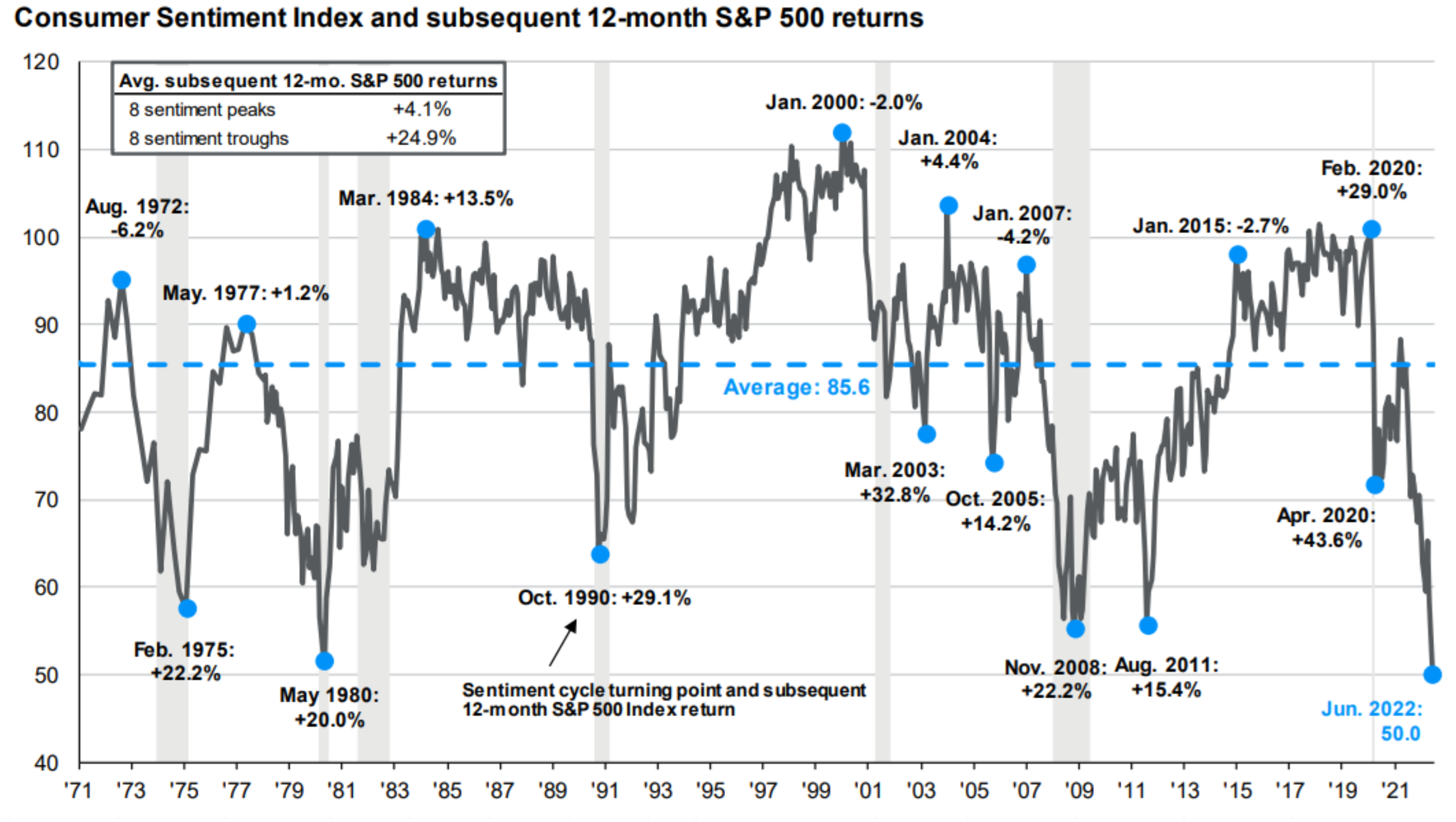

Pre-market equity futures are slightly up as we head into a huge week for new economic data (fed meetings, GDP report and lots of corporate earnings announcements). Obviously equity markets have been ugly this year (the Nasdaq 100 is down ~25%), but we’ve seen signs of a recovery in the last two weeks (e.g. rates down, equities up). For a little more perspective, consumer sentiment is also very low, but has picked up a bit recently. Here is a reminder of how markets often perform following low points in the Michigan Consumer Sentiment Index.

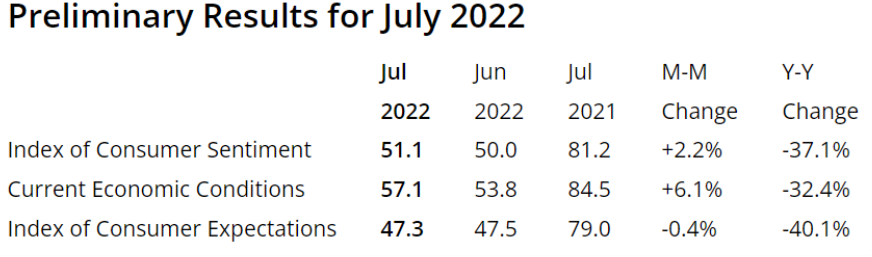

The above chart is as of the end of June, but it still shows clearly how markets tend to do very well 12-months after low points in sentiment. And as you can see in the more recent preliminary results below, sentiment has improved slightly so far this month—perhaps an indication that we have bottomed.

Of course there is no guarantee that markets have now turned the corner. However, with the fed’s very aggressive interest rate hawkishness, combined with valuations that have come down quite a bit, now seems an increasingly attractive time for long-term investors to be in the market.

Recall, just 1-year ago valuation multiples were very high (especially for growth stocks) and optimistic investors thought the market could only go higher. Now, with markets (and valuation multiples) decidedly lower—investors may be making the opposite mistake in believing the market will continue to decline.

Disciplined long-term investing has been a winning strategy throughout history, and in our view—it will be this time too. No one knows exactly when, but the market is eventually going higher, and a few years down the road people will likely look back and say—wow, mid-2022 was a great time to buy.