2022 was a very different year for investors. The stock and bond markets were both down significantly, and as monetary policies shifted from dovish towards hawkish—and fiscal pandemic stimulus evaporated—investors were left with the giant sucking sound of high inflation. And making matters worse, central bankers pushed the economy towards recession by dramatically hiking interest rates in an effort to stifle the high inflation problem they helped create. Further still, the dramatic shift in markets may just be starting. In this report, we review what looks to be the beginning of a new market paradigm and review 10 top investment ideas that investors may want to consider going forward.

A New Market Paradigm: Higher Interest Rates

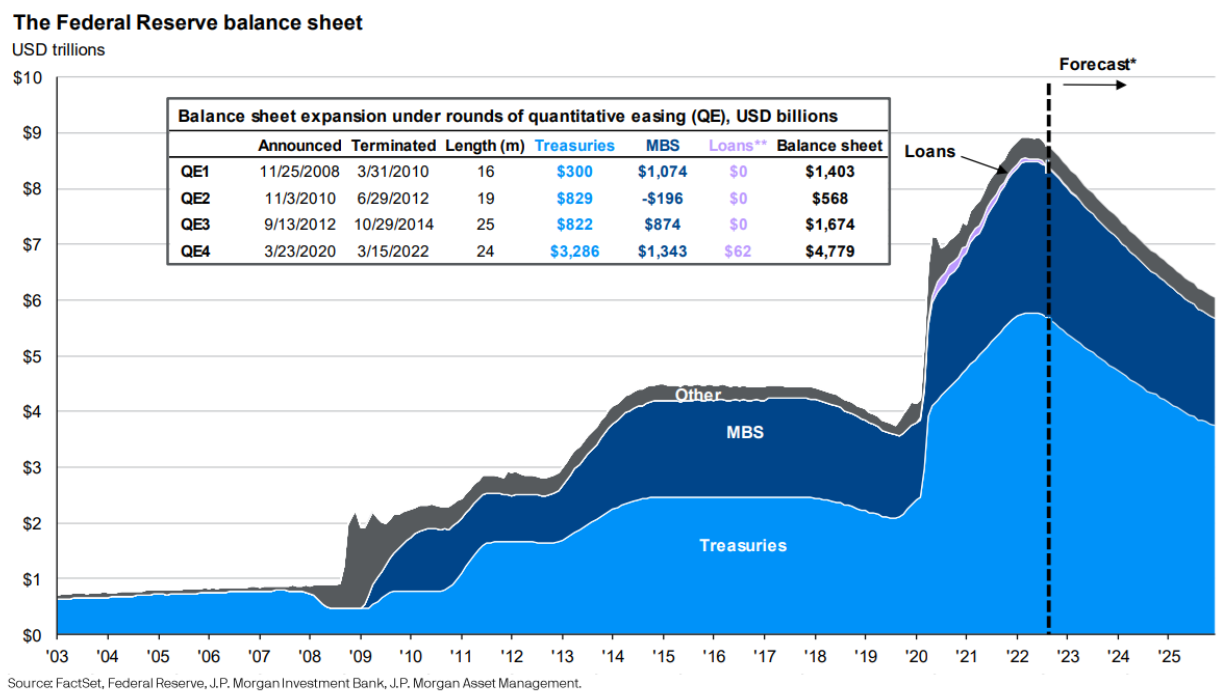

Briefly, when interest rates go up, bond prices go down and stock prices face pressure (more on this in a moment). That’s exactly what we saw in 2022, and it seems unlikely that central bankers will reverse course in 2023 as rates are expected to keep rising and as the US fed intends to unwind its massive balance sheet (it built up the balance sheet following the Great Financial Crisis (“GFC”) of 2008-2009 and during the 2020-2021 pandemic bubble) thereby creating further headwinds for investors.

Mathematically, when interest rates rise, bond prices adjust by falling (so their yields, basically interest payments divided by price, become commensurate with prevailing market rates). Similarly, when interest rates rise, stock prices face pressure (because it makes it a lot harder for businesses to grow, because the cost of funding growth is now higher, and because the value of future earnings are discounted at a higher rate). This is what caused stock and bond markets to fall in 2022 (central bankers kept raising rates—the opposite of what they did during the GFC and the pandemic bubble).

There are small signs that the high rate of inflation is slowing. For example, the latest CPI and PPI monthly readings increased at a slightly slower pace, and the Fed’s most recent interest rate hike was only 50 basis points, instead of the previous 75 basis points. These are incrementally encouraging signs for the market, but there really is no reason to believe the Fed will reverse course (i.e. dramatically lower rates, and/or stop unwinding its balance sheet) barring any unforeseen macroeconomic crisis. Rather, it seems that higher interest rates are here to stay, something investors haven’t had to deal with in well over a decade.

What Do Higher Rates Mean for Investors?

