There is a lot to like about this attractive electrical components stock that we first wrote about back in 2015. For example, it is highly profitable, growing rapidly, has a large Total Addressable Market (“TAM”) opportunity and the shares are currently on sale because short-minded investors are incorrectly extrapolating short-term revenue growth estimates (due to a tough comp and the market cycle) and not seeing the long-term secular trend remains firmly intact.

Power Integrations (POWI)

Based out of San Jose, CA (and with operations around the globe), Power Integrations designs, develops, manufactures, and markets analog and mixed-signal integrated circuits (ICs), and other electronic components used in high-voltage power conversion worldwide.

Long-Term Secular Growth Drivers:

Power Integrations is a leader in the industry (thanks to its ultra simple power converters, competitive cost structure and high level of energy efficiency), and the company will continue to benefit from attractive long-term secular growth drivers, including:

Ongoing transition to highly integrated power supplies

Integration saves labor and materials, improves reliability

Enabler of reduced carbon emissions

EcoSmart™ technology saves equivalent of about 1.9M homes’ electricity usage each year by reducing standby consumption in electronics and appliances

Strong presence in renewable energy, electric transportation, efficient high-voltage DC transmission

Gallium-nitride (GaN) technology expands dollar content, increases efficiency

Expanding high-voltage market opportunity – SAM up ~3x since 2010

Advanced chargers for smartphones, tablets, notebooks

Home & building automation / smart lighting and appliances / IoT / smart utility meters

Electrification of tools and transportation

BridgeSwitch™ motor-drive ICs expand appliance SAM

LED lighting

Sizeable opportunity in electric vehicles

The company estimates its TAM to be $4 billion, whereas its total revenue over the last year was only $703 million.

