The one-two punch of inflation and the omicron variant has sent the market into a bit of a correction lately. Especially for high-growth stocks. The question is: How big will the correction be, and what changes should you make to your investment portfolio?

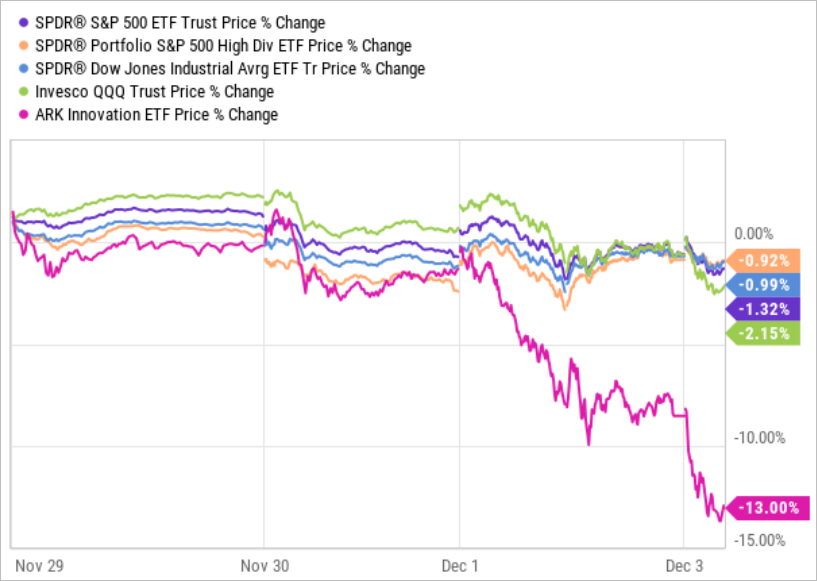

For starters, here is a look at the recent performance of the S&P 500 (SPY), the Dow Jones Industrials Average (DIA), and the Nasdaq 100 (QQQ). The chart also includes Cathie Wood’s high-growth ARK ETF (ARKK) and the S&P 500 High-Dividend ETF (SPYD).

As you can see, the market has sold off in the last week, and growthier stocks (such as those in the Nasdaq 100, and especially the ARKK ETF) have sold off even harder. For reference, the ARKK ETF holds a lot of naturally socially distanced tech stocks that did extremely well coming out of the start of the pandemic in 2020. However, here is a look at the same chart over the last five-years, and the story is quite different.

Inflation and the Omicron Variant

The two big fear-mongering narratives in the media over the last week have been the dangers of inflation and the dangers of the Omicron variant. With regards to inflation, it creates challenges for the economy, but especially for growth stocks (because growth stocks are valued more based on future earnings, and the present value of those future earnings falls as inflation rises). Regarding the Omicron variant, everyone remembers the painful market crash in early 2020 when the coronavirus first became a pandemic, so investors are very sensitive to news about the dangers of the new omicron variant.

Fear-Mongering Headlines:

For perspective on the fear that has dominated headlines and news flow lately, here are a couple characteristic headlines:

IMF urges the Fed to speed up monetary policy tightening amid mounting inflation fears. This one is evokes fear because as the Fed raises rates (to slow inflation) it also slows the economy, and this can be bad for stocks, especially growth stocks.

WHO says Covid omicron variant detected in 38 countries, early data suggests it’s more contagious than delta. This headline also creates significant worry in many investors’ minds.

Also, if the two headlines above aren’t enough to scare you, here is a look at the latest 7-year asset class return forecasts from world-renowned investment firm GMO.

According to GMO, stocks are in trouble over the next seven-years, unless you are investing in deep-value stocks in emerging markets (such as Brazil, Russia, India and China).

But before all this negativity sends you into a panic, here is a look at JP Morgan’s long-term capital market assumptions (see page 126), and they see returns for equities positive in the years ahead.

What Should You Do Now, as an Investor?

The number one thing you can do as an investor is to ensure your investment portfolio is consistent with your personal long-term investment goals and then DON’T PANIC!

