Common characteristics of “top growth stocks” include very high sales growth trajectories, high gross margins and very large total addressable markets. And many of these stocks were pandemic darlings—gaining 50%, 75%, 100% and more—after the initial onset of the pandemic, but have since been in freefall in recent months (as economies re-open), and there could still be significantly more pain ahead. In this report, we share helpful data on 50 top growth stocks (to help you gain perspective on the current situation), and then review three stocks in particular that are attractive and worth considering for investment.

50 Top Growth Stocks In Freefall:

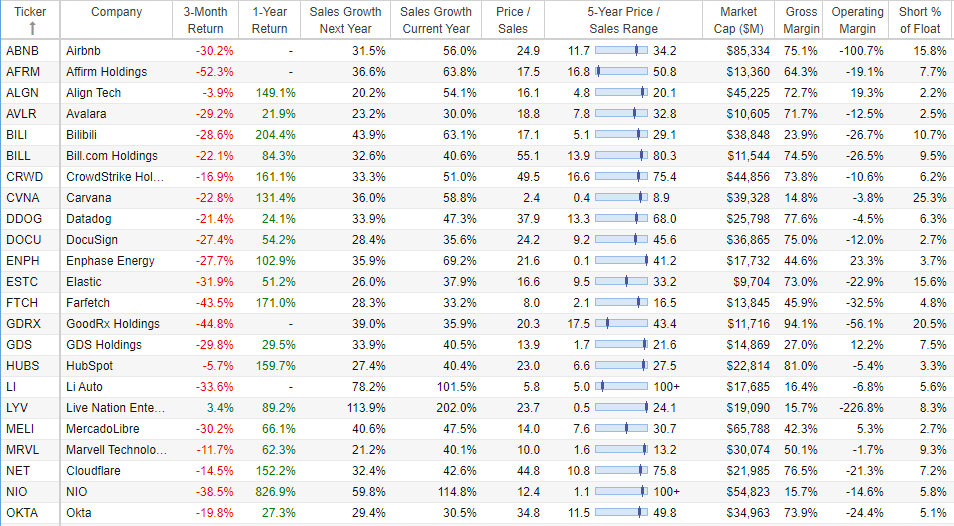

To get right into it, here is data on 50 top growth stocks that are down big in recent months. Notice the strong 1-year performance (lots of green) and the ugly 3-month performance (lots of red).

You’ll also notice that the stocks in the table above have very high sales growth rates (for this year and next)—often above 20% and 30%. For perspective, blue chip stocks like Procter & Gamble (PG) and JP Morgan (JPM) have only single-digit expected revenue growth rates. You’ll also notice that the gross margins (sales - “cost of goods sold’) on the business is the table are generally high (and attractive quality). However, operating margins are low (because many of these high growth businesses have been spending very heavily to growth their businesses). The point is simply that these are the types of high growth stocks that performed extremely well following the initial onset of the pandemic.

However, for a little more perspective, this next chart shows the recent performance of a few of these top growth stocks since mid-February when the growth stock sell off began. You can see the S&P 500 (SPY) is up since this time (the pink line), but the specific growth stock names we’ve highlighted are down.

Also, if you follow along with popular growth/innovation strategy, ARK Innovation ETF (ARKK) it’s down a lot since this time too (brown line) as it holds many of these popular growth stocks. At Blue Harbinger, we focus on fundamental long-term research, but that’s not to say we turn a blind eye to technical analysis (we don’t), and you can see in this next chart that some significant technical damage has been done to growth stocks recently, as measured by ARKK recently breaking below its 200-day moving average—a metric followed by many, and a bad sign for those in the technical world.

