This single tenant focused industrial REIT offers healthy monthly dividend payments (8.0% yield) and the potential for significant price appreciation. We believe it will benefit from the current uncertainty amid the coronavirus outbreak given its high exposure to the e-commerce sector. The trend for online shopping is a secular one but has become more prominent currently as people are forced to stay at home. We do caution that the current situation will impact the business but given its diversified portfolio and high exposure to e-commerce we expect healthy price appreciation once the situation returns to normalcy. This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion about why it’s worth considering if you are a long-term income-focused investor.

Overview: Stag Industrial (STAG), Yield: 8.0%

STAG Industrial Inc. is an industrial REIT focused on single-tenant industrial properties in the US. It owns ~450 properties in 38 states with ~9.4 million sq. ft. of rentable area. The vast majority of portfolio consists of warehouse/distribution buildings (365 properties) and light manufacturing buildings (69 properties). As of the end of FY19, its portfolio was ~95% leased and well diversified across tenants and industry. No single tenant accounts for more than ~1.9% of its total rental revenue and no single industry accounted for more than ~11.1% of total rental revenue. Notably, ~43% of STAG’s portfolio has e-commerce exposure with marquee clients such as Amazon which is a positive as it will provide some cushion against the coronavirus turmoil.

STAG differentiates itself from other REITs by focusing on tenants which are larger in size and as such have the capacity to withstand economic challenges and recessions. STAG’s tenant base is highly diversified with ~414 tenants and ~61% of its tenants have revenue of more than $1 billion. Additionally, 86% of tenants have revenue of greater than $100 million (these are not the small businesses that will be most challenged during this crisis). Importantly, STAG performs an in-dept credit analysis on tenants before lease signing and performs ongoing credit monitoring via an in-house dedicated team of credit professionals. This helps safeguard STAG during economic downturns as large companies have better ability to continue paying rent during such times.

(source: Company Presentation)

Exposed to Secular Growth of E-Commerce

The trend for online shopping is a secular one and the novel coronavirus (COVID-19) outbreak is likely to boost it further as people are forced to quarantine and order from home. This should further increase demand for warehouse space by the e-commerce players. E-commerce sales still represent just a small fraction of total retail sales (~11% as of 2019), thereby providing a long runway for growth. This means high occupancy rates and high rents for the companies that develop and own these properties. STAG is well positioned here given that ~43% of its portfolio is exposed to e-commerce sector.

(source: Company Presentation)

Solid Growth Prospects

STAG reported solid Q419 earnings with Core FFO increasing 25% over the prior quarter on an absolute dollar basis, but on a per-share basis rose only 2% due to dilution (new shares issued). STAG noted that the industrial market continues to perform well during its Q4 earnings call.

“In 2019, rents were up almost 4% in the aggregate, according to our friends at CBRE. Completions of 63 million square feet modestly edged out net absorption of 56 million square feet for the fourth quarter. For the year, the market saw a 224 million square feet of completions compared to 183 million square feet of net absorption. As a result, vacancy rose 20 basis points year-over-year to 4.4%, but still remains significantly below long-term averages. Construction activity remains robust with a pipeline of 309 million square feet of announced development.”

STAG plans to grow its portfolio via accretive acquisitions (but we will see what happens in the near-term, due to the coronavirus). The single-tenant properties due to their binary nature (either rented or not) often create mispriced assets which provide STAG an opportunity to buy them at attractive valuations. The company expects acquisition volume to be between $800 million and $1 billion for 2020. This includes acquisition of $725 million and $875 million of stabilized assets with an expected cap rate range of 6% to 6.5% and between $75 million and $125 million of value-add acquisitions with NOI coming online in 2021 (however, again. we’ll see what happens with the economy).

