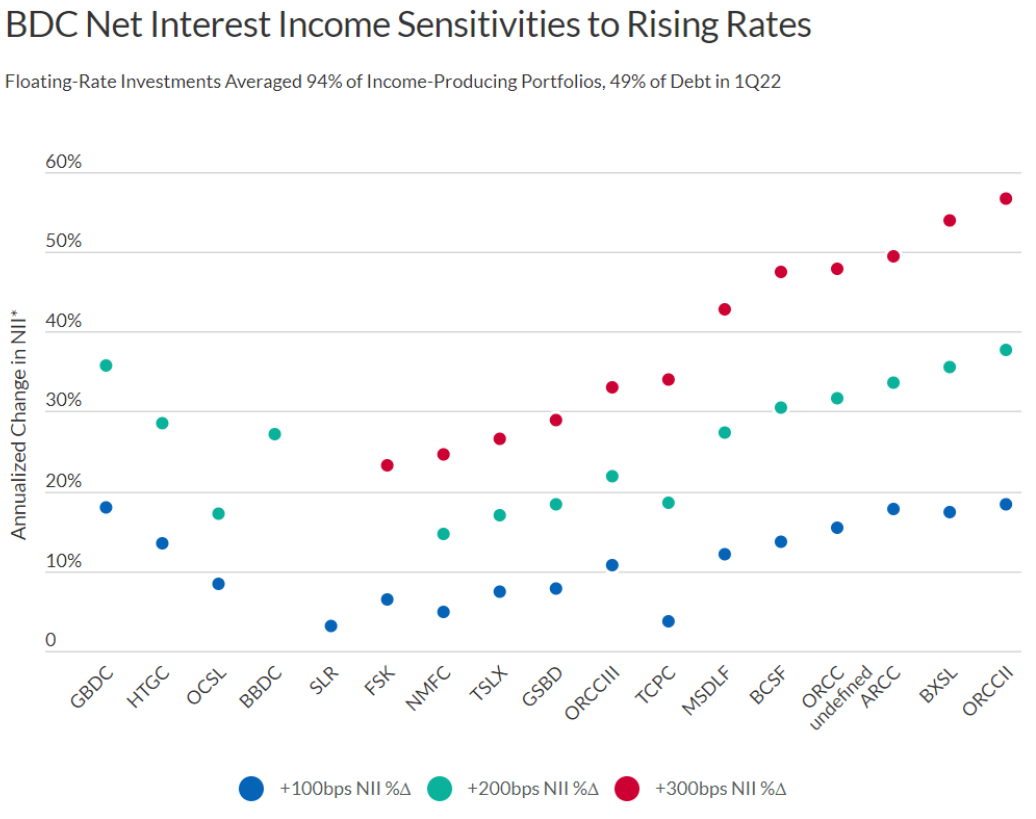

However, there are different factors impacting profits, and here is a look at how varying BDCs are impacted by differing amounts of interest rate hikes.

As you can see, Hercules (HTGC) is again impacted relatively positively as rates rise by different levels. Other names that are particularly positively impacted are Owl Rock (ORCC) and Ares Capital (ARCC).

The Bottom Line

As interest rates rise, BDCs are impacted positively, although by varying levels. The downside risk is that as the Fed keeps hiking they run the risk of driving the market into a deep recession which would increase defaults by BDC investments (a bad thing). And even though we expect more NAV write downs are market stress rises, the good news is that BDCs have significant asset coverage cushion (they can withstand more stress as rates rise) as per our earlier chart. We continue to own both Ares Capital (ARCC) and OwlRock (ORCC) in our Income Equity Portfolio, and Hercules (HTGC) is also high on our watchlist for a potential new purchase. These BDC currently yield an attractive 9.1% (ARCC), 10.0% (ORCC) and 10.2% (HTGC), respective. And they can be an important part of a prudently-diversified high-income investment portfolio.

Note: Read our recent report on HTGC here.

View all of our Income Equity Portfolio holdings here.