If you like dividend-growth stocks, offering an attractive yield and price appreciation potential, you may want to take a hard look at this diversified energy manufacturing and logistics company. It’s coming out of its toughest year in operating history (2020, thanks to covid), but is giving strong indications there are more share price increases, share buybacks and eventually dividend hikes, once it gets the additional 2020 debt under control—which we believe it will quite soon (i.e. it’s currently turning the corner hard). In this report. we review the business, dividend safety, valuation, risks and then conclude with our opinion on investing.

Overview: Phillips 66 (PSX), Yield: 4.3%

Phillips 66 (PSX) is a one of the largest and most highly integrated energy manufacturing and logistics companies. It is engaged in the transportation, processing, storage and marketing of petrochemical products. PSX was originally the downstream business of ConocoPhillips (COP) until 2012, when it was spun-off as part of COP’s restructuring. Today PSX operates highly diversified lines of businesses across four segments:

Midstream: transports, gathers, processes and markets crude oil, natural gas, natural gas liquids (NGL) and refined petroleum products in the US. The business includes a 74% limited partner interest in Phillips 66 Partners (PSXP) and 50% equity investment in DCP Midstream LLC (DCP).

Chemicals: encompasses assets in CPChem as a 50:50 joint venture with the oil giant Chevron (CVX). Operations are structured around two primary business lines, Olefins and Polyolefins (O&P), and Specialties, Aromatics and Styrenics (SA&S), with production capacity concentrated in the US (80%) and the Middle East.

Refining: refines crude oil and other feedstocks into petroleum products, such as gasoline, distillates and aviation fuels at 13 refineries in the US and Europe. PSX currently has the capacity to refine 2.2 million barrels of oil per day.

Marketing and Specialties: encompasses marketing and sales of refined petroleum products, such as gasoline, distillates and aviation fuels, mainly in the US and Europe. Also includes the manufacturing and marketing of specialty products, such as base oils and lubricants.

Integrated Segments Provide Diversification Across Business Channels

PSX’s diversification across business channels is an important differentiator for the company from its peers. While refining has traditionally been PSX’s core business, being tied to commodity prices, it is also the most volatile. The segment has seen sharp volatility, with extreme upside during favorable economic cycles and extreme downsides during times of economic turbulence, typically when oil prices are depressed and cause significant declines in refining margins. This can be gauged from the fact that refining turned from being the largest profit generating segment to the biggest loss making one in the pandemic year of 2020. However, PSX has invested heavily into its other businesses, especially midstream, which typically generates much more predictable cash flows, and this has helped it to significantly iron out the volatility from its refining segment.

Source: May 2021 Investor Presentation

From the chart below, it is quite evident that PSX’s diversified asset base has historically helped it to post impressive numbers. While the profitability declined in 2019, primarily because of depressed refinery margins, it still was not in negative territory in 2020, which was an exceptionally tough year for the energy sector in general and the worst year in PSX’s operating history since its IPO.

PSX’s diversification benefits can also be gauged from its robust EBITDA generation capability. As evident from the chart below, despite the refining segment generating negative EBITDA in 2020 and in the LTM March 2021 period, the company was still able to generate a positive adjusted EBITDA at the consolidated level.

Promising Signs of Recovery Amid Weak 1Q21 Performance

While overall market conditions continued to experience improvement during 1Q2021, the February winter storm significantly impacted PSX’s refining, midstream and chemical operations in the Central and Gulf Coast regions, which resulted in lower asset utilization and higher maintenance costs, and led to a higher adjusted operating loss of $509. Importantly, the company saw sequential gains in the refining and marketing and specialties segments, which were offset by sequential losses in the midstream and chemicals businesses due to higher costs associated with the winter storm, as we can see from the chart below.

Source: 1Q21 Investor Presentation

What was particularly encouraging is the fact that the improvement in the refining business was driven by increased utilization, which stood at 74% vs. 69% in 4Q20, and higher realized margins of $4.36 per barrel vs. $2.18 in the previous quarter as crack spreads continued to improve. Also, worth noting, despite the lower utilization, the chemicals business saw higher margins, primarily due to tight supplies, low inventory levels and continued strong demand.

Given the improving economic environment, PSX’s management is upbeat on the rest of 2021 and expects most of its businesses to come back to the 2019 levels by the second half of 2021. As a matter of fact, a number of indicators are pointing to a recovery in the energy sector. For example, oil prices have continued to recover; US crude oil inventories are about 1% below the five-year average, gasoline inventories are about 2% below the five-year average and distillate fuel inventories are 5% below the five-year average for this time of year, signaling their higher demand in the market; refinery inputs have been increasing and utilization rates have been on the uptrend; and there is an increasing demand for gasoline and other oil products as people have started commuting more with the advent of vaccines.

