When investors think of “big dividends” their minds often gravitate to stocks with the highest dividend yields. However, “yield on cost” can be an extremely important metric for long-term income-focused investors because it can reveal massive dividend opportunities flying under the radar. For example, the attractive undervalued dividend stock we review in this article doesn’t have the biggest current yield, but if you look backwards and forwards, the yield on cost is truly massive and it has the trajectory to continue growing dramatically larger.

Visa Inc (V)

The company we are referring to is Visa (the “credit card” company). Technically, Visa is a global payments technology company that operates mainly through its transaction processing network “VisaNet” (which enables authorization, clearing, and settlement of payment transactions). To be clear, Visa doesn’t issue cards or set rates; rather it provides other institutions with visa branded payments products that they then use to offer credit, debit and cash access programs to their customers.

For perspective, Visa processed over $2.7 trillion of payments in its most recent quarter.

source: investor presentation

And according to some sources, Visa’s total addressable market opportunity is well over $100 trillion. That leaves a lot of room for continuing growth, especially as the digital payments world continues to evolve and expand. For example, according to Visa CEO Al Kelly, the company now has:

“nearly 60 crypto platform partners with the capability to issue Visa credentials, and there -- we're already capturing over 3.5 billion of payment volume in FY21.”

Big, Growing “Yield on Cost”

Yield on Cost is the current dividend payment divided by the price (or cost) you paid for the stock. For example, if you got shares of Visa around its initial public offering in 2008 for about $11 per share (split adjusted), your current yield on cost is a whopping 13.6%. This is because Visa’s businesses has been strong enough to raise the dividend every year since its IPO (a trend we expect to continue).

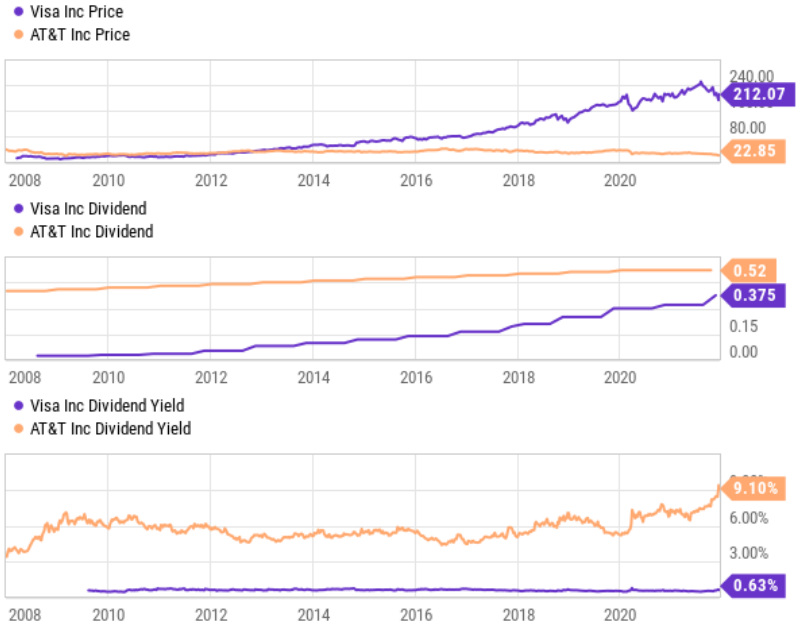

To put this in perspective, here is a look at the historical dividend payment and dividend yield of Visa (currently yielding 0.7%) and hugely popular dividend stock AT&T (T) (currently yielding 9.0%).

source: YCharts

Back in 2008 (when Visa IPO’d), you could have purchased 1 share AT&T for around $33 or 3 shares of Visa (at $11 each). Back then, the total dividends paid by your 3 shares of Visa would be far less than the dividend paid by one share of AT&T. However, given the dividend growth rates, you actually receive far more dividend payments from Visa today than you do on AT&T. That’s the magic of dividend growth and “yield on cost.” Also notice, the dividend yield on Visa has always been lower than AT&T, but your initial Visa investment would now pay MORE dividends each quarter.

