Shares of this Brazilian electronic commerce juggernaut looked attractively inexpensive a few months ago, but have since fallen significantly further. Its woes stem from a weakening currency, interchange fee pressures, covid and now a recent FBI raid of its major POS terminal providers (in relation to cyberattacks). However, the business continue to strengthen and the market opportunity remains huge (lots of room for continuing growth). Contrarians may consider purchasing shares outright, however in this report we share an attractive income-generating options trade. The trade not only puts attractive upfront cash in your pocket (that you get to keep no matter what), but it also gives you a shot at picking up shares of this highly attractive business at an even lower price (if the shares get put to you before the contract expires in less than 1 month. We believe this is an attractive trade to place today (and potentially over the next few trading sessions) as long as the price of the underlying shares doesn’t move too much before then.

StoneCo (STNE)

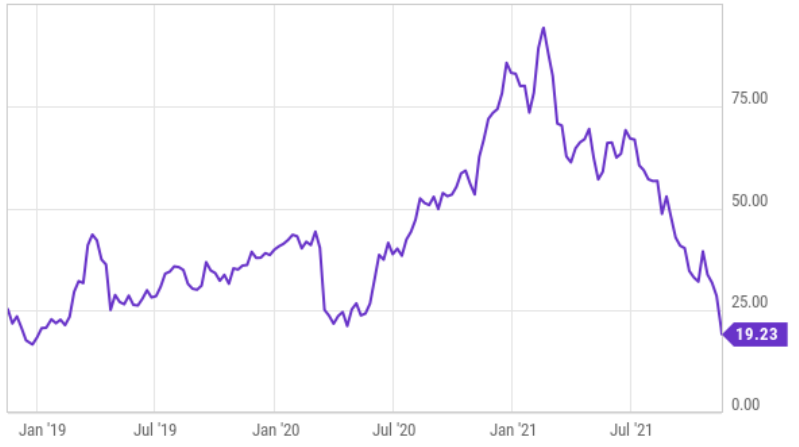

Purple line: StoneCo share price

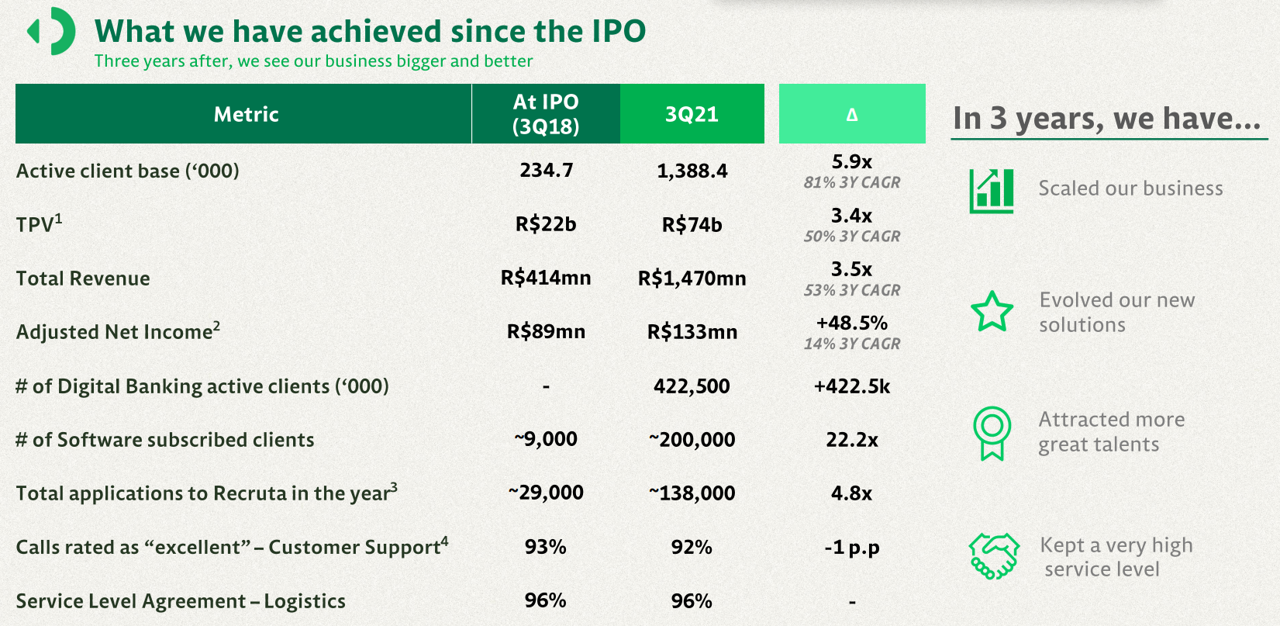

The attractive company we are referring to is StoneCo. StoneCo is basically the financial operating system for Brazilian merchants and a workflow tool to help them sell through multiple channels. And the company continue to grow steadily and at a large scale since its IPO in 2018.

However, the share price continues to decline for the reasons we’ve described above (i.e. a weakening Brazilian Real currency, interchange fee pressures, covid and now a recent FBI raid of its major POS terminal providers in relation to cyberattacks). We fully acknowledge some investors may be uncomfortable with the risks, however based on the attractive business and valuation, StoneCo shares are hard to ignore (i.e. they have a lot of long-term upside from here). As a side note, Warren Buffett’s Berkshire Hathaway continues to be a big shareholder.

We wrote the company up in great detail last summer, and you can view that report here.

The Trade:

Sell Put Options on STNE with a strike price of $16 (~16.7% out of the money, it currently trades at ~$19.23), and an expiration date of December 17, 2021, and for a premium of at least $0.40 (or $40 because options contracts trade in lots of 100). This comes out to approximately 2.5% of extra income in about 1 month—which may not sound like a big return—but it is very significant for such a short time frame (it’s approximately 30% of extra income on an annualized basis, if you could implement similar trades throughout the year). And this trade not only generates attractive upfront premium income for us now, but it gives us a chance at buying shares of this attractive long-term company at a significantly lower price ($16—the strike price) if the market price falls below $16 and the shares get put to us before this option contract expires on December 17th. And we get to keep the upfront premium income no matter what.

