Many income-focused investors concentrate their nest eggs in the same subset of market sectors. Considering a few high-income investments in non-traditional high-income sectors can unlock tremendous value and opportunity. Horizon Technology Finance Corporation (HRZN) is a business development company, that pays a big monthly dividend, and offers an attractive combination of growth and value by focusing on development stage companies. In this report, we analyze the company’s income and growth profile, dividend prospects and finally conclude with whether the company’s stock offers an attractive balance between risks and rewards.

Overview:

Horizon Technology Finance Corporation (HRZN) provides secured loans to venture capital backed development-stage companies. Its target industries include technology, life sciences, healthcare information & services, and sustainability industries. As of September 30, 2019, Horizon’s debt investment portfolio consisted of 32 companies with an aggregate fair value of over $253 million. Horizon’s investment objective is to generate current income from credit investments as well as capital appreciation from warrants it receives with its credit investments. The company’s total portfolio by type of investments is listed below:

In 2018, Horizon entered into a joint venture with Arena Investors LP to form Horizon Secured Loan Fund (LLC) in which each have a 50% ownership. As of September 30, 2019, HSLFI had an investment portfolio of $43 million.

What Is A Business Development Company (BDC)?

A typical business development company is a closed-end investment company that invests in privately owned, middle-market companies, providing them capital to grow or recapitalize.

What Are the Advantages of Investing via a BDC?

High dividend yield as BDCs are required to distribute 90% of their profits to shareholders as per the governing law.

Being a regulated investment company, a BDC is not required to pay corporate income tax on profits.

They offer diversification as the portfolio consists of companies belonging to varied industries.

Experienced Investment management teams.

Fair amount of liquidity and transparency as BDCs are traded on public exchanges, unlike venture capital funds which are privately placed.

As they are traded on stock exchanges, period of volatility can lead to shares of BDCs trading at attractive discounts to NAVs.

Long tenured investment team with a focus on technology venture lending

The company’s four co-founders Robert D. Pomeroy Jr., Gerald A. Michaud, John C. Bombara and Daniel S. Devorsetz are all still employed at the firm. Below is a summary of the leadership team:

Following is a concise organizational chart of the company. The leadership team above is supported by professionals in business development, Portfolio Management and Operations.

Low Loan to Value (LTVs) reduces risks associated with venture lending

Unlike traditional middle market BDCs that lend at LTVs of nearly 70-80%, Horizon’s LTV tends to be around 20%. In other words, for every $20 of capital at risk, the underlying assets backing the loan are typically valued at $100. The secured and low LTV nature of the company’s lending balances the risks that come with investing in venture stage technology and life sciences companies. As shown in the charts below, the company’s portfolio is equally split between technology and life sciences and generally focused on expansion and late stage ventures as opposed to early stage.

Source: Horizon Technology Finance

The company’s largest investment accounts for 7% of the total portfolio. The company’s top 5 debt investments as per fair value are listed below :-

Industry leading investment yields

Horizon enjoys superior investment yields as compared to its peers. The company generates significantly higher yields using a combination of coupons, fees and warrants that combine to bring yields in the 13-18% range as shown below.

Horizon’s performance has experienced a turnaround in recent years

While the company generates strong yields on its portfolio, its performance suffered a temporary setback during 2015-17. Horizon’s total debt investments reduced from $250 million in 2015 to $194 million in 2016. This was due to the combined affect of deteriorating asset quality which resulted in write offs as well as higher prepayments due to low interest rates. Total realized losses during 2016-17 were around $30 million. Since then, management has made efforts to improve the asset quality and minimize realized losses. The effort looks to be paying off as in 2018, Horizon had no realized losses and YTD fiscal 2019, realized loss on investments have totaled just $4 million. Not surprisingly, as evident in the table below, in terms of total returns (capital gains + dividends), the company underperforms peers on an ITD and 5 year basis but significantly outperforms on a 3 year basis highlighting near term improvements.

Supportive regulations provide additional funding capacity

BDCs are regulated investment companies and therefore they must distribute a substantial portion of earnings as dividends to their shareholders. As a result, they have to fund growth via issuance of additional shares or through borrowings. In 2018, the consolidated Appropriation Act was passed which amended the required asset coverage ratio for BDCs from 200% to 150%, effectively doubling their borrowing capacity. Horizon recently issued $100 million asset-backed securities at a fixed interest rate of 4.21%. Additionally, the board has also passed a resolution to issue $50 million worth of additional stocks from time to time as required in future. Total available liquidity capacity as of Q3 2019 was $228 million and the company is well positioned to grow its lending portfolio as a result.