High Profit Margins

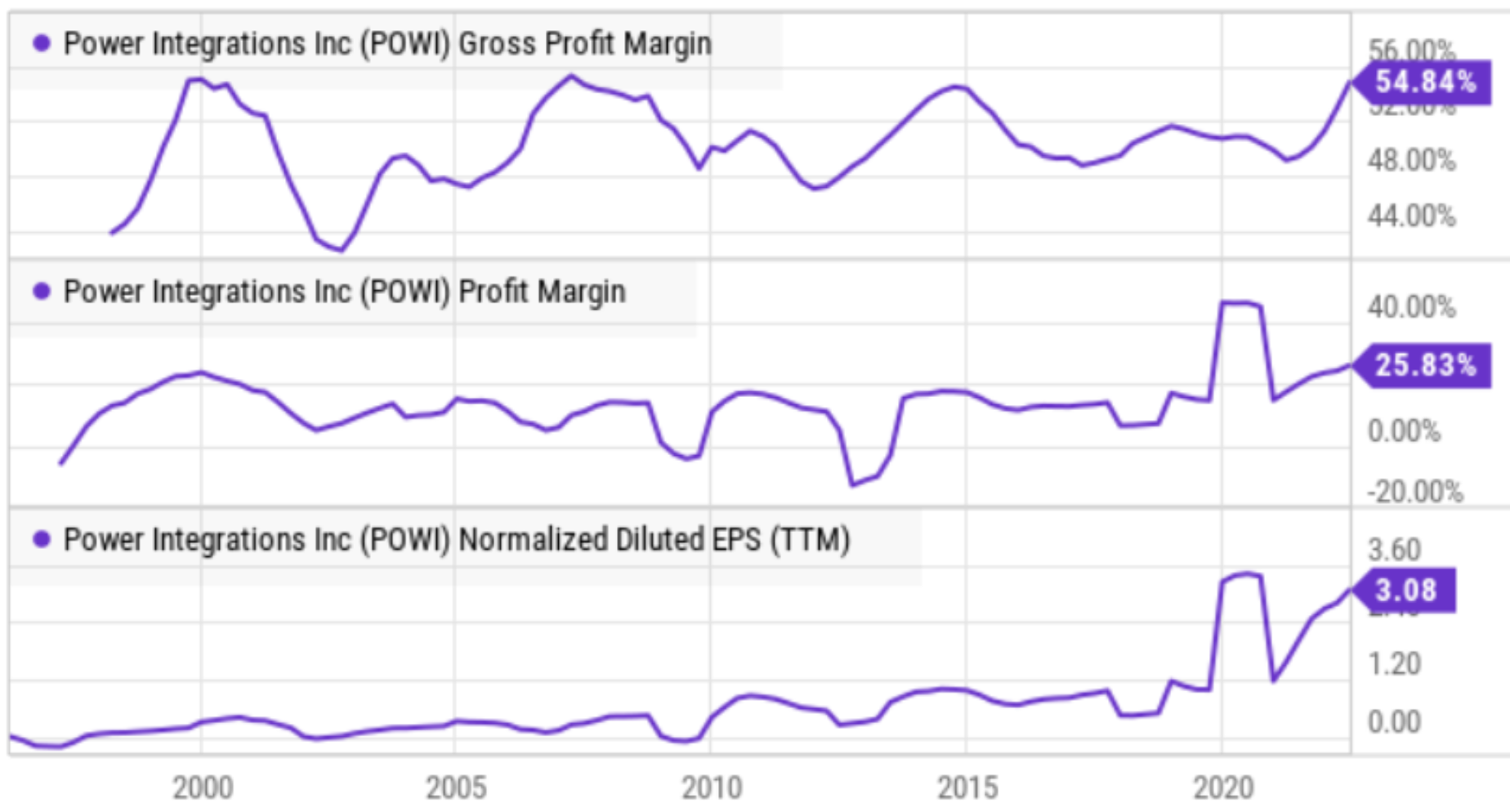

Importantly, POWI is already a highly profitable business. For example, as you can see in the charts below, POWI has very strong gross margins, healthy bottom line net profit margins, and earnings per share has continued to increase over time.

Compelling Valuation:

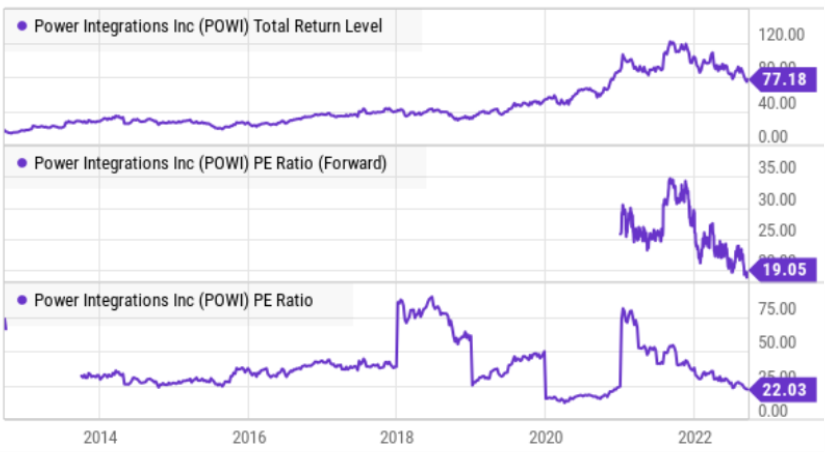

As you can see in this next chart, Power Integrations’ shares have delivered strong returns over the years, however they have pulled back significantly over the last year, thereby making for in increasingly attractive entry point based on the price-to-earnings ratio.

Of course a big reason why we believe a forward P/E of 19.05x is so attractive (even though it is slightly higher than the market average) is because Power Integrations’ long-term growth trajectory is considerably higher than the overall market (thanks to the secular trends and large TAM, as discussed previously).