Overall, as the economy recovers, there will be increasing demand for oil and oil products, which will massively benefit not only PSX’s refining business, but also its midstream business, which is likely to see accelerated volumes, as well as the marketing and specialties business, which will see increased demand for products such as gasoline at its gas stations as more people commute.

PSX has been planning to restart its paused organic growth projects in the midstream segment. For example, at Sweeny Hub, it plans to resume construction of Frac 4 in 2H21, which will add 150,000 barrels per day. The Sweeny Hub fractionation complex averaged 330,000 barrels per day in 1Q21 and upon completion of Frac 4, it will have 550,000 barrels per day of fractionation capacity, which will be supported by long-term customer commitments, and thus will bring in a stable stream of cash flows.

The outlook for the chemicals business also looks bright due to a strong retrieval in polyolefins pricing. PSX appears to be well positioned in North America and Middle East where it can take advantage of the low ethylene product cost. Additionally, it is advancing optimization and debottlenecking opportunities at its Cedar Bayou facility that will increase production of ethylene and polyethylene to meet their growing demand in food packaging, medical supplies and other consumer products.

Source: May 2021 Investor Presentation

Further, the company is investing heavily into renewable fuels. For example, it is converting its uncompetitive San Francisco Refinery in Rodeo, California, from fuels made from crude oil to fuels made from cooking oil, fats, greases, and soybean oils. The facility has the capacity to produce 8 MBD of renewable fuels and is expected to produce more than 50 MBD of renewable fuels upon its full conversion in 1Q 2024, making it the world’s largest facility of its kind. This reinforces our view on PSX as the refinery of the future. With product distribution through integrated logistics network of marine and product terminals, the company is expecting a return of more than 30% from the project. It has also installed hydrogen fueling stations and hopes to use solar energy to power its pipelines and refineries. We believe as PSX penetrates more into low-carbon fuel technology and integrates its existing business channels for the same, it will have a larger area to grow in the longer-term.

Consistently Returning Capital Back to Shareholders through Buybacks and Increasing Dividends

PSX has a solid track record of returning capital back to shareholders in the form of dividends and share buybacks. The company has returned as much as $28 billion to its shareholders since its listing in 2012, with repurchases of 34% of its shares initially outstanding and nine dividend increases. The dividend increases have been at a CAGR of ~20% since 2012, which we find very impressive. 2020 was an extremely challenging year, yet PSX maintained its dividends and also repurchased $443 million of its shares before suspending the buyback program in March 2020 to preserve liquidity amid the challenging operating environment.

Source: Company website

PSX’s dividends have historically yielded higher than the broader S&P500 index. Its current dividend of $0.90 per share results in an annualized yield of ~4.3%, which is well above the S&P500's ~1.4% dividend yields, and highly competitive with the broader energy sector’s ~3.4% yield.

Source: Multpl, PSX and Blue Harbinger Research

Dividend Safety:

While PSX has a history of generating enough cash flows to fund its dividends and buybacks, alongside its growth Capex, the past year was indeed a difficult one and threatened the safety of its dividend payouts. The company’s cash flows from operations had taken a significant hit and were not enough to cover the Capex (despite a substantial cut down in growth Capex), let alone its dividends. As a matter of fact, PSX has intentionally restrained spending on growth Capex. Its total capital budget for 2021 is $1.7 billion, of which only $600 million is for growth Capex.

Source: PSX 10K Filings

To cover the funding gap, PSX took on additional debt on its balance sheet, which significantly increased its leverage ratio to ~8.7x its adjusted EBITDA in 2020. Even in the most recent quarter, PSX’s cash flows from operations of $271 million were not enough to cover its dividends of $394 million, as they were entirely used for its $331 million capital expenditure, notably only about half of which ($174 million) was on growth projects. The company rather utilized its cash pile of over $2.4 billion (as of 31 December 2020) to fund the dividend payments, while also paying down $500 million of debt.

Source: 1Q21 Investor Presentation

We think, PSX’s decision to use the available cash without worrying too much about liquidity highlights the confidence it has in generating large amount of cash from its operations, going forward. Accordingly, we believe 1Q21 will probably be the penultimate quarter where the safety of PSX’s dividends was threatened. According to Greg C. Garland, Chairman and CEO, during the 1Q21 earnings call:

“I do think that the gating decision for us is really mid-cycle cash book. We want to get back to $6 billion to $7 billion of mid-cycle cash flow, and that creates the optionality for us certainly to invest $1 billion in our sustaining capital to fund our dividend, $1.6 billion and grow that dividend. And then that leaves us with a lot of optionality in further paying down debt or investing more in the company.”

