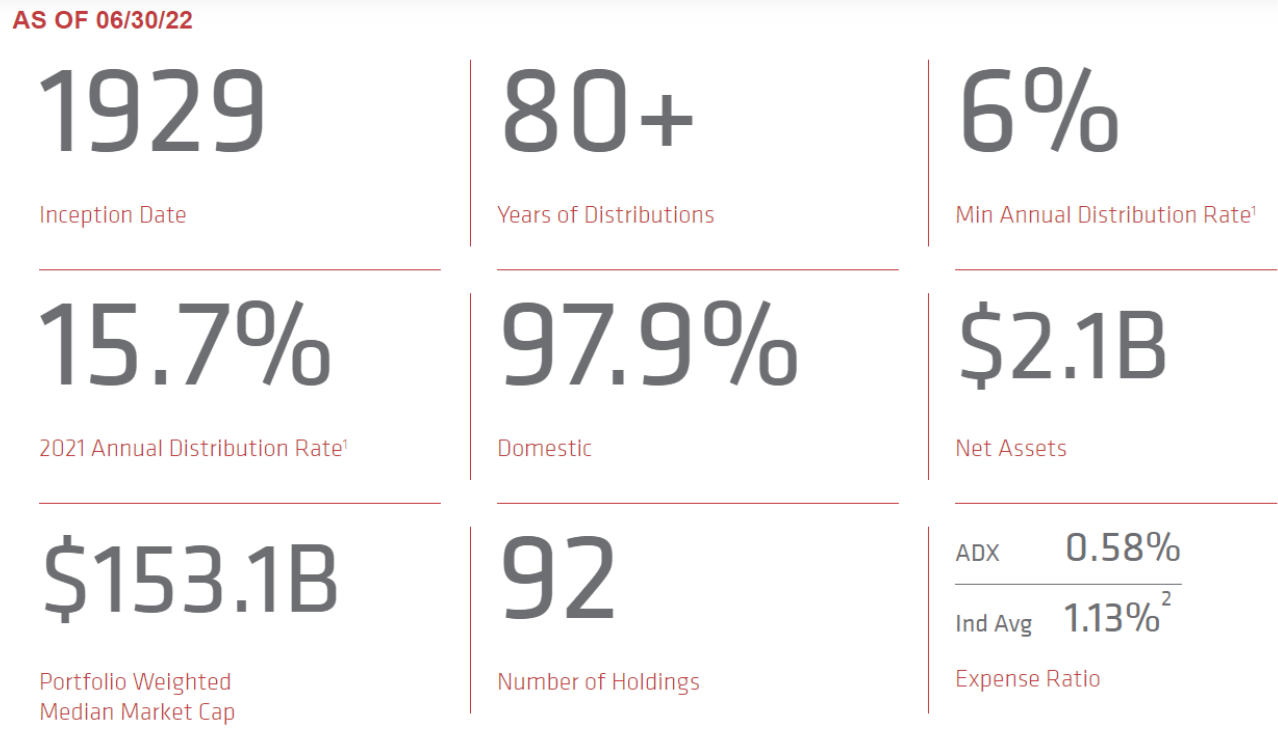

When the market falls, just keep buying more. That’s one of the best strategies a long-term investor can follow, and one of the best ways to implement it is through the Adams Diversified Equity Fund (ADX). This attractive closed-end fund (“CEF”) trades at a compelling 14% discount to its net asset value (“NAV”), and it guarantees at least a 6% distribution yield each year. What’s more, it has been paying big distributions to investors for over 80 years straight, and it has an impressive long-term track record of outperforming the S&P 500 (net of fees). We review all the details in this report, and then conclude with our strong opinion on investing.

Overview:

Per the company’s website, ADX seeks to deliver superior returns over time by investing in a broadly-diversified equity portfolio. More specifically, the fund invests in a blend of high-quality, large-cap companies (see top 10 holdings below), and seeks to generate returns that exceed its benchmark, as well as consistently distribute dividend income and capital gains to shareholders.

