In this report, we share data on over 100 big-yield investments, including CEFs, REITs, BDCs and MLPs. We provide high-level information and market commentary on each category, and then countdown our top 10 most attractive (with yields ranging from 5% to well over 10%), starting with #10 and finishing with our top ideas.

Closed-End Funds (CEFs):

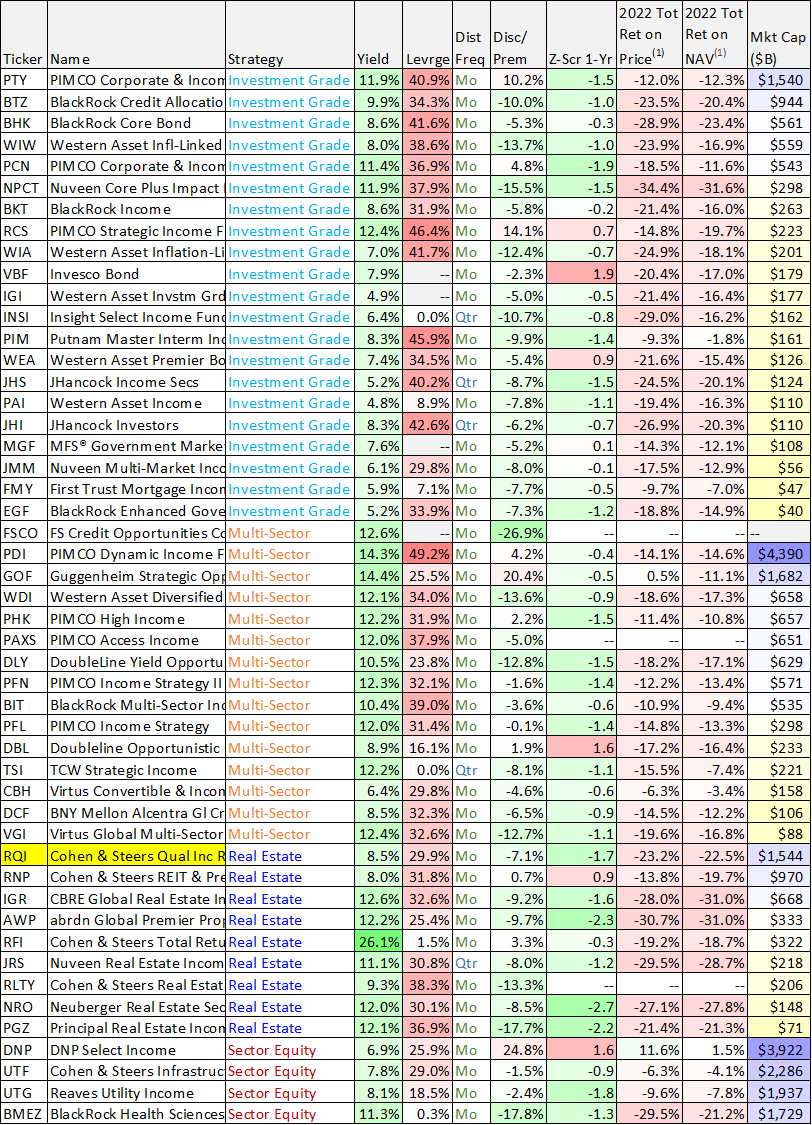

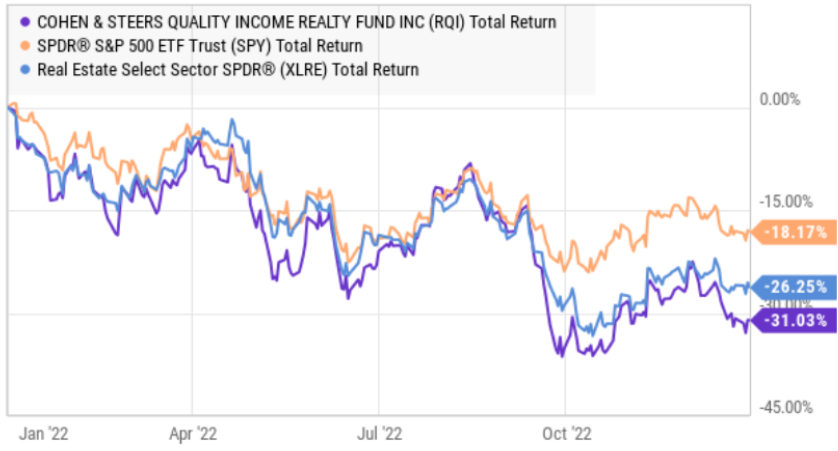

If you don’t know, a CEF is basically a portfolio of individual investments grouped together that trade as a single fund. CEF strategies can range from “Investment Grade” bond funds to specific “Sector Equity” funds, to name just two. CEFs are unique (as compared to other mutual funds and exchange traded funds) because there is no immediate mechanism in place to ensure the market price of a CEF stays close to the aggregate value of its underlying holdings (i.e. its net asset value or “NAV”). And as such, CEF prices can trade at wide discounts and premiums versus NAV, thereby creating unique risks and opportunities (we greatly prefer to buy quality CEFs at discounted prices). For example, the following table shows 100 different CEFs, sorted by strategy, and including the current price premium or discount versus NAV for each fund as of the last trading day of 2022.

data as of 12/31/2022, source: CEF Connect

A few more things to notice in the above table include leverage (CEFs are allowed by regulation to borrow against their NAV, which can increase income and total returns, but also increases risk), yield (CEFs pay distributions, not dividends, and those distributions are often paid monthly and sourced from a combination of dividend and interest income on the underlying holdings, plus capital gains and sometimes a return of your own capital), and 1-year z-score (which is a measure of how far the current discount or premium is relative to the average—negative numbers are considered better by many investors therefore we have highlighted them in green).

