Healthcare is a diverse sector. And recent performance has been wide ranging (see data below). This is creating select, highly-attractive big-dividend opportunities ranging from individual pharmaceutical stocks, to healthcare-focused CEFs and even “healthcare” REITs, to name just a few. In this report, we rank our top 10 big-dividend healthcare opportunities, starting with number 10 and counting down to our top ideas.

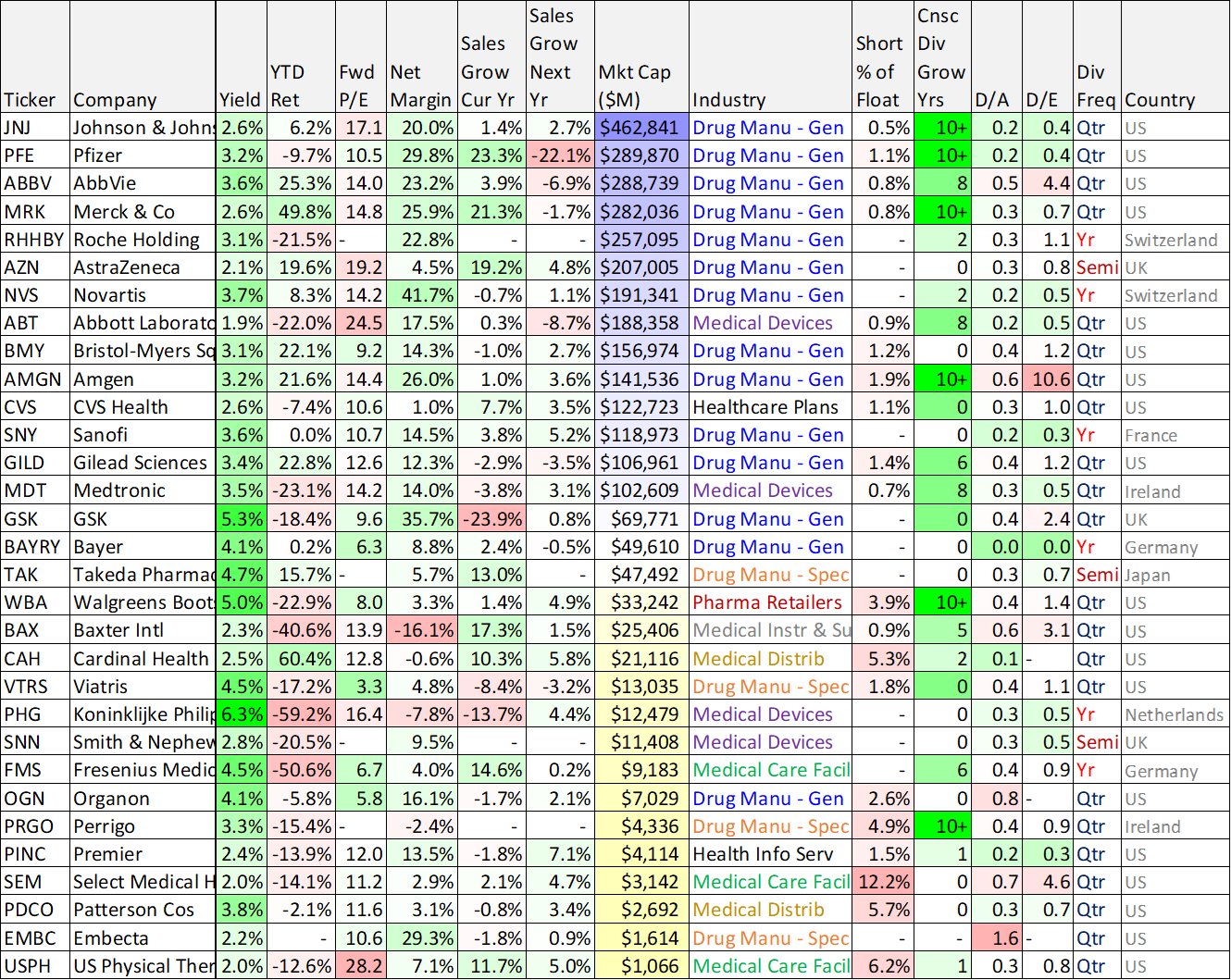

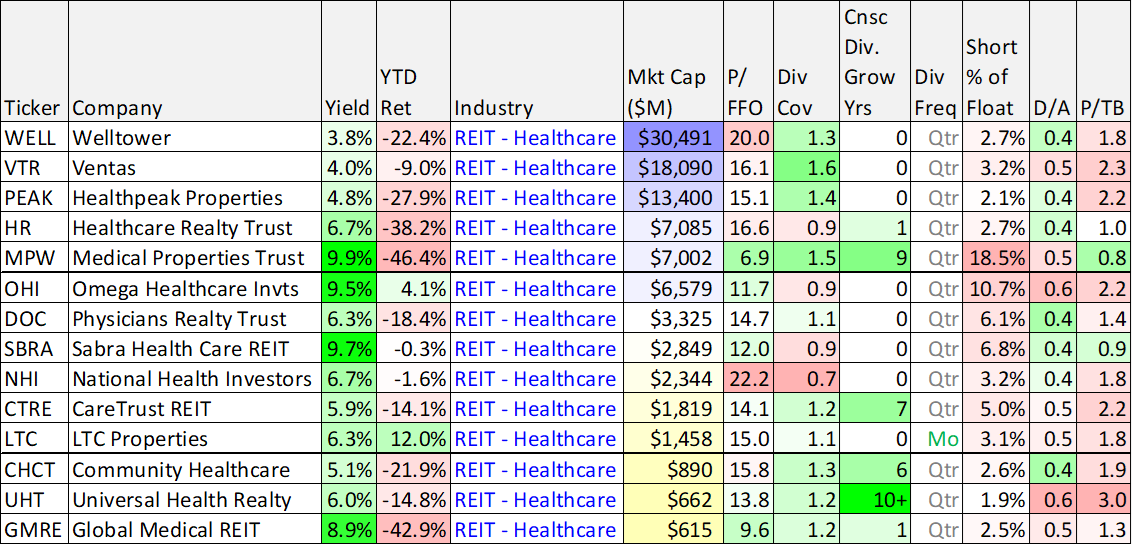

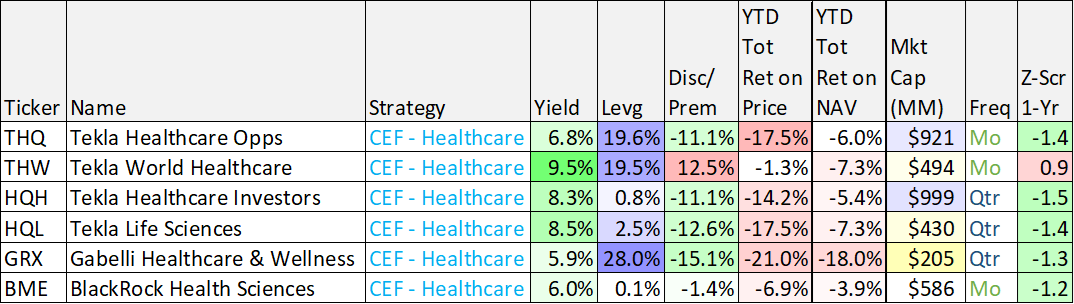

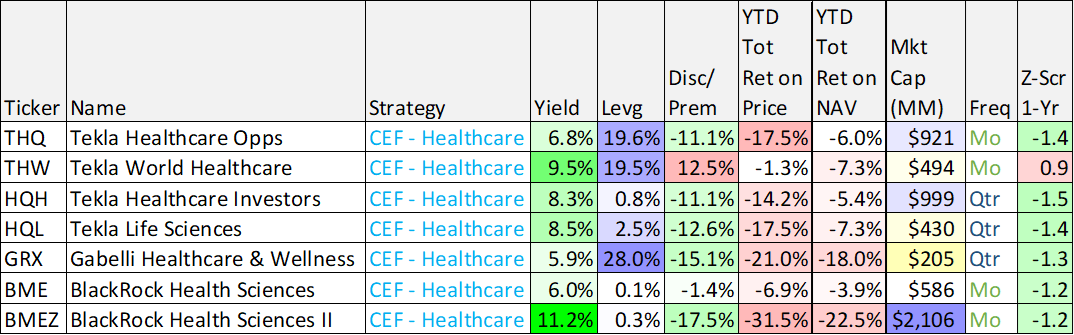

As a primer on the diversity of healthcare opportunities, here is data on over 50 “healthcare stocks.” We put “healthcare stocks” in quotes because some are healthcare REITs (technically the real estate sector, not the healthcare sector) and some are healthcare CEFs (technically closed-end funds, not individual stocks). Nonetheless, they’re all healthcare related, and as you can see in the table below, performance has been diverse and dividend yields can be significant.

You likely recognize at least a few of your favorites in the tables above. You’ll also notice a variety helpful (hopefully) data points, depending on the type of investment, as well as year-to-date performance and current dividend yields.

Why Healthcare Now?