Market Cycle Fear:

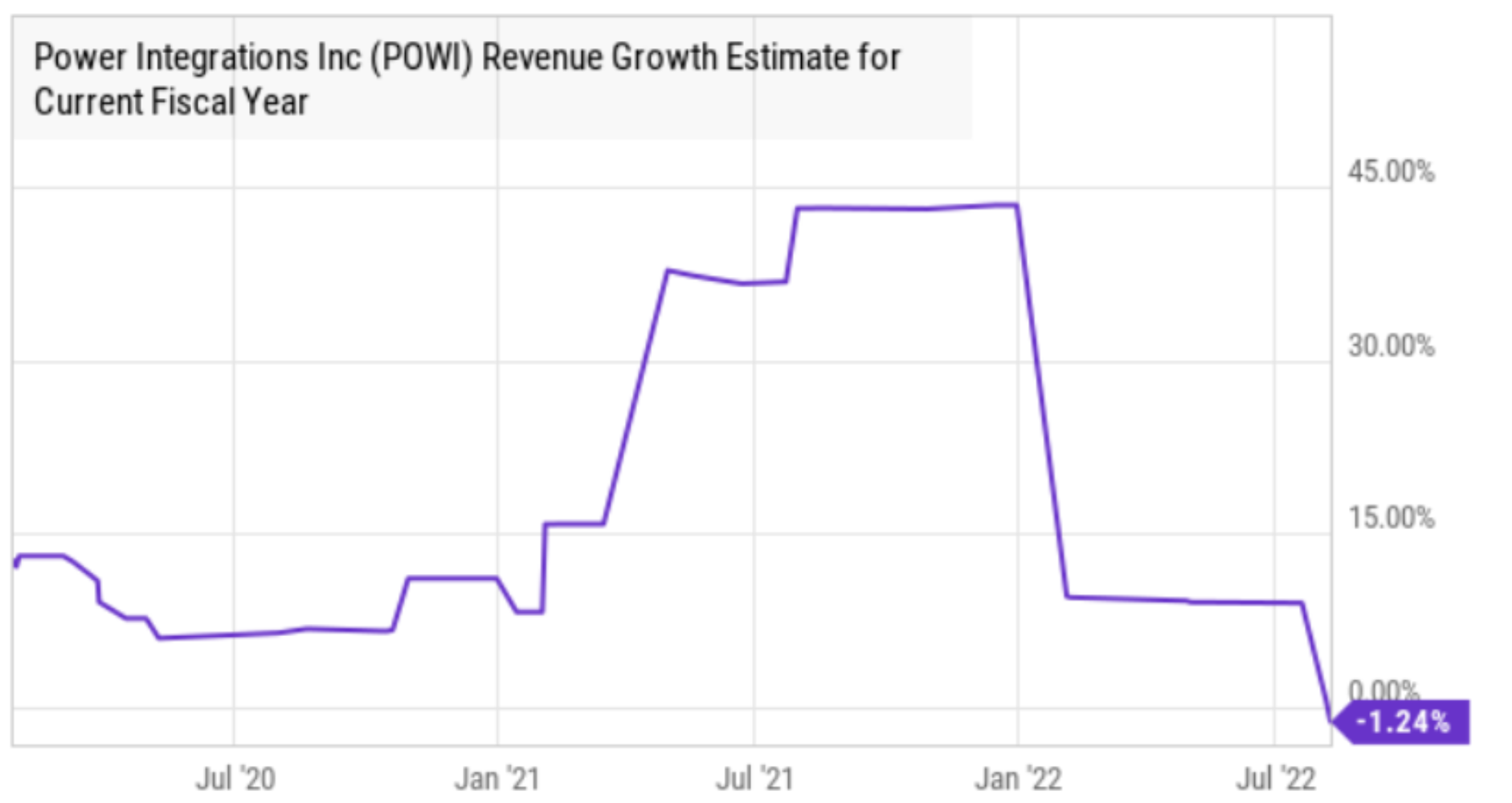

The shares have sold off this year because as the Fed hikes interest rates that slows the economy. What’s more, a short-sighted look at POWI’s growth rate has been a cause for concern for some investors. Specifically, as you can see in the chart below, the expected revenue growth rate for this year is actually slightly negative.

And according to CEO, Balu Balakrishnan, on the last quarterly earnings call:

In summary, while the near-term demand environment is challenging and uncertain, we have a playbook that has served us well in the past economic cyclical downturns. We intend to follow it again here, focusing on winning market share and bringing innovative products to market so we can come out stronger at the other end.

How long (and deep) the current market cycle will be is unknown, but the market will begin to recover long before the economy does, and it can make a lot of sense to buy good business when they are less expensive (like POWI is now) and then hold on for the rebound and the continue secular growth in the years ahead. The real money in investing is made over the long-term.

Further, revenue growth is simply not perfectly smooth, in comes in lumpy batches, and 2021 was a big revenue growth year thereby created a difficult revenue growth comp for 2021.

Nonetheless, the long-term revenue growth trajectory remains intact and the shares are currently relatively quite inexpensive.

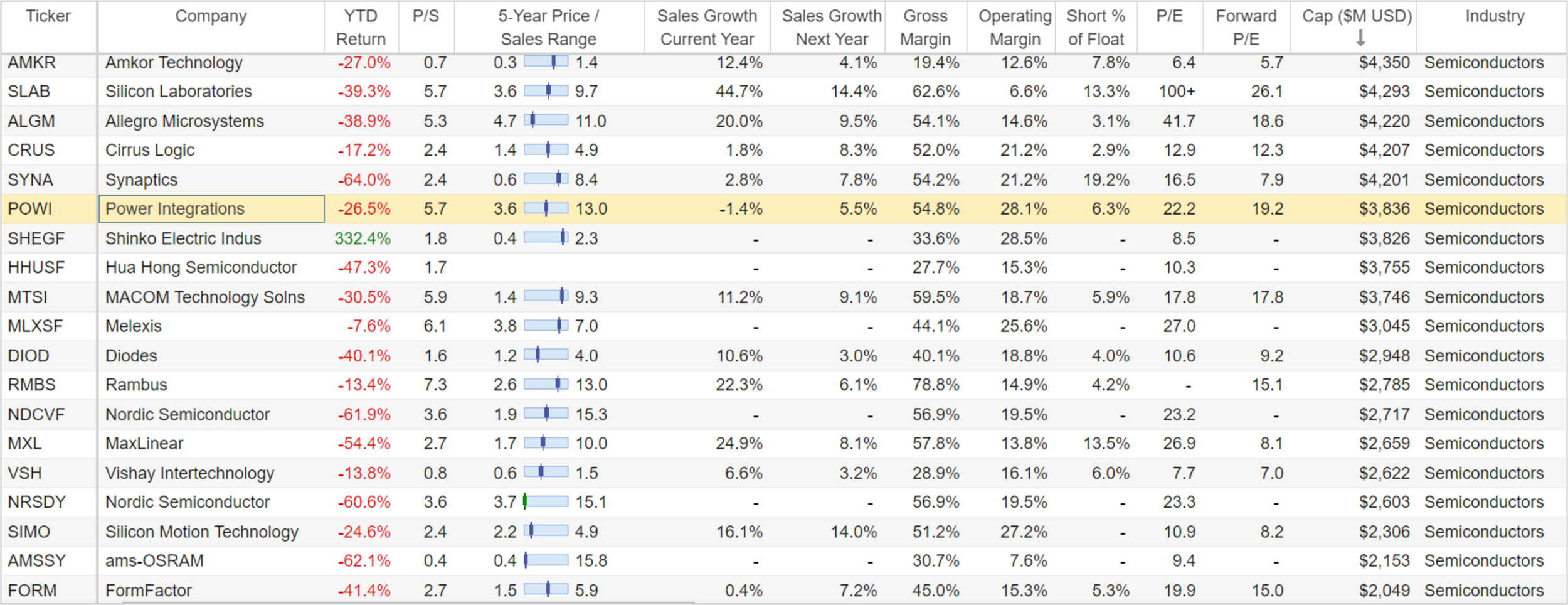

Semiconductor Industry

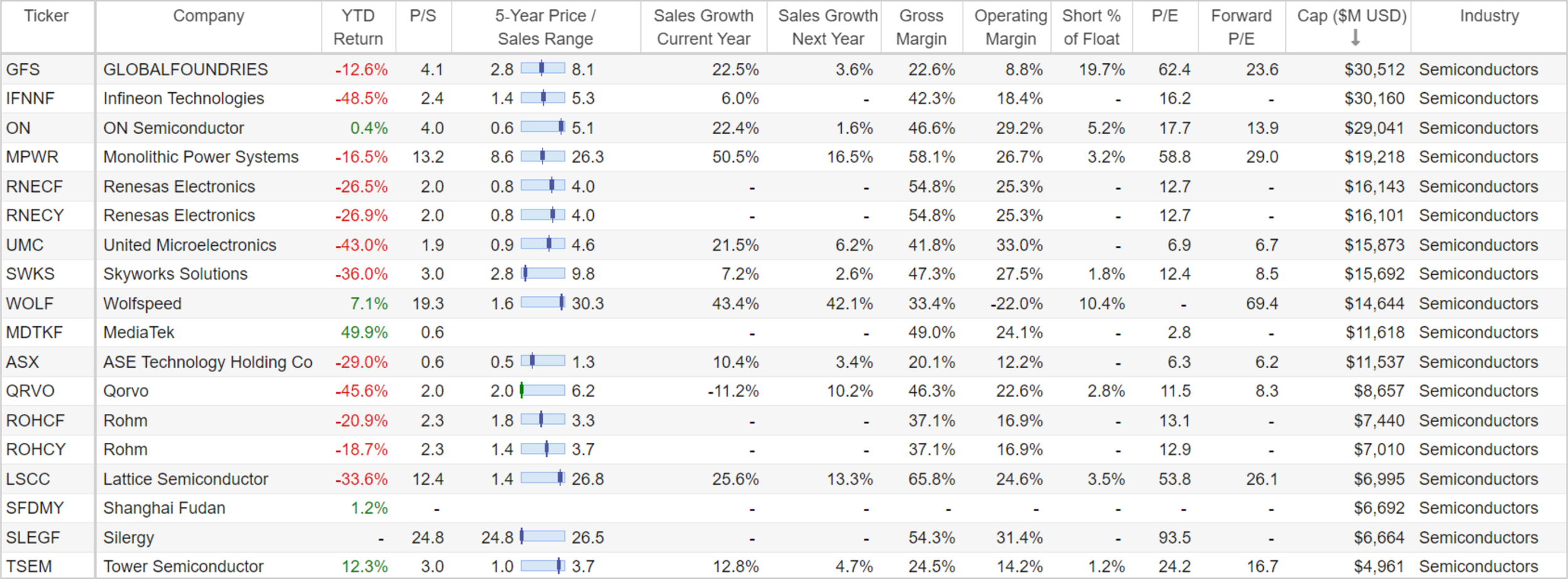

POWI is classified into the semiconductor industry of the technology sector. And while it is very important to note there are widely different types of semiconductor companies (ranging from large to small, innovative to foundry, and everywhere in between), here is a look at some valuation and price performance data for a variety of other stocks in this industry (the list is sorted by market cap, from largest to smallest, and POWI is highlighted in yellow).

You’ll also note that while most names are down significantly this year, Power Integrations has very strong gross and operating margins, and its P/E valuation is actually quite compelling as compared to its long-term growth trajectory (but not necessarily its near-term growth as shown in the above table).