Increased lending activity as well as higher yields are driving interest income growth

As a result of increased funding capacity, the company’s investment activity in 2019 ramped up significantly. Last year, new debt investments were $183 million as compared to $62 million in 2018. In fact, Interest Income has grown by a strong 25% YoY in the first 3 quarters of 2019. This growth has been fueled by increased lending as well as expansion of debt investment yields from 15% in Q3 2018 to 17.7% in Q3 2019. Finally, please note that the company is externally managed and pays a management fee to its manager. The management fee structure is tiered, and the fee percentage reduces as the portfolio grows. In fact, for portfolio size over $250 million, management fee reduces to 1.6% from 2%, thereby making any incremental growth in assets more profitable for shareholders of the BDC since the company has now crossed the $250 million mark.

Improving dividend coverage

As a result of improvement in interest income, the company’s dividend coverage ratio has recovered from below 1x in 2018 to above 1x in YTD fiscal 2019. However, what has also helped is the fact that the company reduced its dividend from $0.115 per share per month to $0.10 per share per month in 2016 following portfolio weakness. As the company puts its dry powder to work, the company should be able to maintain a reasonable dividend cover in the near to medium term.

Superior valuations coupled with growing dividends

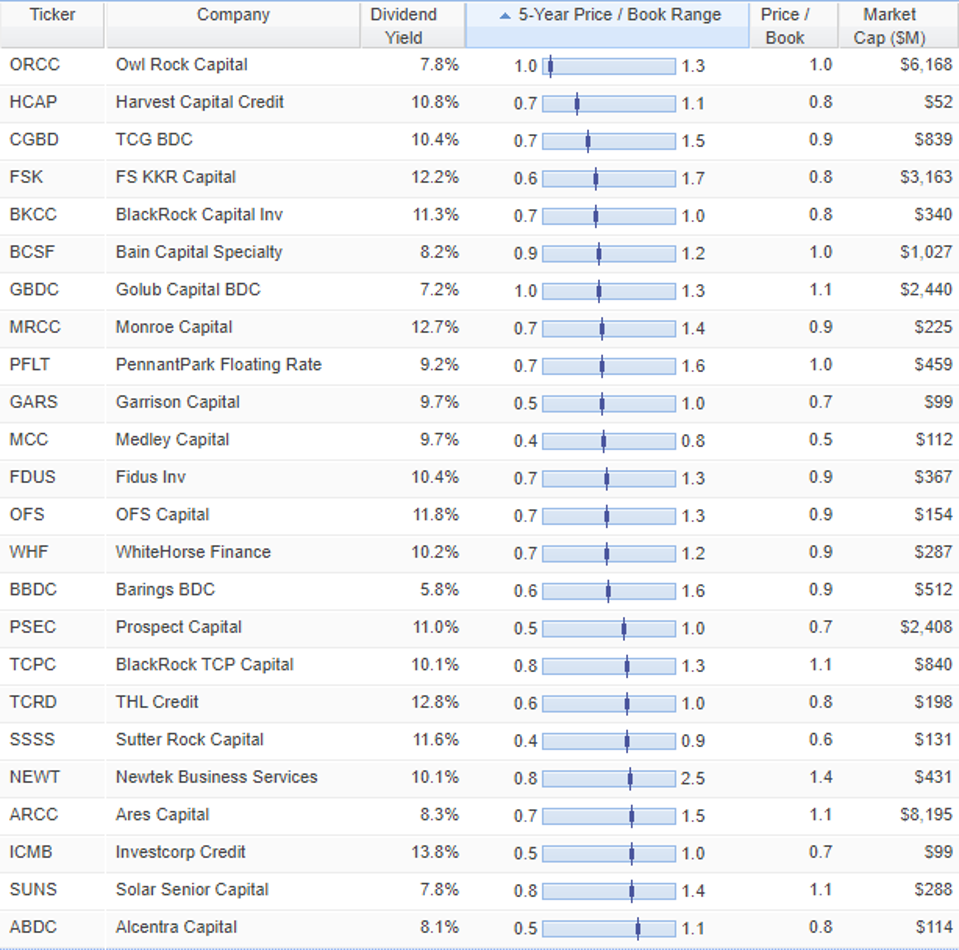

Horizon’s dividend yield has come down from its peak of 13% in 2016 to below 10%. This decrease is due to the combined effect of dividend cut in 2016 as well as recovery in stock price. Despite slightly lower yields relative to its own history, the company’s current dividend yield of over 9% is highly attractive given its growth prospects.

(source: Google Finance)

(source: Stock Rover)

Risks

The company invests in early and growth stage technology and life sciences companies, and as such the portfolio is more susceptible to technological disruptions or typical risks associated with venture companies. Having said that, the company makes secured loans with a low loan to value of 20% and the loan recipients tend to be backed by institutional capital such as venture capital firms. These mitigating factors provide us confidence in the company’s earnings power.

Conclusion

Horizon is sitting on significant attractive dry powder relative to its portfolio size and has started to deploy increased amounts of cash on new investments. The increased investment activity will lead to growth in interest income as well as dividends. The stock trades at a dividend yield of over 9% (paid monthly) which is highly attractive considering its prospects of income and dividend growth in the near future. Further, its exposure to non-traditional high-income sectors of the market can unlock valuable results for long-term income-focused investors.