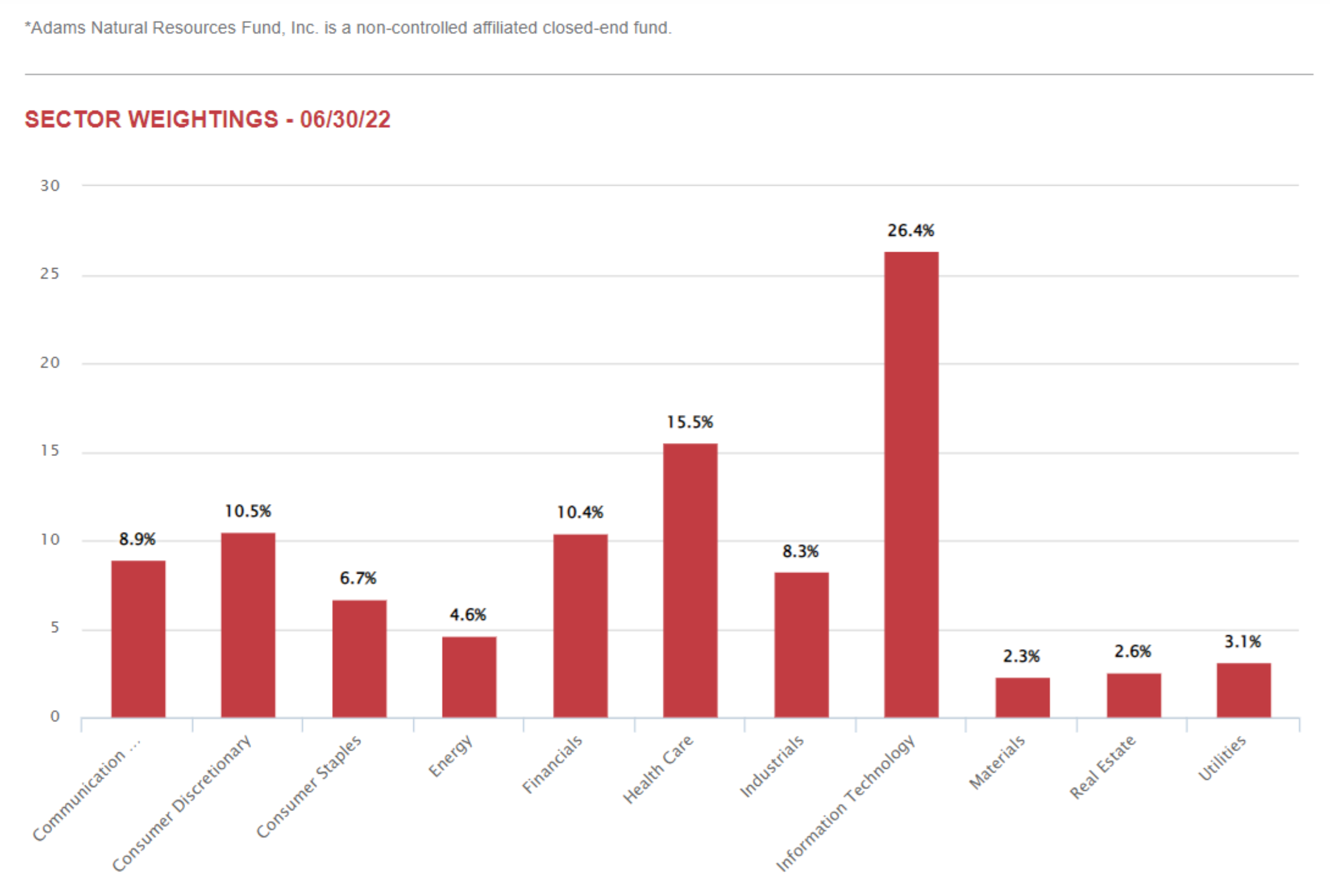

And for more perspective, here is a look at the fund’s recent sector diversification, which is somewhat similar to these sectors weights in the S&P 500 index.

