2022 was an ugly year for growth stocks. And it’s going to get worse for many of them (as the pandemic bubble continues to burst). In this report, we rank 100 top growth stocks based on the financial metrics we consider most important in the current market environment (i.e. how they function with higher interest rates). We have a special focus on Amazon, comparing it to peers on these same financial metrics, but also diving into its specific business fundamentals, including competitive advantages (not just scale and Amazon Web Services, but also subscriptions like Prime and its burgeoning advertising business), risks and valuation. We conclude with our strong opinion on Amazon and investing in select growth stocks in the current market environment.

100 Growth Stocks, Ranked

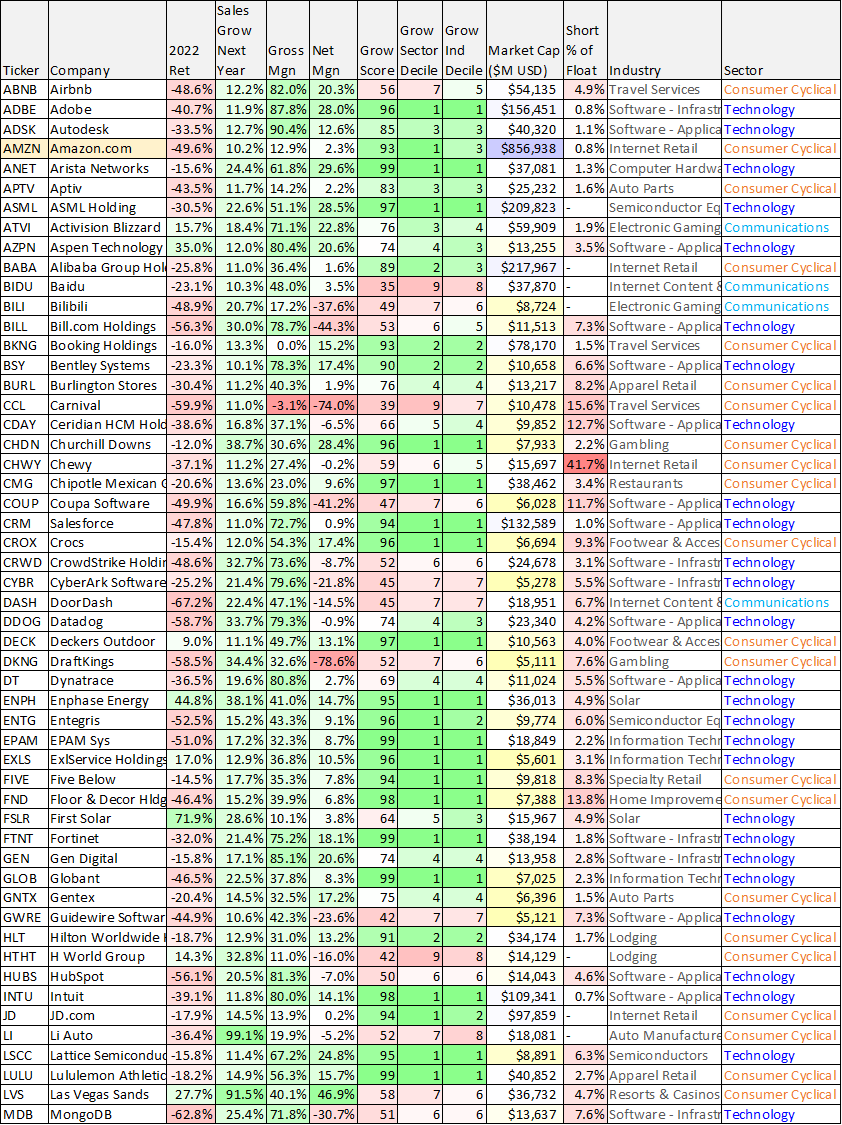

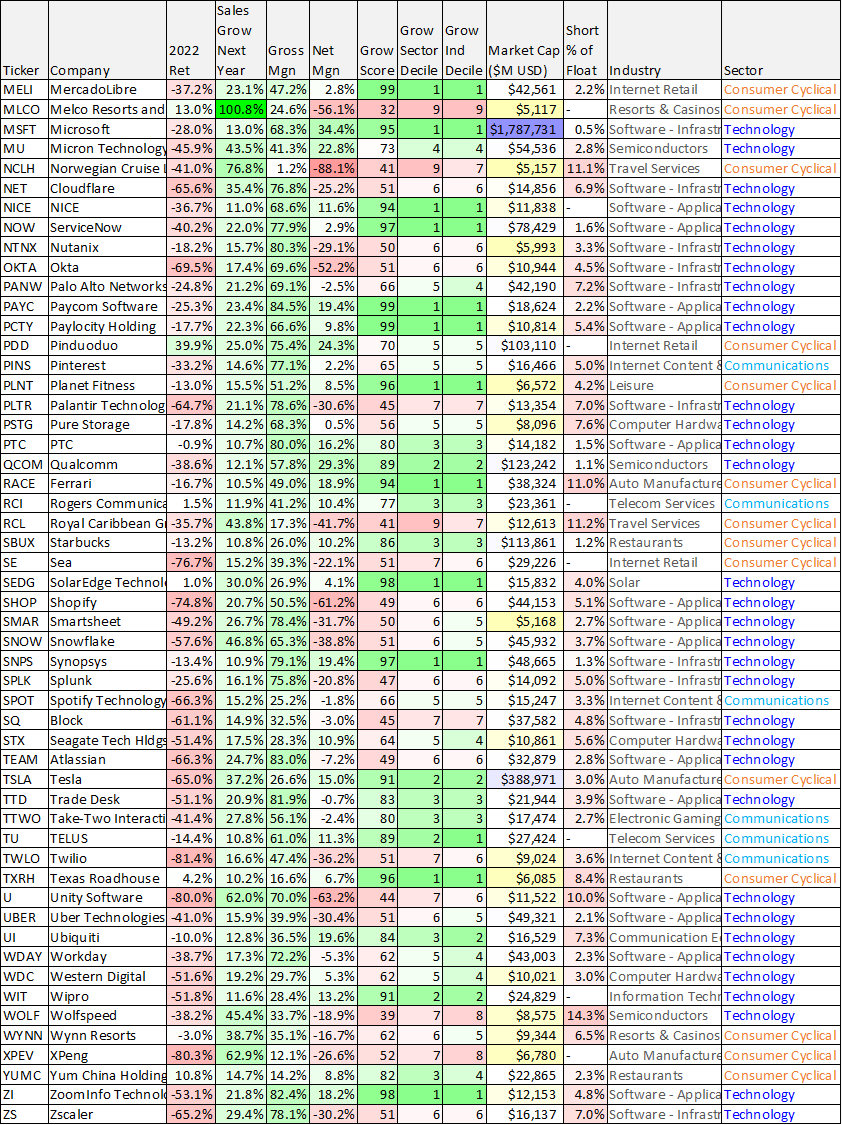

Before getting into the details on Amazon, here is our high-level ranking of 100 top growth stocks (see below). To be included in this table, we required at least a 10% expected growth rate for next year (many of them are much higher) and a market cap of at least $5 billion. We also limited the table to the three worst-performing market sectors of 2022: Technology, Communications and Consumer Discretionary.

One big theme behind this table is that profitable businesses (those with positive net income margins) have performed a lot better than those that are not profitable (as you can see in the table below). This has a lot to do with rapidly increased interest rates (higher rates means funding growth is more expensive, future earnings are discounted more, and economic growth is slower; not to mention issuing new shares is less attractive for businesses now that share prices are down significantly). The table is sorted alphabetically by ticker.

For reference, the growth score in the table looks at the 5 year history, as well as forward estimates, for EBITDA, Sales, and EPS growth, to rank the best companies (the best companies score a 100 and the worst score a 0). We also included sector and industry growth deciles (1 is best, 10 is worst) to help make the scores more comparable. You likely recognize at least a few of your favorite growth stocks in the table.

You may have also noticed that Amazon, one of the most popular and widely recognized business names in the world, was down ~50% in 2022, but ranks well in the table.