It can make sense to have an allocation to healthcare stocks for diversification and risk management reasons, especially as some opportunities can provide less volatility (and steady income) as macroeconomic conditions continue to deteriorate. For example, many large cap pharmaceutical companies (such as AbbVie (ABBV), Merck (MRK) and Amgen (AMGN)) have performed very well over the last year.

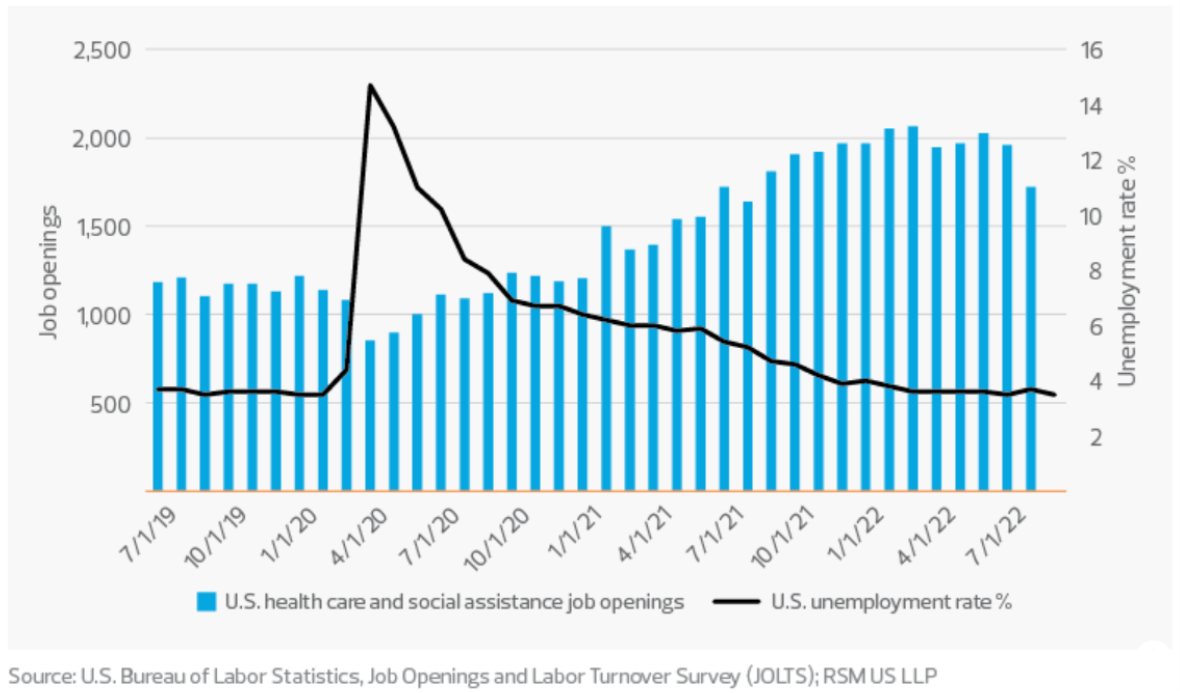

However, two healthcare subgroups that have performed particularly poorly are medical device companies and healthcare facility REITs. We’ll get into specific examples later in this report, but a big reason for the poor performance is because these subgroups are recovering from the pandemic at a significantly slower pace than expected. Specifically, this next chart shows how job openings have remained stubbornly high at healthcare organizations as they struggle to find enough “post-pandemic” workers to meet demand.

This phenomenon has negatively impacted certain pockets of healthcare stocks more than others, and it is also creating select attractive opportunities, as we will cover.

