The company we review in this report is known for manufacturing power generators (and related products) but has recently opened up significant growth opportunities in the “clean energy” and “smart grid 2.0” spaces. It has also recently been benefiting from increased demand for standby home generators (due to frequent power outages in the US as a result of harsh weather conditions). As an investment, the company’s comprehensive set of offerings is uniquely positioned to benefit from the large market opportunity ahead. In this report, we review the business model, the market opportunity, financials, valuation, risks, and then conclude with our opinion on investing.

Overview: Generac Holdings (GNRC)

Founded in 1959, Generac Holdings is a leading provider of power generation, storage, and related energy technology products and services. A few of the company’s offerings include portable inverters, standby generators, energy monitoring and management solutions, Distributed Energy Resource Management Systems (DERMS), and several others. It caters to residential, SMB commercial businesses, and industrial markets. The company is leveraging several secular tailwinds unfolding in the energy space. These include increased reliance on clean energy, the evolution of the conventional electricity utility model or shift to “Smart Grid 2.0”, growing demand for residential power generators and storage systems due to frequent power outages, and the transition to next-gen telecom infrastructure to accommodate 5G. The company’s recent acquisitions (including Enbala, Neurio, Pika Energy, Off-Grid Energy, and many others) place it well to leverage the megatrends in this industry.

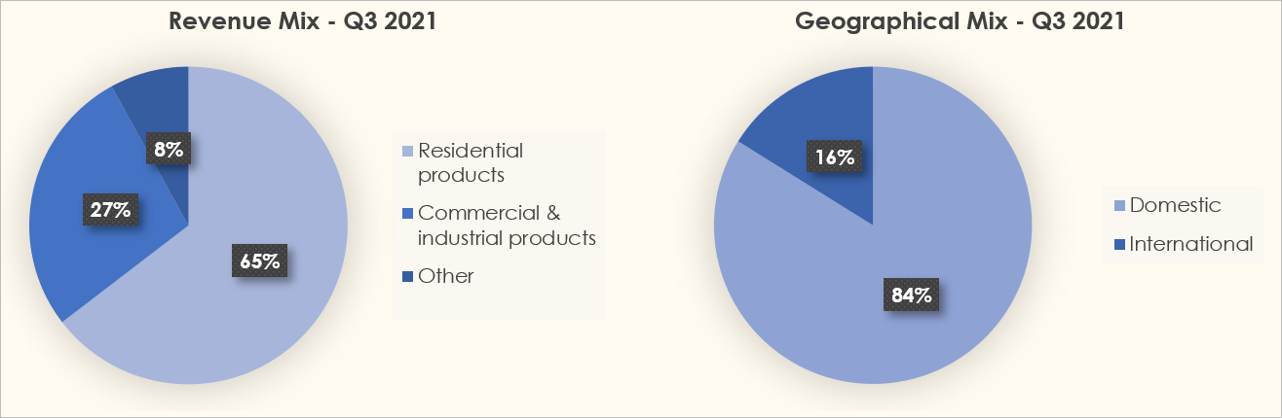

The company derives revenue mainly from selling energy generation, storage, and other related products either directly or via dealers and distributors to Residential, Commercial & Industrial (C&I) customers. Residential products include automatic standby and portable generators, energy storage and monitoring solutions, and other power devices. C&I products consist mainly of natural gas fueled stationary generators that can produce large power output. Other offerings in the C&I products suite include mobile generators, light towers, mobile heaters and pumps. In Q3 2021, sales of residential products contributed 65% of the top-line whereas C&I products accounted for 27%. Generac also derived 8% of total consolidated revenue in Q3 2021 from sale of other products (mainly consisting of aftermarket service parts, accessories, warranties and grid services subscription revenue). Based on geography, the US & Canada accounted for 84% of total revenue in Q3 2021 while the remainder came from the international segment.

Source: Company’s 10-Q

Heightened focus on clean energy generation and storage

Generac has long been known for its power generators and inverters. In fact, as per the company’s estimates, it held over 70% market share in the US residential standby generators market. However, despite holding a leadership position, the market is still underpenetrated as evidenced by just 5% of US homes currently utilizing generators for off-grid power needs. Additionally, while most backup generators are fueled by diesel, Generac utilizes a cleaner approach, relatively speaking, by incorporating natural gases such as methane and propane. More recently, the company also forayed into solar energy storage and monitoring solutions through the acquisition of Neurio Technology Inc. and Pika Energy, Inc. This transition to clean energy has become increasingly important for company’s top-line growth prospects considering rising demand for off-grid power solutions including backup generators and storage systems that work more reliably during bad weather conditions than traditional grid electricity. The graph below shows how the increased number of recent power outages has had a positive impact on company’s sales.