Amazon Business Overview:

If you don’t know, Amazon divides its business into three segments (North America, International and Amazon Web Services), but that is a bit of a disservice to analysts considering essentially 100% of the profit is generated by AWS. North America and International are basically the geographical breakdown of retail sales, which generate essentially zero profit on a segment basis, but have very profitable and growing sub-areas in those segments (mainly subscriptions like Prime and the burgeoning advertising business) that will likely be growth and profit drivers in the future. Most of Amazon’s revenues come from North America (~60%) and International (~27%), but virtually all profit (100%) currently comes from its third segment, AWS.

Competitive Advantages:

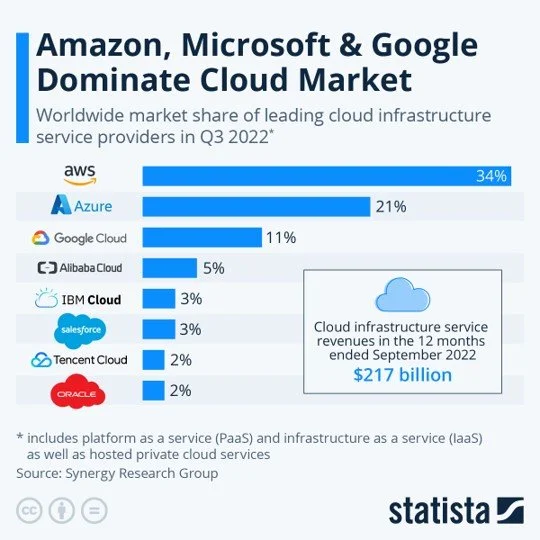

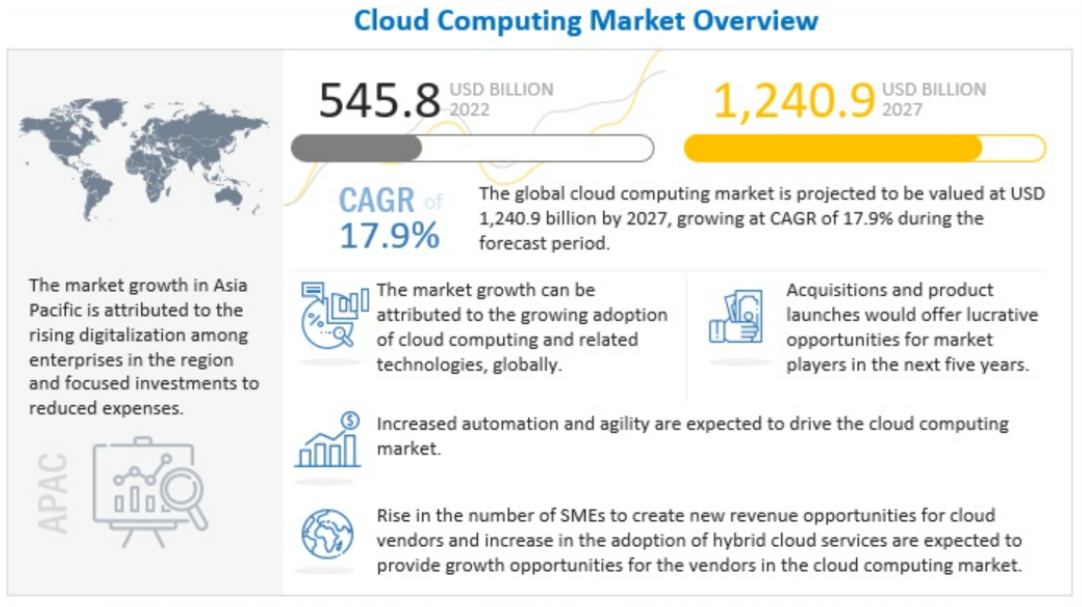

Amazon has huge competitive advantages over its peers stemming from massive economies of scale (which enable it to deliver low cost services) and network effects (for example, Amazon gathers all types of information about users that will help its advertising efforts). Amazon Web Services is the leading cloud services provider (ahead of Microsoft Azure (MSFT) and Google Cloud (GOOGL)) and this segment has massive long-term growth potential stemming from the ongoing digital transformation and migration to the cloud (an enormous long-term secular trend that has slowed in recent months, but is still only just beginning in terms of long-term opportunity).