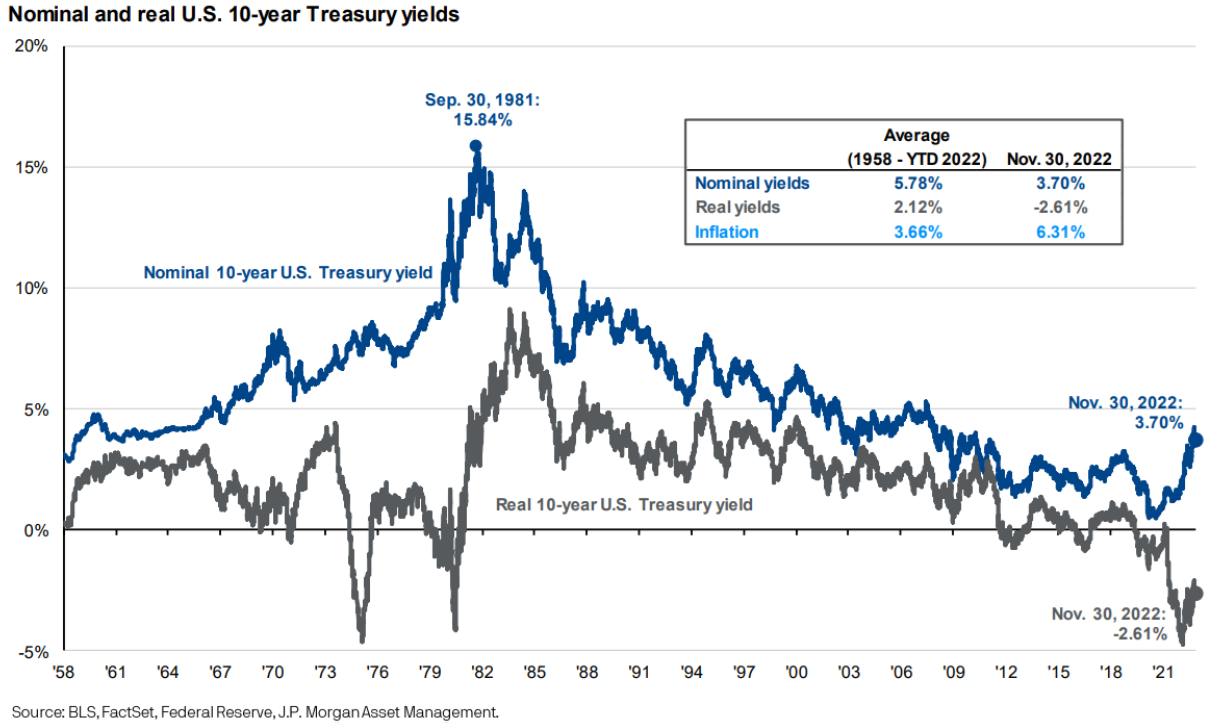

Prior to 2022, interest rates had been coming down for almost 40 years straight. And this created a tremendous tailwind (a good thing) for investors. As mentioned, lower rates increase bond prices, and lower rates makes it easier for businesses to grow (good for stock prices). Lower rates also encourage investors to borrow, thereby accelerating the rate of growth.

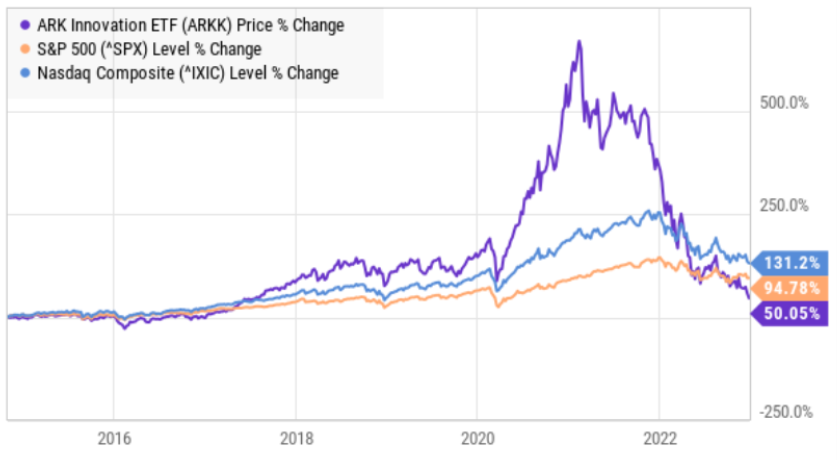

In recent years, it was the Fed’s artificially low interest rates (near 0.0%) that enabled growth stocks to outperform value stocks so dramatically. For example, a breed of unprofitable, high-revenue-growth “pandemic stocks” soared to extreme levels during the pandemic bubble as investors incorrectly seemed to assume interest rates would stay near zero forever. This environment gave rise to pandemic darlings, such as the now infamous ARK Innovation ETF (ARKK), which soared to incredible levels during the pandemic (by investing in high revenue growth stocks with basically zero (or negative) current profits), but has subsequently fallen in epic fashion.

