In recent quarters, while real estate sub sectors such as office and retail have struggled as a result of the pandemic, selective industrial REITs have emerged as outperformers primarily because of the growth in e-commerce. For example, the specific industrial REIT we review in this article has consistently expanded its asset base since its IPO in 2011 and is well placed to grow in the years ahead (through planned acquisitions and rental accretions). It also offers a 4.7% dividend yield, paid monthly. In this report, we analyze the company’s income profile, growth as well as dividend prospects and finally conclude with our opinion on investing.

Overview: STAG Industrial (STAG)

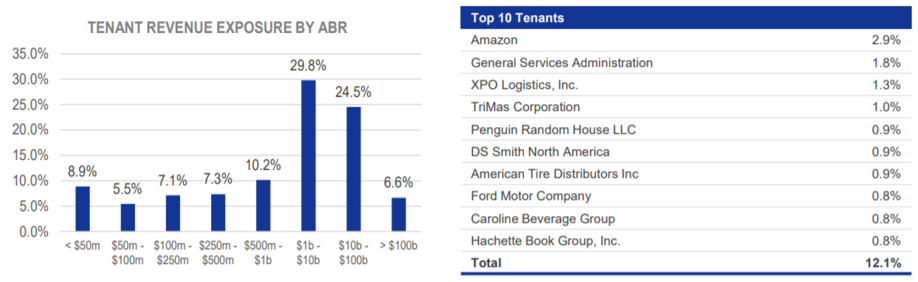

Headquartered in Boston, STAG Industrial owns and operates industrial properties (primarily warehouses), and leases them to single tenants across United States. It operates as a REIT and distributes the majority of its earnings to its unitholders through monthly dividends. As of 30th September 2020, the company owned 462 buildings (384 warehouses, 70 light manufacturing buildings and 8 office buildings) across 38 states with a total square footage of 92.3 million sq. ft. and a portfolio occupancy rate of over 96%. STAG has a weighted average lease term of 5.1 years and weighted average rent of $4.51 per square foot. The company has a well-diversified tenant base spread across industry verticals including auto components, e-commerce, freight & logistics, and building products, to name a few. Amazon is STAG’s single largest tenant and accounts for 2.9% of annualized base rent. The top 10 tenants account for just 12% of the company’s annualized base rent. STAG boasts a robust business model with stable and secure recurring cash flows. In Q2 2020, while several REIT sectors saw rent deferrals, STAG was able to collect 98% of all rental payments.

Source: STAG Industrial’s Investor presentation

Exposed to large and growing end markets

STAG operates in the growing industrial REITs space where demand has seen a steady rise over the last few years primarily driven by growth in e-commerce. This secular shift from brick-and-mortar stores to online retail has been further accelerated in the current pandemic. The shift has created additional demand for warehouses and other supply chain assets to serve as fulfillment centers for faster, more reliable, last mile delivery to customers. In fact, the company recently provided a business update and raised its 2020 same-store NOI outlook from 0.75%-1.25% to 1.25%-1.75% due to strong demand for the company’s assets.

As per eMarketer research, US e-commerce sales as a percentage of total retail sales will reach 14.5% in 2020, increasing to 19.2% by 2024. According to a CBRE report, for every $1 billion in additional e-commerce sales, the industrial market would need to deliver 1.25 million square feet of warehouse space to meet this demand. Approximately 40% of STAG’s portfolio handles e-commerce activities, therefore the growing e-commerce space will act as a long-term secular growth driver for the company. According to Benjamin S. Butcher, STAG CEO, during the Q3 2020 earnings call:

“There was such a mad rush as the pandemic came on, but I think we're still seeing a lot of people position themselves for the further increases in e-commerce activity that will ensue as we move and hopefully out of the pandemic era, but certainly as we continue through the pandemic era.”

Source: emarketer.com

Creditworthy tenant base helps generate stable and predictable cash flows

STAG’s property portfolio is highly diversified across geographies, tenant base, industries, and lease terms. Its portfolio includes exposure to several industry verticals and less than 25% of leases expire through 2022. The company’s focus on single-tenants helps secure larger and well-established tenants. Approximately 55% of STAG’s tenants are publicly rated and 86% of the tenants have revenue of over $100 million whereas 61% of tenants generate an annual revenue of over $1 billion. This highly diversified and sophisticated tenant base results in reduced risks and stable future cash flows.

