The market has sold off hard this year, especially if you are a high-growth technology company. One name that has gotten hammered particularly hard is mobile growth platform, Digital Turbine (APPS). In this report, we give an update on the business, the opportunities, profitability, valuation (as an acquisition target and as a standalone company) and our opinion on investing.

Overview:

Digital Turbine thinks of itself as a “one-stop-shop growth & monetization platform.” It basically works with wireless carriers and device original equipment manufacturers (“OEMs”) to pre-install apps on new devices. And it has been expanding its offerings through acquisitions, including Appreciate, Fyber and AdColony. A few things make Digital Turbine special: (1) it’s business model gives it access to unique data that is highly valuable to advertisers (and the total addressable market opportunity (“TAM”) is massive, (2) it’s actually a profitable business, and (3) the valuation has come down dramatically making it interesting as a standalone investment and as a potential acquisition target.

For more perspective, here is a look at how the company’s growing offerings (through acquisition) have added to revenue when a device is first activated to well beyond.

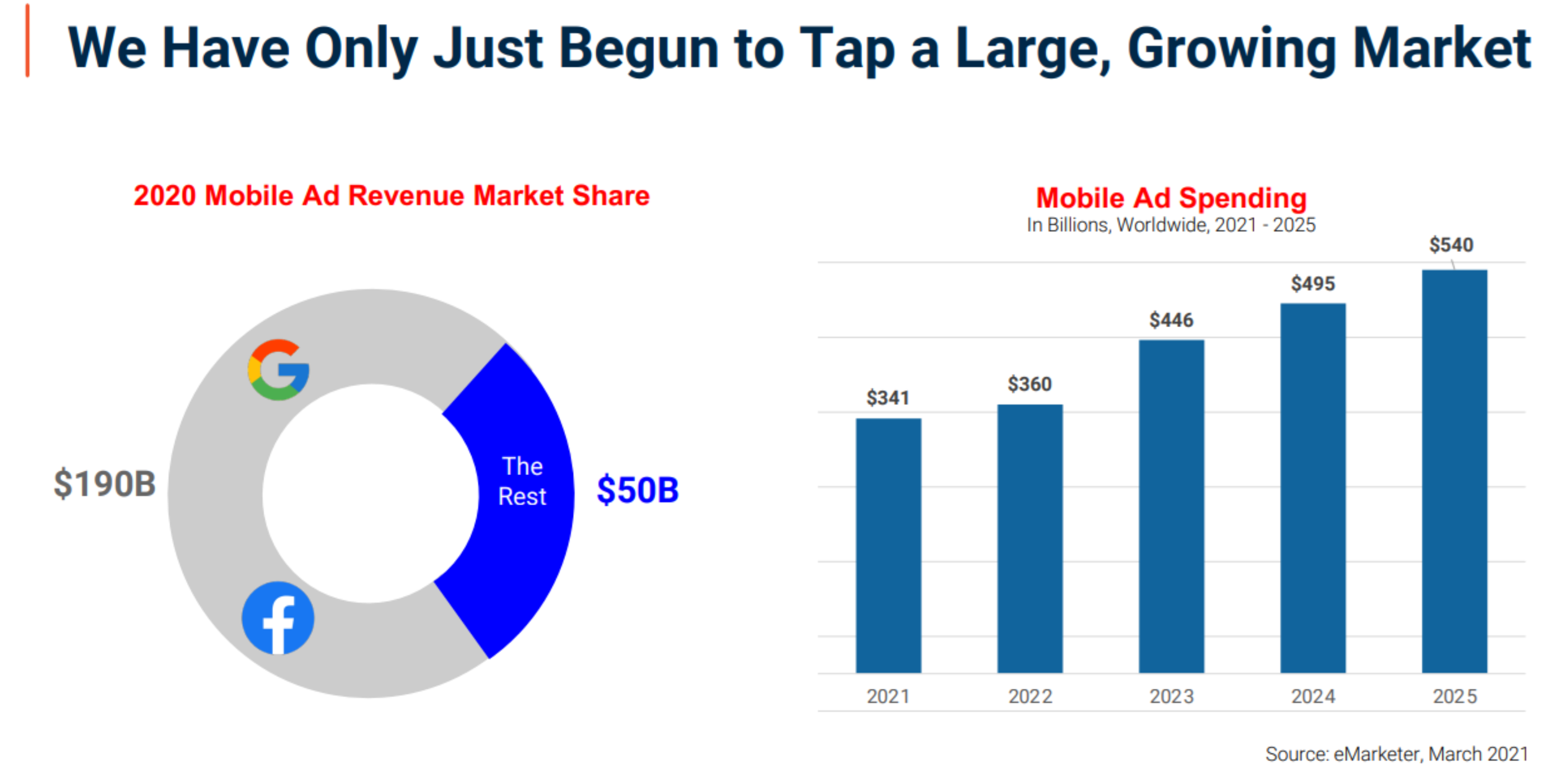

Importantly, mobile advertising is a massive growing secular trend with a huge total addressable market (“TAM”) opportunity.

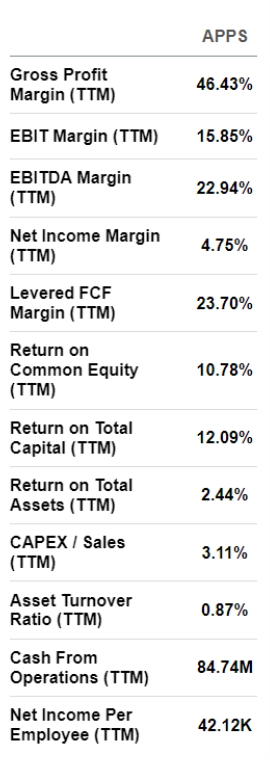

Profitable Company

Unlike a lot of smaller high-revenue-growth businesses, Digital Turbine is actually profitable. For example, it is cash flow profitable, and its Gross and Net Income Margins are healthy. Here is data from the company’s most recent earnings announcement.

Valuation:

One interesting metric to start with is that Digital Turbine trades at only 9.5 times forward cash flow; this equates to a 10.5% cash flow yield (1/9.5), which is compelling. Similarly compelling, the shares now trade at only 2.2 times forward sales, which is extremely attractive for a company that continues to grow rapidly (both