For years, income-investors have decried the artificially low interest rates set by the Fed. However, if you’ve not been paying attention, things have changed significantly in recent months. Yields are a lot more interesting now, ranging from bond closed-end funds to specific individual bonds. In this report, we countdown our top 10 bond ideas for you to consider.

Without further ado, let’s get right into it.

10. PIMCO Dynamic Income (PDI), Yield: 13.6%

This is the widely popular, massive yield, PIMCO Closed-End Fund (“CEF”). It was formed in 2012 and it invests in fixed-income securities (bonds) from across the globe (primarily mortgage-backed securities, investment-grade and high-yield corporate bonds, developed and emerging markets corporate bonds, and sovereign bonds). Many investors have come to love PDI for its massive monthly income payments which have never been decreased (only increased) and which have been sourced primarily from income on the underlying holdings (and not necessarily any return of capital).

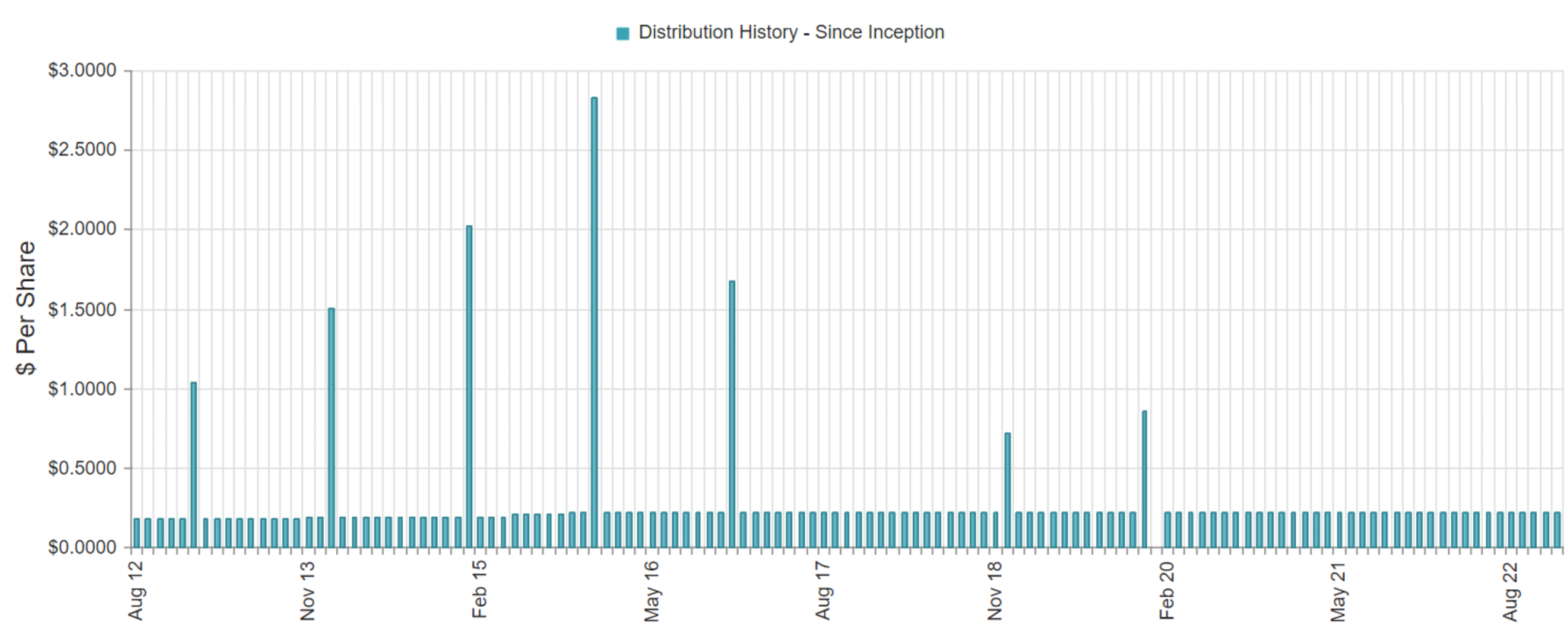

It also has a history of paying special dividends too (as you can see in the chart above). And you can have a look at its recent Undistributed Net Investment Income (“UNII”) in the table below.