Higher rates have also created a wide variety of additional challenges. For example, housing market activity just fell off a cliff (people can afford a lot less house when interest rates increase dramatically), grocery prices are through the roof thanks to inflation, and real yields are still negative (when you back out the cost of inflation, returns are still significantly negative).

Further still, education prices have soared (thereby burying graduates in now higher interest rate debt). And even the used car market seems in big trouble as we go from not enough supply (due to new car shortages related to pandemic supply chain disruption) to a potential oversupply and increasing loan defaults as borrowers weigh the tradeoffs between higher rates and oversized payments on cars they bought at inflated prices.

Growth Vs. Value Stocks: 2023 and Beyond

There are many different ways to define growth versus value, but “growth stocks” are basically businesses that have relatively higher expected future growth rates and generally higher current valuations. Conversely, “value stocks” have lower valuations, as well as lower future growth rates, but they are often more profitable now (versus growth stocks which are often expected to be more profitable later). There is a higher degree of uncertainty with regards to growth stocks; as long as market conditions stay healthy, investors are generally rewarded over the long-term for taking on the higher uncertainty risk associated with growth stocks. But when economic and monetary conditions decline (like they did in 2022 at a rapid pace) growth stocks are punished (like they were in 2022).

Going forward, we don’t expect interest rates to go back near 0.0% in 2023 (barring any exogenous crisis) and we don’t expect unprofitable high-revenue-growth stocks to rebound hard either. Rather, we prefer select growth stocks that are already profitable because they can fund their own continued growth rather than relying on the capital markets (capital markets are now much more expensive as interest rates have risen, and now that many growth stock prices have fallen dramatically thereby making it more expensive to raise cash by issuing more of their own shares—a common technique during the pandemic bubble).

Some contrarian investors view now as an attractive time to buy growth stocks based on the assumption that inflation will slow (i.e. it’s been transitory) and the assumption that the Fed will become less hawkish (i.e. temper its monetary policies). But even in this case, the pandemic growth stock darlings likely aren’t going to rebound to their previous highs anytime soon simply because they’re still not profitable and economic conditions (higher rates for borrowing and lower stock prices for new share issuances) makes it harder for them to become profitable. In our view, now is a good time for contrarians to consider select “profitable” growth stocks. These aren’t necessarily the fastest revenue growers, but they do have well-above-average growth rates (along with other attractive qualities) and they have sold off hard in sympathy with the unprofitable growth stocks (i.e. babies thrown out with the bathwater).

10 Stocks Worth Considering

Based on our new market paradigm (i.e. higher rates and a Fed with no immediate incentive to lower them), we’re offering up a variety of investment ideas that we believe are attractive and worth considering. As described below, these ideas are broken out into five different categories, including growth stocks, value stocks, big-dividend opportunities, style allocations, and income-producing bonds (yes, bonds are again worth considering, as we will explain).

Two Growth Stocks Worth Considering:

As mentioned, we like “profitable” growth stocks in the current environment (as opposed to the unprofitable stocks with extremely high revenue growth rates that soared during the pandemic, but have subsequently fallen dramatically and may still have significantly further to fall). Specifically, we believe certain attractive high-revenue-growth stocks, that are also significantly profitable, have incorrectly sold off too far in the recent market correction, thereby making them compelling opportunities on a go-forward basis, such as those describe below.

1. Veeva Systems (VEEV):

As mentioned, we like high-revenue-growth stocks that are also profitable. And not only is Veeva Systems highly profitable (and growing revenues rapidly), but it also has zero debt, tons of cash and a sticky-client base that is economically non-cyclical. Further, it has a large total addressable market opportunity, a wide economic moat and basically no competition. We don’t know where the market will be tomorrow, next month or even at the end of 2023, but over the long-term (many years), Veeva has a ton of share price appreciation potential.

If you don’t know, Veeva provides cloud-based software solutions specifically for the life sciences industry. They have more than 1,000 customers ranging from leading pharmaceutical companies to emerging biotechs. And like most companies that have anything to do with “the cloud,” the shares sold off hard in 2022—down nearly 40%—as the pandemic bubble burst.

In our view, the 2022 sell off has created an attractive buying opportunity in Veeva. For starters, Veeva is a growth stock, so the shares are not cheap, but considering it lacks the negative characteristics that caused other high-growth stocks to sell off, and it possesses all the attractive characteristics we’ve described above, we believe it’s absolutely worth considering if you are a disciplined long-term investor. We recently wrote up Veeva in detail, and you can access that report here.