Source: STAG Industrial’s Investor presentation

Benefits from population shift from urban to semi urban/rural areas in the post-pandemic world

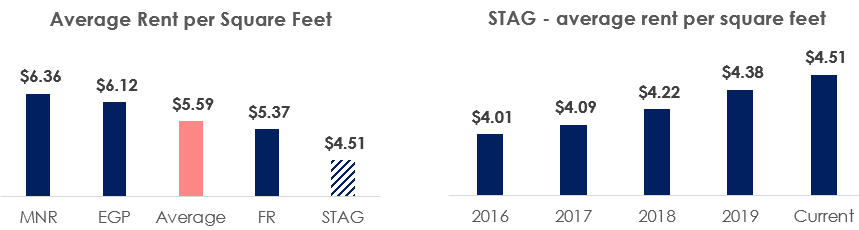

STAG’s industrial properties are generally located in suburban areas, which is why its average rental per square foot is below market averages. As evident in the chart below, STAG’s average rent of $4.51 per sq. ft. falls in the lower quartile of the industrial REIT sector. However, investors must note that suburbs have remained one of the fastest growing economic areas. This has helped the company consistently grow its rental rates over the last few years. Additionally, increased demand for suburban housing in the post-pandemic world will continue to support the long-term secular growth trend in suburban areas.

Source: Individual company reports, Source: STAG Industrial

Growing FFO through acquisitions and rental accretion

STAG has consistently reported an increase in FFO for the past few years. This is primarily because of growing rental rates combined with continued expansion of total asset base. STAG’s asset base has increased from 314 properties with a total square footage of 61 million in 2016 to 462 properties with a square footage of 92.3 million in 2020, representing growth of nearly 50% in 4 years. This has helped the company grow its FFO per share from $1.26 per share in 2012 to $1.84 per share in 2019. Despite the difficult economic environment in recent quarters, STAG has continued expanding its asset portfolio. Between October 2020 and December, 7th 2020, it has acquired 4 million sq. ft. of assets for approximately $298M. Additionally, the company has been able to achieve asset growth at a controlled leverage ratio as indicated in the chart below.

Source: STAG Industrial, Source: Seeking Alpha

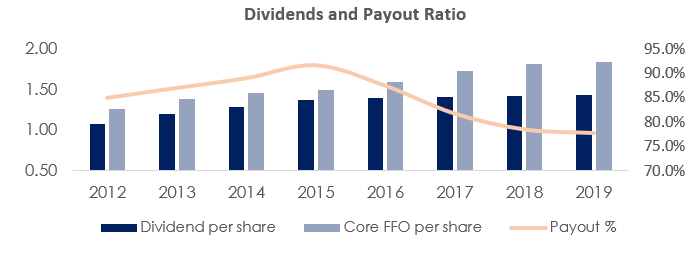

History of consistent dividend payout and improving cushion

STAG has a history of consistently paying dividends since its IPO and the dividends have grown at a CAGR of 4.2% since 2012. It is important to note that dividend growth in the last few years has been slower despite strong FFO growth. Resultantly, the company’s dividend cushion has improved. We believe dividend growth may strengthen marginally over the next few years.

Source: STAG Industrial

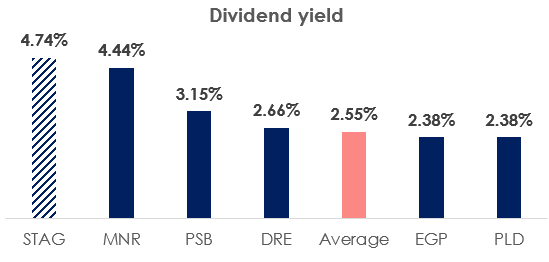

Attractive and sustainable dividend yields

Industrial REITs generally offer low dividend yields because they are seen as a safe investment option for long term investors. In this context, STAG’s 4.7% dividend yield is significantly above the industry average as well as its nearest peers and offers an attractive investment opportunity in our opinion for income-oriented investors.

Source: Seeking Alpha

Risks

COVID-led slowdown: A prolonged economic slowdown in the post-pandemic world may lead to a decline in consumer spending even in the e-commerce channel. This may result in higher vacancies at STAG’s properties which would cause a decline in rentals. Having said that, we believe the economy will have to get much worse than it is now for the sector risks to materialize.

Demand and supply imbalance: Given the dislocation in other sub-spaces in the REITs universe as a result of COVID-19, the relatively resilient industrial REIT subspace might see more investment activity which could impact the demand and supply balance in the future. Having said that, we believe that the secular growth in e-commerce will absorb elevated supply growth in warehouses over the medium to long term.

Conclusion

STAG operates in the attractive industrial REIT space and boasts strong business fundamentals. The company has a well-diversified client base primarily comprised of large creditworthy companies which helps STAG generate safe, stable, growing and predictable cash flows. Despite a low risk profile, the company provides an attractive dividend yield as well as capital appreciation potential to investors.