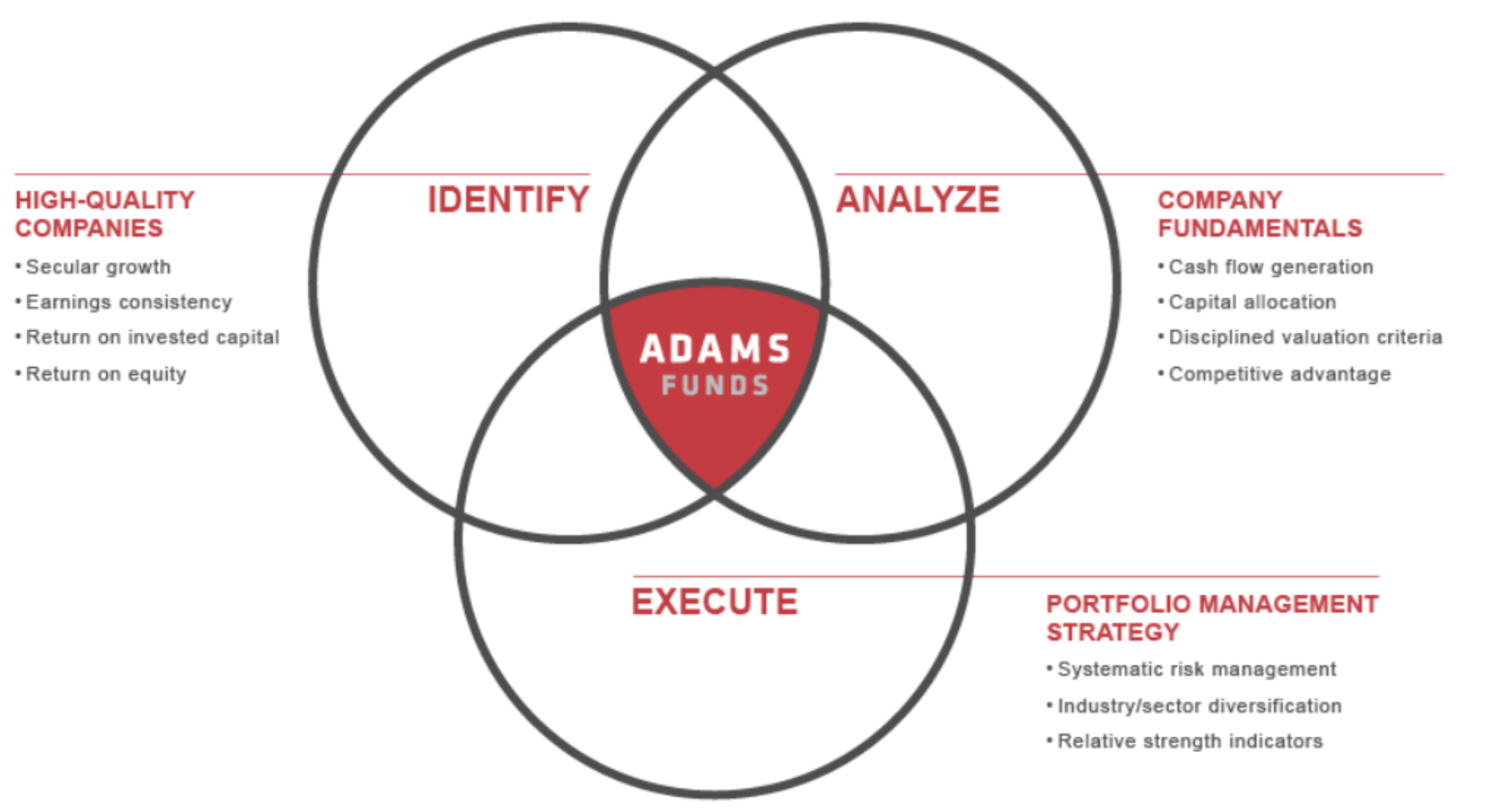

Further, the ADX investment process is disciplined and consists of three core tenets: Identifying high-quality companies through a proprietary research process; employing rigorous analysis to assess company fundamentals and executing a portfolio management strategy that focuses on generating long-term capital appreciation with careful attention to risk management.

Attractively Discounted CEF Price:

Unlike most mutual funds and exchange traded funds, closed-end funds (such as ADX) generally cannot create new shares (i.e. they are closed-end) and therefore can trade at significant premiums and discounts to their NAVs (based on market supply and demand) thereby creating significant risks and opportunities.