Driving Smart Grid 2.0 transformation through acquisitions

Over the last decade, power generation and delivery have largely remained untouched when it comes to the digital transformation (a truly massive secular megatrend). Rather, the ecosystem has followed the traditional top-down approach whereby electricity is produced in a power station (largely through coal, water, and nuclear sources) which is then transferred to local stations via grid lines and then distributed in the community. However, increased usage of alternative sources of energy (especially solar, both on the residential and C&I fronts) has led to large-scale power mismanagement due to less flexible existing power infrastructure. Anticipating the need for more effective power management systems, Generac has executed several inorganic initiatives focusing mainly on acquiring software companies operating in distribution, optimization, and management of grids. One of those acquisitions was the recent purchase of Enbala Power Networks, Inc., a Distributed Energy Resources (DERs) technology company. Enbala, through its Concerto Platform, offers real-time power balancing services to utility companies and energy retailers. Additionally, it enables the formation of Virtual Power Plants (VPPs) which can support power distribution during violent weather conditions by facilitating the management and distribution of power generated from off-grid sources. Generac’s industry-leading generators and storage systems, combined with Enbala’s software platform, positions it well to drive the Smart Grid 2.0 transformation. According to Aaron Jagdfeld, the CEO of Generac:

“We’re on the edge of a transformation of the electrical grid, moving from a dated and centralized power distribution model to one that will be digitized, decentralized and more resilient. Enbala is a proven virtual power plant (VPP) and DER management platform, and we believe their business model can be incredibly synergistic with our business.”

Additionally, the recent $1 trillion infrastructure deal signed by President Biden is worth noting because one of its key focus areas is the improvement of existing power infrastructure.

Additionally, the acquisition has also added a meaningful software component to the company’s business model which was largely hardware-based. This will result in an increased percentage of recurring revenue in overall revenue thus bringing more predictability and stability to cash flows in the future.