through acquisitions and organically). Noteworthy, Digital Turbine does have $126 million of cash on its balance sheet plus $549 million of total debt (compared to a $1.9 billion market cap) and thereby trades at 9.5 times forward EV-to-EBITDA, which is still compelling, especially considering how hard the shares sold off as the recent pandemic bubble burst (accelerated by the fed’s hawkish interest rate trajectory).

Also interesting to note, Digital Turbine’s “distant cousin peer,” ironSource was recently acquired by Unity Software (U), an indication that there is demand for the synergies to be obtained by combining unique data sources (such as that of Digital Turbine and ironSouce) with more widely available data for marketing purposes. According to Oppenheimer, Digital Turbine could be in play as an acquisition target.

Analyst Timothy Horan, who has an outperform rating on Digital Turbine, noted that the company is the "only other dominant source for on-device presence," citing the reason that the aforementioned deal was done was because of a "diversity" of data.

If Digital Turbine were to get acquired it would be at a large premium to the current share price. Either way, we view Digital Turbine as attractive as an acquisition target and as a standalone company. The business has a lot of value and it is trading at a significantly low price.

The Bottom Line

There have been lots of changes at Digital Turbine with the recent acquisitions, and the shares have also gotten hit particularly hard by the fed-induced pandemic bubble sell off. Nonetheless, the business remains profitable, it continues to grow into a massive ongoing secular trend opportunity, and it has unique value stemming from the unique data it gathers from being preinstalled with OEMs and then combined with other ecosystem data. We view Digital Turbine shares as attractively valued as a standalone company and as an acquisition target. We have a small position in Digital Turbine within our Disciplined Growth portfolio and believe the shares have significant price appreciation potential from here.