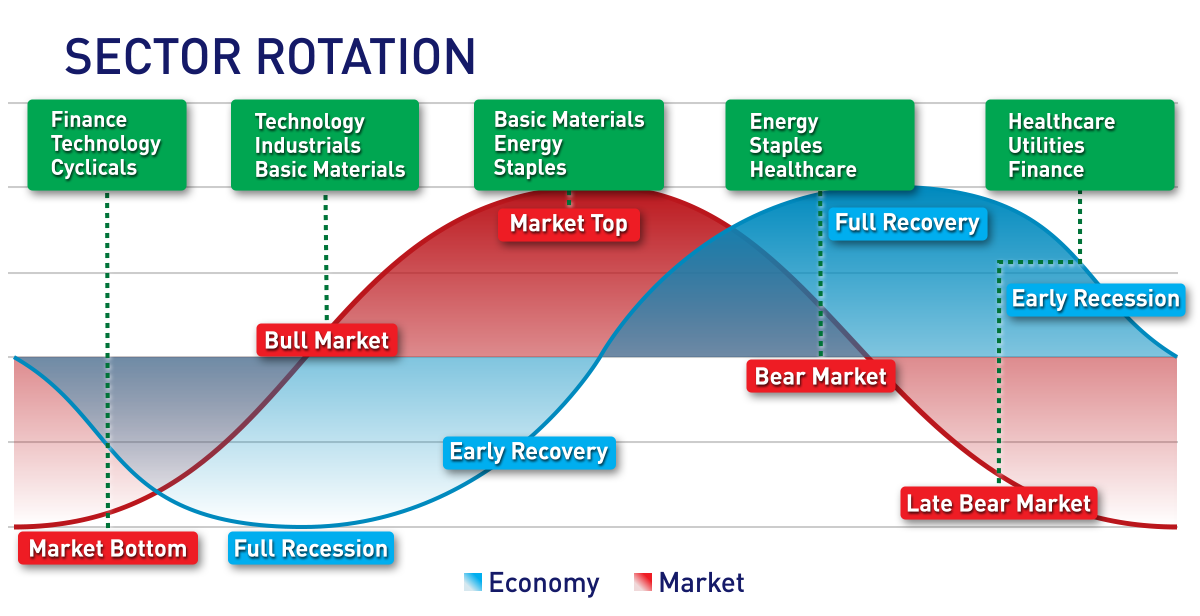

As alluded to earlier, another reason to consider the healthcare sector now is because of where we are in the market cycle. For example, it is often argued that healthcare stocks can perform well in the early recession part of the market cycle—a period which many investors believe we are about to enter.

While this may be true to some extent, it is our view that owning attractive companies over the long-term (throughout the market cycle) is a winning strategy, and if they pay big dividends—that can make it a lot easier for some investors to tolerate any near-term volatility. In our view, the healthcare sector is currently offering a select variety of attractive big-dividend opportunities.

Top 10 Big-Dividend Healthcare Opportunities

With that backdrop in mind, let’s get into our top 10 ranking, starting with number 10 and finishing with our top ideas.

10. Baxter International (BAX), Yield: 2.3%

Coming in at number 10 on our list, Baxter is an attractive healthcare equipment company. It has a long history of paying (and growing) its quarterly dividend, but the shares have fallen sharply this year as its recovery from the pandemic has been slower than expected. Specifically, as described above, patients are scheduling previously-postponed surgeries at a slower pace due to healthcare staffing issues, inflation and simply lingering pandemic concerns. Baxter announced third quarter results in-line with expectations, but lowered its full-year guidance as SG&A expenses rose (post-pandemic inflation).

If you are a disciplined long-term investor, Baxter is attractive. Specifically, it is the industry leader in many of the products it offers, and the business will improve over time. It also trades at an attractive earnings multiple (13.9x forward p/e). We’d have ranked this one higher, but its dividend yield is relatively low compared to other names on this list.

9. Tekla Healthcare Investors (HQH), Yield: 8.3%

Based in Boston, Tekla offer four closed-end funds focused primarily in the healthcare sector, and the Tekla Healthcare Investors Fund is currently attractive for a variety of reasons. For starters, it offers exposure to a wide variety of healthcare sector companies (it recently had around 150 holdings, including stocks like Amgen (AMGN), Gilead (GILD) and UnitedHealth Group (UNH)), thereby giving investors some instant healthcare sector diversification.

HQH currently trades at a ~10% discount to the value of its underlying holdings, or Net Asset Value (“NAV”), a wide discount by historical standards. Large discounts and premiums to NAV are a unique characteristic of CEFs (as compared to other mutual funds and exchange traded funds) and they can create unique risks and opportunities (we generally greatly prefer to buy attractive CEFs at large discounts).

Perhaps one reason why this fund currently trades at a wide discount is because investors may have been hitting the sell button as the quarterly dividend (technically a distribution) was recently reduced. As a matter of policy, the fund has a managed distribution policy:

The Fund has a managed distribution policy (the Policy) which permits the Fund to make quarterly distributions at a rate of 2% of the Fund's net assets to shareholders of record. The Fund intends, to the extent possible, to use net realized capital gains when making quarterly distributions. However, implementation of the policy could result in a return of capital to shareholders if the amount of the distribution exceeds the Fund's net investment income and realized capital gains.

Overall, if you are an income-focused investor, we view HQH as attractive for its large price discount (versus NAV), its very low use of leverage (recently 0.85%), its reasonable expense ratio (recently 1.19%) its attractive exposure to the healthcare sector, and its big distribution yield (paid quarterly).