Risks:

Amazon faces risks. For starters, the market was disappointed by Amazon’s most recent quarterly earnings announcement (whereby the shares sold off sharply) stemming from slower growth than expected in AWS as the aftereffects of pandemic-driven social distancing (and work from home) continue to wear off). What’s more, this negative trend could continue as overall economic growth has slowed and the potential for an ugly recession continues to loom. Furthermore, there are reports that Amazon is set to lay off up to 20,000 employees (a recent trend among large technology-driven companies) in the coming months; this is encouraging from a proactive cost-control standpoint, but concerning, and indicative of potentially rough roads ahead.

Another risk is foreign currency effects whereby earnings have recently been impacted negatively by negative translation effects. The varying degree and pace of post-pandemic monetary policy shifts and lockdown policies have contributed to a dynamic foreign currency risk environment.

Cloud competition from Microsoft (which is gaining ground on AWS) and Google are also a risk. However, given the scale of the massive cloud secular trend—there is room for multiple big players to succeed, and cloud will likely be a leading profit-driver for the next decade at least.

Valuation:

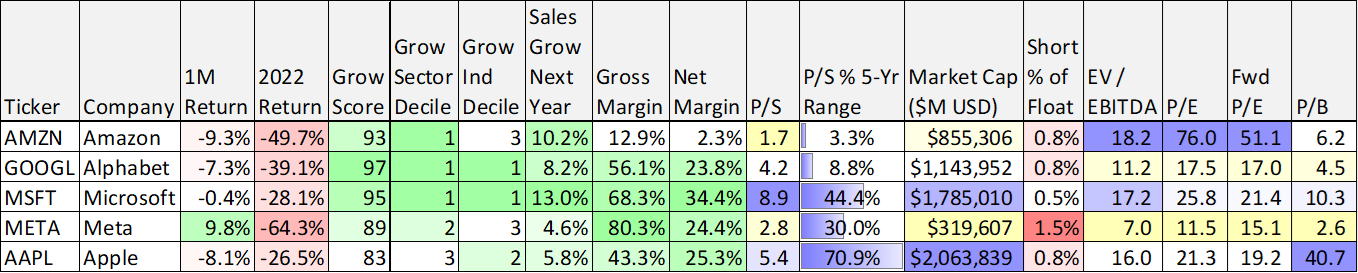

Don’t be fooled by Amazon’s low net profit margins (see table below). It is largely a high-sales low-net-margin retail business. And this massive revenue retail business creates massive economic moats and network effects that strengthen its other profitable high-growth operations (AWS, subscriptions and advertising).

Currently trading at under 2 times sales (the lower end of its historical range), and with revenue expected to grow (and keep growing) at roughly double digits (based on massive long-term secular trends), Amazon is extremely attractive—despite the fact that it’s growing at a slightly slower pace than most analysts had previously expected (as they over-extrapolated the short-term “pandemic bump”). Also important to note, Amazon spends heavily on research and development, a cost that can be reduced anytime to increase profit, but remains important for future growth.

Furthermore, the Fed’s aggressive interest rate hikes this year have had a particularly negative impact of high-growth stocks (see performance in the tables above). We believe these factors helps explain the share price declines, and also contribute to the attractiveness of the investment opportunity as inflation will eventually slow, the fed’s aggressively hawkish policies will moderate (hopefully sooner than later), and Amazon will keep growing rapidly for many years.

Conclusion:

Growth stocks have been hit particularly hard by rapidly rising interest rates. And as we wrote in our new 2023 Outlook: 10 Stocks Worth Considering:

We could be in the very early innings of a new long-term market paradigm whereby near-zero interest rates are gone for decades and so too may be the incredible leadership and performance of growth stocks.

That said, many of the high-growth pandemic darlings that have already fallen so hard, may still have further to fall as higher interest rates have pushed profitability further into the future (and maybe never). On the other hand, select growth stocks that are already quite profitable and have attractive long-term market opportunities (such as Amazon), have already sold off too hard. We don’t know where the market will be next week, next month or at the end of 2023, but over the long-term many of the most attractive stocks listed in this article (such as Amazon) will likely be trading significantly higher.