Conservatively Managed, Investment Grade Balance Sheet:

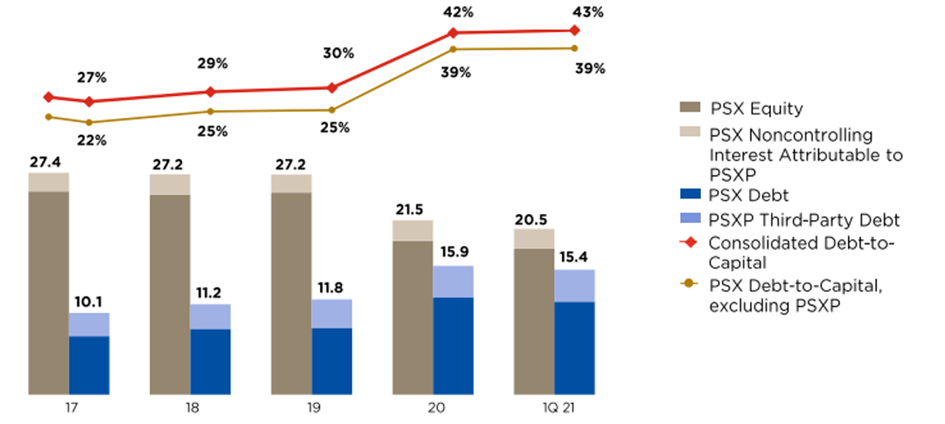

While the leverage on PSX’s balance sheet has certainly increased as a result of it taking on additional debt during 2020 to finance its funding gap, it still maintains a very healthy balance sheet with a strong liquidity position of $6.7 billion as of 31 March, 2021, comprising of $5.3 billion of available credit capacity and $1.4 billion of cash and equivalents. The company’s outstanding debt at the end of 1Q21 was $15.4 billion, and represented a debt to capital ratio of 43%, which was understandably at an all-time high.

Source: Investor Presentation, May 2021

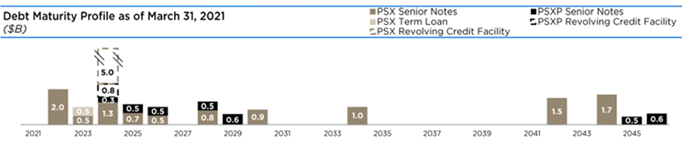

PSX manages its balance sheet quite conservatively, taking on high leverage only during times of financial stress, such as in 2020. Also, it’s debt maturities are spread out over significantly long time periods of time. For example, its current outstanding debt is scheduled for repayment over the next 25 years, and it doesn’t have any debt maturing in 2021. The company does have significant debt maturities coming up after 2021, but we think it will be in a good position to either pay or roll them off as it recovers from the shocks of the pandemic.

Source: Investor Presentation, May 2021

Also, PSX has focused its efforts on accelerating its debt repayments to bring its debt levels back to the pre-covid levels of ~$12 billion as it believes a lower debt level will further enhance its already strong credit ratings that currently stand at A3/BBB+, but has a negative outlook, while also helping it to decrease its overall cost of capital and providing it more flexibility with regards to its capital allocation decisions, going forward. We believe dividend growth will likely resume at some point after PSX gets it debt levels back to the pre-covid levels. According to CFO Kevin Mitchell on 1Q21 earnings call:

“Our primary focus from a leverage standpoint is around the credit rating. So we have an A3 and BBB+ rating, so very strong investment grade, but we do have a negative outlook on both. And so we want to get back to maintain those ratings and with a stable outlook. And to do that, we need to demonstrate that we're getting debt levels back somewhere towards where they were before the pandemic kicked in.... And once we're on a nice sort of pathway to getting back to somewhere around about that $12 billion level, I think we'll have a lot more flexibility to start considering other alternatives which could entail at some point, we want to get back to the dividend, get a dividend increase at some point. Again, at the right time, we'd like to be buying our shares back.”

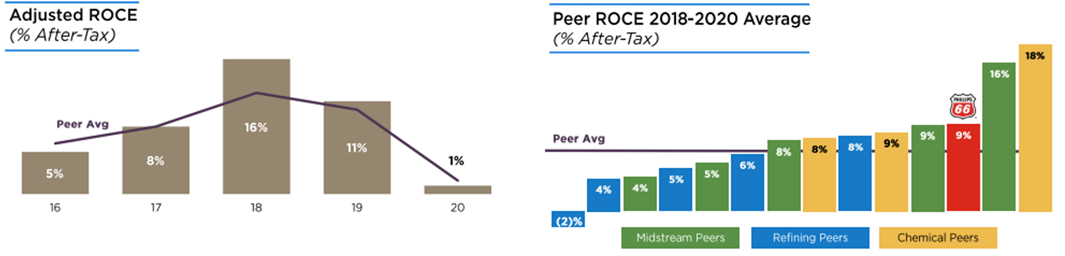

Outperforming its Peers:

PSX has historically generated superior return on capital employed (ROCE) to its peer group. While its ROCE significantly declined to just about 1% in 2020, on a three-year basis, it still averaged a healthy 9%, which is superior to many of its peers, not just in the refinery business, but also in the midstream and chemical businesses.

