Enterprise Products Partners L.P. is an American oil and natural gas midstream service provider with its headquarters in Houston, Texas. In this report, we analyze the company’s business model, income, growth, distribution prospects and finally conclude with our opinion on whether EPD offers an attractive balance between risks and rewards.

Overview:

Incorporated in 1968, Enterprise Products was listed in 1998 under the ticker EPD. The company is the 3rd largest midstream service provider in the U.S. with around 50,000 miles of pipelines, 260 MMBbls of storage capacity for natural gas liquids, crude oil, petrochemicals, and refined products and 14 bcf of natural gas storage capacity. Revenue for EPD is classified as marketing activities and midstream services. Marketing activities include revenue for product sales whereas midstream services include fees from EPD’s integrated businesses such as gathering, processing, transportation, fractionation, storage, and terminaling. Operating profits for EPD are somewhat immunized to energy price fluctuations considering 85% of the operating profit is generated from fee-based sources.

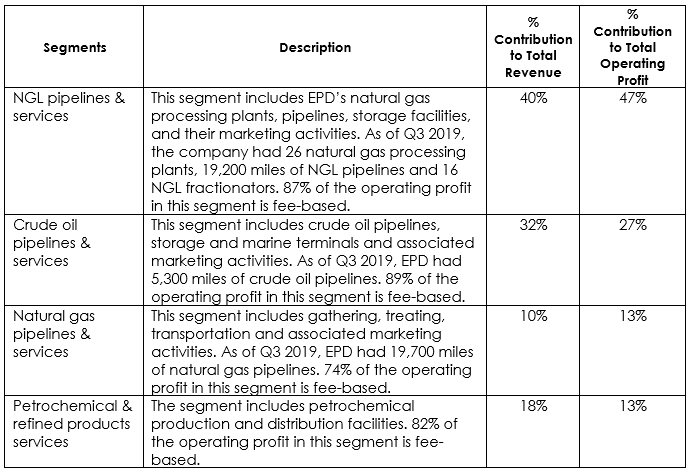

The company divides its operations into four segments.

Consistent growth in volumes over the years

EPD has consistently reported strong growth in volumes since 2016. In 2019, fee-based natural gas processing volumes per day increased by 9% on YoY basis. Volumes transported per day, as well as volumes handled at marine terminals in 2019, increased by 6% YoY and 17% respectively. The table below shows the trend in volumes handled by EPD over the last few years. The company is seeing volume growth primarily because of sustained U.S. crude oil and natural gas production increases and the company has leveraged this growth through capacity additions.

Profitability continues to growth with volumes

Given the fee-based nature of EPD’s contracts with its customers, swings in commodity prices are more pronounced than the actual impact on EBITDA. EBITDA in Q3 2019 was up 6% YoY despite a fall of 17% in revenue which was impacted by lower year on year commodity prices. As it is evident in the charts below, despite the collapse in energy prices in 2015, EPD’s earnings power did not see much impact. In fact, it reported a 2% increase in EBITDA in 2015. The company’s ability to maintain earnings and cash flow in a severe energy downturn provides confidence its ability to keep paying dividends in the future.

Source: Enterprise Products Partners, LP

Capital investments to capture growing demand

EPD has $12 billion of planned investments out of which projects worth $9.1 billion are already under construction. Around 77% of contracted volumes of the new projects are from investment grade customers and 70% of the volume-weighted contracts have average duration of over 10 years. EPD expects to generate $1.2 billion to $1.8 billion additional gross operating profits per year from these upcoming projects.

EPD scores well on leverage and interest coverage

EPD has a high-quality balance sheet providing the management team considerable room to reinvest in the business and manage through any market turbulence. The company’s Debt to EBITDA is one of the lowest in the sector and Interest coverage is the highest. Additionally, the company’s debt to EBITDA ratio has improved from 4.2 times in 2014 to 3.5 times in Q3 2019.

Source: Company Reports

Industry-leading yields and history of consistently growing dividends

EPD has consistently grown its dividends for the last 20 years. In FY 2018, EPD declared a dividend of $1.72. The dividends in the last 5 years have grown at a CAGR of 5%. Dividend as a percentage of annual DCF has generally stayed below 80%. Given the stability of the company’s cash flows even in the wake of commodity price volatility, EPD has significant dividend cushion.

Source: Company Reports

Attractive valuation especially considering earnings quality

Units of EPD are currently trading at an attractive valuation. The company’s units are yielding 6.1% (actually 6.9% after Friday’s marketwide price decline) which is well above the industry median. Additionally, the stock is trading at the lowest EV/EBITDA in the peer set. Not surprisingly, the company’s directors have recently purchased around 2.2 million shares of the company.

Source: Yahoo Finance

Possible MLP to C-Corp Conversion

EPD is registered as a Master limited partnership but is considering converting into a corporation, however no additional clarity was provided on the recent earnings call as to whether the conversion will happen and the associated timeline. A conversion has become more attractive after the decrease corporate tax from 35% to 21%. As per its current status, the distributions which EPD makes are taxable in the hands of the unitholders and not the partnership. The unitholders also have to file K-1 forms during tax season which slows down the tax compliance process and as a result many investors have chosen to stay away from K-1 issues companies. A change in structure may help expand the shareholder base. Recently, Blackstone, an alternative investment firm, converted itself from partnership to C-corp and since then Blackstone’s stock has risen by 61%. In the recent Wells Fargo Midstream and Utility Symposium, when asked about clarity on corporate structure conversion, EPD’s CFO Randy Fowler said “There may be an element of inevitability, K-1 island is becoming very exotic.”

Risk

Any large fluctuations in energy prices may not affect EPD in the short run, but in the long term, its performance can be adversely affected. A long-term decrease in exploration and development activities (due to lower energy prices) could lead to a decline in volumes handled by EPD.

Conclusion

EPD is one of the major midstream service providers in the U.S. The company’s fee-based cash flows provide investors the opportunity to gain exposure to the oil and gas space with reduced risk and partial insulation from commodity price volatility. The company has consistently grown its volumes and EBITDA despite swings in commodity prices. We believe the company is well positioned to grow its dividend in the near to medium term. At nearly 7% dividend yield, the risk reward is attractive.