10. Cohen & Steers Quality Income Realty Fund (RQI), Yield: 8.5%

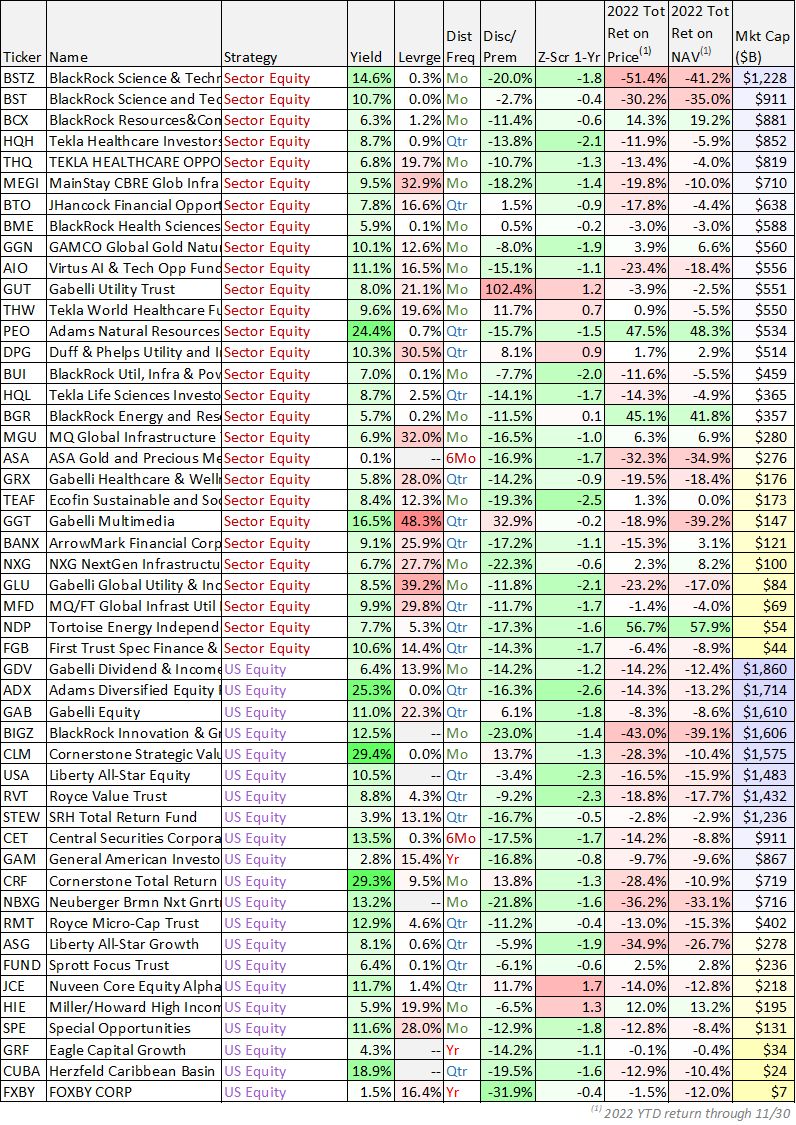

RQI invest in income-producing real estate securities, mainly REITs, but also other common stocks, preferred stocks and bonds. For perspective, here is a look at the fund’s recent top 10 holdings (you likely recognize many of these REITs):

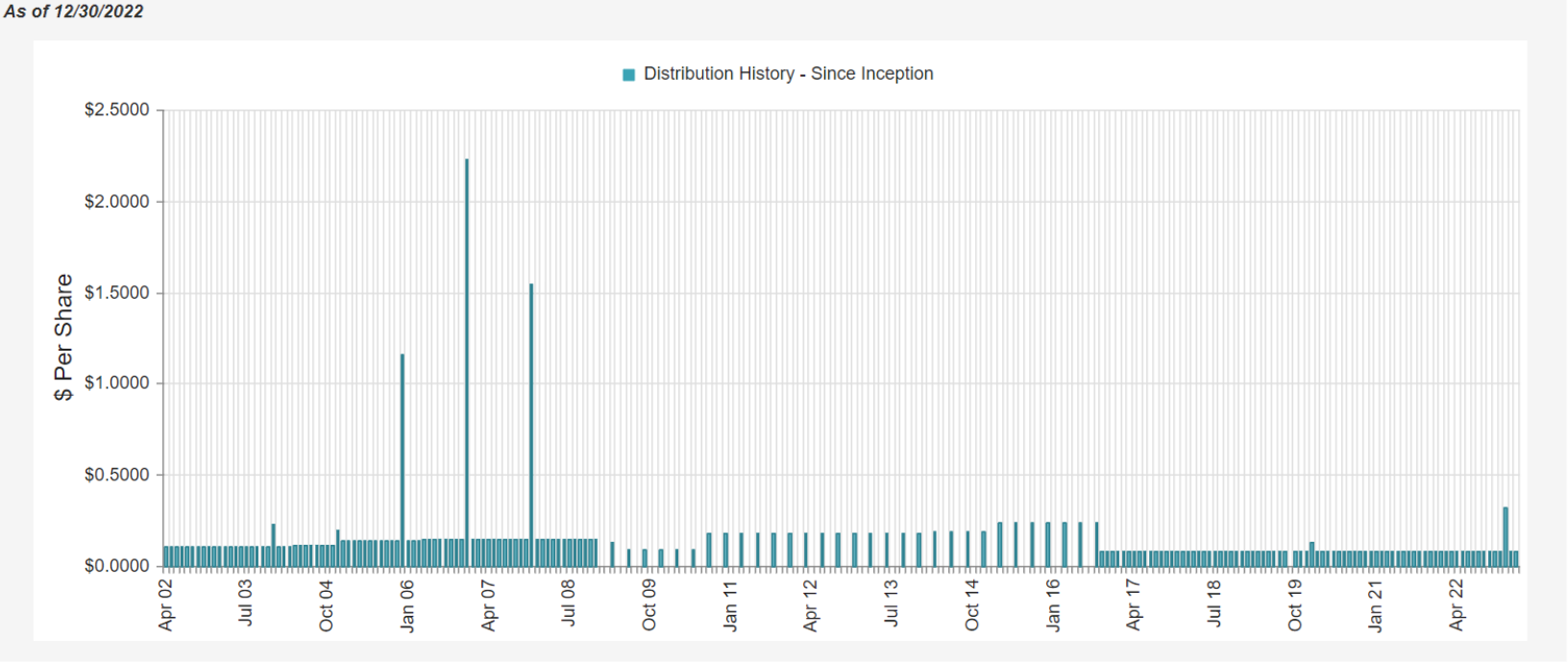

According to the RQI website: “the primary investment objective of the Fund is high current income through investment in real estate securities. The secondary investment objective is capital appreciation.” And here is a look at the fund’s performance, since inception in February of 2002:

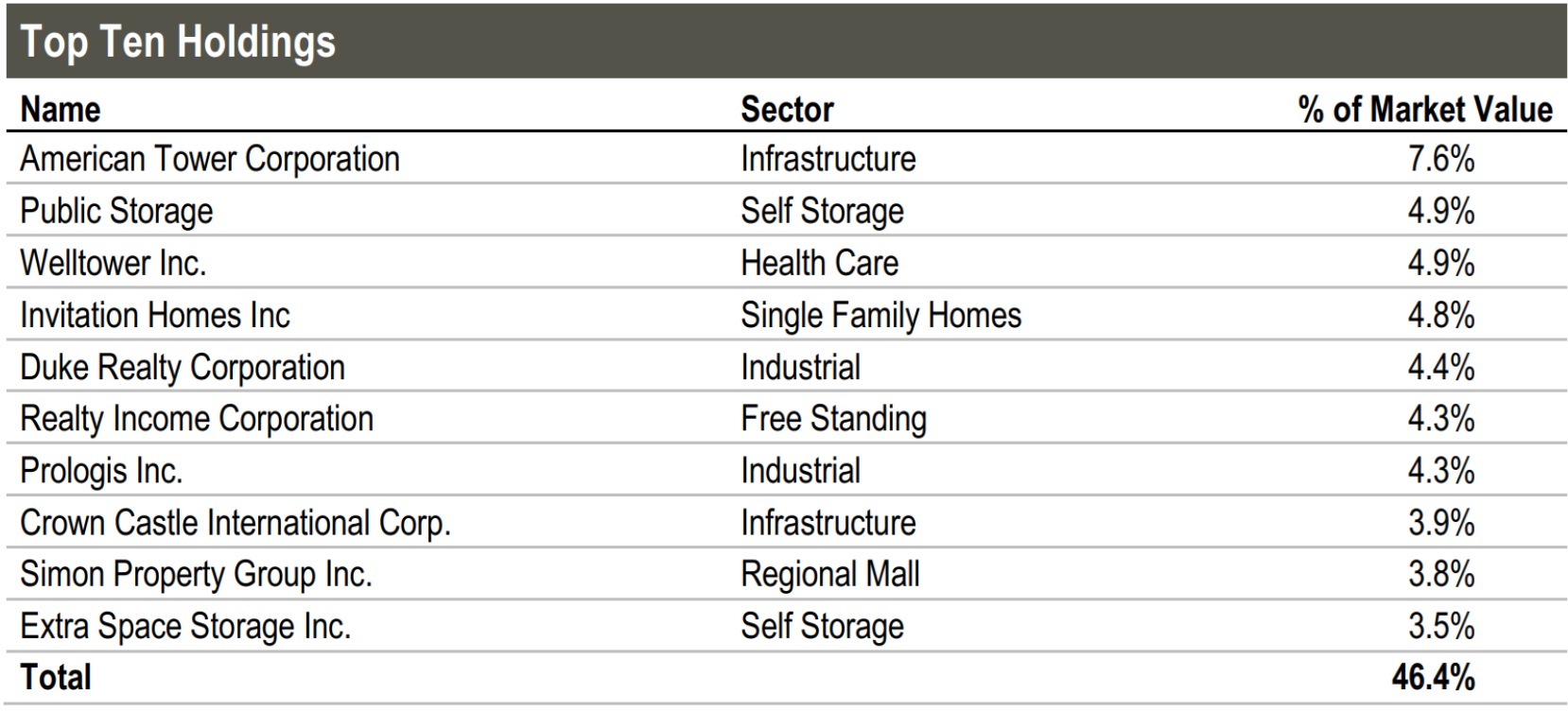

Important to note, RQI has delivered strong total returns since inception, but that includes distributions reinvested. If you take the distributions as spending cash, then the simple price return has been more moderate, as would be expected. The price of this fund took a significant hit when the housing bubble burst in 2008-2009, and had been rebounding since then until 2022 (whereby the shares were down over 30% for the year).

Why RQI Is Attractive:

In our view, RQI currently presents an attractive opportunity, if you are income-focused investor, for a variety of reasons, such as those described below.

Healthy Monthly Income: RQI currently offers an attractive 8.5% distribution yield, paid monthly. The fund’s inception date is February of 2002, but it switched back to a monthly distribution (from a quarterly) in 2017.

The distribution has recently been sourced mainly through income and capital gains, without any return of capital, which we view as a sign of health.

RQI also delivered a special dividend (in December) which was sourced through long-term capital gains and may have been related to some well-timed tax-loss-harvesting and portfolio rebalancing (as real estate securities were down significantly in 2022).

REITs are Contrarian: REITs performed poorly as a group in 2022 (the real estate ETF (XLRE) was down more than 28% on a price-return basis). We view these declines as a near-term overreaction to pandemic disruption, including the mini housing bubble (then bust) caused by very low rates and pent-up demand during the pandemic, and followed by high rates (making homes more expensive to finance) and demand slowdown as the market somewhat normalized. Also, there was very high demand for industrial real estate during the pandemic as supply chains adjusted, and now industrial real estate valuations have cooled off as demand growth has slowed. We view now as an increasingly attractive time to consider real estate, especially as inflation and higher interest rates are expected to moderate in 2023.

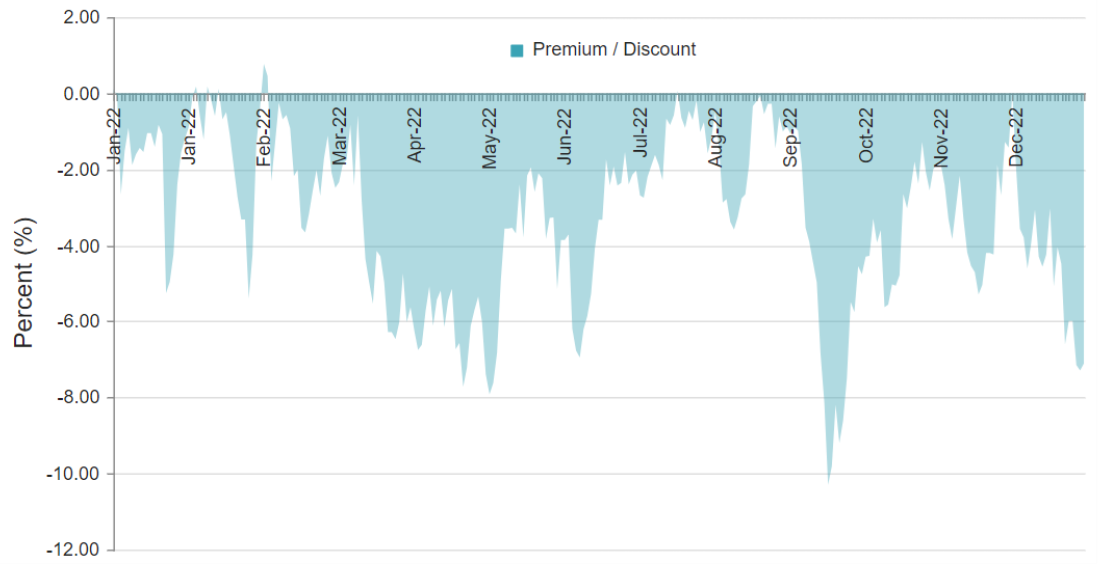

Discount to NAV: As mentioned, CEFs can trade at significant premiums and discounts to NAV, and as you can see below, RQI currently trades at a significant discount. There is no guarantee that this discount will disappear (and it could still get wider), but we greatly prefer to buy attractive CEFs and discounted prices.