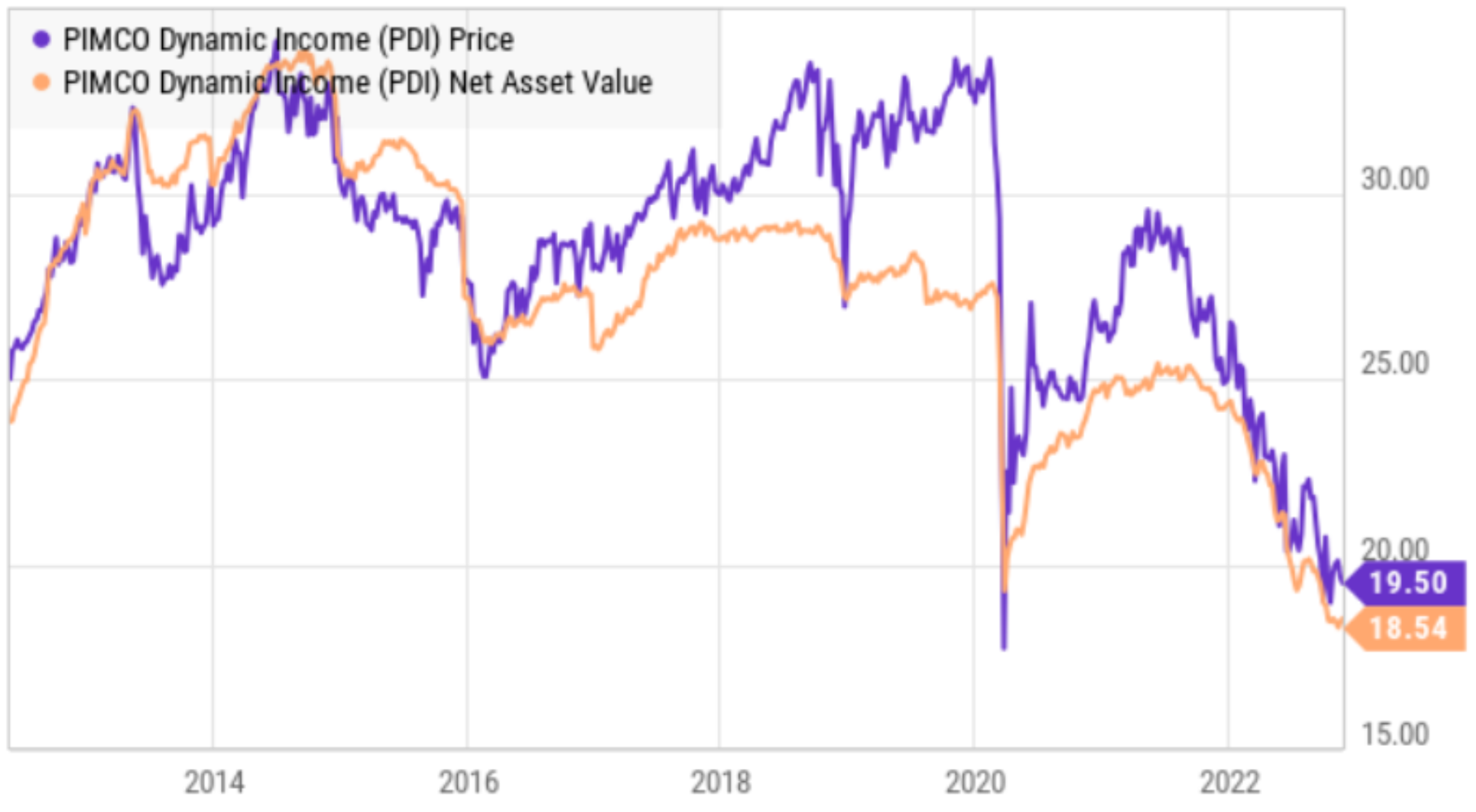

Importantly, even though many investors in this fund are focused mainly on the income payments, it’s been hard not to notice the massive price declines this year as the fed has been aggressively increasing interest rates (as rates rise, bond prices fall). And in PDI’s case, its use of leverage (or borrowed funds) helps keep the income payments high, but has also magnified the price declines this year.

Further, as the price has declined, the leverage percentage has mathematically risen, and now sits at over 48% (50% is the regulatory limit). This can create challenges (i.e. the potential to undergo forced sales of underlying holdings at less than attractive prices—thereby locking in loses—to keep the leverage ratio below 50%). However, even if this fund is forced to sell a few things at losses, and even if it is finally forced to reduce its distribution payment a little—it’ll still keep paying big income.

Also important, PDI currently trades at a relatively small price price premium versus its underlying net asset value (currently around ~5.2%), whereas the premium has been much larger at points over the last few years (as you can see in the price versus NAV chart above).

Furthermore, there are indications the Fed may slow its rate of interest rate hikes (and even reverse course in the second half of 2023, considering the latest CPI and PPI inflation numbers were slightly “less high” than expected) which bodes well for the price of this fund. If you are seeking big monthly income payments, PDI is worth considering.