2. Amazon (AMZN):

For reporting purposes, Amazon divides its business into three segments (North America, International and Amazon Web Services), but that is a bit of a disservice to analysts considering essentially 100% of the profit is generated by AWS. North America and International are basically the geographical breakdown of retail sales, which generate essentially zero profit on a segment basis, but have very profitable and growing sub-areas in those segments (mainly subscriptions like Prime and the burgeoning advertising business) that will likely be growth and profit drivers in the future. Again, most of Amazon’s revenues come from North America (~60%) and International (~27%), but virtually all profit (100%) currently comes from its third segment, AWS.

Amazon has huge competitive advantages over its peers stemming from massive economies of scale (which enable it to deliver low cost services) and network effects (for example, Amazon gathers all types of information about users that will help its advertising efforts). Amazon Web Services is the leading cloud services provider (ahead of Microsoft Azure (MSFT) and Google Cloud (GOOGL)) and this segment has massive long-term growth potential stemming from the ongoing digital transformation and migration to the cloud (an enormous long-term secular trend).

Like virtually every cloud and tech-related company, Amazon shares have sold off hard in 2022—down more than 50%! However, unlike many other high-growth stocks that soared following the onset of the pandemic, Amazon is actually profitable and cash rich. Amazon has tons of free cash flow that is uses to fund its long-term growth initiatives thereby eliminating much of the capital market risk that so many other growth stocks currently face.

Currently trading at only ~2 times sales (the lower end of its historical range), and with revenue expected to grow (and keep growing) at roughly double digits (based on massive long-term secular trends), Amazon is attractive. Granted, the businesses faces near-term headwinds (inflation, slowing growth, pandemic aftershock), but the long-term leadership opportunities remain fully intact, and the shares present a compelling long-term opportunity. It’s the type of stock you could add to your portfolio today, and then wake up 5 years later to find them trading at a dramatically higher price.

Two Value Stocks Worth Considering

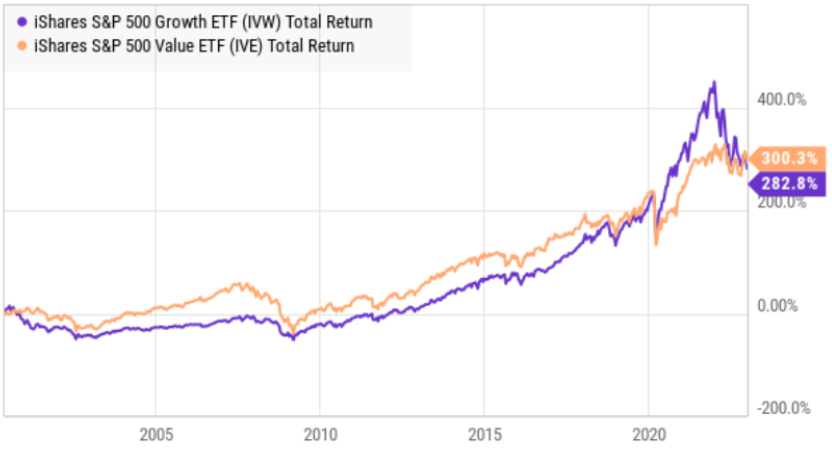

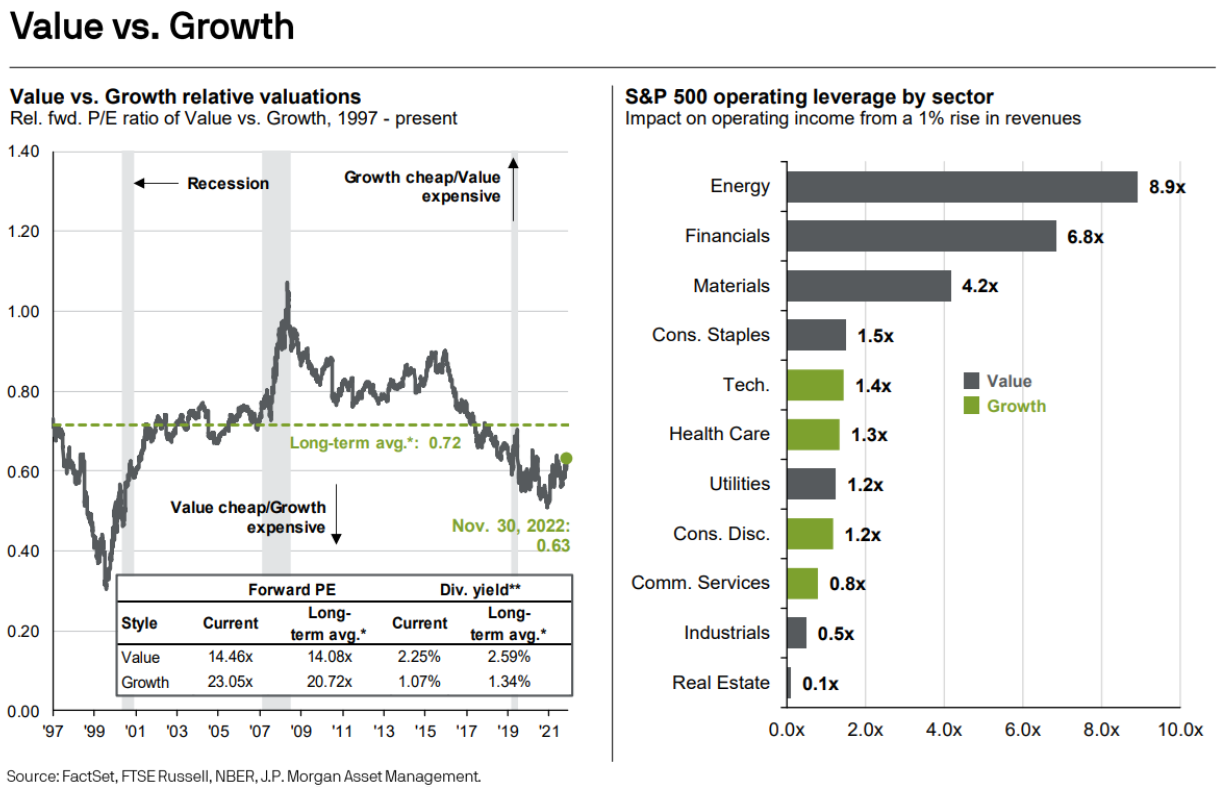

Prior to 2022, growth stocks had been dominating value stocks for over a decade. This phenomenon was driven significantly by artificially low interest rates (which benefit growth stocks more than value stocks).

However, now that interest rates have increased (and there seems to be no immediate incentive for the Fed to take them back near zero anytime soon), value stocks are increasingly attractive, particularly as compared to growth stocks.

In particular, we like businesses that are arguably helped by higher inflation (i.e. companies with significant tangible book value) and those that are helped by higher interest rates (i.e. improved net interest margins), as we will explain with the two example below.

3. Celanese (CE), Yield: 2.7%

Celanese is materials company. It manufactures performance engineered polymers and it is also the world's largest producer of acetic acid (and its chemical derivatives). Celanese materials are used in things like automobiles, medical applications, consumer electronics and many more.

Like much of the rest of the world, Celanese’s business was disrupted by the pandemic (specifically by supply chain disruptions and manufacturing shutdowns, both in the US and abroad). The shares are down nearly 40% in 2022. Celanese is a value stock.

We view Celanese as an attractive contrarian value stock because it has cost advantages over peers (due to its scale and because it has access to low cost feedstocks courtesy of its Clear Lake Texas operations and low cost US natural gas), and because we are near a low point in the market cycle (hopefully!) that was caused by pandemic disruption. Celanese recently acquired DuPont’s (DD) mobility and material portfolio, which will compliment Celanese’s existing portfolio and low cost leadership.

Trading at under 7x earnings, with a net margin of 17.4%, and having grown its dividend to investors for 13 consecutive years, we view Celanese as an attractive contrarian opportunity with significant share price appreciation potential as pandemic supply chain disruptions resolve and Celanese emerges as the low cost leader with increasing economy-of-scale advantages.

4. J.P. Morgan (JPM), Yield: 3.0%

Growth for banks can slow as the economy enters recession (recession is largely expected in 2023). However, sharply rising interest rates (which are expected to continue) increase bank profitability through expanded net interest margins (i.e. the spread between the rate banks borrow at and the rate they lend at). We prefer lower risk and financially strong lenders in the current environment because they can benefit from higher interest rates and avoid the level of defaults that some smaller less-diversified and higher-risk lenders face.

As such, we prefer big banks (too big to fail) over most regional banks and over most (but not all) high-risk lending organizations (such as business development companies—more on this later). As such, we like J.P. Morgan—the most dominant bank in the U.S. and one that stands to benefit significantly from higher interest rates and significant operating leverage.

J.P. Morgan operates and leads across a wide variety of segments, including investment banking, payments, credit cards, trading, commercial banking and wealth management. And it benefits from economies of scale and high switching costs. J.P. Morgan has an impressive 30% net income margin and nearly a 13% return on equity. It trades at 1.5x book value and 11.3x forward earnings. Financials (banks) are a traditional “value” sector of the economy, and stand to do well based in our new interest rate paradigm.

Two Big-Dividends Worth Considering

Big dividends help some investors sleep well at night. And with interest rates and inflation now higher, certain big-dividend opportunities are increasingly attractive, such as the two we describe below.

5. Ares Capital (ARCC), Yield: 10.3%

Business Development Companies (or BDCs) basically provide financing (loans and sometimes equity) to smaller “middle market” businesses (which are riskier by definition). As such, we view BDCs as “at risk” as the economy increasingly heads towards a recession in 2023. Despite the fact that BDCs should benefit from rising interest rates (especially those with more floating rating investments and more fixed rate balance sheet debt).

However, not all BDCs are created equally. For instance, we like “higher quality” BDCs (because they will be less negatively impacted by an economic slowdown), and we like BDCs focused on distressed investing that currently have a lot of dry powder (i.e. excess cash or lending capacity so they can invest opportunistically as attractive distressed opportunities may arise).

With interest rates going higher, this particular BDC (Ares Capital) stands to benefit further, especially considering its favorable mix of floating rate investment income versus fixed rate debts. Ares is the “blue chip” BDC in the room considering its large size, impressive portfolio quality, extensive industry relationships and its conservative balance sheet.

Ares recently announced quarterly Non-GAAP EPS of $0.50 (beating expectations by $0.01), and total investment income of $537M (+21.5% y/y) beating by $22.59M. Further, in a sign of strength, Ares raised its dividend by 11.6% to $0.48 (previously $0.43). And with a price-to-book value of only around 1.0, we view Ares as attractive.

6. The Williams Companies (WMB), Yield: 5.2%:

Energy companies are generally a capital-intensive “value” sector of the economy. And with energy prices higher, most energy companies stand to benefit. After all, energy was by far the best performing sector of the stock market in 2022 (due to higher prices and post-pandemic re-openings).

Midstream companies (the companies that transport oil and gas, often via pipelines) are unique in the energy sector as their revenues are largely fee-based, thereby less sensitive to energy prices. However, midstream company clients (such and exploration and production companies) are sensitive to energy prices. And as such, the strong performance of traditional energy companies in 2022 has strengthened their balance sheets and reduced their risk of bankruptcy. This is great news for midstream companies, especially in the years ahead (because their clients’ “financial gas tanks” are no longer running so close to “empty”).

In particular, Williams handles 30% of the natural gas in the United States that is used every day for things like heating homes, cooking, and generating electricity (Williams has valuable interstate natural gas pipelines and gathering & processing operations throughout the U.S). We like Williams in particular because its large transport network positions it to keep investing in high-return projects. Net Income margin was recently 17.4% and ROE 14.8%—both attractive. Also noteworthy, roughly 50% of it earnings come from rate-regulated gas pipelines—which means its revenue is even steadier (i.e. fee revenue is steady and rate-regulated fees are even steadier).

We also like Williams because it offers an attractive dividend and it does not issue a K-1 statement (a lot of midstream companies are organized as Master Limited Partnerships and thereby issue K-1 statements which can create headaches at tax time). Williams issues an ordinary 1099-DIV at tax time, and the dividend is positioned to keep growing based on William’s strong financial position and ongoing growth.

Two Market Styles Worth Considering

As described earlier, we believe value stocks are increasingly well positioned to deliver stronger returns than growth stocks in the years ahead. And as you already know, certain market sectors and styles tend to be much more value-oriented than others. Here are two ways to invest in two value sectors/styles of the market that we consider attractive.

7. Vanguard Value ETF (VTV), Yield: 2.5%

If you are looking for a quick-and-easy, low-cost way to increase your exposure to value stocks, the Vanguard Value ETF is an efficient and effective way to do that. In particular, Vanguard is known for well-managed low-cost passive investing, and that is what VTV delivers.

With an expense ratio of around 0.04% annually, and holding around 340 positions, VTV’s largest sector exposures are the value-oriented sectors, including Healthcare (22.4%), Financials (20.2%), Industrials (12.6%), Consumer Defensive (11.3%) and Energy (8.4%). Technology, which is a growth sector and by far the largest market sector in the S&P 500, is only around 8.1% of VTV. The top holdings in this fund were recently Berkshire Hathaway (BRK.B), UnitedHealth Group (UNH), Johnson & Johnson (JNJ), Exxon Mobil (XOM), J.P. Morgan (JPM) and Procter & Gamble (PG), all leading value stocks.

There is no active manager on this fund that is picking and choosing the best value stocks. Rather, this fund’s objective is to passively own all of the value stocks. Specifically, it seeks to track the performance of the CRSP US Large Cap Value Index, by using full replication technique.

If you are looking for a quick, effective and low-cost way to increase your exposure to value stocks, the Vanguard Value ETF is worth considering.

8. Royce Micro-Cap Trust CEF (RMT), Yield: 13.2%

If you have the time and resources to actively select individual investments, then CEFs (i.e. closed-end funds) should only be utilized sparingly simply because they can add a layer of unnecessary fees that ultimately detract from your net investment returns. We generally reserve CEFs for only select bond funds (that offer unique manager skills, investment opportunity sets and leverage that is not easily achieved and managed by individual investors) and/or stock funds that trade at attractive discounts to net asset value (“NAV”) and that are managed by teams with highly specialized and efficient skill sets.

Led by lead portfolio manager (and his team), Chuck Royce, Royce Investment Partners has been a small cap specialist since 1972. And the Royce Micro-Cap Trust has outperformed its benchmark for the 1-, 3-, 5-, 10-, 15-, 20-, 25-year, and since inception (12/14/93) periods ended 9/30/22. The fund actively invest in small and micro-cap stocks (the average market cap is only around 590 million versus roughly $2 billion for the Russell 2000 small cap index). Navigating small and micro-cap stocks requires specials skills (due to liquidity constraints and the risks and opportunities of the CEF structure) and the Royce team has a long-track record of success. RMT has delivered strong performance net of fees (the total expense ratio was recently 1.35%, an acceptable level for active micro-cap) and the strategy appears positioned to perform well going forward.

Specifically, small and micro-cap stocks currently present a compelling contrarian opportunity right now as the market paradigm shifts. For example, the Russell 2000 small cap index (and the Russell microcap index) have significantly underperformed the S&P 500 in recent years, and that has historically been an exceptional time to buy, as argued by this Royce article.

Also important, RMT currently trades at a wide discount (~12.0%) to its NAV (i.e. the market value of all the underlying holdings in the fund). Large discounts and premiums are a unique characteristic of CEFs (as compared to other mutual funds and ETFs), and wide discounts can create a compelling buying opportunity, as we believe it does in this case for RMT. Specifically, you get access to all the returns of the underlying holdings at a discounted price.

Also, we’d be remiss not to explain that the reason this fund offers such a big yield is NOT because the underlying holdings pay such big dividends. Rather, it is commonplace for CEFs to generate a significant portion of their distribution from capital gains (and in some cases from a return of your own initial capital investment, just to maintain the high distribution). The big distribution yield can be helpful to investors that really appreciate steady income payments, but the performance described above includes a reinvestment of the distributions, and if you are a long-term investor—simply reinvesting the distributions automatically can make a lot of sense.

Overall, if you are looking for an attractive contrarian opportunity, the Royce Micro-Cap Trust is worth considering, especially as the overall market paradigm continues to shift.

Two Bond Investments Worth Considering.

Bonds are boring, right? Not so fast. The very low interest rates offered by bonds over the better part of the previous decade gave rise to some pretty distorted views on stocks and bonds. And the sharp price declines for bonds in 2022 (as the Fed raised rates) has left an even more terrible taste in many investors mouths. However, with interest rates now higher, the attractiveness of certain types of bonds has also increased (especially with the yield curve inverted), as we will explain below.

9. 1-Year US Treasuries, Yield: 4.6%

Why on earth would an investor invest in something as boring as a US treasury? For starters, the yield on a 1-year treasury is currently higher than the yield on a 10-year treasury (this is unusual, it’s the inverted yield curve we mentioned, and it’s sometimes an indication of recession on the horizon). And this 4.6% yield is massive as compared to the close-to-zero percent yield a 1-year treasury offered a year ago (this is what happens when the fed raises rates).

Furthermore, if you buy a 1-year treasury and hold it to maturity, you don’t have to worry as much about rising and falling interest rates. Because as long as you hold to maturity, you are 100% guaranteed (by the full faith and credit of the US government) to get paid in full. This is a very different interest rate risk profile than a 10-year treasury whereby the price can fluctuate significantly over the next 10 years (depending on how interest rates move), and 10 years is a lot longer than 1-year to wait for your investment to mature at par (so you get paid in full). A 1-year treasury has very little interest rate risk, it offers a decent return (as compared to the near 0% return of 1 year ago, and as compared to all the risk and volatility in the stock market) and it is 100% guaranteed by the US government. If you are looking for a little safe income, a 1-year treasury is a decent option that may be worth considering for many investors.