Important to note, you can adjust the strike price of this trade (for example to $17) depending on how badly (and at what price) you want the shares put to you, and to generate a different amount upfront income as shown in the table above).

*Also note, market prices are constantly moving, and you will have to “work” this trade a little to get a price you like. Regardless, the current high premium income is attractive.

Your Opportunity:

We believe this is an attractive trade to place today, and potentially over the next few trading days, as long as the price of STNE doesn't move too dramatically before then and you’re able to generate enough premium income to your liking.

Our Thesis:

Our overall thesis is simply that STNE is an attractive long-term business, despite the near-term volatility, and we’d love to own shares (as a long-term investment) if they fell to a purchase (strike) price of $16. StoneCo just announced earnings on November 16th whereby revenues continued to grow rapidly (and on a large scale), but the market reacted negatively because the company has been spending heavily on investments (to fund future growth—a good thing in our view). And if these shares do not get put to us, then we’re also happy to simply keep the very high upfront premium income that is generated by this trade.

Important Trade Considerations:

Two important considerations when selling put options are ex-dividend dates and earnings announcements because they can both impact your trade. In STNE’s case neither one is a concern because STNE doesn’t pay a dividend, and because it isn’t expected to announce earnings again until well after this trade expires. If the company announced earnings before this contract expires—that would add significant uncertainty risk to the trade, and we’d have to take that into consideration when deciding what amount of premium we’d be willing to accept. As the trade stands, the high premium income more than compensates us for the volatility risk, in our view (especially considering if the shares get put to us, we like them as a long-term investment).

Conclusion:

StoneCo is an attractive, high-growth, profitable, fintech company that is trading at an attractive price (valuation). We fully expect the share price to remain volatile in the quarters ahead, but over the long term we expect the share price to go dramatically higher.

We believe the trade described in this report is very attractive. Specifically, it puts a high amount of upfront income in your pocket right away (that you get to keep no matter what) and it also gives you a chance to pick up shares of this attractive business at a significantly lower price if they fall below the strike price and get put to you before the options contract expires (in just under 1 month).