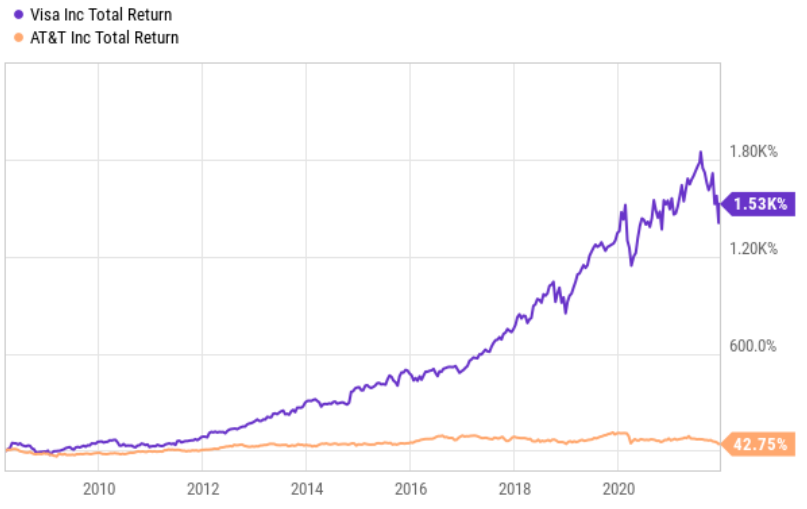

What’s more, if you look at the total returns (dividends plus price gains) of AT&T versus Visa over this time period, Visa wins by an incredibly wide margin (see chart below). This is the importance of “yield on cost,” and an important reminder of why you shouldn’t blindly chase after the highest yield.