9. 1-Year US Treasuries, Yield 4.7%

It might be odd to see US treasuries on this list, but the yield has amazingly gone from near 0% to 4.7% in the last year, and treasuries have some distinct advantages over bond funds. First and foremost, they’re 100% guaranteed by the full faith and credit of the US government. In this sense, they are a lot less risky than PIMCO bond funds, such as PDI.

Secondly, with only 1 year to maturity, you will have a lot of control over interest rate risk. Specifically, if you hold until maturity, you are guaranteed to get paid in full. Whereas the PIMCO CEFs may undergo forced sales of some of their underlying holdings (thereby locking in ugly losses, as described above) because the bonds they hold have longer maturities and thereby more interest rate risk. By holding an individual treasury bond, you have total control over when you sell and when you decide to lock in any gains or losses (besides, with only 1-year to maturity, the price won’t vary too much).

And what’s particularly interesting (besides the fact that the yield has gone from 0% to 4.7% over the last year) is that the 1-year treasury actually currently yields more than the 10-year treasury (see chart above). This unusual inverted yield curve can be a sign of and ugly recession (risk) on the horizon. So if you are looking for safe income, 1-year treasuries are surprisingly attractive right now.

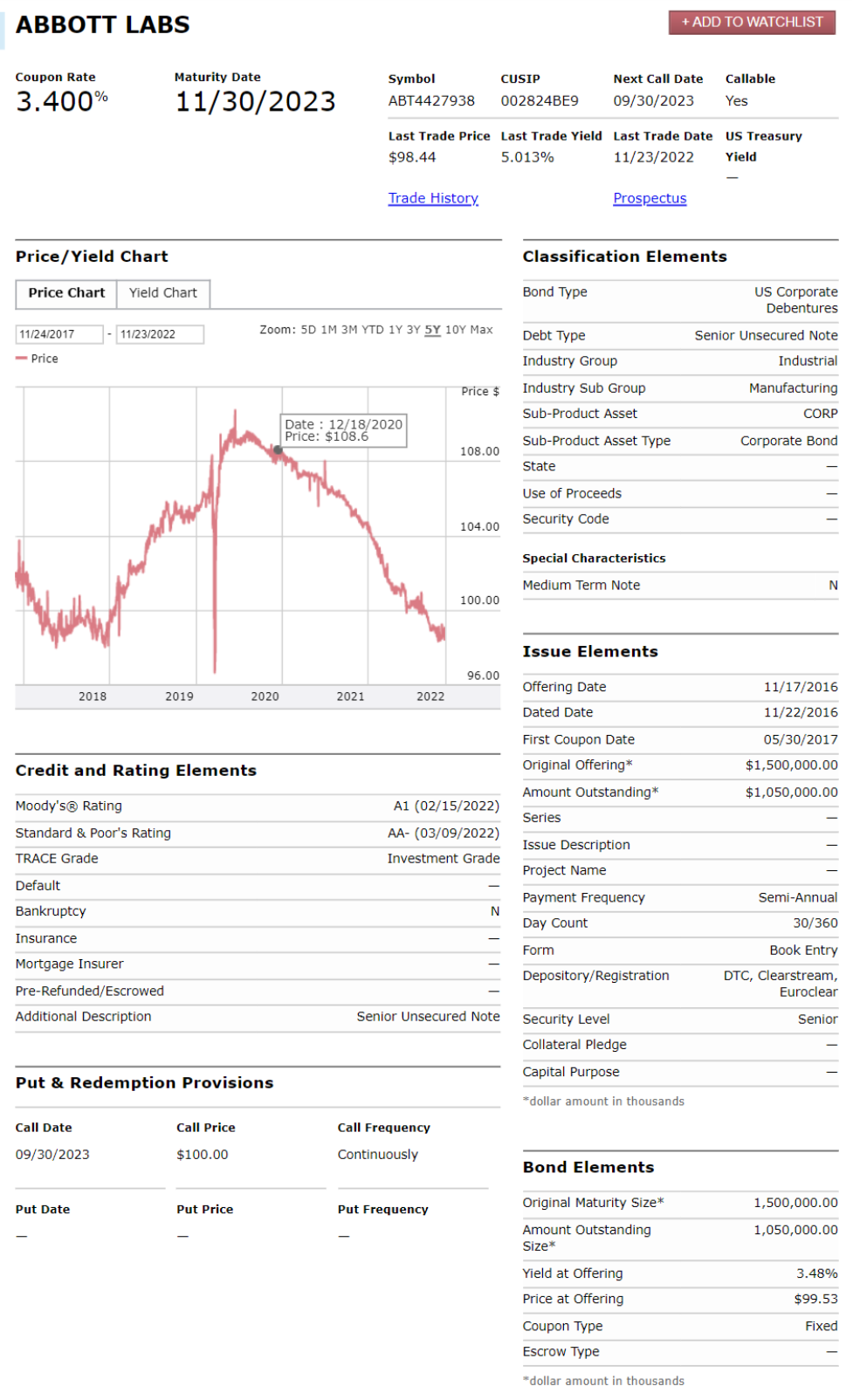

8. Abbott Labs 11/30/23 Corporate Bonds, Yield: 5.0%

Investment-grade corporate bonds (such as these Abbott Labs bonds) can offer even higher yields than treasuries over the same period of time. For example, these Abbot bonds mature in roughly 1-year and offer a yield (coupon payments plus price appreciation) of over 5.0%, as you can see in the graphic below.