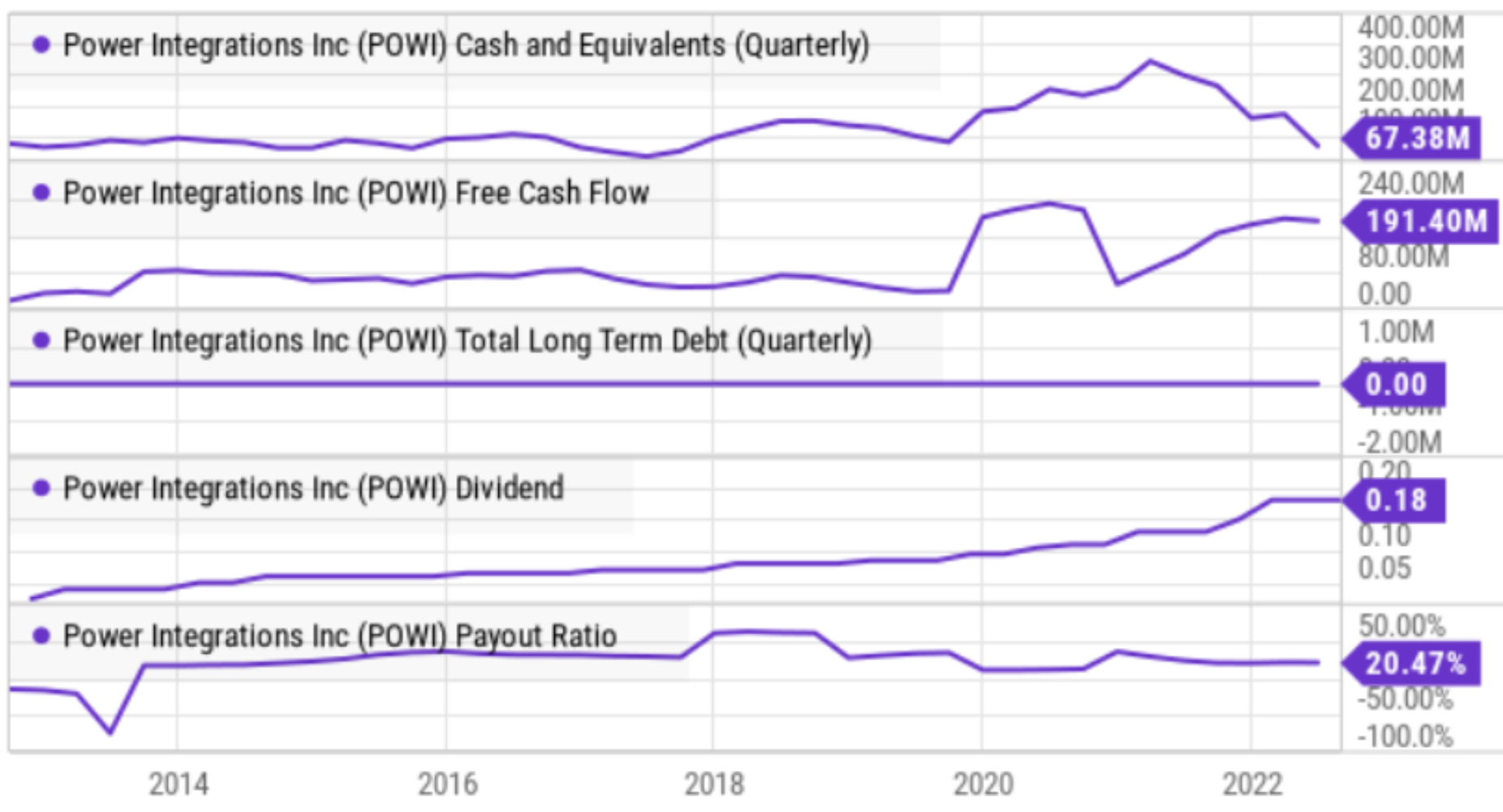

Dividend Growth

Also interesting to note, Power Integrations currently offers a 1.03% dividend yield, and it has increased its dividend payment to shareholders in each of the last nine consecutive years. To some investors, this is a sign of financial strength and stability, and this notion is backed up by the company’s strong cash position, strong free cash flow generation and zero long-term debt.

We expect the share price and the dividend payment to continue to grow at a healthy clip in the years ahead given the financial strength and the ongoing secular trend.

Conclusion:

Sadly, when the market is soaring, a lot of investors go out and buy all of the best performing stocks. And when the market is down, investors hide all their money under the mattress because they are afraid. This approach flies against the popular Warren Buffett notion to be fearful when others are greedy, and greedy when others are fearful. Power Integrations share price is down because of the market cycle and a tough revenue growth comp. However, the long-term secular growth trend remains intact and POWI’s share price is attractive considering the strength of the business. If you are a disciplined long-term investor—Power Integrations is worth considering for a spot in your investment portfolio. We do not currently own shares, but it is high on our watchlist.