RQI Risks:

Leverage: As mentioned, CEFs use leverage (borrowed money) and this can increase income and returns in the good times, but also increases risk in the bad times (like this year). RQI currently has nearly 30% leverage, which has contributed to its underperformance versus the real estate ETF (XLRE) this year, but it also position the fund for a strong rebound when the market recovers. Thirty-percent leverage is on the higher end for an equity fund, however we view it as acceptable for this fund, considering the long-track record and resources of the management team.

Management Expenses: RQI is an actively managed fund, which means there is a team actively selecting securities (it currently holds over 200) instead of just passively investing in all real estate securities (that is the strategy of passive ETFs (such as (XLRE)). The total expense ratio on this fund was recently 1.45% (on all assets, including those purchased with borrowed money) and 1.91% on net asset value (all assets net of borrowing). This rate also includes the cost of borrowing (which will increase as rates go up). We view this ratio as expensive, but acceptable considering the strong investment process and management competencies and resources, but management fees are a drag on total performance nonetheless.

RQI Bottom Line

If you like big distributions, discounted prices (versus NAV) and the real estate sector, RQI is worth considering. It has a long track record of success, and appears well-positioned for continuing long-term gains going forward, especially if you like big steady distribution income paid monthly.

Real Estate Investment Trusts (REITs):