Generally, we greatly prefer to purchase CEFs at discounted prices versus their NAV because it means we are getting to own the underlying holdings at a discounted price. And in the case of ADX, it currently trades at a large 14.1% discount to NAV. This is not unusual for ADX, but it is still very attractive (because we get access to the earnings and dividend power of the underlying holdings at a significantly discounted price). For example, here is a look at the size of ADX’s price discount versus NAV over the last 5 years.

Minimum 6% Distribution Yield

ADX guarantees a minimum annual distribution yield of at least 6% and it is often more. For example, as you can see in our earlier graphic, the 2021 distribution yield was a whopping 15.7%. And as mentioned, ADX has been paying big distributions for over 80 years straight. However, there are a few things you need to understand about the distribution.

First, ADX pays quarterly distributions, and the distribution in the first three calendar quarters of each year are smaller, followed by a larger distribution in the fourth quarter that brings the annual distribution up to at least 6%. Because of this nuance, many websites often incorrectly report the ADX yield as smaller (because they are incorrectly basing it on only one of the most recent quarterly distributions instead of the aggregate annual distribution).

The next thing you need to know is that the distribution is not based only on the dividends of the underlying holdings, but also can be based on capital gains (short-term and/or long-term and a return of capital. You can see the recent breakdown in the following table.

This breakdown is important because it can impact the annual taxes you pay on distributions. For example, a lot of the dividends are taxed at the lower qualified rate and long-term gains can be taxed at a lower rate than short-term gains. Further, a return of capital can act to reduce your taxable cost basis thereby increasing your capital gains tax if/when you do sell shares. All this information is conveniently provided to your in the annual tax form, and it is good to see the ADX management team prudently manage the distribution sources.

Reinvest the Distributions

Some investors choose to receive the distributions in cash (which can be very nice), while others choose to reinvest the distributions to help their total ADX investment grow over time. And on of the great things about reinvesting the distribution is that you get to reinvest it to buy more shares at a significantly discounted price (remember ADX currently trades at an attractive 14.1% discounted market price versus its NAV).

Outstanding Long-Term Performance

Most actively managed funds are not able to outperform the S&P 500 over the long-term, but as you can see in the following chart, ADX has an outstanding long-term track record of outperforming the S&P 500.

The outperformance holds true over many different time periods, and significant contributors are the attractive price discount (which exists almost always) and the strong management team.

Attractive Low Expense Ratio:

Importantly, the fund’s strong performance is net of expenses. As you can see in our earlier graphic, ADX’s annual expense ratio was recently only 0.58%, which is low and compares favorably to the industry average of 1.13%.

Don’t Try to Time the Market:

One of the things we really appreciate about ADX is the management team’s long-term investment approach. For example, according portfolio manager, Mark Stoeckle, it’s important to stay invested and not try to time the market, especially when the market gets bumpy like it has this year. According to recent June 13th article Stoeckle: “a bedrock principle of sound investing is never let fear dictate your long-term strategy.” He also noted the following:

Over the past year through the end of May, the broad stock market is down less than 1% even after factoring in the recent sell-off.

Over the past three years, the market is still up nearly 60%.

And over the past decade, stocks have returned roughly 280% (which works out to an average of about 14% a year), nearly quadrupling investors’ money.

