There’s usually at least some truth to every fear mongering media narrative, and the talking heads and short sellers have not been kind to retail REITs, as growing e-commerce continues to dramatically change the industry landscape. Yesterday we received news confirming that Simon Property Group (SPG) intends to acquire its smaller “A-Class” property REIT peer Taubman Centers (TCO), and shares of TCO shot up dramatically. There remains heightened uncertainty and volatility in this space, and it is making for an interesting, high-upfront-premium, income-generating options trade opportunity. We believe this is an attractive trade to place today, and potentially tomorrow as long as the share price doesn’t move too dramatically before then.

The Trade:

Sell Put Options on Simon Property Group (SPG) with a strike price of $130 (7.9% out of the money), and an expiration date of March 20, 2020, and for a premium of $1.21 (this comes out to +9.7% of extra income on an annualized basis, ($1.21/$130 x (365/38 days until expiration). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of SPG at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own SPG, especially if it falls to a purchase price of $130 per share).

Your Opportunity:

We believe this is an attractive trade to place today and potentially tomorrow as long as the price of SPG doesn't move too dramatically before then (keep in mind SPG goes ex-dividend on Thursday 2/13, more on this below), and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 9% to 12%, or greater.

Our Thesis:

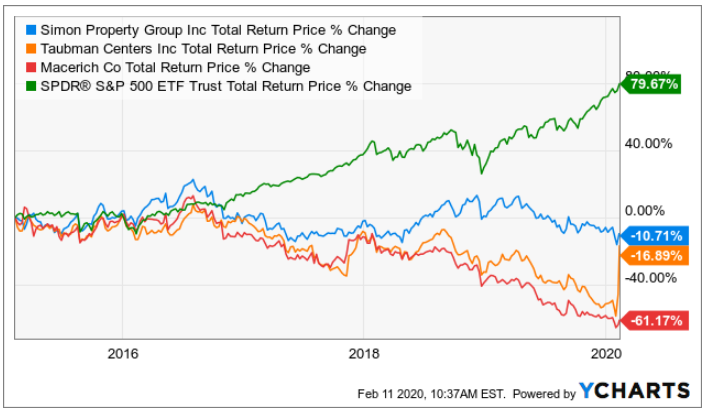

Our thesis is basically that SPG is an attractive long-term, big-dividend (5.8% yield) Blue Chip company with price-appreciation potential, and the shares have sold off inappropriately over the last year (as you can see in the chart above) as the negative retail narrative against SPG is somewhat real but more dramatically way overblown. We recently completed a full write-up on SPG, describing its financial strengths and business attractiveness, and you can access it here:

Also important to note, we alread do own shares of SPG, and we wouldn’t mind owning more (for the long-term) if the price falls even further than it aleady has and the shares get put to us.

Please also keep in mind, options contracts trade in lots of 100, so to secure this trade with cash (in case the shares get put to you and you have to buy them) you’ll need to keep $135 times 100 on hand (the strike price times an options contract lot of 100). You’ll also need to be comfortable holding that many shares in your account from a position-sizing / risk management standpoint.

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the price and thereby impact your trade. In this particular case, earnings is largely a non-issue because SPG won’t announce again after this contract expires. However, it’s very important to note that SPG goes ex-dividend on Thursday (that’s the day the shares start trading without the dividend—i.e. the share price should go down). In our view, we’ve baked in enough cushion to account for the dividend considering the percentage by which the trade is currently out-of-the-money, the premium income, and the fact that we like SGP as a long-term investment.

Conclusion:

SPG is an attractive, big-dividend, A-Class “mall” REIT, that has been experiencing way too much selling pressure (in our view) due to the overblown “retail apocalypse” narrative. Further the recent news about the Taubman acquisition has added volatility to the price—thereby increasing the upfront premium income available on this trade. In our view, SPG is being smart an opportunistic by buying Taubman when there is “blood in the streets.” They are being greedy when others are fearful. We view it as an attractive opportunistic move by SPG.

As noted earlier, in our full SPG report, we view SPG as presenting an attractive investment opportunity at its current price, however if you’re uncertain about pulling the trigger on a normal buy order, you might consider this trade instead. It allows you to generate attractive upfront income that you get to keep no matter what. And this options trade also gives you a chance of picking up shares of this attractive long-term blue chip company at an even lower price, if the shares fall even further than they already have, and they get put to you at $130. And at a price of $130, SPG is an extremely attractive long-term cash flow generator.