This means if you are an income-focused investor, don’t go dumping your life-savings into growth stocks just because they sold off over the last week. And if you are a long-term growth investor (with the stomach to handle volatility)—don’t go selling your growth stocks because they’re down. In fact, if you’ve been sitting on the sidelines (with cash that you’ve been meaning to invest), Now is a more attractive time to buy than last week.

Very importantly, don’t panic! When the market gets volatile, people make emotional mistakes that get them off track and cost them money. Stay focused on your long-term investment goals. And if you’re investment portfolio is set up correctly, the best thing to do when the market gets volatile is usually—absolutely nothing! Disciplined, goal-focused long-term investing is a winning strategy.

Let’s Talk Individual Stocks: Here are my Real-Time Watchlists

I follow a lot of individual stocks, and one way I group them conceptually is high-growth stocks versus high income stocks. And for your reference, you can view my growth stock watchlist here and my high-income watchlist here.

Income Securities

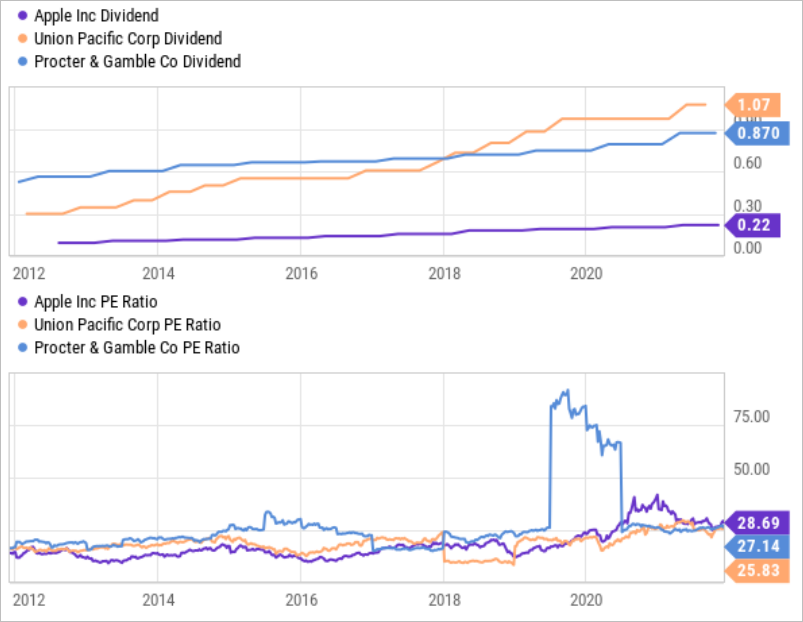

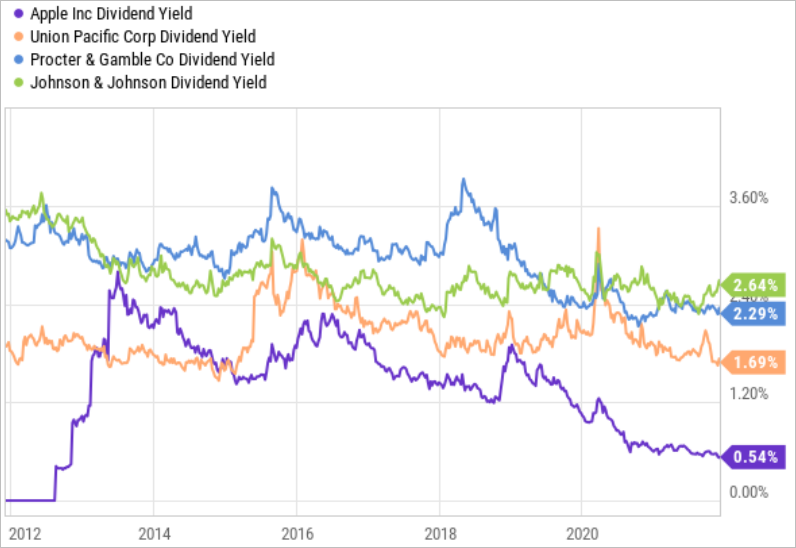

From an income-securities standpoint, right now, I really like long-term dividend-growth stocks that are strongly profitable and trading at attractive valuations relative to their long-term value and ongoing growth potential. The part about being “strongly profitable now” is really important because if inflation continues to be high, current earnings (and near-term future earnings) are much more valuable than earnings-in-the-distant-future driven only by high potential growth in the years ahead (because of inflation). These stocks don’t necessarily pay huge dividends, but they pay healthy growing dividends.

