There is almost a mystical aura surrounding the 60+ “Dividend Aristocrats.” To be included on this exclusive list, you must be an S&P 500 stock that has increased its dividend for at least 25 consecutive years. And there are many highly-respected companies on the list, including the likes of Johnson & Johnson (JNJ), Procter & Gamble (PG) and Exxon Mobil (XOM). However, before you go buying any stock just because it’s on this list, there are a few things you need to consider. Let’s start by looking at the list (below) and then dive into some details.

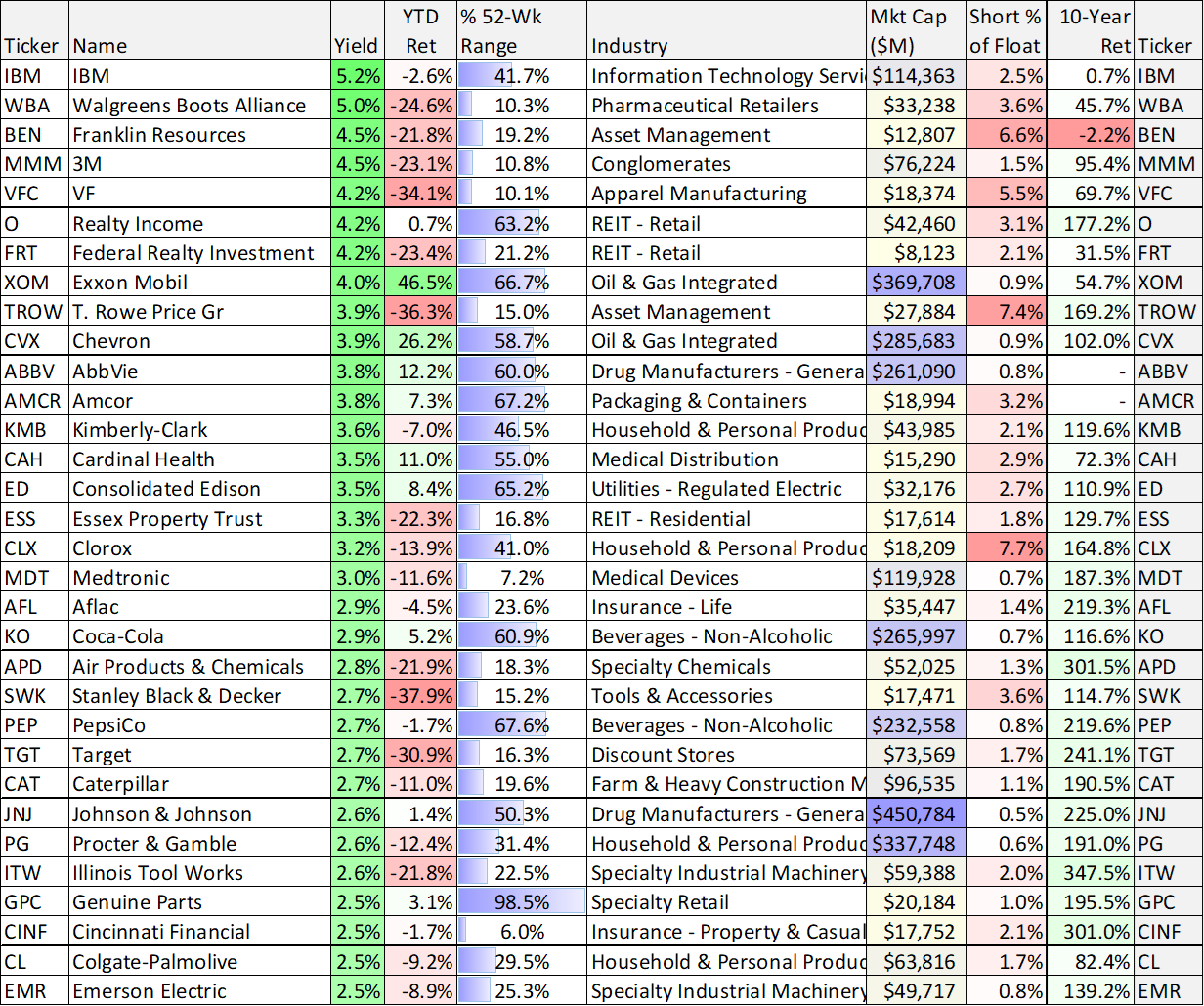

data as of 21-Jul-22

As you can see, the list is sorted by current dividend yield, and the names include many large caps that you’ve probably heard of, and a few small caps that you probably haven’t.

What’s interesting is that the best performers also all have the smallest yields. This is a great reminder to long-term investors that “yield chasing” (or simply buying a stock because it offers a high current yield) may not be the best strategy.

Dividend yields mathematically increase when share prices go down, and this can be a red flag. Similarly, some companies stretch themselves way too thin financially just to maintain a big dividend—and this also can cause problems and be a red flag.

The general theory behind the dividend aristocrats is that if a company can afford to increase its dividend every single year for 25+ years then it must be a great investment—and in some cases that is true. For example, we own Johnson & Johnson (JNJ) and Realty Income (O) from the list. However, some names like IBM (IBM) and Franklin Resources (BEN) have put up terrible 10-year returns even though they offer among the biggest growing dividends (and keep in mind the 10-year returns in the table above include the dividend payments!).

The Bottom Line

The Dividend Aristocrats can be a great starting point for identifying potential investments, but investors shouldn’t just blindly buy a stock because it’s on this list. For example, West Pharmaceutical Services (WST) has been the best 10-year performer on the list, but that doesn’t mean it will be the best performer in the future. Conversely, Real Estate Investment Trust, Realty Income (O) has put up respectable 10-year returns and offers an attractive dividend yield, and that is one we currently do own in our Income Equity Portfolio. For reference, you can read our recent Realty Income report here.

However, at the end of the day, you need to know your goals and then invest accordingly. Don’t just buy a stock because it is on some list (even if it is the “Dividend Aristocrat” list). Do your due diligence. Disciplined goal-focused, long-term investing will continue to be a winning strategy.