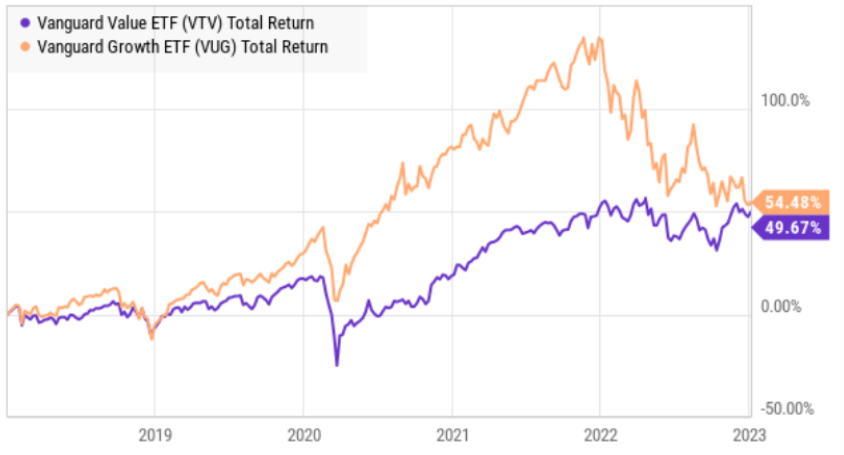

Market carnage continues this year, with tech and growth stocks down more than value. The story remains the same: rates are higher (harder to fund continuing growth) and the economy is slowing (teetering on recession) as the fed keeps hiking rates to fight inflation.

