Risk Creep is when the market has performed very well for an extended period of time, and you start getting over confident and taking on too much risk that is not consistent with your investment goals. Since the depths of the financial crisis in early 2009, the market has not gone straight up, but it’s been pretty close, and it’s been powerful. This market will eventually come crashing down. Are you ready? Here’s what you can do to prepare.

No one knows when the market will fall, and if they tell you that they do—they’re full of it. But when the next big crash comes. Will you be ready? Will you be a buyer or a seller?

Of course there are periods where certain sectors or styles of the market fall, and fall hard. For example, if you recall, popular big-dividend REITs hit a tough spot and lagged the market significantly just last quarter. Was that the time to head for the hills and sell all your REITs out of fear? Or did you buy more. At that time, we were encouraging investors to buy more REITs opportunistically, as long as it was consistent with their long-term investment goals, and to of course not go overboard. REITs are just one part of a healthy balanced income-focused portfolio. And REITs are making a strong comeback (with more room to run), outpacing the market in their recent rebound since mid-December. That’s one example where things are working out well.

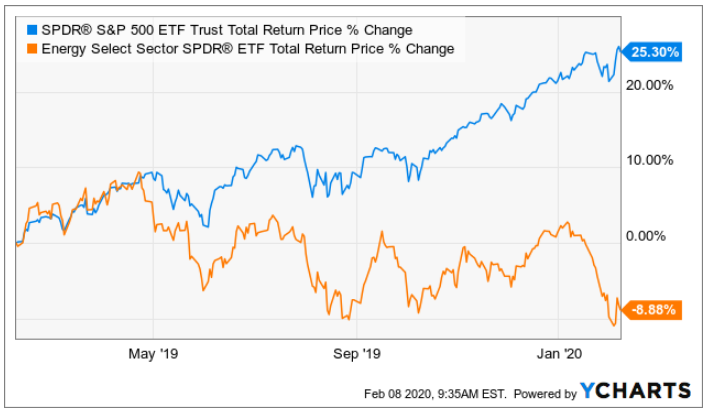

At the start of 2019, many investors were screaming about how energy stocks were down, and therefore they were a screaming buy then. Well, if you dumped all your nest egg into energy stocks back then you’d be very disappointed because they’ve continued to underperform mightily as new technologies have increased supply and kept commodity prices lower. Not to mention the wave of institutional fossil fuel divestment continues in powerful force, and continues to keep prices lower. One bright spot for energy stock investors is that the demand for fossil fuels will NOT go away anytime soon as alternative energy sources are still NOT widely used or cost effective. Also, and very importantly, as energy stocks keep profiting hand-over-fist (BP, XOM, RDS.B), they’re dividend yield have mathematically grown mightily large, an attractive thing if you are an income-focused investor. We haven’t dumped 100% of our nest egg into energy stocks (that would be foolish from a risk management standpoint) but we do continue to like a healthy amount of big-dividend energy stocks as you can see in our current holdings.

Just a couple years ago, everyone and their brother (including the fed) thought interest rates were finally about to head meaningfully higher. Well, that hasn’t happened, and expectations point to continuing low rates for even longer. Our twitter-in-chief has been vocal about keeping rates even lower to make the US competitive with foreign countries which have even lower rates. We continue to find attractive high-income fixed-income investment opportunities, particular in Closed-End bond funds (Such as BIT and PCI, to name a couple—see our portfolio for all of them).

Regarding non-US investment opportunities, we continue to find them attractive (such as emerging markets—which by the way have been underperforming for a while, and are increasingly “due” for a rebound, in our view). We believe that the US economy still leads the world, and as the US economy has been very strong for years, the rest of the world will continue to follow, and likely has more strong upside ahead. We like to play this through individual stocks (such as Proctor & Gamble—which derives a huge portfolio of its revenues from emerging markets, and we also like emerging market ETFs such as IEMG, VWO and EEM).

Further still, growth stocks have been outpacing value stocks for over a decade now. This is highly unusual, but that doesn’t mean it cannot continue. This can create challenges if you are an income-focused investor because most income investments are also value investments. However, we continue to like to have some exposure to growth stocks, and we do like several growth stock investments that also pay very high dividend yields, such as CEF Adam’s Diversified Equity Fund (ADX), which holds a lot of powerful growth stocks, but still pays a huge dividend (especially in Q4 every year). We own ADX, but we’ve also recently written about other attractive big-dividend growth investments, such as Horizon BDC (HRZN) and TriplePoint BDC (TPVG). It can be very important for risk-management and total return reasons, to generate at least some of your income from growth investments. They may eventually come crashing down (and value stocks will soar again) or they may just keep rising higher as the economy remains strong. This is why we try to pick very attractive individual investment opportunities across a variety of high-income categories and opportunities.

Cash can be a critically important way to be prepared for the next market sell-off, whenever it comes (again, no one, and I mean no one, knows when the next big sell-off is coming—and if they try to tell you they do—they’re full of it). But here’s why cash can be so important. First, and obviously, you need it to pay your bills. And this is why so many investors like big safe dividends—because even when the market sells off they keep paying you the income (spending cash) you need. Further, simply holding some cash (as dry powder) so you can be an opportunistic buyer when that next sell-off comes. Just understand that there is an opportunity cost to holding cash—that is you’ll miss out on potential market returns. For example, if you panicked during the great financial crisis of 2009, you be dead in the water having missed out on one of the greatest stock market rallies and rebounds in history over the last decade. The flip side of that is that we have had such a strong rally that you need to be careful not to let too much “risk creep” back into your portfolio

The Bottom Line:

The market will eventually crash, but absolutely no one knows when (crystal balls are not real folks). It’s okay to be a little bit opportunistic when the next crash comes (whether that be a market wide crash or just a big sell-off in certain sectors or styles). But the most important thing you can do is to prepare proactively. That means structure your investment portfolio appropriately—for your personal needs—now! Don’t go dumping 100% of your nest egg into hot growth stocks, Bitcoin, or whatever else the media pundit fearmonger jokers are trying to sell you. Pick attractive individual opportunities across important investment categories now, so you don’t reactively panic when the crash comes. We say it all the time, and we’ll say it again. Disciplined, goal-focused, low-cost, long-term investing has proven to be a winning strategy over and over again throughout history. Be smart.

pictured: Seth Klarman

Our Portfolio Tracker.