A few examples of stocks I view as attractive now are those that can continue to perform well, despite inflation, such as Apple (AAPL), Union Pacific (UNP), Procter & Gamble (PG) and Johnson & Johnson (JNJ). None of these stocks are going to deliver massive disruptive growth, but they are going to keep delivering strong profits, healthy dividends and long-term price gains, regardless of inflation.

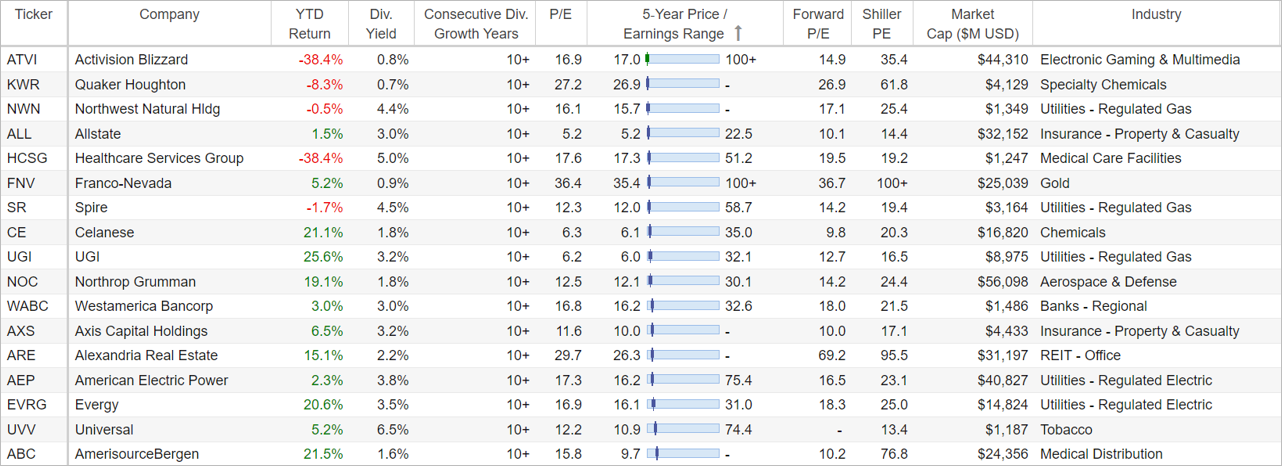

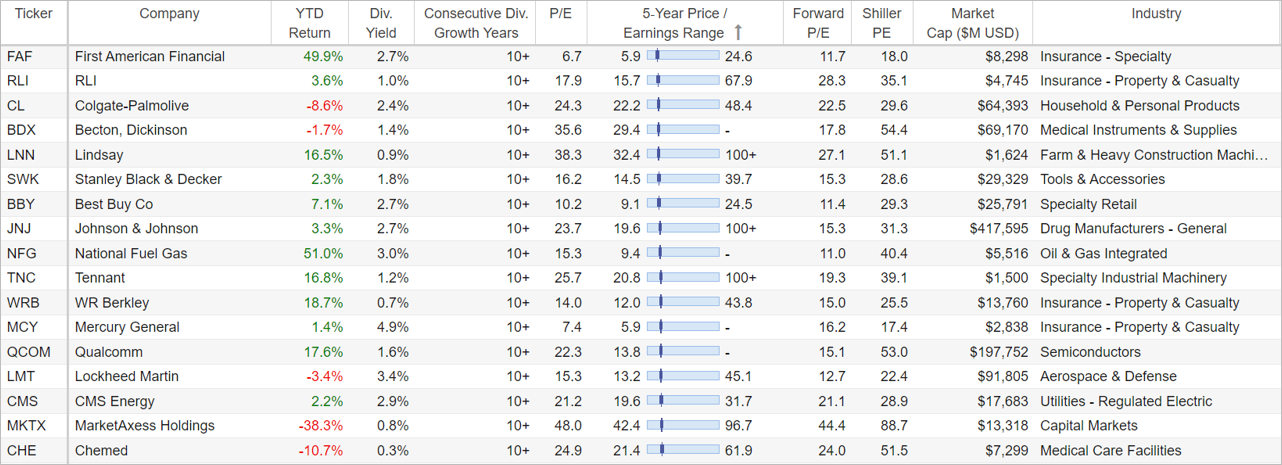

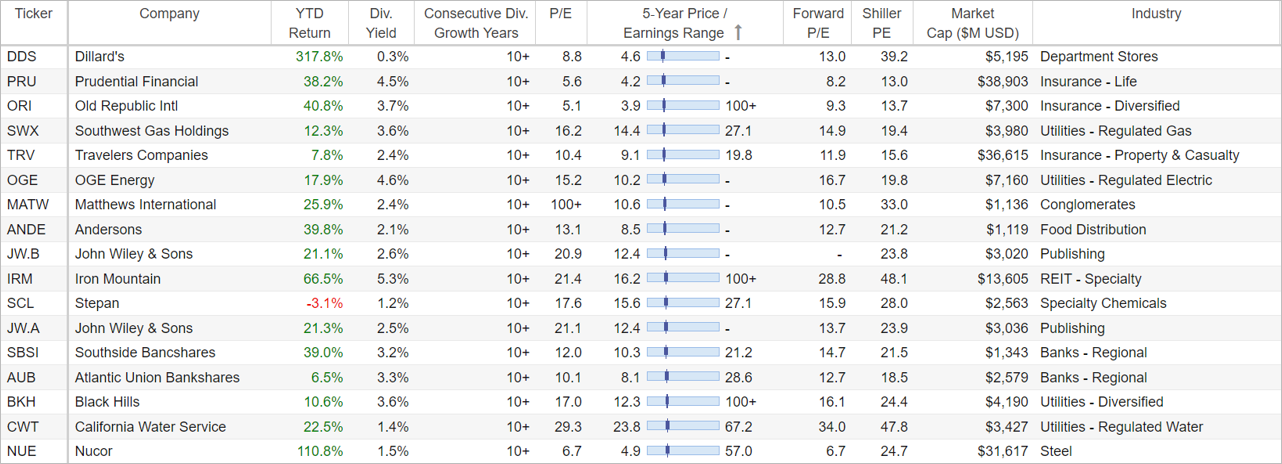

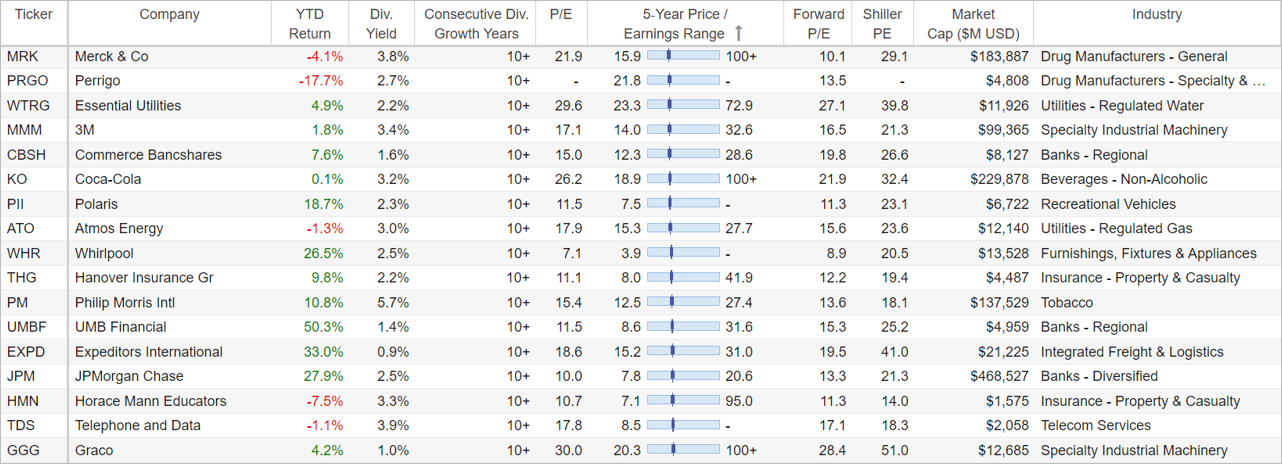

And to go a little further with this theme of dividend-growth, healthy-profitability, here is a list of over 60 stocks that have grown their dividends for at least 10 consecutive years and currently trade in the lower half of their 5-year P/E ratio range.

Notable names from the above list include First American Financial (FAF), Qualcomm (QCOM), Merck (MRK), 3M (MMM) and JP Morgan (JPM).

Big-Dividends Corner

As an important point, big-dividend stocks (those with yields above 5.0%) generally involve a little more risk (and volatility) because the businesses are often (but not always) a bit stretched to pay out such high dividends. As such, the biggest divided stocks are usually not a safe haven when the market panics; rather, they too can sell off. And when they sell off, that’s often a better time to buy (depending, of course, on the individual business). I personally continue to like big-dividend payers, such as BlackRock’s multi-sector fixed-income Closed-End Funds (CEFs), depending on your personal goals.

Growth Stocks

From a high-growth stock perspective, the last week has been a bloodbath. For some investors, this is validation that these were “terrible” stocks that should have never been touched in the first place. But for others, they’re left wondering if now is “the time” to “buy low.” In our view, the answer is: it depends on your goals. Specifically, if you’re a low-volatility income-focused investor, then don’t go dumping your nest egg into growth stocks. And if you are a long-term growth investor: Don’t panic. Don’t make the mistake of ditching your long-term plan out of short-term fear.