*Honorable Mention:

Medical Properties Trust (MPW), Yield: 10.7%

Not officially on our top 10 ranking, we’re including MPW as an “honorable mention” because its big yield is hard to ignore. MPW has performed worse than most REITs this year (and the shares have been highly shorted), as it faces challenging headwinds from struggling hospital operators, heavy debt and rising interest rates. However, there are reasons to believe these headwinds are subsiding as fundamentals improve (for example, operators are bringing down costs, reimbursement rates are increasing and debt challenges are being worked out with Prospect and Steward) and macroeconomic headwinds may be subsiding (i.e. inflation is showing signs of slowing and the fed may continue to slow its rate of interest rate hikes).

We recently wrote up this REIT in detail for our members, but the basic gist is that if you are a highly risk-averse investor, MPW is not right for you. But if you can handle the volatility, the shares are worth considering for a spot in your prudently-diversified long-term income-focused portfolio (especially considering the very low P/AFFO ratio and the very large dividend yield).

8. Gilead Sciences (GILD), 2023 Bonds, Yield: 5.0%

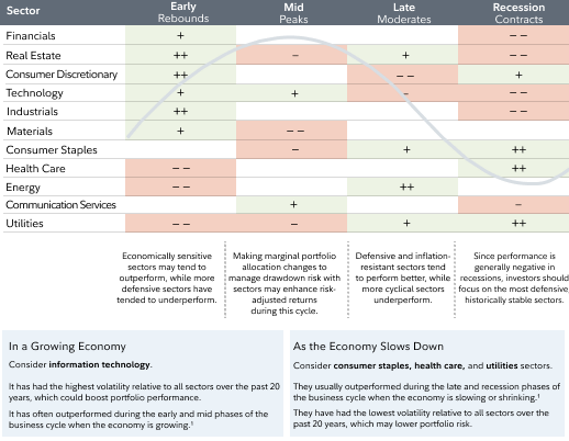

Gilead in a biotech company that offers a compelling yield on its common stock (currently around 3.4%), but considering the recent strong performance of those shares and the rich valuation, we like the bonds more than the stock. Specifically, the September 2023 bonds are rated investment grade and offer an annualized yield of 5.0%, and that is an amzing increase versus one year ago (as you can see in the chart below) as interest rates have been rising sharply.

In particular, the bonds trade below par—so you’ll get some price appreciation in addition to coupon payment. Gilead is an extremely profitable business (thanks to its HIV drugs), but the pipeline is lackluster, and this is why we prefer these bonds that offer an attractive yield and mature in less than a year. Moreover, if you are uncomfortable with all the near-term volatility in the stock market, these income-producing bonds are highly attractive.

7. GSK, formerly GlaxoSmithKline, (GSK), Yield: 4.7%

Based in the UK, GSK is a pharmaceuticals company (they create, discover, develop, manufacture and market pharmaceutical products, vaccines, over-the-counter medicines, and health-related consumer products). And GSK is currently attractive for a variety of reasons, including its high profitability (35.7% net margin), low valuation (9.6x forward p/e) and outsized dividend yield, as you can see in our earlier table. The shares have been pressured lower by Zantac litigation risks, but those concerns continue to lift.

Further, GSK has attractive mid to long-term growth ahead related to its respiratory and HIV drugs, and its strong late stage pipeline. Further, its large scale, powerful distribution network and patent protections continue to give it competitive advantages and pricing power. If you are looking for a healthy dividend and potential share price appreciation, GSK is attractive and worth considering.

6. Gabelli Healthcare & Wellness (GRX), Yield: 5.9%

Another closed-end fund (this one managed by Greenwich, Connecticut-based GAMCO), GRX offers a variety of attractive qualities. For starters it’s focused on healthcare stocks (it recently held 174 positions, including names like CVS Heath Corp (CVS), Johnson & Johnson (JNJ) and AbbVie (ABBV)), it offers a big quarterly distribution (that has been steadily increasing) and it trades at an attractively large discount to NAV (recently ~13.7%).

This fund is also interesting because it uses a healthy amount of leverage (or borrowed money) recently ~28.3%. Leverage can help magnify the distribution payments to investors, but it also introduces risks and opportunities. For example, leverage can magnify price loses in the bad times, but also magnify price gains in the good times.

Also important to note, this fund has recently been sourcing its distributions from income on its underlying holdings (and not necessarily capital gains or return of capital). Some return of capital can be acceptable from time to time, but it is important for investors to note that ROC can reduce your investment cost basis thereby resulting in some unexpected gains if/when you do eventually sell shares. The total expense ratio on this fund is a little higher also because of the cost of borrowing.

Overall, if you are an income-focused investor that likes long-term gains and discounted prices, GRX is worth considering.

5. Bayer (BAYRY), Yield: 4.0%

You may know Bayer as the “Bayer Aspirin” company, but it’s actually a diversified life sciences company that operates through its Pharmaceuticals, Consumer Health, and Crop Science segments. Based in Germany, but trading in the US through ADRs (it reports using international accounting standards not US GAAP), Bayer is a large cap with a market cap of over $50 billion USD.