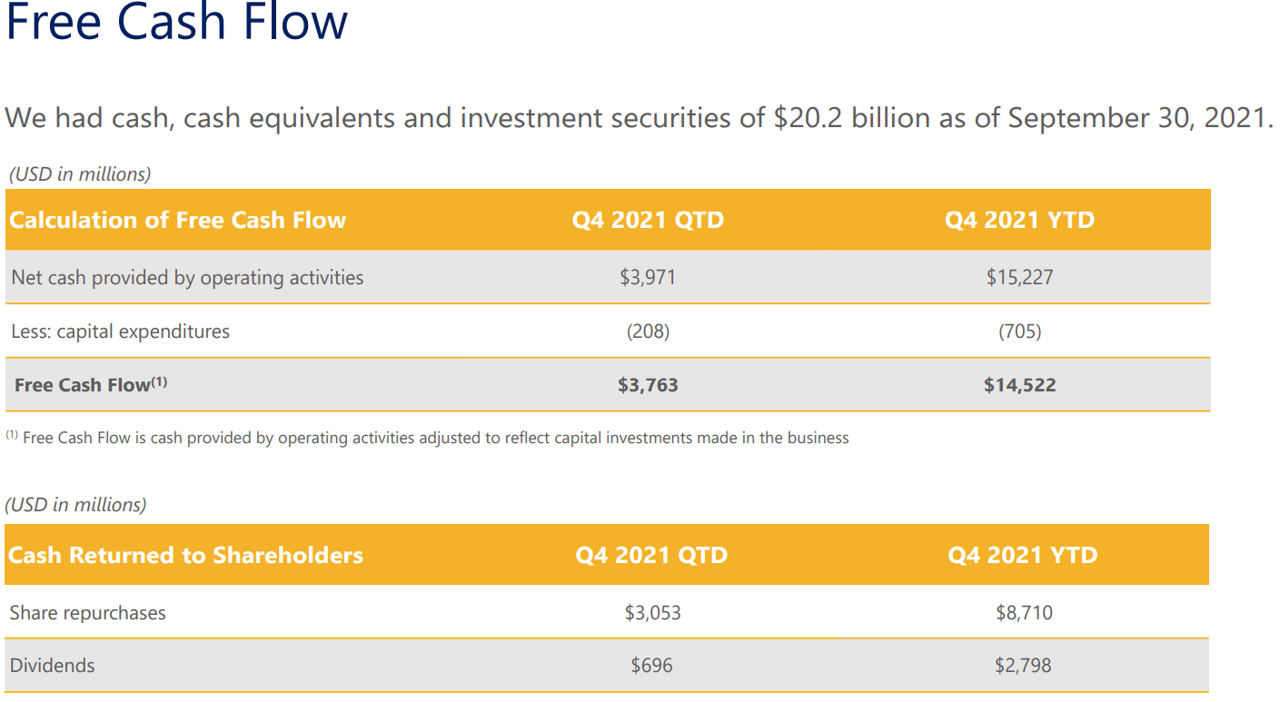

Further still, we believe Visa can continue to grow its dividend (and its share price) at a much higher rate going forward, considering the massive total addressable market opportunity, the comfortable dividend payout rate, and ongoing share repurchases (see free cash flow data below). Visa is a dividend growth monster (in a good way!).

source: Visa investor presentation

Why We Like Visa Now

Aside from the incredible dividend growth power, the three main reasons we like Visa right now are (1) it’s a really good business, (2) the current valuation is attractive, and (3) It is a forward-looking and innovative company with a massive and growing total addressable market (“TAM”) opportunity in the years ahead.

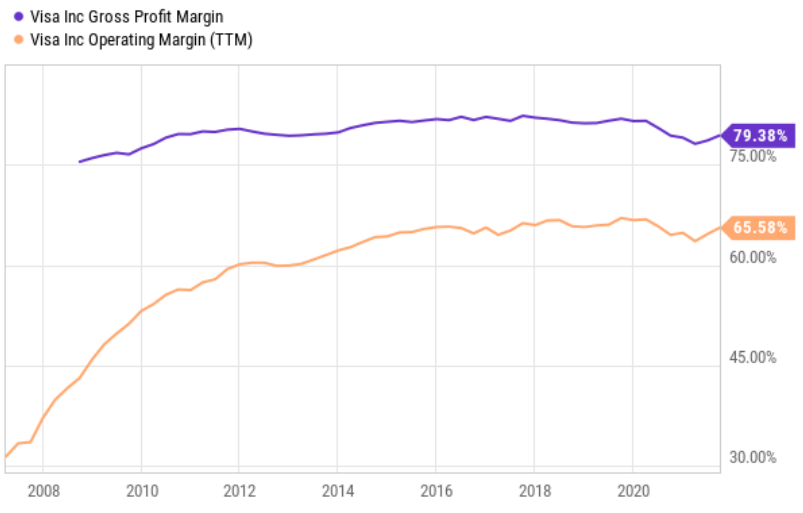

Regarding “it’s a really good business,” Visa is a well-run, highly profitable, blue chip business. For example, here is a look at the company’s gross (+79.4%) and operating (+65.6%) margins. These are obscenely attractive high margins that make just about every other company in the world jealous, especially considering Visa’s already massive size (and its massive growing TAM opportunity). At this point, Visa is basically a money-printing machine.

source: YCharts

Also, according to Visa CEO Al Kelly (during the most recent quarterly call), there are four key reasons why Visa is even better positioned now for growth than before the pandemic, including (1) the enormous opportunity ahead in consumer payments, (2) Visa continues to enhance its network capabilities to facilitate money movement more seamlessly and securely for all players in the ecosystem and accelerate the penetration of new flows, (3) Value-added services that simultaneously help Visa clients leverage Visa’s scale and sophistication, and (4) Visa enables much of the disruption and innovation in the payments ecosystem, which helps to accelerate Visa's growth.

Visa is well-positioned to capture growth in the evolving payments ecosystem/

Current Valuation:

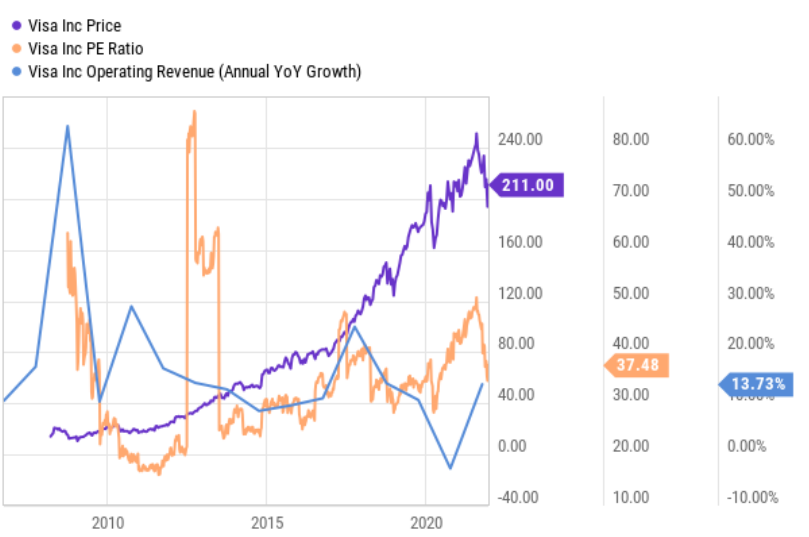

As you can see in the chart below, Visa’s share price has dropped in recent months. And its price-to-earnings ratio (this is a very profitable business) has also dropped.

source: YCharts

Furthermore, you can see in the chart above that Visa’s operating revenue growth rate remains high (in the teens) and consistent with the historical rate.

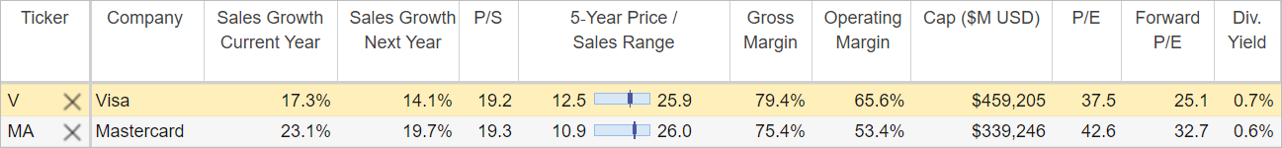

Further, as you can see in the table below, Visa has high forward-looking sales growth numbers (for this year and next). Plus, Visa has significantly higher margins than its peer, Mastercard, and a lower (more attractive) P/E ratio.

source: StockRover

From a valuation standpoint, we view Visa as attractively priced as compared to its profitability and growth. Also noteworthy, Visa Direct (the company’s service that facilitates funds transfers by Visa’s client financial institutions) is “unique as it is more -- has more endpoints and more use cases compared to the next competitor and offers flexible technology.” -Al Kelly, Visa CEO.

Further, as the market shifts further away from the onset of the pandemic, the “hot” pandemic stocks (the tech stocks with high sales growth but little profit) continue to fall out of favor—which bodes well for solid blue-chip stocks/companies like Visa.

Risks

Perhaps the biggest risk to Visa comes from disruptive technologies as the digital payments industry evolves. For example, Visa increasingly competes with virtual currency payments, new payment networks, fintechs, technology companies (that have developed payments systems enabled through online activity in ecommerce and mobile channels), and governments (such as Brazil, India and Russia that are developing, supporting and/or operating national schemes, real-time payment networks, and other payment platforms).

Visa has somewhat of a moat against these competitors through its already entrenched payment procedures, supported by user acceptance and Visa’s strong fraud protection and dispute resolution. Further, Visa continues to innovate and partner with emerging technologies to capture new market share.

Another risk for Visa is simply regulation. As a global organization, various governments have regulated Visa’s fees as well as slowed growth through acquisitions via monopoly and/or antitrust charges. Nonetheless, Visa remains a well-established, trusted and important part of the constantly evolving digital payments ecosystem.

Conclusion:

Visa is a digital payments juggernaut and a dividend growth monster. Regarding digital payments, the industry has massive ongoing growth opportunities and Visa remains a clear leader. Regarding dividend-growth, many income-focused investors make the mistake of chasing the highest current dividend yields, instead of focusing on the best dividend-growth opportunities. In our view, Visa remains a highly-attractive dividend-growth opportunity trading at an attractive price. If you are an income-focused investor, Visa shares are worth considering for a spot in your prudently-concentrated, long-term portfolio.