Abbott is a highly-rated healthcare equipment company (pharmaceutical, diagnostic, nutritional and medical device products) with a very healthy investment-grade credit rating (currently AA- from S&P). Notably, you can see the price of these bonds (in the chart above) has fallen sharply over the last year (largely due to fed interest rate hikes) and now trade below the $100 price it will mature at in one year. It’s continuously callable at $100 starting at the end of September next year (so you’ll receive a price gain versus the price you can currently buy it at, if it get called early). Abbot is a good example of a corporate bond that’s gone from yielding close to zero (its price was recently well above $100) to now offering an attractive 1-year yield (little interest rate risk) between now and its roughly 1-year maturity date. A portfolio of attractive, relatively short-term, corporate bonds can be a great way to generate very healthy income.

7. Express Scripts 7/15/23 Corp Bonds, Yield: 5.7%

If you don’t know, Express Scripts is one of the largest pharmacy benefit managers in the world, and it was acquired by Cigna (CI) in 2018. Cigna is a highly-rated healthcare services company, and these bonds have a healthy investment-grade credit rating (A-) from S&P. They also trade below par and offer a juicy 5.7% annualized yield to maturity (3.0% coupon + price appreciation).

Like the previous Abbot Labs bonds, these Express Scripts bonds also traded well above par 1-2 years ago, but have fallen in price as interest rates have risen. They mature in July 2023 (with an earliest call date in May) thereby keeping interest rate risk low (i.e. they mature in just 8 months), and providing some compelling short-term income for investors.

6. PIMCO Dynamic Income Ops (PDO), Yield: 10.6%

We previously wrote about the attractiveness of this relatively new big-yield bond fund for our members-only (and it has since risen in price and narrowed in discount to NAV), and it still offers a compelling high-income opportunity. Some investors prefer PDI (mentioned above) simply because the yield is higher, but we view PDO as an even safer form of high income because the fund is less “stretched.” In particular, the strategies of the two funds are somewhat similar, but PDO is smaller in assets (more nimble) and trades at a better price relative to net asset value (PDO actually trades at a discount to NAV of around 4.6%).

Both funds have been paying distributions from income (not necessarily “return of capital”), but that may soon change for PDI considering its been challenging to keep income payments high (PDI has a higher payout ratio) while the NAV has been falling. It’s true rising rates have hurt the NAV this year, but will also incrementally help earn higher yields going forward (but we’re not entirely out of the woods yet as rates are expected to keep rising and PDI seems particularly “stretched” to maintain the status quo high distribution payments). Both funds are attractive, but we prefer PDO given the current rising rate environment.

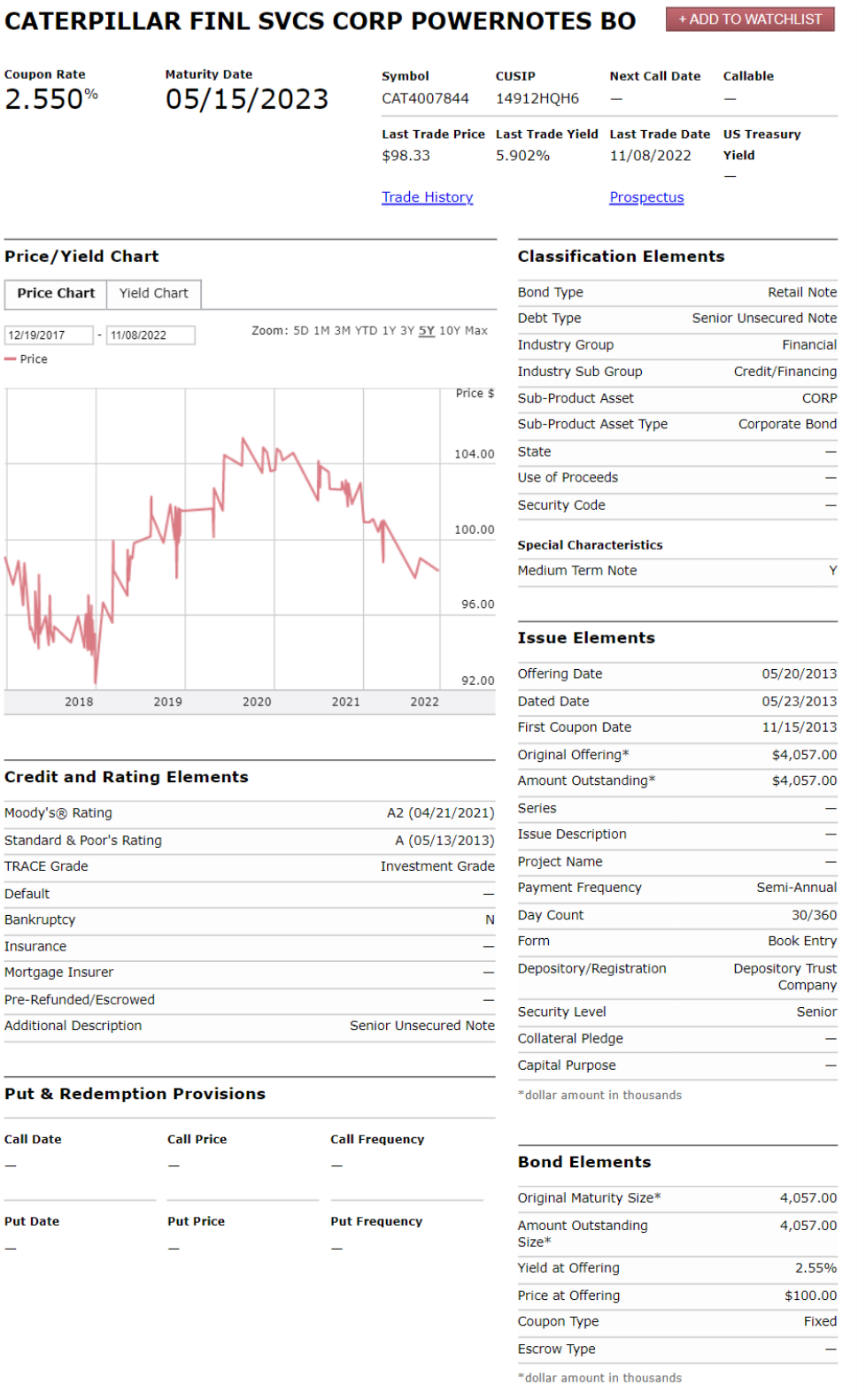

5. Caterpillar 5/15/23 Bonds, Yield: 5.9%

Returning to another corporate bond example, construction machinery company Caterpillar offers an attractive 5.9% annualized yield on their investment-grade (A-rated by S&P) 2023 bonds. Like the other bonds in this report, this opportunity has become particularly compelling in recent months an interest rates have risen (and this bond’s price has fallen from above to below par). Particularly interesting, these bonds mature in just 6 months.

It’s extremely unlikely for Caterpillar to file bankruptcy and default on these bonds within the next 6-months when they mature. Nonetheless, we do still recommend holding a portfolio of corporate bonds to diversify away some of the risks while still keeping the income payments to you high.