Bayer is currently attractive for a variety of reasons, including its competitive advantages (patents, scale, distribution network), pipeline and its valuation (only 6.3x forward p/e). It also offers an attractive 4.0% dividend yield (that is paid annually, not quarterly). In a nutshell, if you are looking for a significant annual dividend and attractive long-term share price appreciation from a company with long-term competitive advantages, Bayer is absolutely worth considering.

Honorable Mention:

Physicians Realty Trust (DOC), Yield: 6.4%

Physicians Realty Trust isn’t the fastest growing REIT, and it has far less dramatic upside price appreciation potential than recently troubled (but improving) industry peer Medical Properties Trust (as we described earlier), but DOC does have much more stability and financial health.

If you don’t know, Physicians Realty Trust owns healthcare properties that are leased to physicians (as well as hospitals and healthcare delivery systems). DOC also offers a well covered dividend, a reasonable valuation, less debt and is in a much stronger financial position than many of its industry peers.

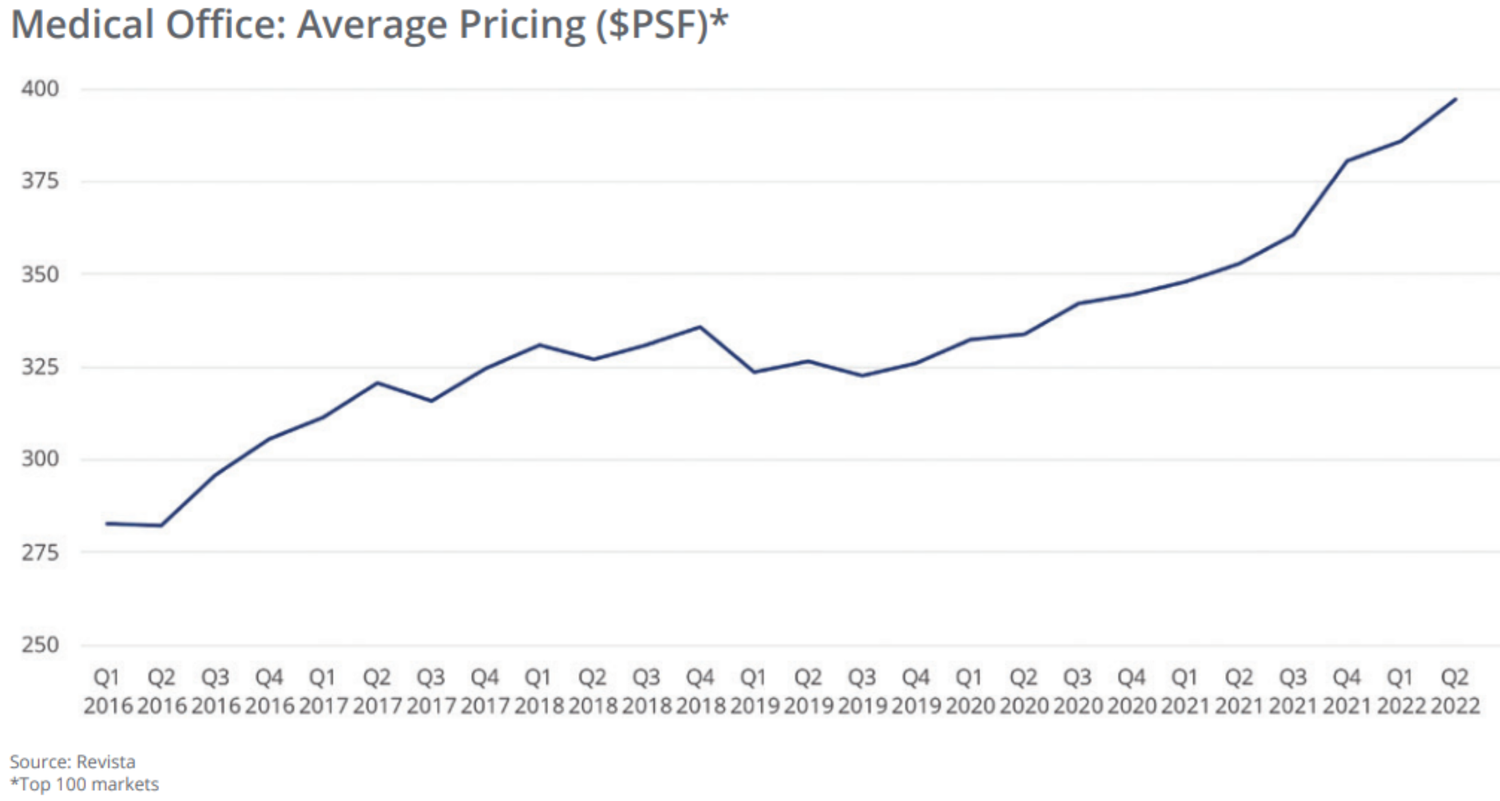

Also worth noting, DOC may be less sensitive to the economic cycle than some peers. Specifically, medical office buildings are somewhat less sensitive to current macroeconomic headwinds, as described by Colliers in their Q2 U.S. Healthcare Services Report:

“While no property sector will be immune to the impact of high inflation, a slowing economy and rising operating costs, the MOB sector is well placed to weather the storm. Underlying business fundamentals for medical tenants are stronger than a typical office user, which reduces concern over future income streams. There is greater stability in demand for medical services and, potentially, pent up demand from procedures canceled or postponed during the pandemic. In addition, U.S. Census data estimates that one in five Americans will be 65 or older by 2030, rising to one in four by 2060, thereby under-pinning demand for medical office facilities.”

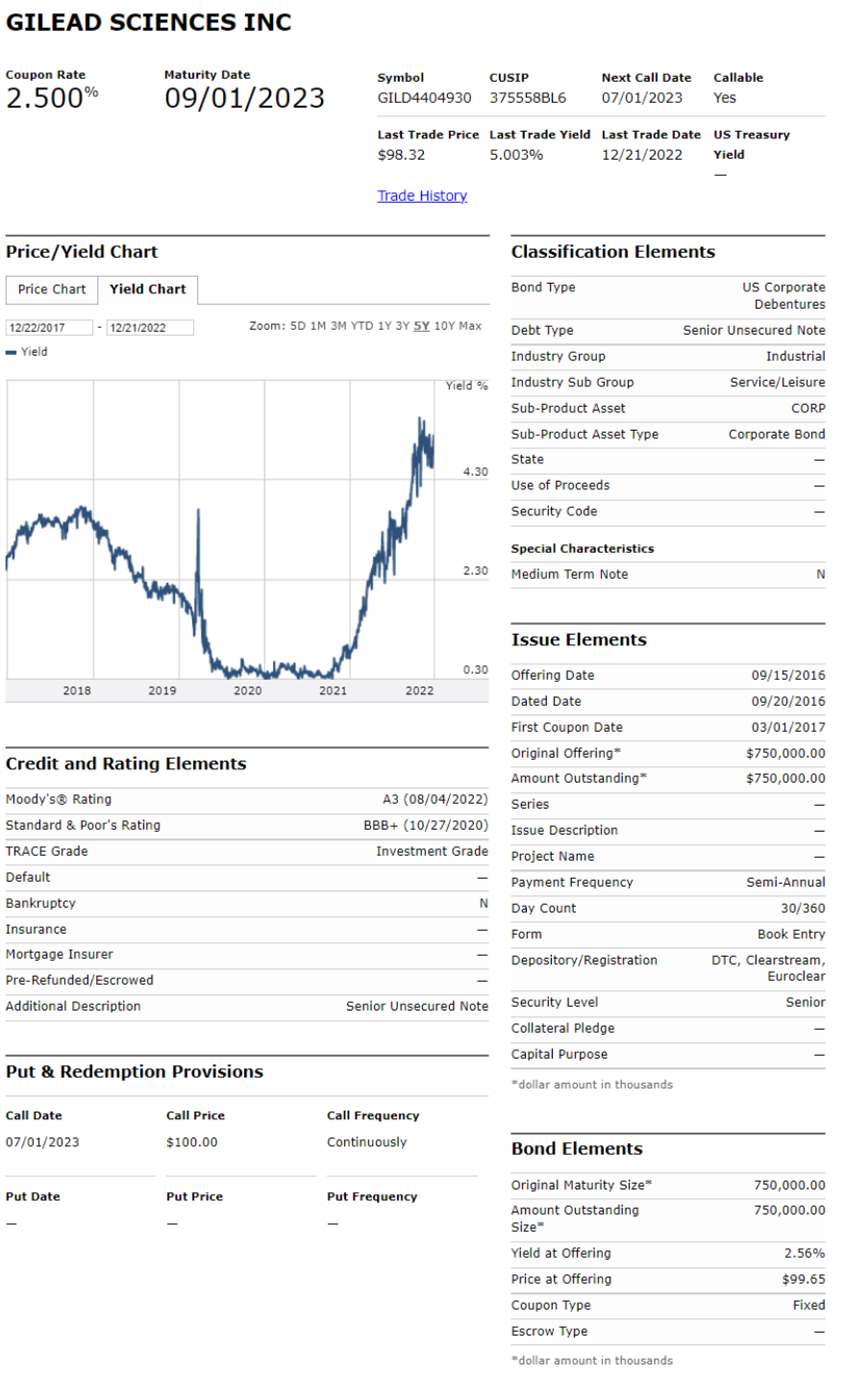

And to put that in perspective, here is a look at the healthy pricing trend for Medical offices (from the same Colliers report).

