If you like steady dividend income and the potential for healthy share price appreciation, REITs are worth considering. Especially this year as share prices are down and dividend yields have mathematically risen. However, not all REITs are created equally. In this report, we share data on over 100 REITs, sorted by industry (and including a brief commentary and outlook for several important REIT industries), and then countdown our top ten REIT ideas (starting with #10 and finishing with our top idea).

A Note on REIT Industries:

Importantly, the various REIT industries in the tables throughout this article are very different (as we will explain below) and the specific REITs within each industry can also be extremely different. With that backdrop in mind, lets get into some REIT industry details and our top 10 countdown.

Retail REITs

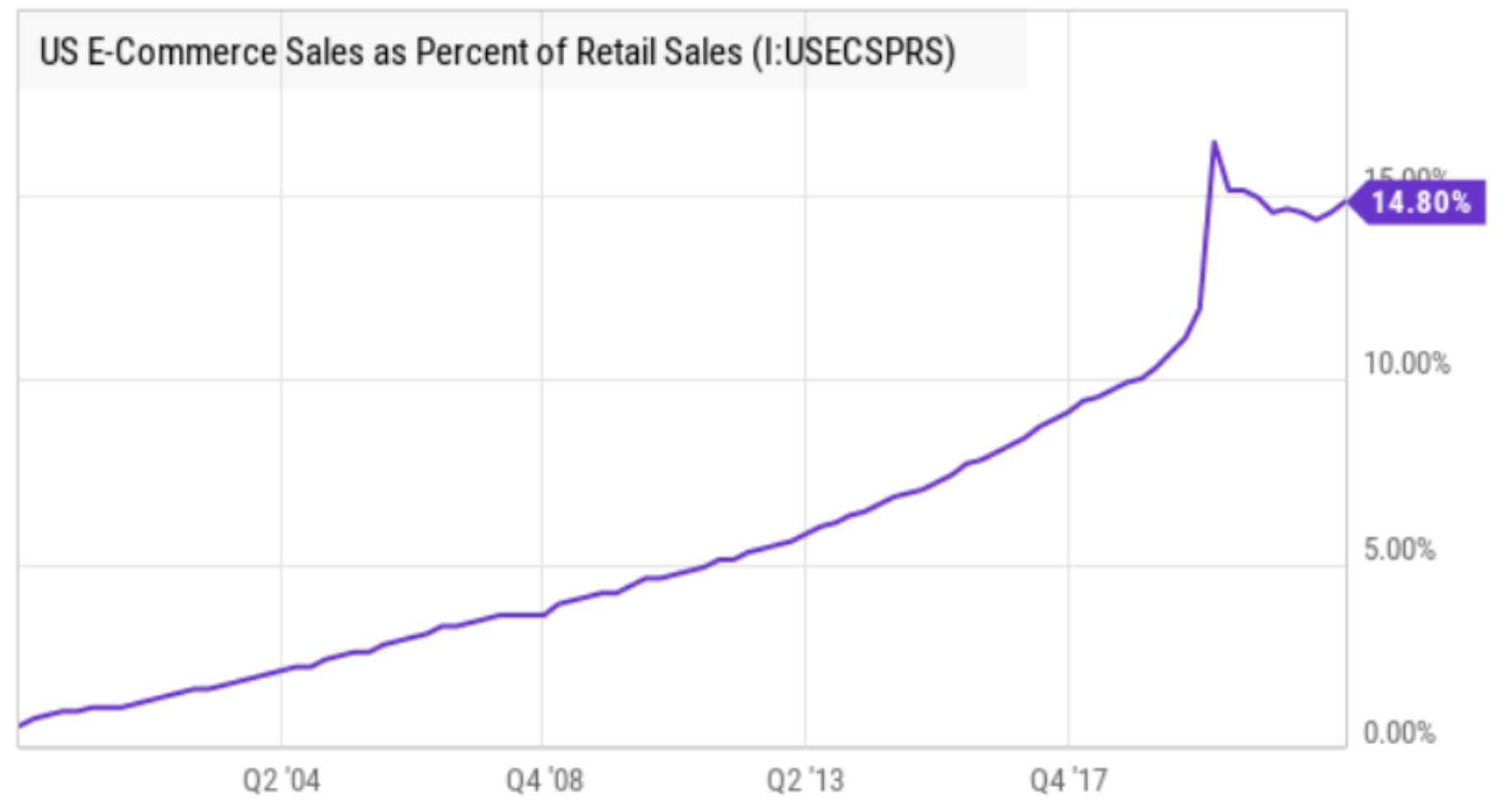

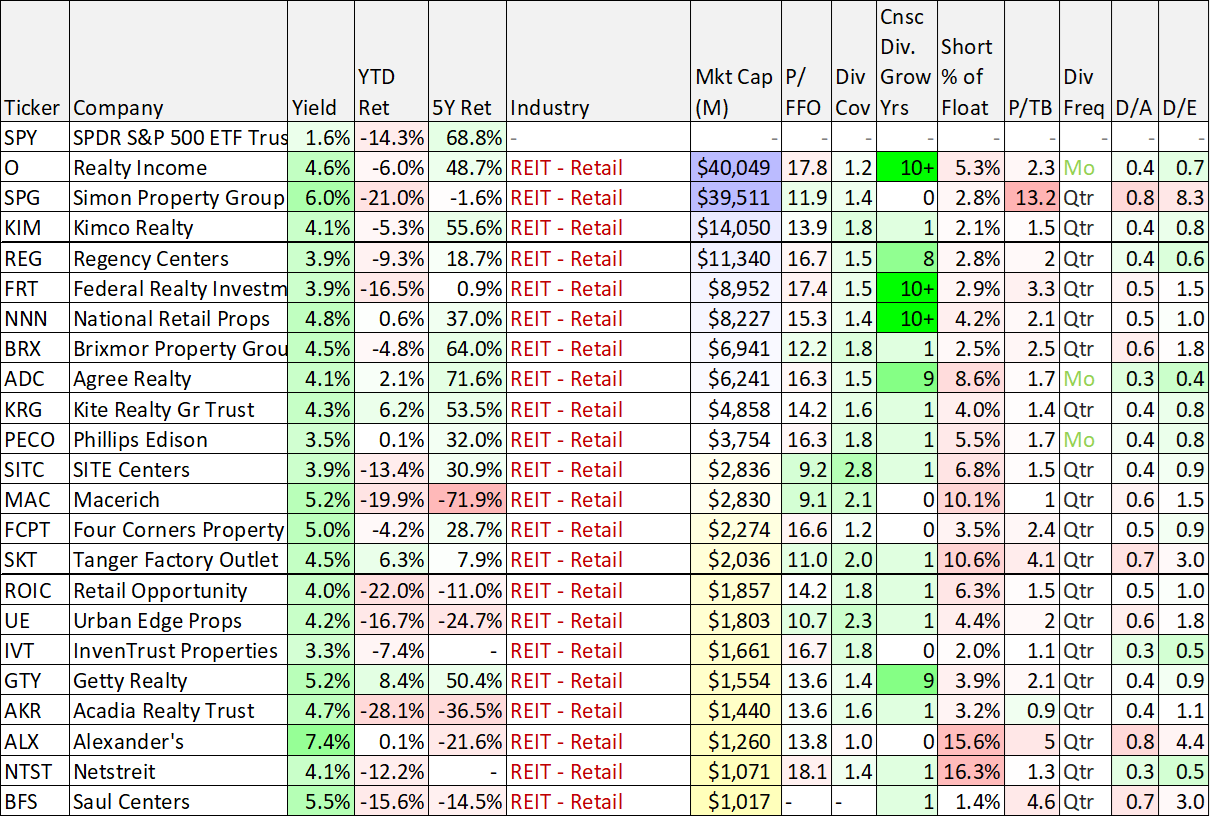

As you can see in the table above, most retail REITs have been ugly this year, and the past few years haven’t been much better. The very high-level oversimplified explanation for the weak performance is that online shopping is destroying demand for retail properties, as you might infer from the chart below.

And while there is some truth to the “death-of-brick-and-mortar-real-estate” narrative, not all retail real estate is actually dying. In fact, A-class retail properties will continue to grow over time as the old adage “location, location, location” matters just as much now as it ever has. As we will explain below, our expectation is that poorly-located retail real estate is entering a “death spiral,” but select prime location properties will continue to grow over time (and keep paying big growing dividends).

10. Simon Property Group (SPG), Yield: 6.0%