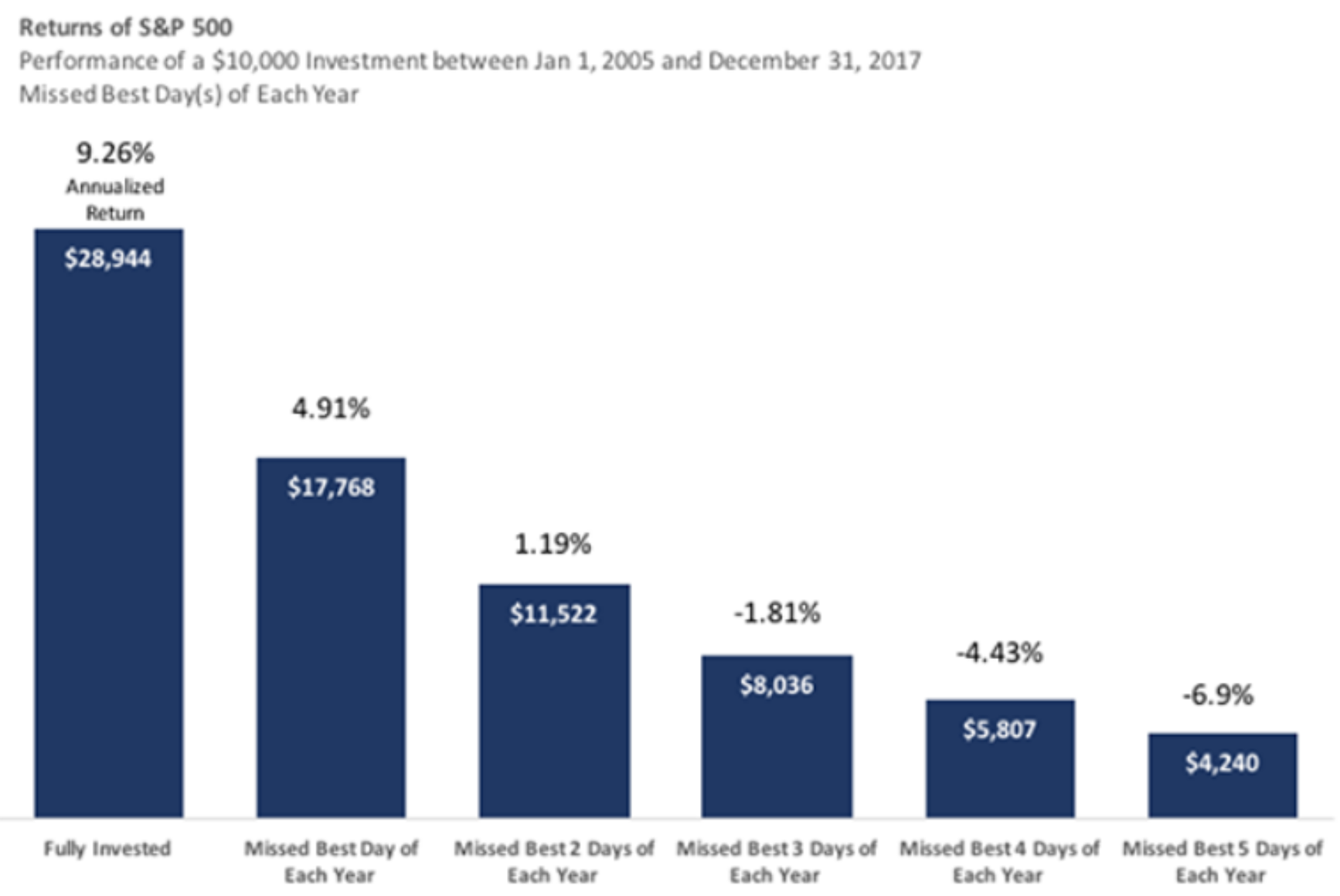

And if the above points are not a good enough reason, here is what can happen when you try to time the market in the short term:

Specifically, the above graphic shows how badly your longer-term returns can suffer if you miss even 1, 2 or 3 of the best performing days for the market (e.g. the S&P 500) each year. It’s simply generally a much better strategy to avoid trying to time the market in the short term. Just stay invested. Or, if you are consistently reinvesting your distributions, just keep buying more!

The Bottom Line

When the market falls (like it has this year) just keep buying more. And one great way to do that is by consistently reinvesting the big distributions paid by the Adams Diversified Equity Fund. In fact, the big distributions (it yields 6% and often much more), attractive management team, impressive long-term track record and huge 14% price discount (versus NAV) are a few of the reasons we selected it as one of our top ideas in our recent report on over 150 big yield CEFs. And while we openly admit ADX may or may not be right for you, we strongly recommend that long-term investors don’t panic over this year’s market declines, but rather stay invested and perhaps even consider using this year’s declines as an attractive opportunity to just keep buying more.