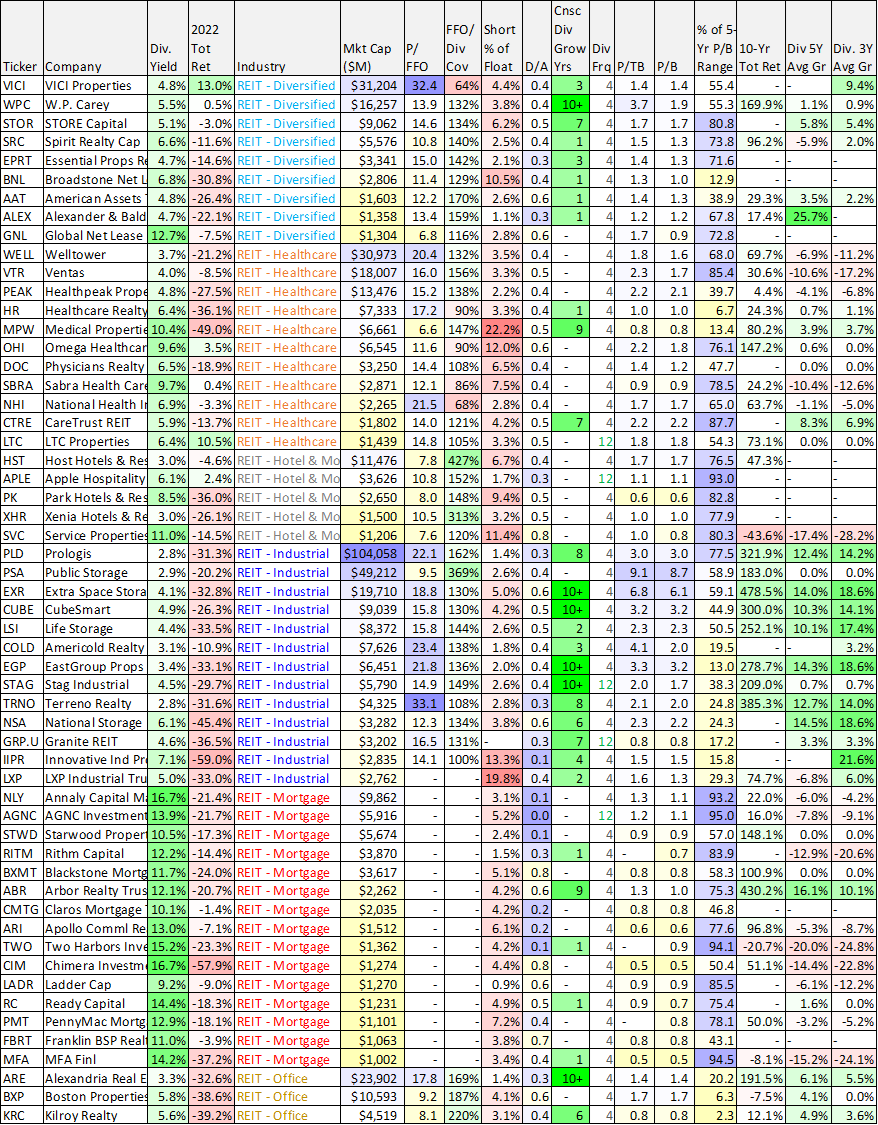

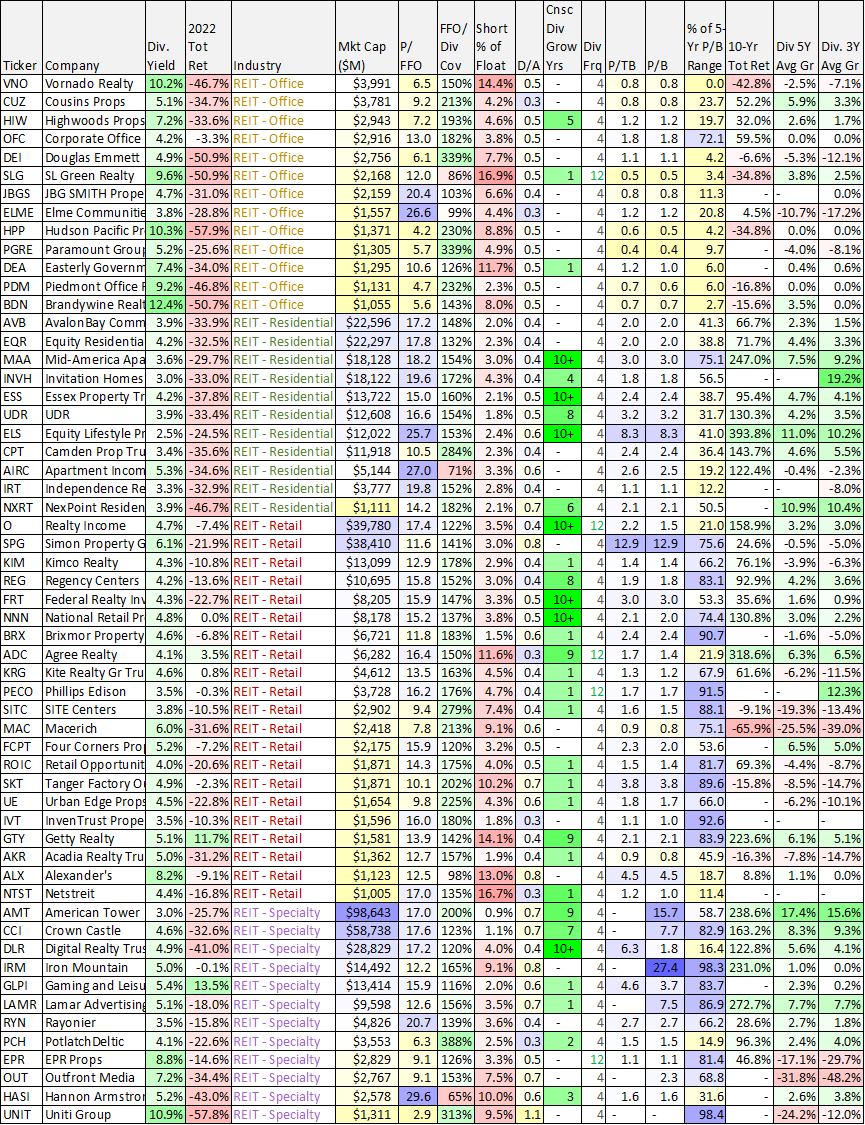

Your interest may have been piqued by the individual REIT holdings of RQI in the previous section. And if you prefer to cut out the middle man (i.e. RQI) and invest in individual REITs directly (this way you don’t have to pay RQI’s management fees and expenses) individual REITs can be attractive (especially now from a contrarian standpoint considering REIT prices are down and dividend yields can be quite meaningful). For example, here is a list of 100 big-dividend REITs (sorted by REIT industries and then market caps) for you to consier.

data as of 12/31/2022, source: Stock Rover

The above table includes a variety of important data points about valuation and dividend strength, and you likely recognize at least a few of your favorites. We have described one of our favorites below.

9. Crown Castle (CCI), Yield: 4.6%

Crown Castle is the nation's largest provider of communications infrastructure (that includes cell towers, small cells and fiber) that connects people and businesses to data and technology. Specifically, the company owns, operates and leases shared communications infrastructure that is geographically dispersed throughout the U.S., including more than 40,000 towers and other structures, such as rooftops (collectively, "towers"), and more than 80,000 route miles of fiber primarily supporting small cell networks ("small cells") and fiber solutions.

Crown Castle shares have sold off recently as other REITs have sold off, but its business is uniquely positioned to continue growing rapidly (whereas other REITs are struggling to find growth). Specifically, the secular trend towards 5G and the “Internet of Things” positions CCI well to continue its high growth trajectory. Further still, the company’s strategy to purse small cell opportunities seems unorthodox to some (considering the strength of it tower business) but the move could prove extremely lucrative in the years ahead. We also appreciate the company’s strategy of returning a healthy amount of cash to investors through dividends (this can help with maintaining a stable investor base), but also spending an ample amount of capital to capitalize on industry growth opportunities. Now at just 17.6x FFO, if you are a long-term income-focused investor (that also likes growth), Crown Castle is worth considering for a spot in your portfolio.

Business Development Companies (BDCs):

Yes there are plenty of big-dividend opportunities outside of the real estate sector, and one particularly interesting corner of the market is BDCs. If you don’t know, BDCs are basically financing companies (they provide loans and sometimes take equity stakes) in middle-market companies (smaller and less established than big corporations). The types of financing BDCs provide is riskier than the types of loans that big banks make, and as such they charge higher interest rates on their loans (to compensate them for the risk). Generally speaking, BDCs can avoid corporate taxation by paying out their income as dividends, and this is why BDCs offer outsized dividends to investors. And for your information, BDCs were basically created by an act of congress to help support smaller businesses.

BDCs vary widely in terms of the types of financing they provide (some focus on specific industries, others focus on the larger or smaller end of the middle market company spectrum, and some focus on more distressed opportunities than others). As such, investors considering BDCs need to be careful to understand their very different risk profiles, especially considering our rising interest rate environment. In theory, BDCs make more money as interest rates rise because it increases their net interest margins (the rate they borrow at versus the rate they lend at), but considering where we are in the current market cycle (i.e. we could be heading into an ugly recession), the higher rates may also cause increased loan defaults for the riskier companies that some BDCs invest in. Generally speaking, BDCs can invest in (provide financing to) anywhere from a few dozen portfolio companies to many hundreds.

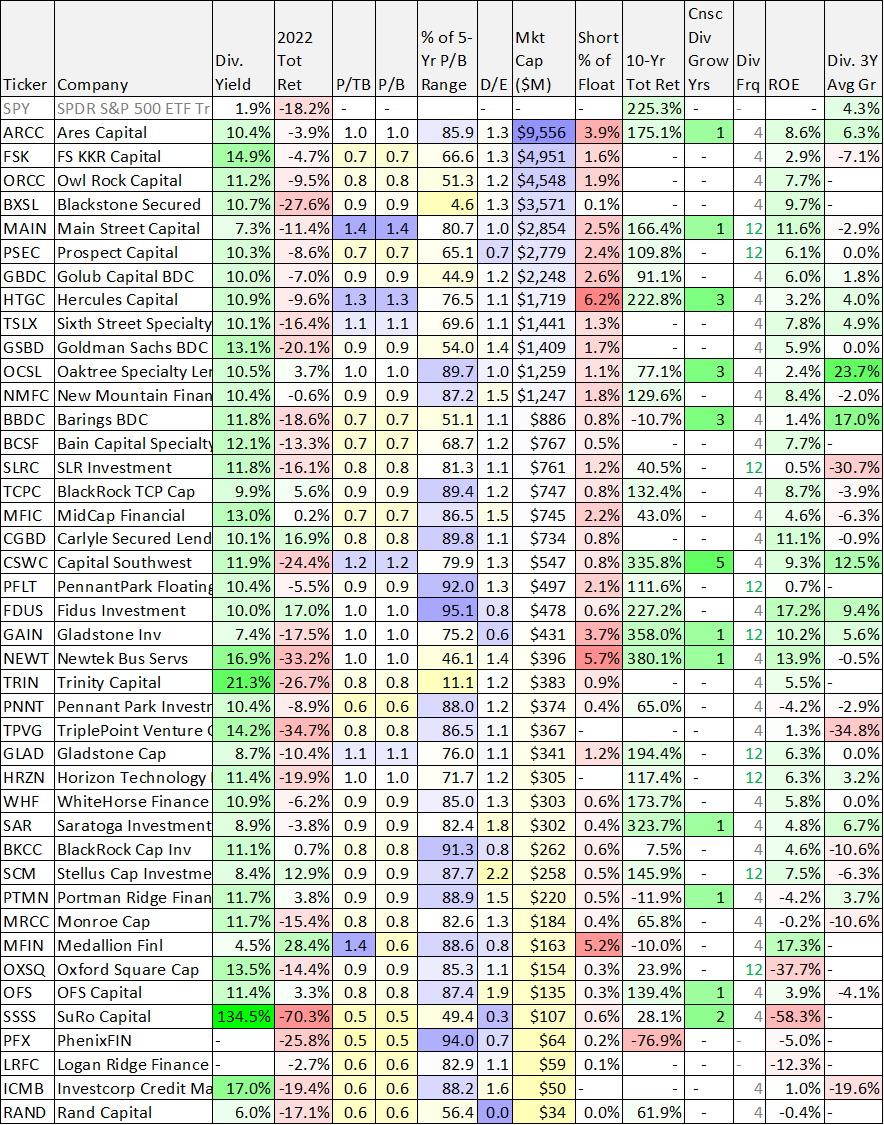

For your reference, here is a look at current data on over 40 big-dividend BDCs, including yields, returns, valuation metrics (price-to-book), market capitalizations, and more.