Coming in at #10 on our list, Simon Property Group is the largest retail mall REIT (shopping malls and premium outlets) in the US. It is focused mainly on A-class properties (more than 80% of operating income), whereas B-class constitutes ~15% of NOI and C-class (and below) less than 1.0%. Without doubt, the ongoing growth of online shopping is disrupting the retail industry, but it is our view that A-class properties will not only survive, but also thrive, whereas C-class and lower will become largely extinct over the next decade.

We recently wrote up Simon in detail for our members, but the basic thesis is that despite the market’s hatred for retail REITs, Simon has a very strong “investment grade” balance sheet, an extremely well-covered dividend (that will likely keep growing as the payout ratio is still overly conservative following the pandemic, see table above), a compelling low valuation multiple (forward P/AFFO is below 11x), and its properties at located in highly sought after locations (based on foot traffic and the need for prime retail locations for companies to market to their omni-channel customers). If you are looking for an attractive long-term contrarian opportunity, Simon Property Group is worth considering.

Industrial REITs

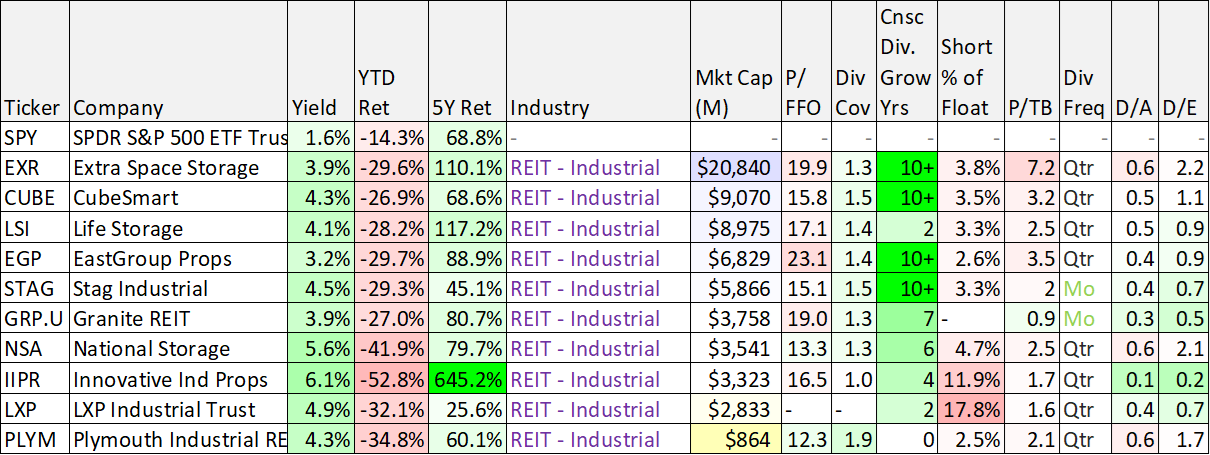

In our view, industrial REITs have particularly attractive long-term prospects because they are supported by economic growth, both online and brick-and-mortar. Industrial REITs experienced strong gains as supply chains adjusted to the pandemic disruptions, but have since sold off hard (thereby making for some very attractive opportunities). Further, industrial property rents continue to grow while vacancies fall (both good things for industrial REITs).

Industrial Real Estate: Warehouse/Distribution (W/D). Source: Colliers

As you can see in our table below, industrial REITs tend to have some of the lowest dividend yields among REITs, but one of the reasons for that is because they also have some of the best long-term growth prospects.