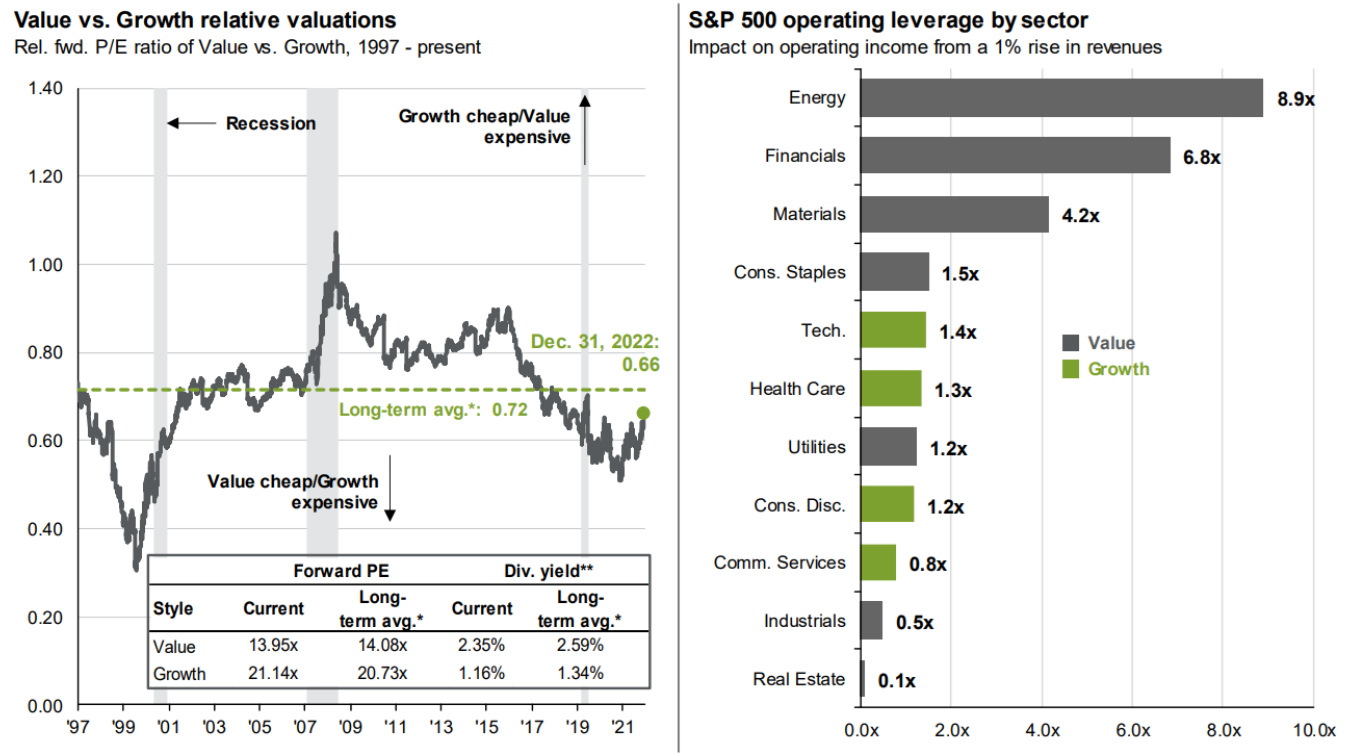

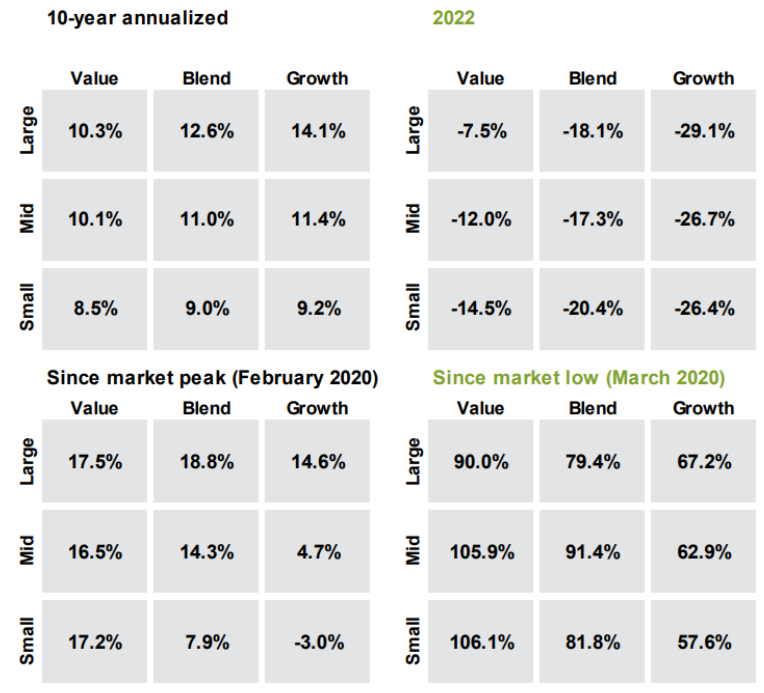

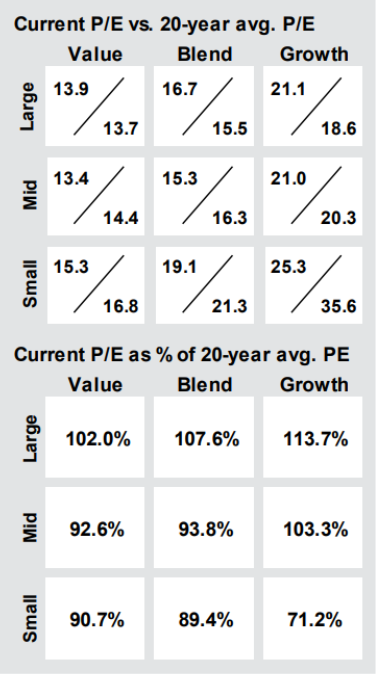

The good news is that inflation will likely slow (knock on wood) as the pandemic stimulus (and easy money) falls further into the past. However, going forward, the top growth stocks are not coming back to prior levels (at least not anytime soon) and value will lead (now that higher rates are here to stay and value stocks remain undervalued relative to growth (even after the dramatic fall).

Here are a few updated growth-versus-value charts (as of 12/31) for perspective:

We like select value and growth stocks. And if you are going to invest in growth stocks, we continue to prefer PROFITABLE business with positive cash flow. This may not sound like rocket science, but many top growth stocks during the pandemic bubble were not yet profitable (the market was banking on them to become profitable over the next few years). And now they may never achieve profitability considering higher rates and a slowed economy.

See also our 2023 outlook report for more ideas: