If you are an income-focused investor, you’re likely concerned about rising inflation because it can eat away at the value of your next egg and the buying power of your income. This article reviews an attractive closed-end fund (“CEF”) that provides a big monthly income payment, plus some protection against rising interest rates and inflation through its floating rate income (i.e. as rates go up, the payments this fund provides also go up). We provide a quick overview of the fund, review its nuts and bolts through 6 important charts, and then conclude with our opinion on investing.

Nuveen Floating Rate Income Fund (JFR), Yield 6.9%

The primary objective of this fund is to achieve a high level of current income by investing in a portfolio of adjustable-rate senior loans. Senior loans are typically bank loans (not publicly-traded bonds). Bank loans are usually too small of a denomination to go to the public market through a typical bond offering, yet by assembling a portfolio of them, investors can achieve attractive returns.

Bank loans typically have floating rates, and this can be particularly attractive in a rising interest rate environment because as rates go up—the loans pay more interest. Bank loans can be a pain to invest in because of all the paperwork, and this generally puts them out of reach for individual investors. However, big firms like Nuveen have economies of scale to build funds and make bank loans available to individual investors through funds, such as this one.

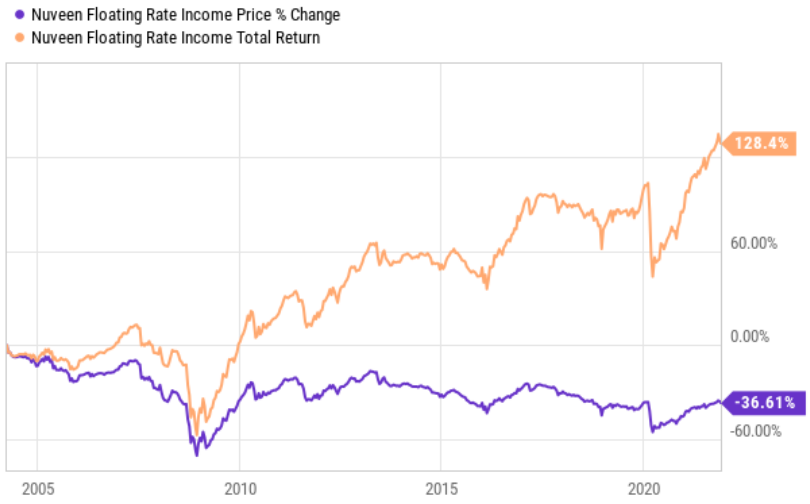

Price Versus Total Returns.

Here is a look at the price return versus total return for JFR, and it is important for investors to consider.

As you can see above the price of this fund has declined over time, but the total return (price return plus income payments) has been consistently positive.

The next chart shows the dividends paid and dividend yield of JFR over time.

Important to note, the fund has continued to pay attractive income over time, but that income has some volatility (i.e. it’s floating rate).

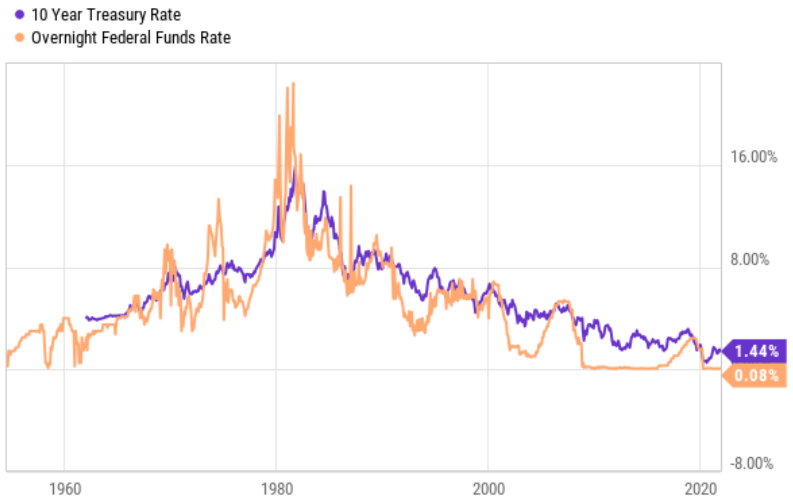

This next chart shows that the price of JFR generally follows the yield on US treasuries over time. It’s not an exact one-to-one correlation, but in general—it tracks.

This is important because if the Fed is about to start aggressively increasing rates to combat inflation, then the price (and the interest paid by this fund) could also be about to rise.

For reference, this next chart shows that the yield on treasuries (a rate the Fed does not set directly) closely follows the Fed Funds rate (a rate the Fed has much more control over).

Again, if the Fed is about to increase rates, that could bode well for the future performance of JFR (especially as compared to non floating rate funds).

How Much Can Rates Increase

Important to mention, the Fed arguably cannot increase rates too much because it would hurt the US Government. Specifically, as you can see in the following chart, “interest” payments (on US Treasuries) are a significant portion of the US government’s total spending, and too much of an increase in rates could be devastating to the government’s budget.

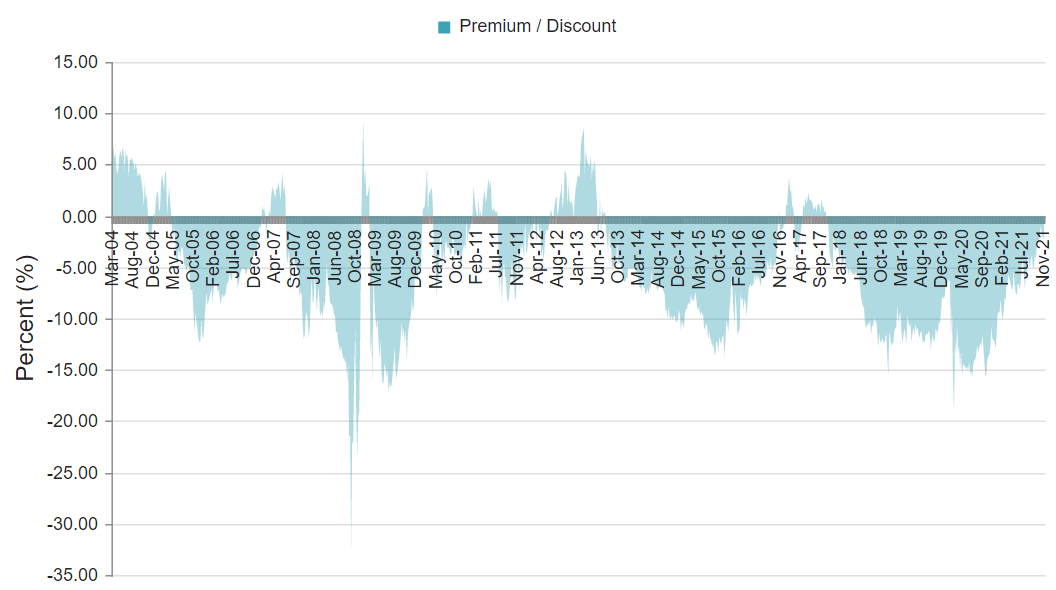

JFR Trades at a Discount

Another important characteristic when considering a CEF (such as JFR) is the market price relative to the net asset value (or the value of the underlying holdings). Because CEFs are closed-end, they can trade at significant discounts and premiums to NAV. JFR currently trades at 2.31% discount.

And in the case of JFR, we generally prefer to buy CEFs at a discount. Again, JFR does currently trade at a discount to NAV (more attractive than a premium).

Fees

JFR does have a significant total expense ratio of around 2.25%. That may seem frighteningly high, but it’s not, and here’s why. First bank loans require a lot of paperwork (lawyers) and Nuveen genuinely is giving investors exposure to an asset class (bank loans) that they couldn’t get on their own.

Secondly, JFR uses leverage (or borrowed money) to magnify returns. Currently, it is around 36.4% levered. This is a good thing in the case of JFR because bank loans are a lot less risky/volatile than the stock market, and 36.4% is a prudent amount in our view. Interest expense (on borrowed money) is a significant part of the total expense ratio. The management fee on the fund is 1.24% (pricy, but worth it considering the asset class exposure and professionally managed leverage and investment selection).

The Bottom Line:

If you are looking for steady monthly income payments, and some protection against rising interest rates and inflation, Nuveen’s JFR CEF is worth considering. It is certainly not a disruptive growth stock that will deliver possible huge returns (again see the total return chart earlier in this presentation), but it is extremely likely that JFR will keep paying big steady income. Furthermore, that income (and the price of the fund) could be set to rise if the US fed begins to more aggressively increase interest rates, as it seems increasingly likely they will. If you are looking for high-income payments, JFR is worth considering.