Source: Investor Presentation, May 2021

Also, the strength of the business, as well as its 60:40 approach of investing (60% of cash flows in growth projects and 40% toward shareholder payouts) has helped it to meaningfully outperform its peers in terms of shareholder returns. We expect the company to continue its 60:40 approach to capital allocation in the longer run, which will provide healthy returns to its shareholders.

Source: Investor Presentation, May 2021

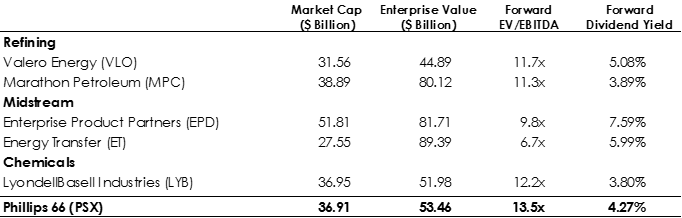

Valuation:

The shares of PSX were heavily sold off in 2020, and the company did not do well for itself in the toughest year in its operating history since its IPO. However, with the improving economic conditions and the improving outlook for the energy industry in general, PSX’s shares started to gain strong momentum in the back half of 2020. Specifically, since October of 2020, the company’s shares have doubled in value and are up about 20% so far this year. However, the shares are still at a significant discount to pre-covid levels of over $100, and currently trade at a forward EV/EBITDA of 13.5x.

While the trading multiple looks high, we believe it is justified given the strength of PSX’s operational diversity across various business lines, which its competitors lack. We expect the shares to return back to pre-covid levels as the economy further stabilizes and company returns back to its previous cash flow and profitability levels.

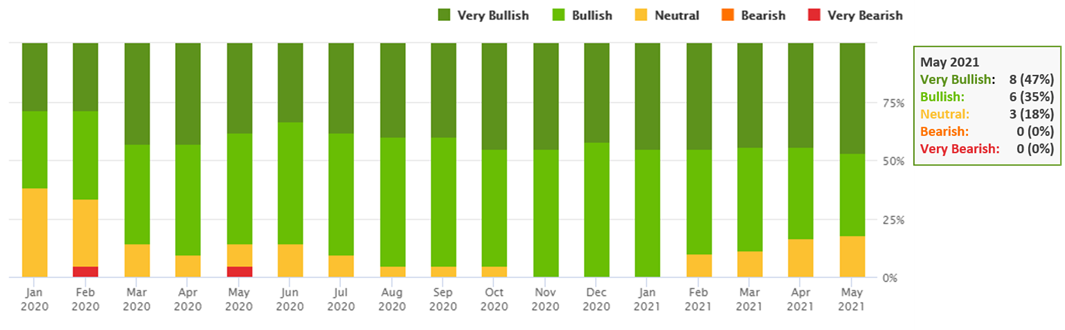

For more perspective, over 80% of the analysts covering PSX have a bullish stance on its shares, and have an average price target of $94, which represents ~10% upside from the current price.

Source: Seeking Alpha

Risks:

Political Risks: The newly elected Biden administration has promised a clean energy revolution and any stringent environmental regulations can possibly have a negative impact on companies operating in the oil and gas sector. However, PSX has already initiated work on technology advancement for low-carbon future and is performing research on renewable fuels, organic photovoltaics, current and next generation batteries and solid oxide fuel cells.

Fluctuations in Commodity Prices: The operations of PSX are susceptible to fluctuations in prices of crude oil, natural gas and NGL, which have historically been volatile. Any downward trend in the commodity prices could result in less drilling activity, production and refining of crude oil, which would mean decreased volume of transportation in pipelines and terminal facilities of company, thereby negatively affecting earnings and cash flows.

Conclusion:

We like PSX, and currently own shares. It had an extraordinarily challenging year in 2020, but did not cut its strong dividend, it has maintained a solid investment grade credit rating, and we especially like the way its midstream segment adds earnings power but also cash flow volatility reduction—especially as compared to its refining business (this midstream diversification is unique as compared to peers and warrants a higher valuation). Management has good reason to be highly optimistic going forward, especially as they pay down dead (with their massive stock pile of cash) and as the economy continues to reopen. While the 4.3% dividend yield is not the highest, it is significantly higher that the S&P 500 (more than double), and the shares also offer healthy long-term price appreciation (something many of the highest dividend yield stocks simply do not offer). If you are looking for an attractive long-term dividend growth stock, PSX is worth considering (again, we own shares).