This is a very quick note, and it is intended to get this information to you quickly. There are currently a variety of attractive Bond CEF’s that are presenting extremely attractive buying opportunities based on their holdings, their currently discounted prices and their temporarily massive discounts to Net Asset Value (“NAV”). These particular Bond CEFs pay you income monthly (double-digit yields), we own them, and the current buying opportunity is highly attractive.

To get right to the point, the following 2 Bond Closed-End Funds are presenting highly attractive buying opportunities now.

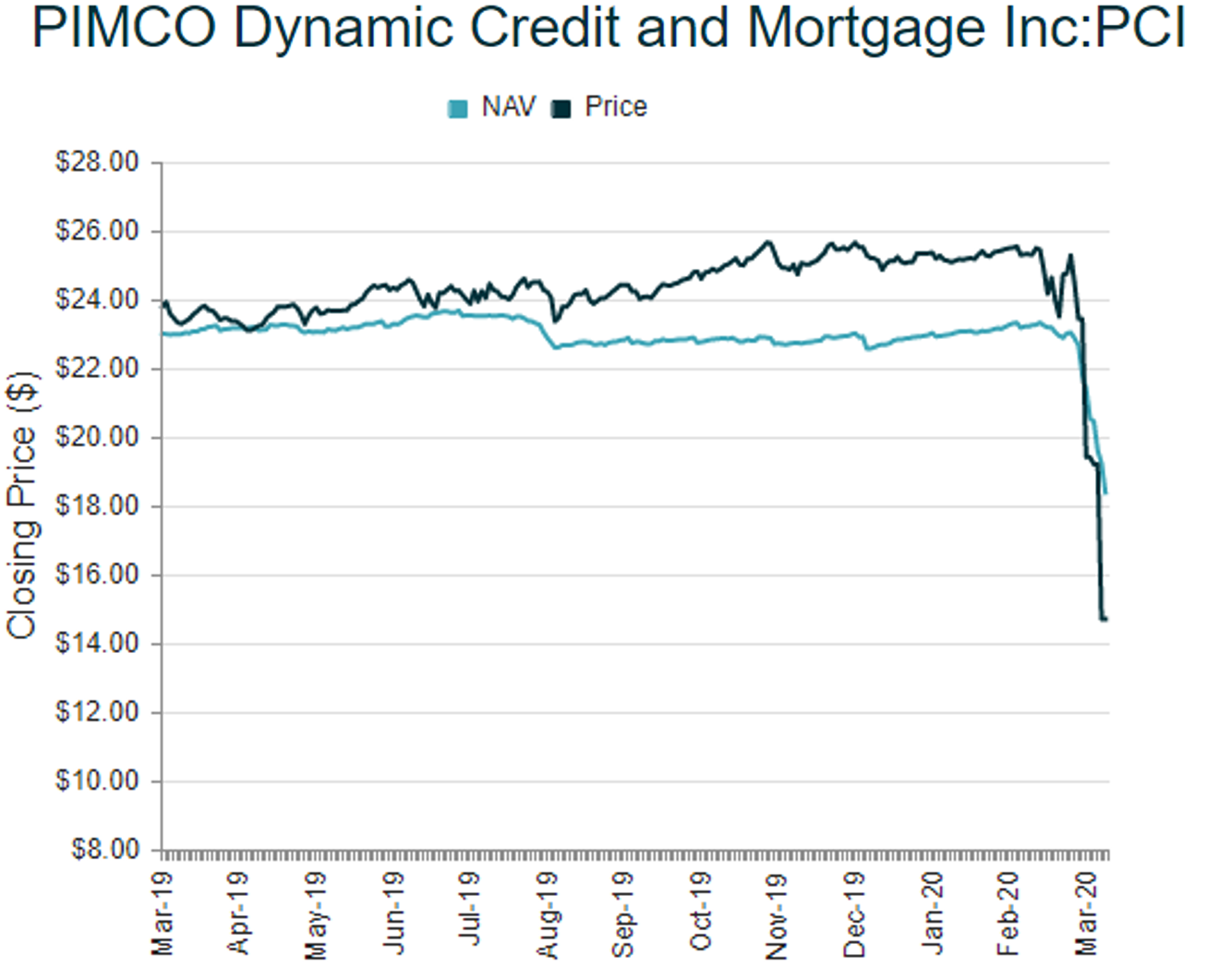

(1) PIMCO Dynamic Credit and Mortgage CEF (PCI)

Yield: 13.0%

PCI is attractive because of its big monthly yield, because the credit markets are distressed temporarily (the fed is fixing this by pumping massive liquidity into the system, and the discount to NAV is extremely large (attractive) as you can see in the following chart. PIMCO funds generally trade at a premium to NAV, but the recent panic selling pressure has created this highly attractive discount. Further still, the bond market will recover and the NAV and price will rise (and that’s in addition to the big monthly income payments you receive for holding).

(2) BlackRock Multi-Sector income Trust (BIT)

Yield: 15.2%

It’s essentially the same story for BlackRock’s Income Trust (BIT), which we also own. Big attractive yield (paid monthly), temporarily discounted price (the Fed is working to fix this) and a huge discount to NAV (which will likely evaporate quickly in the days ahead. Plus both the NAV and price will likely increase swiftly in the says ahead.

You can read our previous reports on these opportunities here:

And we’ll have more to say about these attractive opportunities (which we currently own) later. But as the Fed works to pump massive liquidity into the credit markets, these exceptional opportunities will evaporate quickly.

Bottom Line:

Temporary mispricings like these are very rare. They will likely deliver swift price appreciation as well as healthy ongoing monthly income payments for the long-term. Nonetheless, we continue to own them as part of a prudently diversified long-term income-focused investment portfolio.