9. EastGroup Properties (EGP), Yield: 3.2%

Sticking with our “location, location, location” theme (it matters just as much now as it ever has), EastGroup properties owns industrial properties in prime distribution hub locations across the Southern sunbelt US states. Like other industrial REITs, EGP shares have sold off hard this year, but it will benefit from continuing long-term demand and economic growth (considering its highly valued strategic supply chain hub locations). And it currently trades at only 23 times FFO, low by its own historical standards. We also like EGP because it has a lower market cap that industrial REIT leader, Prologis (PLD) for example, which will make it easier to move the growth needle going forward. If you are looking to buy an attractive industrial REIT at a lower price and attractive valuation, EastGroup Properties is worth considering. We have owned the shares in the past, and may add them back again soon.

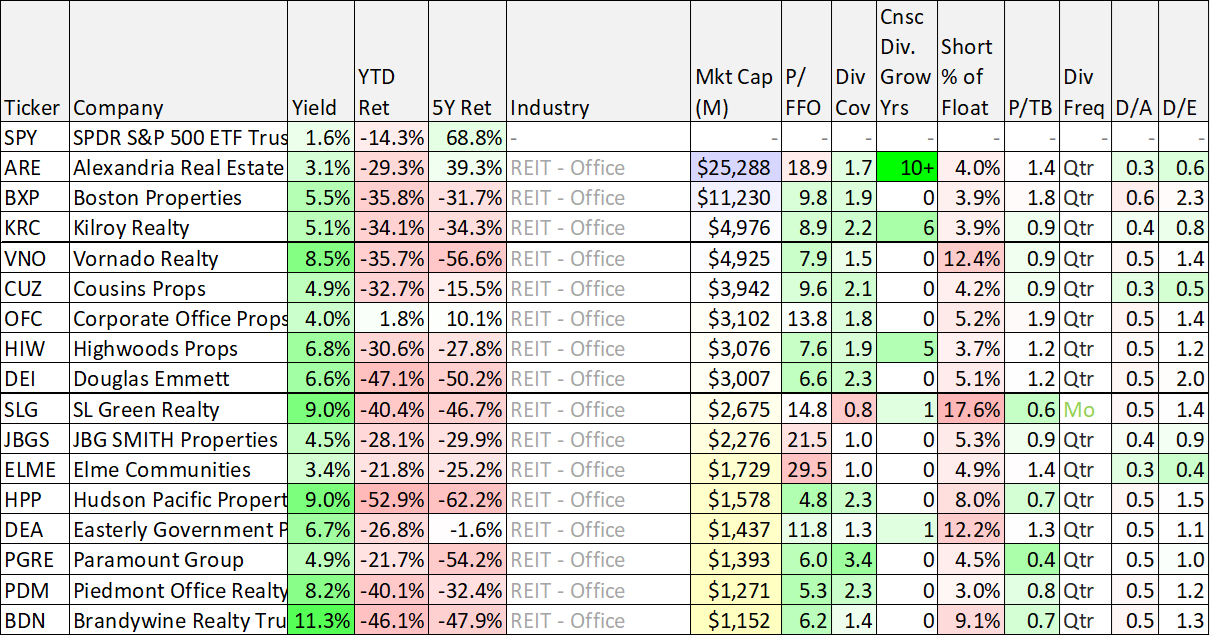

Office REITs:

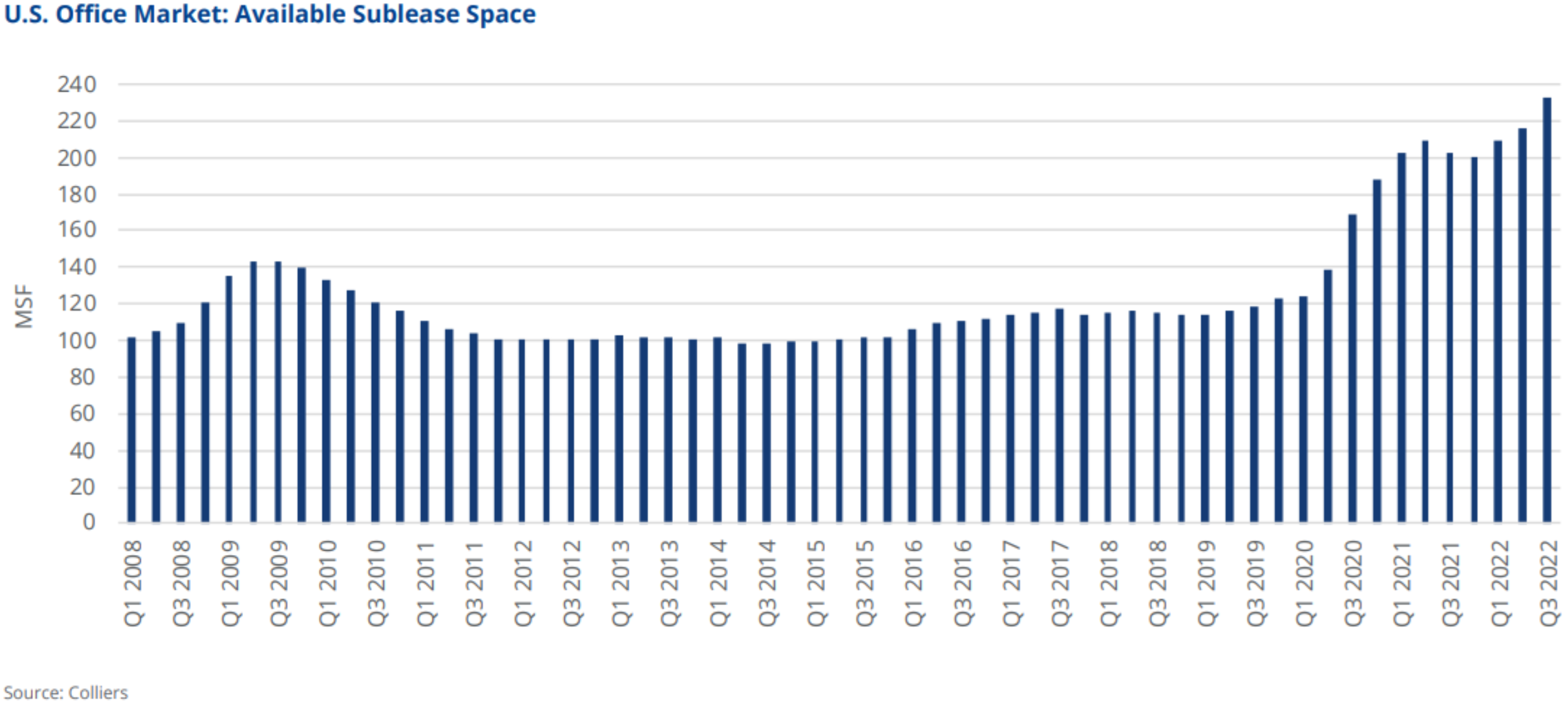

In perhaps an unexpected twist, many of the most sought after office property locations have experienced sharp declines in demand as pandemic lockdowns forced people to work from home—a trend that still continues to a very significant extent. For example, here is a look at available sublease space in the US (below), and as you can see supply is high (not a good sign for the space).

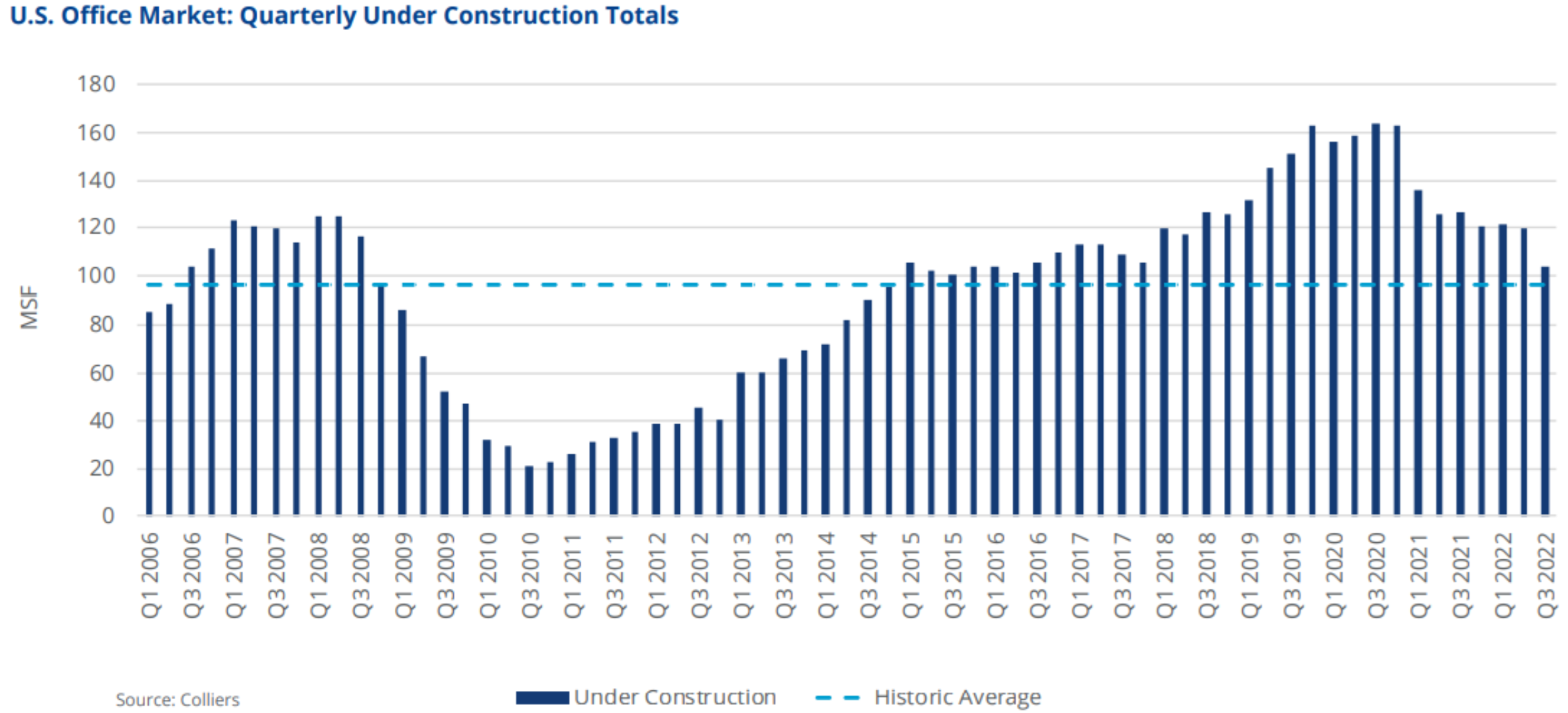

Further still, office construction is down but still high, not a good sign for supply and demand dynamics.

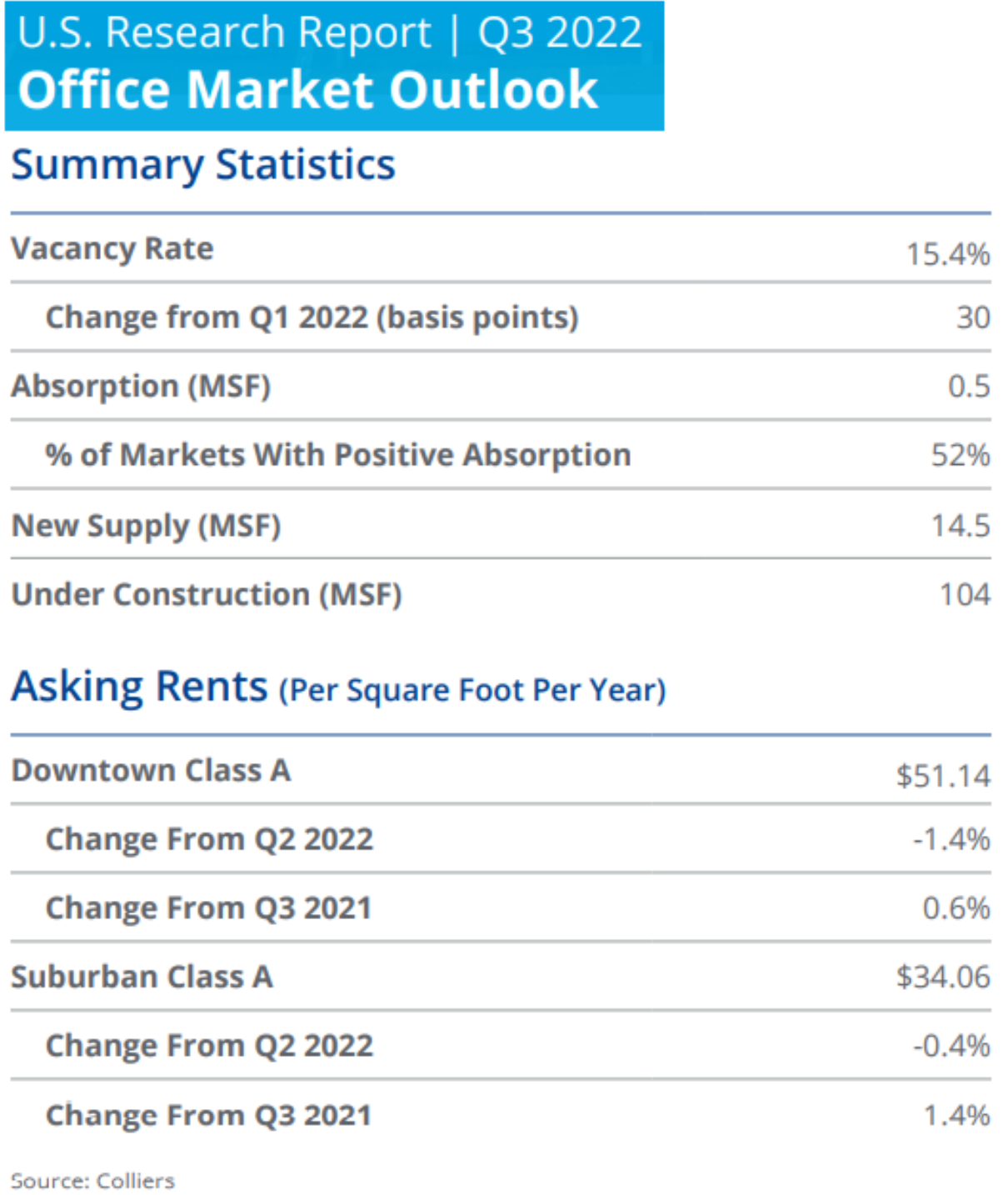

For perspective, the office vacancy rate is high across the US and rents are down (also not a good sign).

There may be plenty of attractive contrarian opportunities in the office REITs space (you can see examples of opportunities in our table below), however we have not selected any office REITs for this top 10 list.

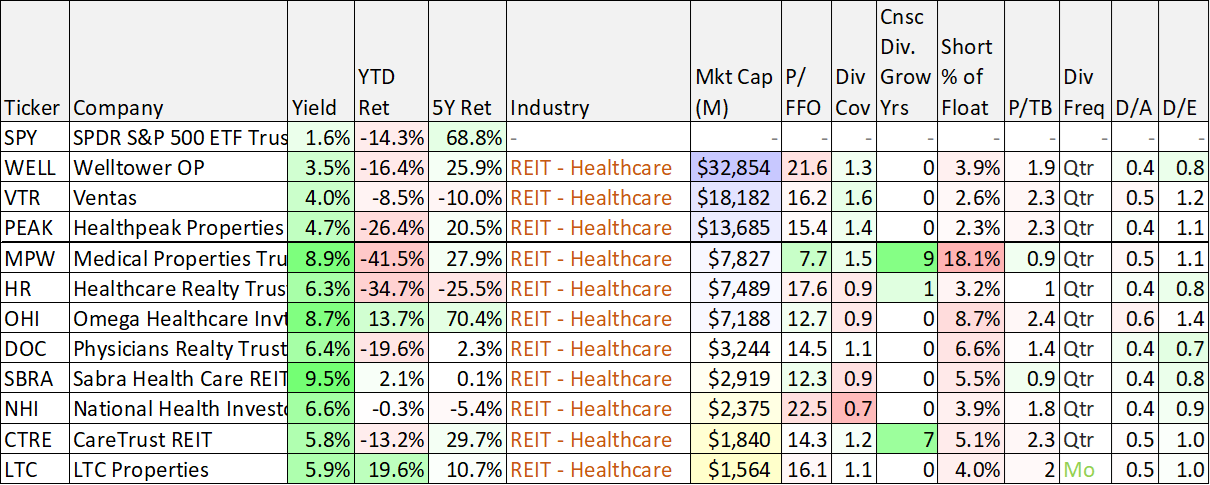

Healthcare Facility REITs

Healthcare facility REITs are widely diverse, ranging from assisted living, to hospitals, outpatient care and even private prisons. However, one thing they have in common is they were greatly disrupted by the coronavirus as many of their tenant occupants and employees were at high risk. Another thing they have in common is depressed share prices and larger than normal dividend yields.

8. Medical Properties Trust (MPW), Yield: 9.1%

Coming in at #8 on our list is a somewhat controversial pick, Medical Properties Trust. MPW has performed worse than most REITs this year (and the shares have been highly shorted), as it faces challenging headwinds from struggling hospital operators, heavy debt and rising interest rates. However, there are reasons to believe these headwinds are subsiding as fundamentals improve (for example, operators are bringing down costs, reimbursement rates are increasing and debt challenges are being worked out with Prospect and Steward) and macroeconomic headwinds may be subsiding (i.e. inflation is showing signs of slowing and the fed may slow its rate of interest rate hikes).

We recently wrote up this REIT in detail for our members, but the basic gist is that if you are a highly risk-averse investor, MPW is not right for you. But if you can handle the volatility, the shares are worth considering for a spot in your prudently-diversified long-term income-focused portfolio (especially considering the very low P/AFFO ratio and the very large dividend yield).

Medical Office Buildings:

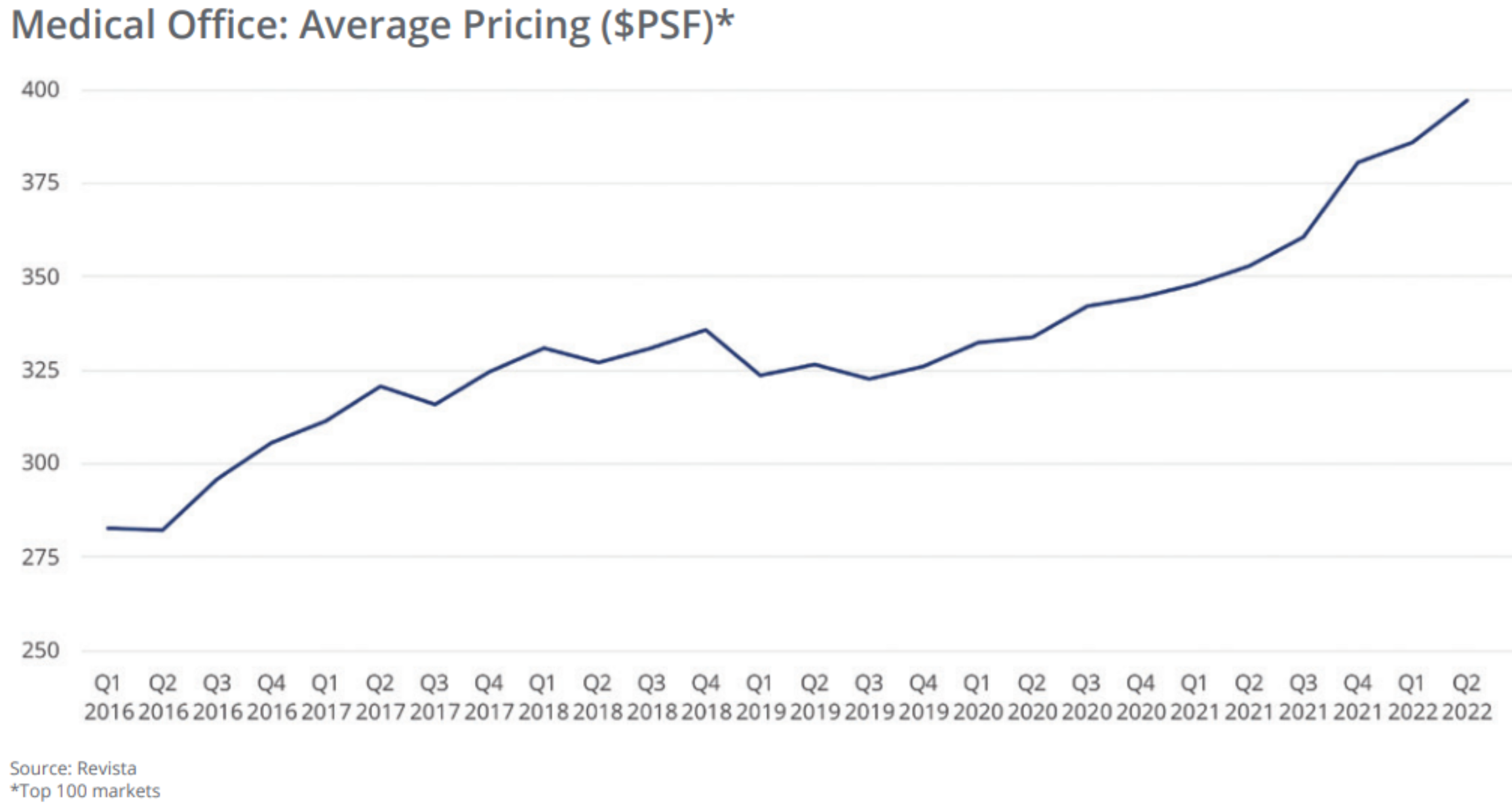

Another interesting sub-industry within healthcare REITs is medical office buildings. This group is somewhat less sensitive to current macroeconomic headwinds, as described by Colliers in their Q2 U.S. Healthcare Services Report:

“While no property sector will be immune to the impact of high inflation, a slowing economy and rising operating costs, the MOB sector is well placed to weather the storm. Underlying business fundamentals for medical tenants are stronger than a typical office user, which reduces concern over future income streams. There is greater stability in demand for medical services and, potentially, pent up demand from procedures canceled or postponed during the pandemic. In addition, U.S. Census data estimates that one in five Americans will be 65 or older by 2030, rising to one in four by 2060, thereby under-pinning demand for medical office facilities.”

And to put that in perspective, here is a look at the healthy pricing trend for Medical offices (from the same Colliers report).

*Honorable Mention:

*Physicians Realty Trust (DOC), Yield: 6.4%

Physicians Realty Trust isn’t the fastest growing REIT, and it has far less dramatic upside price appreciation potential than recently troubled (but improving) industry peer Medical Properties Trust (as we described earlier), but DOC does have much more stability and financial health.

If you don’t know, Physicians Realty Trust owns healthcare properties that are leased to physicians (as well as hospitals and healthcare delivery systems). DOC also offers a well covered dividend, a reasonable valuation, less debt and is in a much stronger financial position than many of its industry peers. If you are looking for a steady dividend yield (along with some price appreciation potential), Physicians Realty Trust is worth considering.

Specialty REITs: Data Centers

The specialty REIT industry is diverse, but one interesting subset of the group is data centers. Data centers basically house servers to support data that is “in the cloud.” And considering the massive secular trend by enterprises around the globe to digitize everything and then migrate it to the cloud for better access, data center REITs (such as Digital Realty (DLR), Equinix (EQIX) and now even Iron Mountain (IRM) to some extent) stand to benefit.

Like the entire real estate sector, most data center REITs have sold off hard this year. And one common negative viewpoint is that they are becoming increasingly obsolete faster than they can build out (or acquire) properties to meet demand. For example, according to Morningstar analyst, Matthew Dolgin, who has a “buy rating” on data center REIT, Digital Realty:

“Virtualization and other technological advances could allow Digital's tenants to do more with less space and fewer connections, reducing their data center needs.”