data as of 12/31/2022, source: Stock Rover

8. Owl Rock Capital (ORCC), Yield: 11.4%

Owl Rock enjoys the benefits of being one of the larger publicly-traded BDCs, but trades at a lower price to book value, as recent credit spread widening has put pressure on portfolio valuations. Importantly, Owl Rock focuses on larger middle-market companies (safer), it has a high-level of first lien debt (safer) and more floating rate investments than debt (a good thing as rates have been rising). ORCC has also been very conservative with its debt to equity level, thereby leaving it some extra “dry powder” for growth going forward as compared to peers. In a nutshell, Owl Rock offers a big growing dividend, it trades at an attractive valuation, and it has room to continue growing going forward.

Owl Rock just raised its quarterly dividend by 6.5% (to $0.33 from $0.31) and announced a new supplemental dividend of $0.03, following its strong Q3 results. Specifically, Owl Rock delivered Net Investment Income of $0.37 (beating expectations by $0.02), GAAP EPS of $0.67, and total Investment Income of $314.05M (+16.7% Y/Y) beating by $21.96M. As per the CEO, the strong results were supported by the “tailwind of rising interest rates.” The BDC board also approved a 2022 Repurchase Program under which Owl Rock may repurchase up to $150 million of the its common stock. Owl Rock is an attractive high-income investment; we currently own shares.

Midstream & Master Limited Partnerships (MLPs):

Energy was the best performing sector of the market in 2022, and Midstream companies (those generally involved in the transportation of oil and gas, often through pipelines) stand to keep benefitting. Although these companies are less sensitive to energy prices than exploration and production companies (because midstream revenues are often fee-based) they are now in a much better situation because their customers (energy exploration and production companies) are much financially stronger than they were before 2022 and this makes them much better customers for midstream companies (i.e. it reduces the risks of customer bankruptcies and restructuring).

One caveat with midstream companies, many of them trade as Master Limited Partnerships (“MLPs”), which means they pay distributions (not dividends) and they send K-1 statements (not of 1099-DIV) at tax time, which can make filing your taxes more difficult. In particular, there are limits to how much distribution income you are allowed to receive in a non-taxable retirement account (such as an IRA) before it triggers actual tax consequences. Not all midstream companies are MLPs (as we have described in the table below), and some investors prefer to invest in non-MLP midstream companies (to avoid the potential tax headaches).

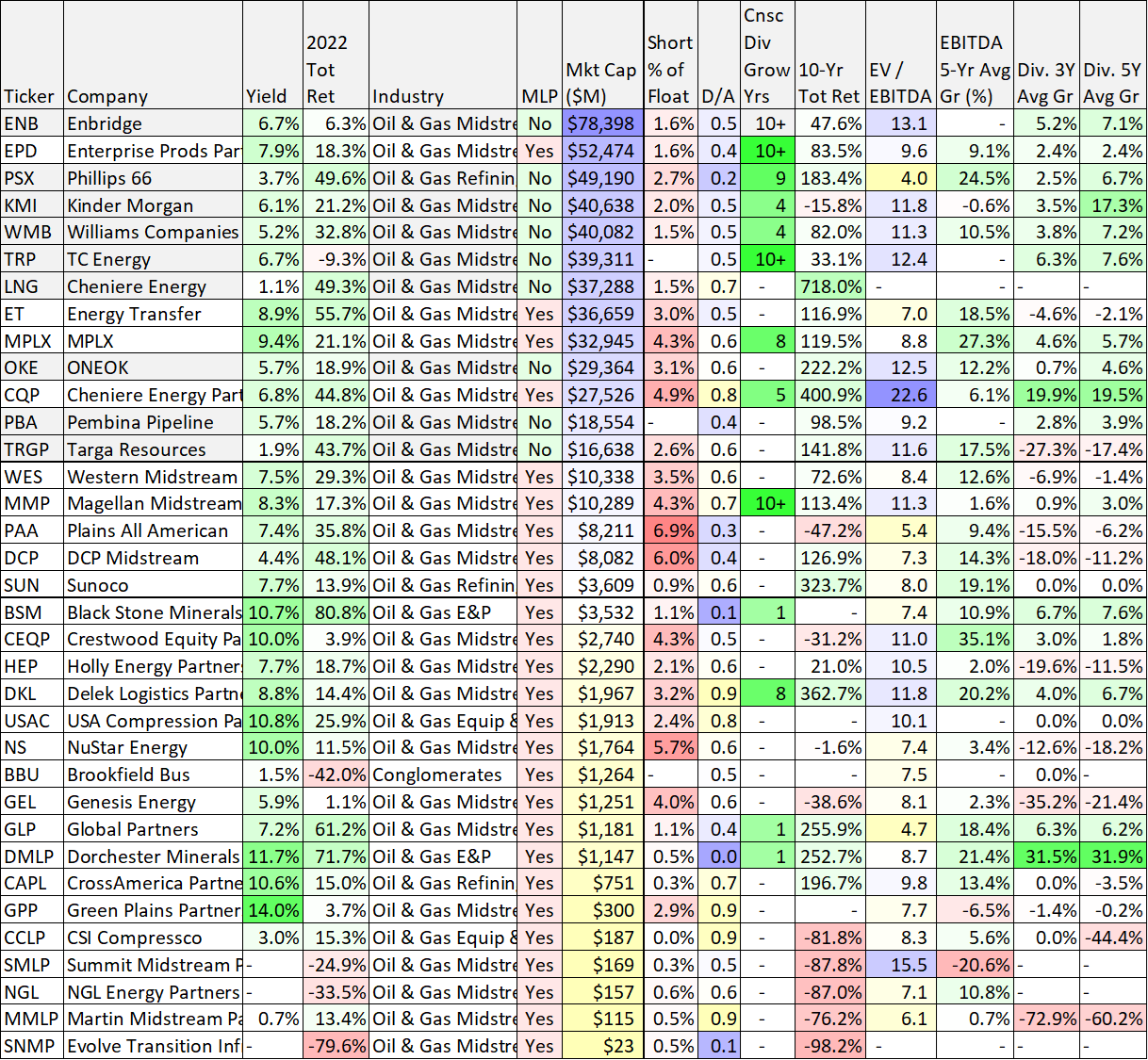

For your reference, here is a list of data on midstream companies, including recent performance, current yields, valuation metrics and more.

data as of 12/31/2022, source: Stock Rover

7a. Enterprise Products Partners (EPD), Yield: 7.9%

Enterprise Products Partners is an integrated energy infrastructure network providing midstream energy services to producers and consumers of natural gas, natural gas liquids, crude oil, refined products and petrochemicals. The company links producers from some of the largest North American supply basins with domestic consumers and international markets.

And EPD is special because its extensive asset base is virtually impossible for competitors to replicate thereby giving it unique advantages, especially including a return on capital invested that exceeds its cost of capital by a healthy margin.

On November 1st, the company reported GAAP EPS of $0.62 (beating expectations by $0.01) and revenue of $15.46B (beating expectations by $1.64B), as pipelines transported a record 11.3 million barrels per day of natural gas liquids, crude oil and other products. Importantly, Distributable Cash Flow (DCF) increased 16%, and it provided 1.8 times coverage of the distribution declared for Q3.

EPD is positioned for continued strength and is deserving of a higher valuation multiple as compared to peers (considering its competitive advantages). The big distribution is very safe and has increased for 23 years in a row.

7b. The Williams Companies (WMB), Yield: 5.2%:

Energy companies are generally a capital-intensive “value” sector of the economy. And with energy prices higher, most energy companies stand to benefit. After all, energy was by far the best performing sector of the stock market in 2022 (due to higher prices and post-pandemic re-openings).

Midstream companies (the companies that transport oil and gas, often via pipelines) are unique in the energy sector as their revenues are largely fee-based, thereby less sensitive to energy prices. However, midstream company clients (such and exploration and production companies) are sensitive to energy prices. And as such, the strong performance of traditional energy companies in 2022 has strengthened their balance sheets and reduced their risk of bankruptcy. This is great news for midstream companies, especially in the years ahead (because their clients’ “financial gas tanks” are no longer running so close to “empty”).

In particular, Williams handles 30% of the natural gas in the United States that is used every day for things like heating homes, cooking, and generating electricity (Williams has valuable interstate natural gas pipelines and gathering & processing operations throughout the U.S). We like Williams in particular because its large transport network positions it to keep investing in high-return projects. Net Income margin was recently 17.4% and ROE 14.8%—both attractive. Also noteworthy, roughly 50% of it earnings come from rate-regulated gas pipelines—which means its revenue is even steadier (i.e. fee revenue is steady and rate-regulated fees are even steadier).

We also like Williams because it offers an attractive dividend and it does not issue a K-1 statement (a lot of midstream companies are organized as Master Limited Partnerships and thereby issue K-1 statements which can create headaches at tax time). Williams issues an ordinary 1099-DIV at tax time, and the dividend is positioned to keep growing based on William’s strong financial position and ongoing growth.

6. PIMCO Access Income Fund (PAXS), Yield: 12.0%

PAXS is a new PIMCO bond CEF (launched in 2022), and it is currently one of the only PIMCO funds that is NOT trading at a large premium to NAV (it currently trades at around a 5.0% discount). We suspect the price will rise rapidly relative to NAV as more investors become familiar and buy into this relatively new fund. PAXS seeks current income as a primary objective and capital appreciation as a secondary objective, and it utilizes an opportunistic approach to pursue high conviction income-generating ideas across global credit markets. Both the duration (4.29) and the total expense ratio (1.79%) are reasonable for this professionally managed (PIMCO is first class) reasonably levered (37.9%) bond fund. You can read more about this fund here and here.

5. Energy Transfer (ET), Yield: 8.9%

One midstream MLP that stands out as an absolutely attractive juggernaut is Energy Transfer. Energy Transfer is one of the largest and most diversified midstream energy companies in North America (it has approximately 120,000 miles of pipelines and associated energy infrastructure across 41 states). Specifically, Energy Transfer transports oil and gas products that are vital in the energy infrastructure for things like heating homes, cooking and electricity. Over the last decade, Energy Transfer has helped drive the US shale oil and gas boom, and it has benefited from it tremendously.

In its most recently reported quarter (Q3), Energy Transfer generated $1.6B in distributable cash flow (up ~20% from 3Q’21), and had excess cash flow after distributions of approximately $760mm. This is a good sign for the strength of the distribution and for continued growth of the business. For example, through Q3 of 2022, Energy Transfer had $1.3 billion in capital expenditures focused on growth and $485 million for maintenance.

Energy Transfer currently trades at only around 7x EV/EBITDA, which is low as compared to peers, and we expect the valuation (and ET’s unit price) to rise. One risk for the company is regulatory and political, especially as the total market cap has risen significantly over the years. However, we believe the strong fundamentals and low current valuation offset the risks for investors.

If you are looking for a big healthy distribution payment, Energy Transfer is absolutely worth considering.

*Honorable Mention:

Medical Properties Trust (MPW), Yield: 10.4%

Not officially on our top 10 ranking, we’re including MPW as an “honorable mention” because its big yield is hard to ignore. MPW has performed worse than most REITs in 2022 (and the shares have been highly shorted), as it faces challenging headwinds from struggling hospital operators, heavy debt and rising interest rates. However, there are reasons to believe these headwinds are subsiding as fundamentals improve (for example, operators are bringing down costs, reimbursement rates are increasing and debt challenges are being worked out with Prospect and Steward) and macroeconomic headwinds may be subsiding (i.e. inflation is showing signs of slowing and the fed may continue to slow its rate of interest rate hikes).

We recently wrote up this REIT in detail for our members, but the basic gist is that if you are a highly risk-averse investor, MPW is not right for you. But if you can handle the volatility, the shares are worth considering for a spot in your prudently-diversified long-term income-focused portfolio (especially considering the very low P/AFFO ratio and the very large dividend yield).

4. STAG Industrial (STAG), Yield: 4.5%

Stag is an industrial REIT (warehouses, distributions centers) that offers a big 4.5% dividend yield (paid monthly) and the shares are down significantly over the last year as industrial REITs in general have gotten hit hard by the pandemic supply chain disruption hangover. Specifically (as we mentioned earlier), industrial REITs have recently suffered a bit of a pandemic boom and now bust, and that has created some interesting contrarian opportunities, such as Stag.

In particular, we like Stag for it’s current low valuation (relative to its funds from operations (“FFO”)), healthy dividend coverage and growing track record of success. In particular, Stag is focused on single-tenant properties, and it is smaller and earlier in its company growth lifecycle than established industrial REIT blue chips like Prologis (PLD), for example. This creates more long-term room for meaningful growth as Stag continues to evolve from a secondary and tertiary property owner to more primary locations too, especially as long-term industrial demand remains attractive. We like Stag (we own shares), and if you are looking for more REIT sector information and ideas, we wrote extensively in this recent report.

3b. Main Street Capital (MAIN), Yield: 7.2%

Switching back to BDCs, Main Street Capital is a perennial favorite (for its internal management team and long track record of success), and it comes it at number “3b” on our ranking. Its dividend has grown dramatically over time, and it has a history of paying special dividends too. Main Street is particularly well positioned to benefit from the changed macroeconomic environment as higher interest rates means higher net interest margins and more earnings for MAIN. Main Street also offers a conservative level of leverage (as compared to peers and as per regulatory limits) and it has an attractive mix of first lien loans down through equity investment opportunities too. As an important note, Main Street consistently trades at a higher price-to-book value than almost all peers (because of its attractive differentiated business) so don’t necessarily let that deter you. Main Street is an attractive, long-term, big-dividend investment currently trading at an attractive price as compared to its value.

3a. Ares Capital (ARCC), Yield: 10.4%

As mentioned, not all BDCs are created equally. And one category of BDCs we like (as the market potentially heads towards an ugly recession) is higher-quality, well-established, BDCs, such as Ares Capital. Specifically, Ares is the “blue chip” BDC in the room considering its large size, impressive portfolio quality, extensive industry relationships and its conservative balance sheet. Additionally, Ares stands to benefit more from rising interest rates considering its favorable mix of floating rate investment income versus fixed rate debts.

Ares recently announced quarterly Non-GAAP EPS of $0.50 (beating expectations by $0.01), and total investment income of $537M (+21.5% y/y) beating by $22.59M. Further, in a sign of strength, Ares raised its dividend by 11.6% to $0.48 (previously $0.43). And with a price-to-book value of only around 1.0, we view Ares as attractive big-dividend opportunity.

2b. BlackRock Health Sciences (BMEZ), Yield: 11.3%

If you like big income, trading at a significantly discounted price, essentially zero use of leverage, a relatively low management fee and distributions based almost entirely on income and gains (virtually no return of your own capital), this BlackRock CEF is hard to ignore. So far, it’s never reduced its big monthly distribution (only increased it) and it has a history of paying additional special distributions too.

The fund recently held 187 positions concentrated mainly in US healthcare stocks, and it is backed by the resources of BlackRock, a vast industry leader. The fund was launched in January 2020, but already has over $2 billion in assets. BMEZ basically trades at its widest discount to NAV since inception, and if you are looking for exposure to healthcare stocks, BMEZ is attractive and hard to ignore.

2a. PIMCO Dynamic Income Ops (PDO), Yield: 11.6%

PDO is a compelling high-income opportunity currently trading at an attractively discounted price (discounts are rare for PIMCO funds). Some investors prefer PDI simply because the yield is higher (and it has a longer track record), but PDI also trades at a premium to NAV and we prefer PDO’s discount (the price is currently around 4% below NAV). The strategies of the two funds (PDO and PDI) are somewhat similar, but PDO is smaller in assets (more nimble) and trades at a better price relative to net asset value.

Also important, both funds have been paying distributions from income (not necessarily “return of capital”), but that may soon change for PDI considering it’s been challenging to keep income payments high (PDI has a higher payout ratio, although some will argue the recent special distribution disproves this point) while the NAV has been falling. It’s true rising rates hurt NAVs in 2022, but will also incrementally help earn higher yields going forward (but we’re not entirely out of the woods yet as rates are expected to keep rising and PDI seems particularly “stretched” to maintain the status quo high distribution payments). Both funds are attractive, but we prefer PDO given the current rising rate environment (and discounted price).

1. Royce Micro-Cap Trust CEF (RMT), Yield: 13.2%

If you have the time and resources to actively select individual investments, then CEFs (i.e. closed-end funds) should only be utilized sparingly simply because they can add a layer of unnecessary fees that ultimately detract from your net investment returns. We generally reserve CEFs for only select bond funds (that offer unique manager skills, investment opportunity sets and leverage that is not easily achieved and managed by individual investors) and/or stock funds that trade at attractive discounts to net asset value (“NAV”) and that are managed by teams with highly specialized and efficient skill sets.

Led by lead portfolio manager (and his team), Chuck Royce, Royce Investment Partners has been a small cap specialist since 1972. And the Royce Micro-Cap Trust has outperformed its benchmark for the 1-, 3-, 5-, 10-, 15-, 20-, 25-year, and since inception (12/14/93) periods ended 9/30/22. The fund actively invest in small and micro-cap stocks (the average market cap is only around 590 million versus roughly $2 billion for the Russell 2000 small cap index). Navigating small and micro-cap stocks requires specials skills (due to liquidity constraints and the risks and opportunities of the CEF structure) and the Royce team has a long-track record of success. RMT has delivered strong performance net of fees (the total expense ratio was recently 1.35%, an acceptable level for active micro-cap) and the strategy appears positioned to perform well going forward.

Specifically, small and micro-cap stocks currently present a compelling contrarian opportunity right now as the market paradigm shifts. For example, the Russell 2000 small cap index (and the Russell microcap index) have significantly underperformed the S&P 500 in recent years, and that has historically been an exceptional time to buy, as argued by this Royce article.

Also important, RMT currently trades at a wide discount (~12.0%) to its NAV (i.e. the market value of all the underlying holdings in the fund). Large discounts and premiums are a unique characteristic of CEFs (as compared to other mutual funds and ETFs), and wide discounts can create a compelling buying opportunity, as we believe it does in this case for RMT. Specifically, you get access to all the returns of the underlying holdings at a discounted price.

Also, we’d be remiss not to explain that the reason this fund offers such a big yield is NOT because the underlying holdings pay such big dividends. Rather, it is commonplace for CEFs to generate a significant portion of their distribution from capital gains (and in some cases from a return of your own initial capital investment, just to maintain the high distribution). The big distribution yield can be helpful to investors that really appreciate steady income payments, but the performance described above includes a reinvestment of the distributions, and if you are a long-term investor—simply reinvesting the distributions automatically can make a lot of sense.

Overall, if you are looking for an attractive contrarian opportunity, the Royce Micro-Cap Trust is worth considering, especially as the overall market paradigm continues to shift.

Conclusion:

Market conditions have been volatile, and big-yield opportunities are wide ranging. However, there are select attractive opportunities from across categories, as described in this report. Critically important, when selecting any investment, you need to make sure it is right for you and your personal situation. We believe that disciplined, goal-focused, long-term investing will continue to be a winning strategy.