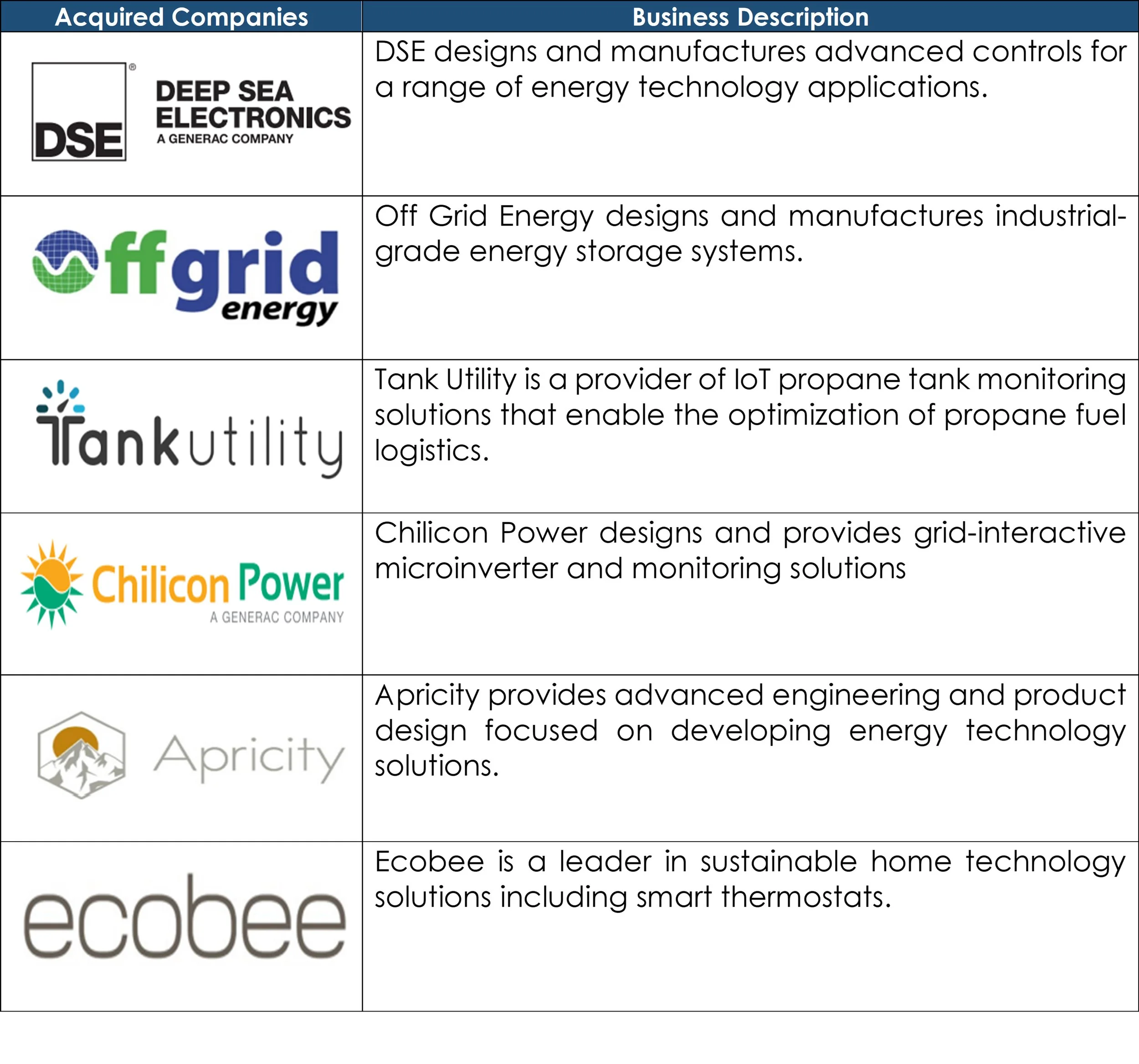

Source: Investors Presentation

A few of Generac’s other recent acquisitions are described below. Interestingly, all the recent purchases are targeted mainly at clean energy and smart grid 2.0 opportunities.

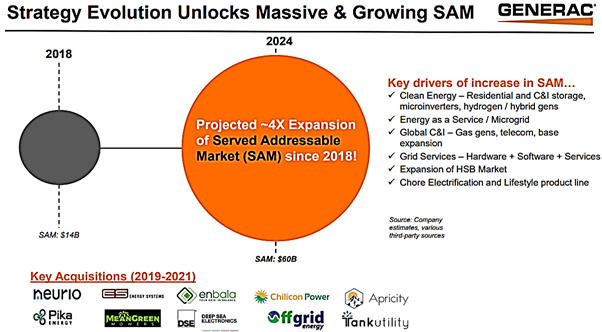

Large and growing Served Addressable Market (SAM)

Generac has grown its SAM significantly since FY 2018. In fact, the company estimated $14B SAM in FY 2018 when it was largely selling generators to Residential and C&I markets. However, as discussed above, the company has evolved its strategy to go beyond generators and has entered other markets, both organically and inorganically. This has led to a notable increase in SAM which is projected to expand over four times to reach $60B in FY 2024. Some of the key drivers of the increase include entry into additional markets including clean energy storage for residential and C&I markets, grid services and Energy-as-a-Service (EaaS).

Source: Investors Presentation

Attractive top-line growth but profit margins facing temporary costs related headwinds

In Q3 2021, Generac reported $943M in total consolidated revenue as compared to $701M in Q3 2020, translating into 34% YoY growth. On an organic basis (i.e., after excluding the favorable impact of acquisitions and foreign currency), revenue increased 30% YoY. Top line improved due mainly to increased sales for all three product areas (namely, Residential, C&I, and Others). Residential product sales rose 33% YoY from $459M in Q3 2020 to $609M in Q3 2021 due to increased sale of standby home generators and solar (PWRcell) energy storage systems. C&I product sales rose 47% YoY from $176M in Q3 2020 to $258M in Q3 2021 due to increased demand for company’s backup systems by telecom customers as they continue to transform their infrastructure to accommodate 5G. Important to note, soft prior-year comparisons due to the pandemic (when commercial and industrial customers tightened their capital spending) also had a positive impact on C&I growth this quarter. Additionally, the other products and services segment grew 14% YoY. Domestic sales (i.e., revenue earned from customers based in the US & Canada) registered 30% YoY growth from $607M in Q3 2020 to $791M in Q3 2021. The company’s products and services experienced strong growth in international geographies as well. In fact, the company’s international segment grew 61% YoY from $95M in Q3 2020 to $152M in Q3 2021. For full-year 2021, the company estimates to report top-line growth between 47% and 50% on a consolidated basis.