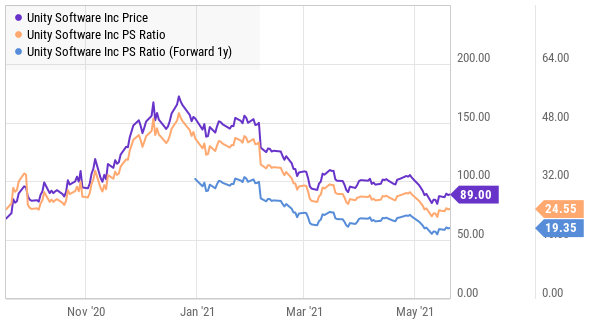

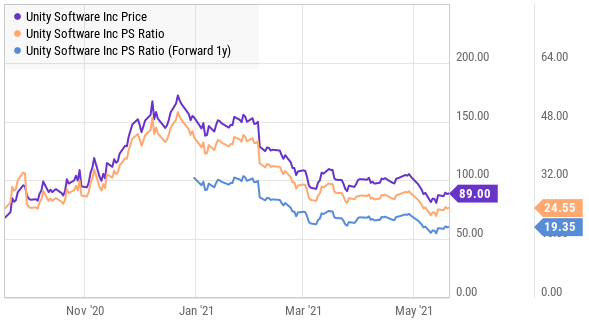

However, returning to something much more important for long-term investors (fundamentals), valuations have improved. For example, the price-to-sales ratios (a metric followed closely for top growth stocks) have come down—an indication that prices are more attractive. However, just because they’ve come down certainly does not mean the near-term pain is over. Included in our earlier table of 50 Top Growth stocks, you can see where each stock’s current price-to-sales multiple sits relative to its own 5-year historical average—and for the most part—many of them are still not cheap.

Generally speaking, when a stock’s price-to-sales multiple gets above 10x, that’s quite high, and it’s an indication that investors believe something special is going on at the company. Specifically, a price-to-sales ratio above 10x generally means the market is expecting very significant future sales growth. And in reality—that’s exactly what is happening with many of the stocks in our table above. More specifically, a lot of these top growth stocks are special in the sense that they do have businesses that can maintain high growth rates for a long time, thereby warranting the high valuations (in our view). And if you are a patient long-term investor, the recent price pullbacks have created increasingly attractive buying opportunities, acknowledging there could be more short-term pain before the long-term price uptrends resume. We have highlighted a few specific examples below.

1. Futu Holdings (FUTU)

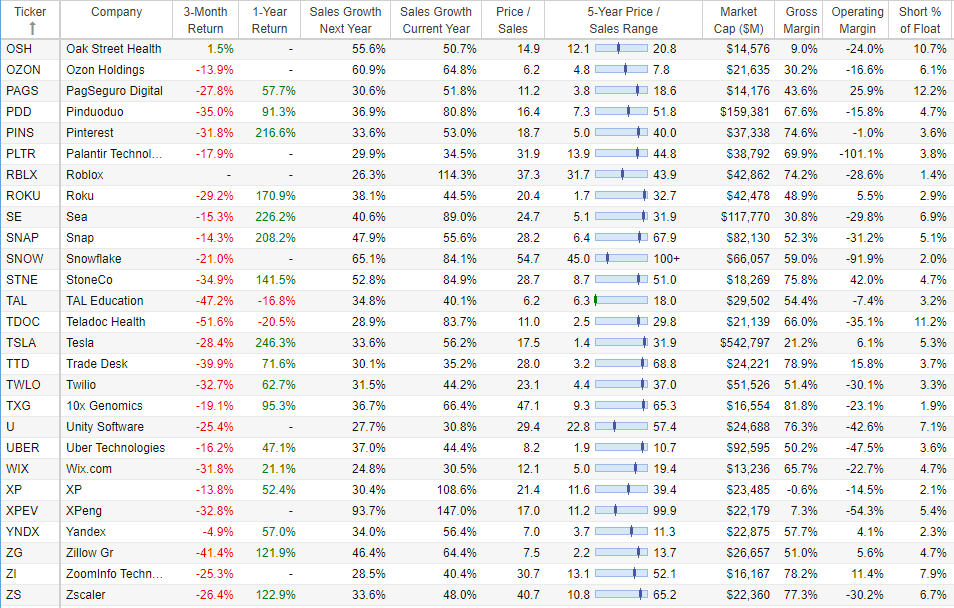

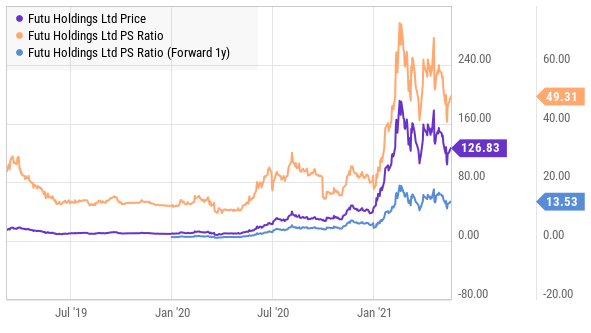

If you are looking for a very high long-term growth stock, then put this Hong Kong based online brokerage and wealth management firm near the top of your watchlist (note: we currently own shares). Revenues are expected to grow at over 100% this year and next. And the company’s impressive integrated platform (e.g. stock trading, margin financing, wealth management, market data and interactive social features) is expanding thanks to its high R&D budget and important relationship with Tencent (the preeminent Chinese internet juggernaut).