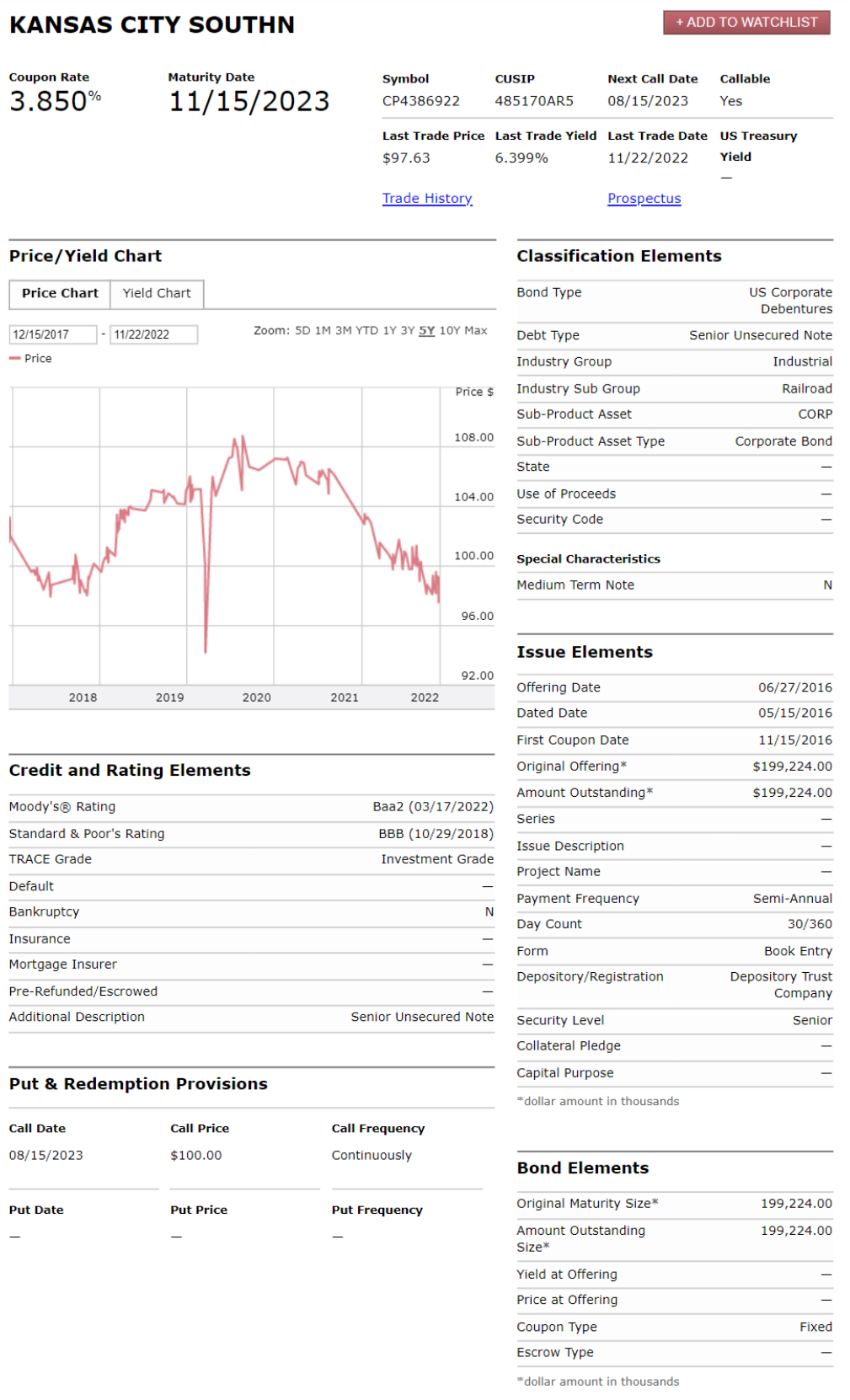

4. Kansas City Southern 11/15/23 Bonds, Yield: 6.4%

Kansas City Southern is a freight railroad that was merged with Canadian Pacific Railroad in late 2021. However, Kansas City Southern still has some compelling investment-grade bonds (BBB-rated by S&P) outstanding. This bonds trade at a discount to par and offer an attractive 6.4% yield.

The yield on these bonds was much lower 1-year ago, but you can see in the chart above how the yield has fallen (as interest rates increased). We like these bonds and believe they are worth considering for a spot in a prudently-diversified income-focused portfolio.

Honorable Mentions:

Bonds are basically loans that have been securities and packaged for easier investment. Another category of loans that have been packaged differently but are still easy to invest in our Business Development Companies. BDCs provide capital (essentially loans) to middle market companies, and BDCs can offer some very compelling big-yields. We recently wrote in great detail on attractive big-yield BDCs (as well as a few more Bond CEF ideas) and you can access that report here:

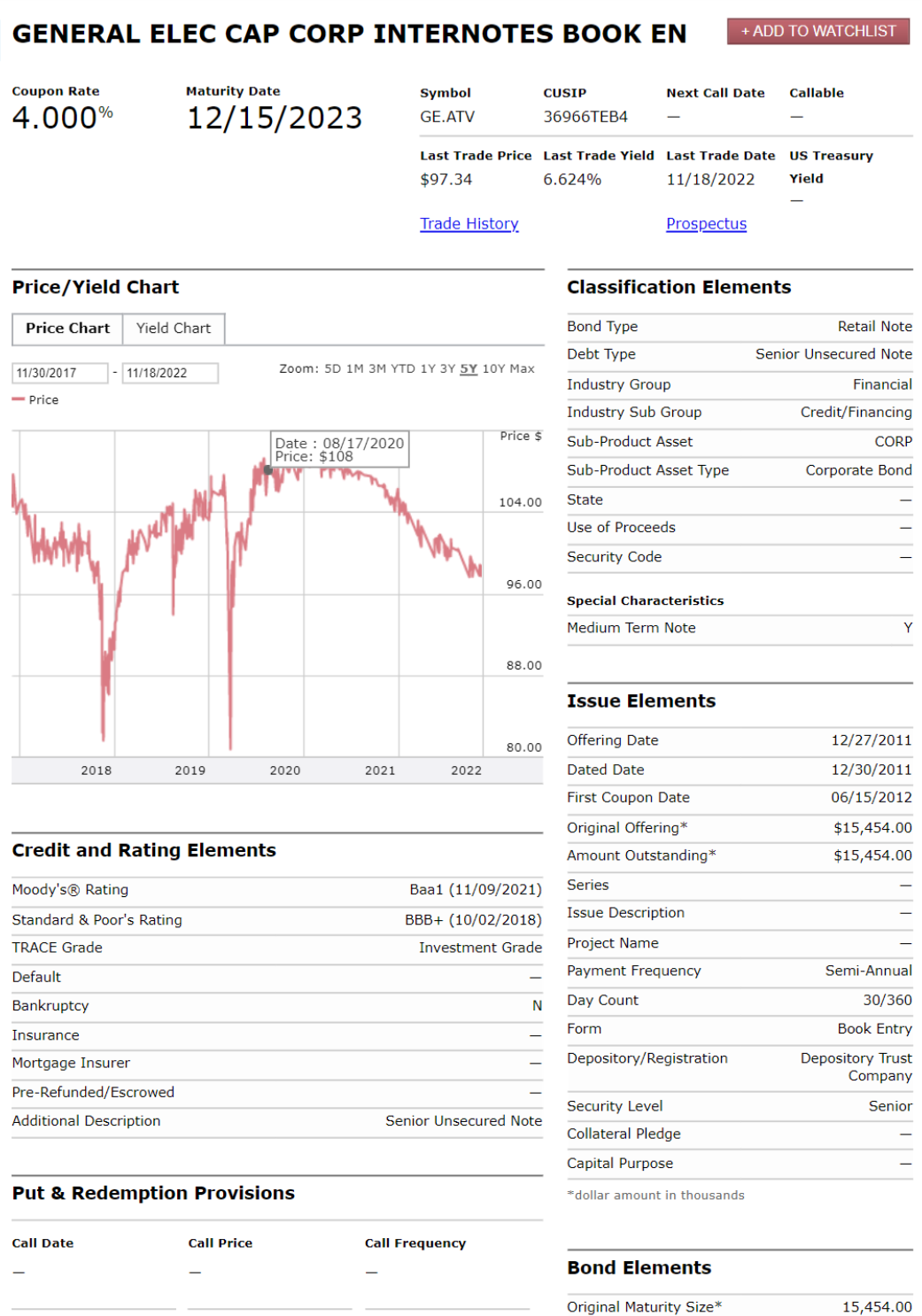

3. General Electric 12/15/23 Bonds, Yield: 6.6%

Climbing even higher in yield, General Electric (GE) has some compelling 6.6% investment-grade bonds outstanding that mature in roughly 1-year.

The yield on these bonds is impressive considering where yields were just one year ago. We like these bonds, and if your are going to consider investing, we recommend doing so only as part of a broadly-diversified income-focused portfolio.

2. 6-Month US Treasuries, Yield: 4.7%

Returning back to US treasuries (which are guaranteed by the US government), the yield on a 6-month treasury is even higher than the yield on the 1-year treasury we mentioned earlier (see chart below). This inverted yield curve is unusual and it is generally considered a sign of broader market concern (we may be headed into an ugly recession). However, risk-averse income investors may be very interested to take advantage of this rate—which is dramatically higher than it was just one year ago.

Be sure to consider your own individual situation if you are considering 1-year versus 6-month treasuries. The yield is slightly higher on the 6-month treasuries, although they are almost the same. Some investors prefer the shorter-term maturity because it lowers the already low duration interest-rate risk, while others prefer to lock in the rate for a longer period because they don’t know where rates will be in 6 months (and they could be significantly lower than they are right now). Either way, treasury yields are dramatically more attractive than they were just one year ago.