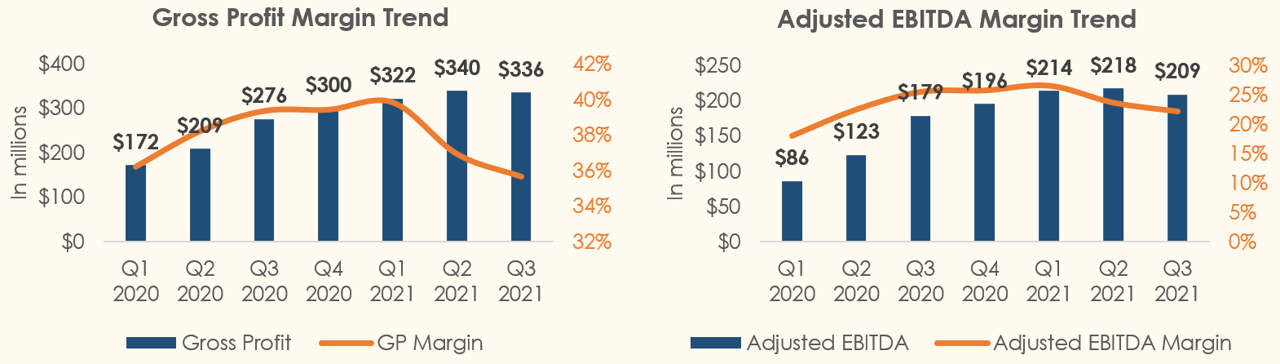

Source: Company’s financials

In addition to growth in top-line, gross profit also rose 22% YoY from $276M in Q3 2020 to $336M in Q3 2021. However, on a margin basis, gross profit margin decreased from 39.4% in Q3 2020 to 35.6% in Q3 2021 due to higher input costs related to commodity, labor, and logistics. Further, increased plant start-up costs at a newly developed manufacturing facility in Trenton also had a negative impact on gross margins. The contraction in gross margin also caused operating margin to decline in Q3 2021. In fact, adjusted EBITDA margin reduced 330-bps YoY from 25.5% in Q3 2020 to 22.2% in Q3 2021. While temporary cost-related headwinds are going to persist in the near-term, the company’s decision to increase product prices slightly will aid margins and offset some of the cost inflation impact. For full-year 2021, Generac expects to report 23.5% in adjusted EBITDA margin.

Source: Company’s financials

Robust liquidity with sufficient cash in hand

Generac had $873M in liquidity consisting of $424M in cash and cash equivalents and $449M available under its ABL revolving credit facility in Q3 2021. Its debt level at $910M is manageable considering liquidity and free cash flow generation. Over the last twelve months, the company generated $455M in FCF and reduced its gross debt leverage ratio i.e. total debt to adjusted EBITDA from 1.5x in FY 2020 to 1.1x on an LTM basis further enhancing its liquidity position. Going forward, Generac plans to follow an asset-light approach and will be allocating just 2.5% to 3% of total sales to capital expenditures.

Source: Investors Presentation

Valuation Multiples Expanding

Operating primarily as a manufacturer of power generators and storage systems, the company’s stock has rallied significantly from last year due to increased demand for its products as a result of frequent power outages in the US as well as its diversification moves discussed earlier. This has led it to trade at an EV-to-EBITDA ratio of 33.4x on a forward basis which is significantly above hardware-oriented low growth peers such as Cummins and Techtronics International (see table below). However, on comparing it to high growth clean energy pure-plays such as Tesla, Enphase, and SolarEdge, the shares seem attractive at the current valuation. While overall the valuation is at a premium, we believe that the company has the potential to grow into its current valuation considering its entry into other industry verticals such as energy storage and grid services, which have significantly expanded Generac’s Total Addressable Market (TAM).

Source: Stock Rover

Risks

Volatile input costs: Generac relies on commodities such as steel, copper, and aluminum to manufacture its products. As such, spikes in prices of these raw materials can lead to increased costs. However, we believe that the company has pricing power, and can increase pricing overtime to offset some of the raw material pressure. Additionally, higher revenue growth will also lead to operating leverage that can help mitigate some of the gross margin pressures.

Conclusion

Leveraging secular tailwind evolving from a rapid shift to clean energy, transformation of traditional grids, and increased demand for off-grid energy sources due to frequent power outages, Generac’s long-term prospects appear attractive with growth expected in both the top and bottom line. Further, robust financials give company much needed flexibility in terms of its ability to pursue organic and inorganic investments. While trading at a healthy valuation multiple, we believe the shares offer upside to disciplined long-term investors.