And the shares of this impressive business have recently sold off (see chart above) thereby making for a more compelling entry point from a valuation standpoint (price-to-sales), especially considering the continuing high revenue growth trajectory:

You can read our recent full report on Futu Holdings here:

2. Unity Software (U)

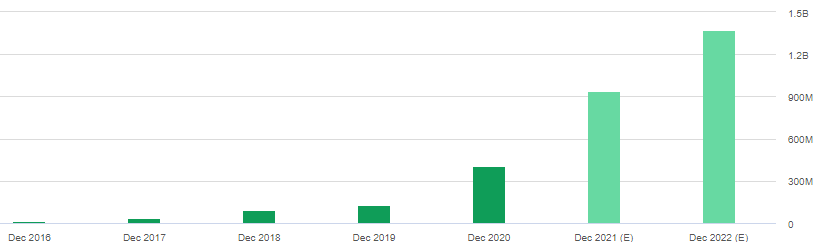

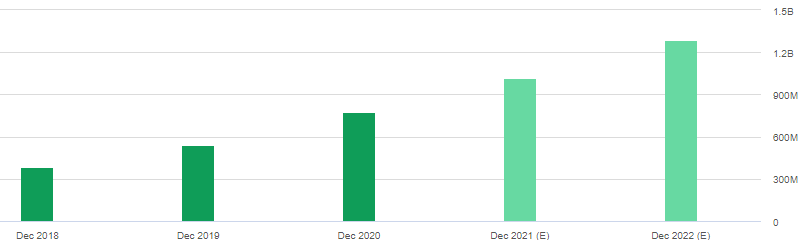

Unity Software provides tools to videogame developers. The company recently completed its initial public offering in September. The business is healthy, revenue is growing rapidly, and it has a large total addressable market.

And like Futu (discussed earlier) the shares of Unity’s impressive business have recently sold off (see chart above) thereby making for a more compelling entry point from a valuation standpoint (price-to-sales), especially considering the continuing high revenue growth trajectory:

You can read our full report on Unity here:

3. Cloudflare (NET)

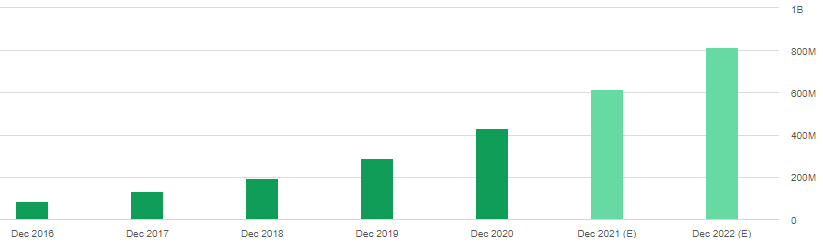

Cloudflare (NET) is one of the leading cloud-based platforms that provides network services and internet security solutions. The company has benefited from strong tailwinds due to increased cloud adoption and digitalization, and it has a lot more room to run.

And like Futu and Unity (discussed earlier), shares of Cloudflare’s impressive business have recently sold off (see chart above) thereby making for a more compelling entry point from a valuation standpoint (price-to-sales), especially considering the continuing high revenue growth trajectory:

For a deeper diver into Cloudflare, you can read our recent full report here:

Conclusion:

Despite recent pain, the share prices of good businesses (such as Futu, Unity and Cloudflare) will come back. And despite where they sit relative to their historical valuation multiples, the sales numbers will continue to grow, and eventually (we don’t know exactly when—no one does) the share prices will regain momentum through multiple expansion and fundamental growth (actually the fundamental growth never stopped). The brilliance of long-term investing is that if you have the patience to wait, the cream eventually rises to the top, and the best businesses will experience dramatic share price increases. Furthermore, even though we don’t know when the free fall will end (momentum can carry the pendulum too far in both directions), the valuations of top businesses are now more attractive than they were just a few months ago.

Further still, it’s also critically important to keep an open mind in understanding that other segments of the market can build momentum before top growth stocks regain it. As long-term investors, we’d never advocate trying to time short-term market moves, but in the intermediate term—and to the surprise of many investors—we wouldn’t be surprised to see energy and commodity stocks gain a little momentum as share prices have started to perk up, valuations remain relatively cheap and rising inflation becomes an increasing factor—a topic we recently wrote about here.

However, at the end of the day, it is critically important to know your own goals as an investor, and to stick to an overall strategy that meets your individual needs. Disciplined, goal-focused, long-term investing is a winning strategy.