7. Digital Realty Trust (DLR), Yield: 4.4%

Digital Realty is a specialty REIT focused on data centers. The shares have sold off way too hard this year as it’s gotten caught up in the tech sell off (tech stocks are down more than the market averages this year). Noteworthy, DLR has low debt, a very reasonable valuation and a dividend (that has been growing every year for 10+ years) that is well covered by FFO. In our view, the selloff is overdone, and DLR currently represents an attractive value. Simply put, if you are looking for a steady big-dividend with some reasonable share price appreciation potential, Digital Realty is a blue chip REIT worth considering.

Diversified REITs

Diversified REITs are typically involved in more that one industry, such as office, retail and industrial, to name a few. The following table shares data on a variety of diversified REITs, and you probably recognize at least a few of your favorites.

6. W.P. Carey (WPC), Yield: 5.3%

When it comes to big-dividend REITs, WPC is a stalwart favorite (it has increased its dividend for over 10 years straight). More specifically, it is a diversified, large cap, net lease REIT, specializing in the acquisition of operationally critical, single-tenant properties in North America and Europe. It owns properties across a variety of market segments (e.g. Industrial (26%), warehouse (25%), office (20%) and retail (16%)). It’s also in a financial strong position, the dividend is well covered, and the yield is high by historical standards (all good things). We recently wrote up WPC in detail, and you can review that report here.

5. VICI Properties (VICI), Yield: 4.7%

VICI Properties is a triple net lease REIT in the gaming and entertainment industry. It owns some of the most iconic properties in the world, including the renowned Caesars Palace (its largest tenant) in Las Vegas, Nevada. More specifically, VICI owns 29 gaming facilities (48 million square feet), approximately 19,200 hotel rooms and over 200 restaurants, bars, nightclubs and sportsbooks (both in Las Vegas and in regional markets throughout the US). It also owns four championship golf courses and 34 acres of undeveloped land adjacent to the Las Vegas Strip.

Per the company’s Q3 earnings call, CEO Ed Pitoniak believes in:

“the power and moat qualities of what we call pilgrimage experiences… These are experiences that tend to attract within that experiential category, the most valuable and loyal clientele, able and willing through all cycles to pay a premium for the purest realization of the experience to which they are devoted.”

In our view, VICI has been wisely increasing the growth trajectory of its business in spaces with high barriers to entry, as it continues to make aggressive acquisitions. For example, in Q3, VICI announced that it had grown its:

“revenue by 100% versus the same quarter in 2021, manifesting the full impact of our acquisitions of the Venetian and MGP; growing our AFFO by 83% year-over-year; growing AFFO per share by 8.5% year-over-year; announcing a dividend increase of 8.3%, giving VICI a dividend compound annual growth rate of 8.2% since our emergence in October 2017.”

VICI’s valuation on a price-to-FFO basis has gone from undervalued versus peers in 2020 (during the height of pandemic fears) to now more fully valued versus peers. For example, it currently trades at around 21.6 times forward FFO versus a REIT sector median of under 15x. However, VICI is unique because of its iconic wide-moat properties and continuing high-growth trajectory. For example, in addition to the acquisitions described above, VICI just completed a $500 million stock offering (which is not insignificant versus its $32.5 billion market cap) for the:

“furtherance of the ongoing business and operations of the Company and other general corporate purposes, which may include capital expenditures, working capital and the repayment or refinancing of indebtedness.”

In our opinion, VICI is not as great of an opportunity as it was in 2020 (when the shares traded significantly lower due to pandemic fears), but it remains an outstanding big-dividend growth opportunity going forward thanks to its iconic wide-moat properties, strong financials, and growing dividends to shareholders.

Specialty REITs: Cell Towers

The specialty REIT industry is diverse, but one subset of the group is cell tower REITs. As a recent Barron’s article explained: “The major wireless companies—Verizon Communications (VZ), AT&T (T) and T-Mobile US (TMUS) in the U.S.—couldn’t function without the communication towers that three REITs own and operate. American Tower (AMT), Crown Castle (CCI), and SBA Communications (SBAC) lease space to the wireless companies, essentially acting as landlords for antennas.”

4. Crown Castle (CCI), Yield: 4.5%

Crown Castle is the nation's largest provider of communications infrastructure (that includes cell towers, small cells and fiber) that connects people and businesses to data and technology. Specifically, the company owns, operates and leases shared communications infrastructure that is geographically dispersed throughout the U.S., including more than 40,000 towers and other structures, such as rooftops (collectively, "towers"), and more than 80,000 route miles of fiber primarily supporting small cell networks ("small cells") and fiber solutions.

Crown Castle shares have sold off recently as other REITs have sold off, but its business is uniquely positioned to continue growing rapidly (whereas other REITs are struggling to find growth). Specifically, the secular trend towards 5G and the “Internet of Things” positions CCI well to continue its high growth trajectory. Further still, the company’s strategy to purse small cell opportunities seems unorthodox to some (considering the strength of it tower business) but the move could prove extremely lucrative in the years ahead. We also appreciate the company’s strategy of returning a healthy amount of cash to investors through dividends (this can help with maintaining a stable investor base), but also spending an ample amount of capital to capitalize on industry growth opportunities. Now at just 18.4x FFO, if you are a long-term income-focused investor (that also likes growth), Crown Castle is worth considering for a spot in your portfolio.

*Honorable Mention:

Broadstone Net Lease (BNL), Yield: 6.3%

Broadstone falls into the diversified REIT category, but roughly 50% of its business is in the industrial REIT industry—an industry we like (as described above). Further, Broadstone has sold off particularly hard this year as the industry has sold off, but also because it is perceives as riskier because it has a smaller market cap, it is relatively new (it IPO’d in 2020) and it is focused on single tenant properties (which are perceived as risker, but Broadstone is so well diversified that it becomes essentially a non-issue).

Broadstone’s debt is low, its dividend is well covered by FFO, and we expect its valuation multiple to expand as more people become familiar with the opportunity. For more information, our recent detailed report on Broadstone is available here.

3. Realty Income (O), Yield: 4.6%

Realty Income is a well known retail REIT for good reason—it offers an attractive dividend (paid monthly) and the business is actually very financially healthy. And financial health is not necessarily something you would expect in the retail real estate sector. Specifically, between pandemic disruption and the continuing growth of online shopping, brick-and-mortar retail has been facing serious headwinds for years.