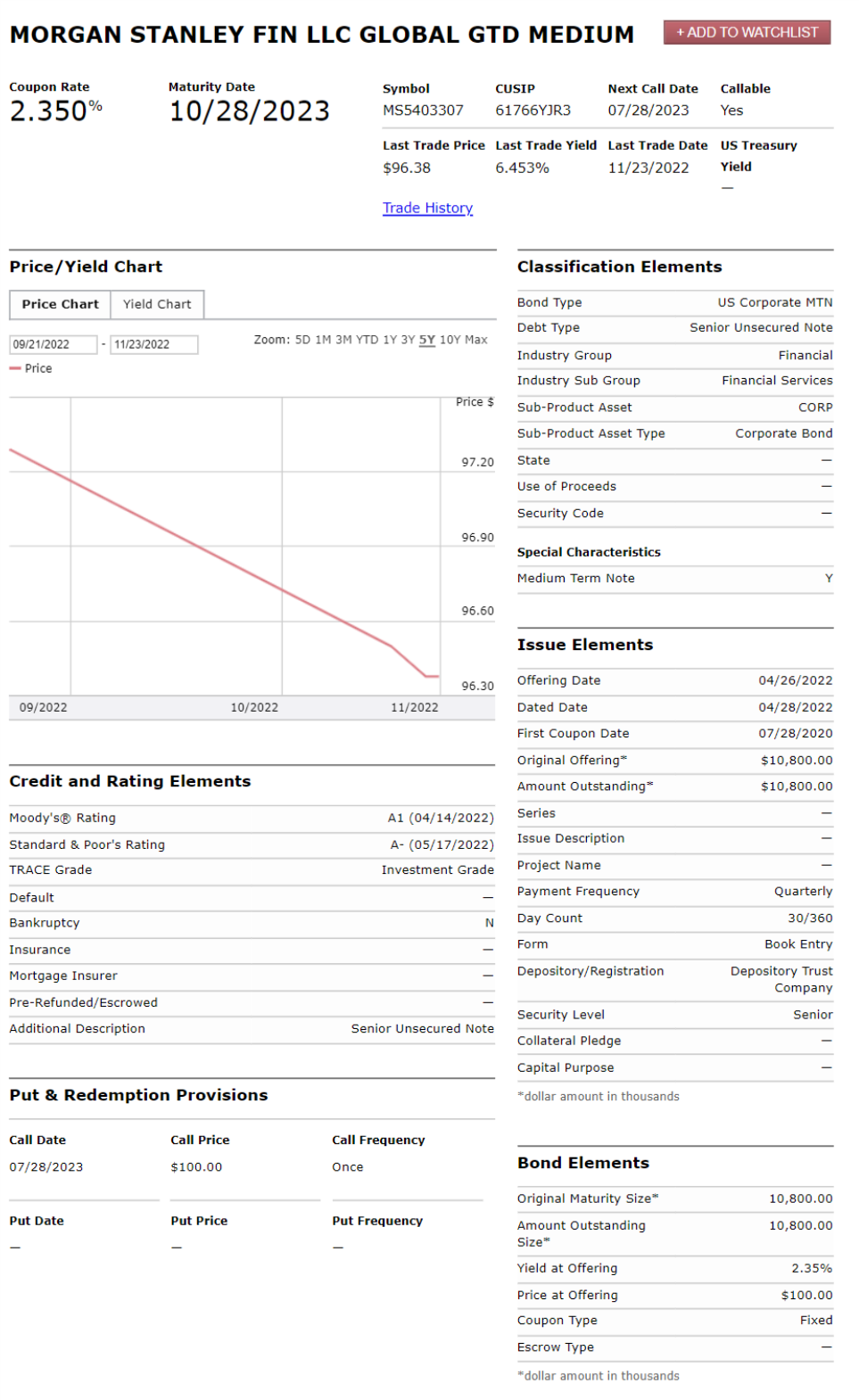

1. Morgan Stanley, Yield: 6.4%

Although they don’t have the highest yield on our list, these Morgan Stanley bonds offer a very compelling yield and have a very strong credit rating.

These bonds are callable beginning in July, but even if they are called it will be at a gain to you (they’re currently trading below the $100 call price).

Again, this type of yield (with this level of investment-grade safety) wasn’t possible just a few months ago, but as the fed has been aggressively increasing interest rates—the yields on these types of bonds have been increasing rapidly.

Conclusion:

If you’ve been sleeping, you may want to wake up and consider investing in bonds. As you can see in our earlier yield curve charts, yields on short-term bonds are now the highest they’ve been in over a decade.

Some investors prefer the very high yields offered by closed-end funds (such as the PIMCO funds we reviewed in this report), but those yields come with risks (such as longer-duration interest rate risks, forced sales and magnified losses this year due to leverage). Nonetheless, as rates have risen and interest rate hikes slow (knock on wood) these PIMCO CEFs are increasingly compelling.

On the other hand, owning individual short-term bonds offers some distinct advantages. Aside from yields (which are now dramatically higher than they were just a few months ago), individual bonds (such as corporates and treasuries) have a lot less interest-rate-driven price risk. For example, you control when you sell them, and you can avoid the unfortunate forced-sale position PIMCO CEFs can often face. Simply by holding individual bonds to maturity, you’re guaranteed by the issuer to get paid in full, and the examples in this report mature in roughly one year or less (much less interest rate risk than PIMCO). We recommend owning a portfolio of individual bonds to reduce risk even further.

At the the end of the day, you need to choose an investment strategy that is right for you. And if you are an income-focused investor, short-term yields have changed dramatically in recent months. Wake up and smell the higher-income opportunities.