Investment-Grade Corporate Bonds

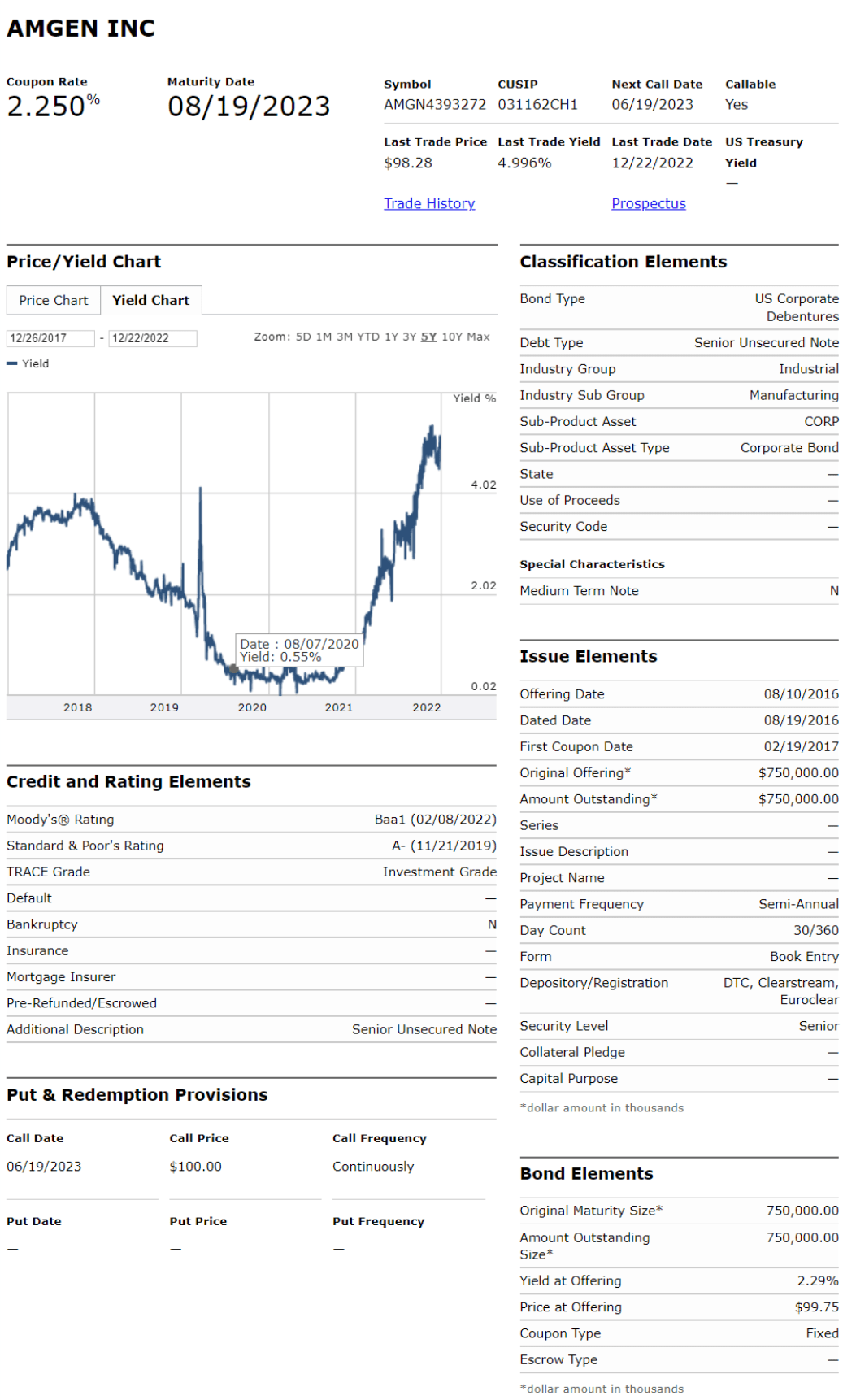

10. Amgen (AMGN) 2023 Bonds, Yield: 5.0%

With 1-year US treasuries yielding 4.6%, there are a variety of investment-grade corporate bonds that are yielding even more. Historically, the default rate on investment-grade bonds is very low, and by building a portfolio of them you can eliminate a lot of the idiosyncratic risks. For example, S&P Global reported that the highest one-year default rate for AAA, AA, A, and BBB-rated bonds (investment-grade bonds) were 0%, 0.38%, 0.39%, and 1.02%, respectively. And that’s the highest one-year default rate (its normally even lower!).

Amgen (a biotech company) offers bonds with “A-” investment grade rating, and maturing in less than one year. This is impressive because just one year ago, the yields on investment-grade corporate bonds was much lower. For example, you can see in the following chart that these Amgen bonds yielded close to 0% in 2021 (when the fed was holding rates near 0%), but yield has now risen to a rate that is worthwhile for many investors (i.e. 5.0%).

Overall, and depending on your own specific needs and situation, you may want to consider corporate bonds as a part of your overall investment portfolio. They can be a lot less risky than stocks, and today’s 5%+ yields are a lot more interesting than the near 0% yields of just one year ago.

Conclusion:

We could be in the very early innings of a new long-term market paradigm whereby near-zero interest rates are gone for decades and so too may be the incredible leadership and performance of growth stocks. Rather, we may have just returned to a period where markets increasingly reward profitable stocks trading at low valuations—a notion that was scoffed at over the last decade, yet preferred for multiple decades prior.

No one know what will happen to interest rates, markets or the economy in 2023 and beyond, but we have shared a variety of select opportunities in this report that appear well positioned for long-term success. We believe that disciplined, goal-focused, long-term investing will continue to be a winning strategy.