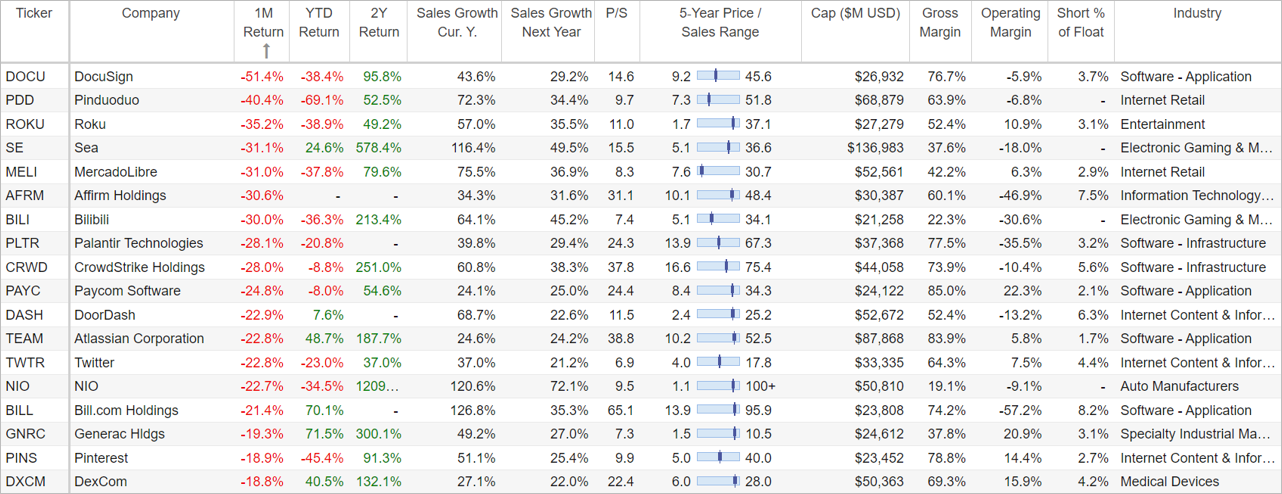

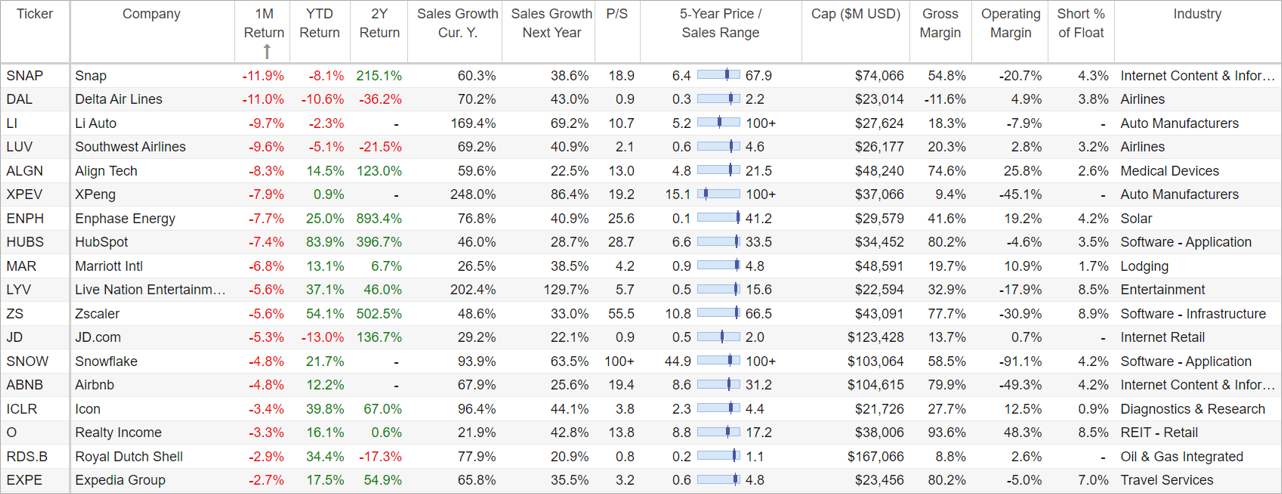

Here is a table of top growth stocks (those with high expected revenue growth this year and next year), and as you can see in the 5-day return column (the one with all the red) performance has been terrible!

Again, this sell off is driven mainly by inflation fears (because the present value of all their expected future income is now worth less—due to inflation). But does that mean they are now, all-of-a-sudden, terrible businesses? No!

Interestingly, a lot of these high sales growth stocks are exactly the same ones that performed so well coming out of the initial covid sell off in 2020 because they were perceived to be naturally socially distanced. The fact that they’re not rebounding hard in light of the new omicron variant is an indication that the market really isn’t that scared of Omicron!

From the names on the above list, three that we really like (if you are a disciplined, long-term, growth investor) are DocuSign (DOCU), Snowflake (SNOW) and Generac (GNRC).

DocuSign (electronic signatures) announced earnings this past week; they provided slightly lower forward guidance, and the shares tanked hard (too hard!).

Snowflake (a cloud-based big-data platform) also announced earnings this past week, and the shares initially gained, but then went lower as the market indiscriminately dragged top growth stocks lower.

Generac (power generators, plus now environmentally friendlier products) also got caught up in the sell off, but remains an attractive long-term play thanks to management’s ongoing expansion into clean energy and power grid 2.0 solutions.

The Bottom Line:

As always, it is critically important to know your own individual goals and volatility-tolerance as an investor. A big part of investing is picking good individual investments, but the other big part is psychological fortitude. Specifically, don’t let short-term market moves and media fearmongering distract you from your long-term goals. It’s often noted (based on empirical data) that the best investors in the world are often “dead investors” because they don’t make the same, panic-driven, short-term trading mistakes as living investor. Disciplined, goal-focused, long-term investing is a winning strategy.