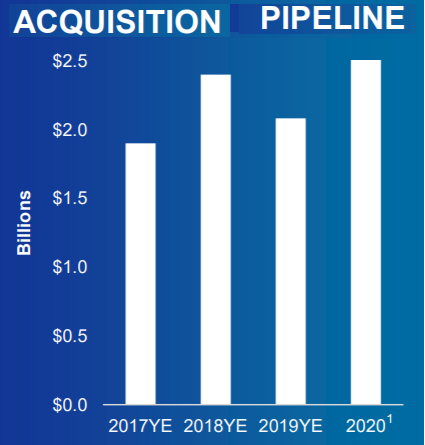

Overall, the US industrial real estate market is large at ~$1 trillion, of which ~$500 billion is made up of single-tenant properties. The sector is highly fragmented with no clear leader. STAG commands just 0.5% of the total industrial real estate market, which provides opportunity for continued external growth. Notably, perceived risk of single-tenant assets frequently creates value acquisition opportunities. STAG’s management has a proven track record in successfully executing this strategy. Over the past five years, average acquisition volume for STAG has been $675 million. The total acquisition pipeline stands at ~$2 billion currently.

Acquisition Pipeline

(source: Company Presentation)

Safe and Sustainable Dividend

STAG is a monthly dividend paying REIT and has a history of raising its dividend every year since 2013. At the current annualized dividend per share of $1.44, STAG delivers a dividend yield of 8.0% which is fairly attractive. The payout ratio was ~78% in 2019 which is quite safe in our view (especially as compared to some other REITs, see table below). Based on its mid-single-digit core FFO per share growth in 2020, the payout ratio was likely to further improve, but we’ll see the near-term impacts of the virus. Assuming dividend remains same, the payout ratio will be ~76% based on expected 2020 core FFO mid-point guidance of $1.89 per share. A payout ratio in mid-70s should keep the dividend safe in our view. This means even if STAG experiences reduced payments from some tenants, it has extra cushion to not only keep paying the dividend but also to consider an increase should the pandemic decline sooner than later.

Additionally, we think STAG has extra cushion from its disposition activities which if needed can fund dividend shortfall. In 2019, STAG made total dispositions worth ~$44 million. STAG has investment-grade credit ratings from various rating agencies. This leads to lower cost of capital and improved ability to raise capital. Importantly, easy access to capital supports STAG’s ability to sustain and grow its dividend.

Only 29% of total debt is maturing in the next three years, thereby leaving STAG with ample financial flexibility. The leverage at the end of 2019 was 4.8x at the lower end of its target range of 4.75x-6x.

Valuation:

From a valuation standpoint, we compare STAG to other industrial REITs with higher focus on single-tenant properties. Specifically, on a Price to Funds from Operations basis (“FFO”) basis, STAG is trading at ~11.5x its 2020E FFO, a discount to the average of the peer group. We think the valuation is reasonably attractive given expectations of core FFO growth rates over the next few years. The stock has fallen ~33% over the past one month amid the sell-off due to COVID-19 fears. This could be a highly attractive entry point for patient long-term investors looking for capital appreciation. However, we caution investors that coronavirus turmoil is likely to affect STAG as well, but it is better positioned to weather the impact given its last-mile ecommerce property locations.

(source: Blue Harbinger Research, Yahoo Finance, Company data)

Risks:

Tenant bankruptcy: STAG is exposed to the risk of tenants not being able to meet their rental obligations. While STAG is well diversified with no significant tenant concentration and it seems unlikely to threaten its dividend safety. However, should an exorbitant number of tenants face coronavirus-related financial trouble it could lead to future cash flow interruption.

Interest rate risk: The US Federal Reserve has cut interest rates to near zero, and even though we expect interest rates to remain relatively tame, dramatically rising rates could create challenges (this seems unlikely given the current environment) Also, as REITs are often seen as an alternative to bonds, higher interest rates could mean decreased demand for REITs, thereby causing a decline in the share price. Further, higher interest rates put downward pressure on earnings as interest costs rise.

Conclusion:

STAG is attractive considering its high yield (8.0%) and monthly dividend payments. The businesses benefits immensely from the secular growth trend of e-commerce, more so in the COVID-19 environment where people are forced to stay at home and shop online. A payout ratio of ~76% suggests that dividend is relatively safe and unlikely to see any cuts. The recent sell-off due to coronavirus fears has made the valuation increasingly attractive as well. STAG could face more near-term price pain (depending on the duration and extent of the coronavirus outbreak), but in the long-term, we believe STAG offers a relatively safe monthly dividend, and the potential for powerful price appreciation. The coronavisus pandemic will eventually be brought under control, and the economy (particularly e-commerce) will get healthy and eventually stronger than ever before.