However, Realty Income stands out for its prime-location properties that will continue to thrive for years to come (for example, top tenants include Dollar General, Walgreen’s, 7-Eleven, FedEx, Walmart and Home Depot, to name a few). It also stands out for its financial strength, including low debt-to-equity, a dividend well covered by FFO, and a long history of increasing the dividend payment every year.

Furthermore, Realty Income continues to grow (albeit at slightly slower pace than historically) as its large size lends itself to more growth through acquisitions. Realty Income won’t be the fastest growing REIT in the sector, but it is one of the safest, especially considering its property types are concentrated in retail areas that are less susceptible to being overtaken by internet shopping. With a dividend yield that has now mathematically risen to 4.6% (as the share price is down moderately this year) Realty Income is a steal if you are looking for a healthy big dividend. For more information, our previous detailed report on Realty Income is available here.

2. Plymouth Industrial REIT (PLYM), Yield: 4.4%

Plymouth Industrial REIT, Inc. (PLYM) is a real estate investment trust focused on the acquisition, ownership and management of single and multi-tenant industrial properties, including distribution centers, warehouses, light industrial and small bay industrial properties.

Plymouth’s properties are located in primary and secondary markets within the main industrial, distribution and logistics corridors of the United States. In particular, Plymouth currently owns and manages 207 buildings containing over 34 million square feet in 13 markets.

Also compelling to note, “re-leasing” rates have been increasing significantly (a good thing for Plymouth). For example, in the first quarter of 2022, Plymouth retained 73% of its expiring leases and increased rent by an average of 12.6%. And the other 27% of leases to new tenants saw rent increases of 29.7% on average. What’s more, there is more room for leasing rate increases as a steady flow of expirations will be up for new (higher) rents in the years ahead.

Here is a recent industry video featuring Plymouth’s CFO, Anthony Saladino, and explaining why the REIT is positioned well for continuing growth.

1. Stag Industrial (STAG), Yield: 4.5%

Stag Industrial has not been spared from the recent market wide selloff (shares are down more than 30% year-to-date), and it has been hit especially hard because it is an industrial REIT caught up in this year’s Amazon-induced selloff for the industrial REIT industry (Amazon set off an industrywide selloff in industrial REITs as it announced it will be significantly reducing is spending on industrial property leases as the initial pandemic supply chain disruption needs have now subsided).

This year’s sharp decline has some contrarians salivating at the opportunity to “buy low,” especially considering Stag has increased its dividend for over 10 years in a row, and the dividend yield has mathematically risen as the share price has fallen. Not to mention, Stag pays its dividend monthly (which can be particularly compelling to some investors) and it continues to benefit from the ongoing e-commerce secular trend (currently approximately 40% of STAG’s portfolio handles e-commerce activity).

Stag certainly faces risks, such as its single tenant properties (often located in secondary and tertiary locations) and the potential for an ugly recession. However, we believe the long-term need for industrial properties will continue to grow and Stag stands to benefit.

Conclusion:

REIT share prices have taken a big hit this year, but many of them have maintained their big dividend payments, thereby making the sell off easier for some investors to tolerate. What’s more, many REITs are positioned to not only survive a macroeconomic slowdown, but also to thrive in the years ahead. And their dividend yields are currently larger than normal (they’ve mathematically risen as the share prices have fallen). If you are a long-term income-focused investor, now is an excellent time to own select REIT opportunities, such as those described in this report, within your prudently-diversified, long-term, income-focused investment portfolio.

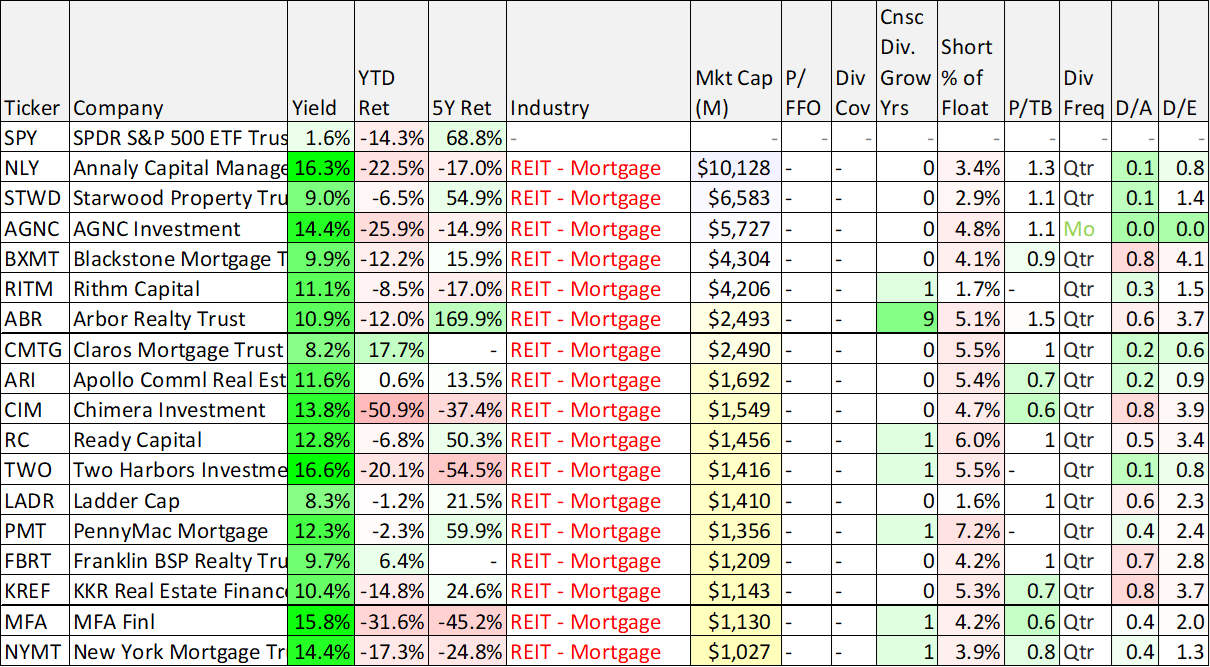

For reference, you can view more REIT data below (sorted first by industry and then by market cap).