Overall, if you are looking for a steady dividend yield (along with some price appreciation potential), Physicians Realty Trust is worth considering.

4. Amgen (AMGN) 2023 Bonds, Yield 5.0%

Returning to bonds again, Amgen (a biotech company) offers some good ones. With an “A-” investment grade rating, and maturing in less than one year, this 5% (annualized) yield is impressive (especially considering this time of steady investment grade income simply wasn’t available as year ago as rates we near 0%—as you can see in the chart below).

If you’re looking for steady income (without all the stock market volatility) holding these 5.0% yield investment grade bonds to maturity is an attractive option worth considering.

3. Tekla Healthcare Opportunities (THQ), Yield: 6.8%

If you are looking for big monthly distribution payments (that have never been reduced in its nearly nine year operating history), THQ is worth considering. It recently held 127 positions concentrated mainly in healthcare stocks (such as Eli Lilly (LLY), Cigna (CI) and Humana (HUM)), and trades at a wide ~10% discount to NAV. Interestingly, this fund may invest up to 20 percent of its assets in the debt of healthcare companies, up to 25 percent of its assets in healthcare REITs, and up to 30 percent of its assets in convertible securities. Recently, THQ owned roughly 85% stocks and 15% bonds.

This fund also recently had ~20% leverage (or borrowed money), which can magnify income, but also magnify volatility. The management fee was recently 1.24% (reasonable for this type of fund) and its total expense ratio was around 1.87% (after you factor in the interest expense, i.e. cost of borrowing).

The distributions have recently included a significant dose of return of capital (“ROC”), which is fine for now, but should be monitored (considering ROC can reduce your cost basis, thereby increasing your potential capital gains taxes if/when you sell). Overall, we view this as an attractive big yield opportunity to gain exposure to the healthcare sector.

2. Medtronic (MDT), Yield: 3.6%

Medtronic doesn’t have the biggest yield on this list, but it offers one of the best based on its 45 years of consecutive dividend increases, and based on the strength of the company and its current low valuation (i.e. the shares have attractive long-term price appreciation potential).

Medtronic is a medical device company, and its shares are down significantly this year based largely on its lower-than-expected business recovery from covid. Specifically, patients delayed procedures during the pandemic, are now resuming, but at a slower pace than expected and because there is still a shortage of hospital workers.

Importantly, Medtronic has a variety of competitive advantages. Aside from its massive profitability, cash and free cash flow generation, Medtronic benefits from high switching costs (surgeons don’t easily switch to new company products). For example, Medtronic holds approximately 50% of the market in its core cardiovascular products. It also leads in spinal pumps, insulin pumps and certain neuromodulators, to name a few.

In a nutshell, Medtronic is a highly profitable “wide-moat” business, currently trading at a relatively low valuation multiple (as we wrote about in this new detailed members-only report) and offering 45 years of dividend increases and a current yield near all-time highs (an indication from management that the shares are undervalued, in our view). We believe Medtronic is well-positioned for continued improvement, and the shares currently offer a highly-attractive contrarian opportunity for long-term investors. We are currently long shares of Medtronic in our Income Equity Portfolio.

1. BlackRock Health Sciences (BMEZ), Yield: 11.4%

If you like big income, trading at a significantly discounted price, essentially zero use of leverage, a relatively low management fee and distributions based almost entirely on income and gains (virtually no return of your own capital), this BlackRock CEF is hard to ignore. So far, it’s never reduced its big monthly distribution (only increased it) and it has a history of paying additional special distributions too.

The fund recently held 187 positions concentrated mainly in US healthcare stocks, and it is backed by the resources of BlackRock, a vast industry leader. The fund was launched in January 2020, but already has over $2 billion in assets. BMEZ basically trades at its widest discount to NAV since inception, and if you are looking for exposure to healthcare stocks, BMEZ is attractive and hard to ignore.

The Bottom Line

Performance within the healthcare sector has been wide ranging. However, select attractive opportunities are available, as described in this report (and depending on your own personal situation and needs).

Not only do many healthcare opportunities have less downside risk and plenty of long-term price appreciation potential, but they also offer big yields that can help many investors psychologically weather any near-term price volatility. Disciplined, goal-focused, long-term investing is a winning strategy.