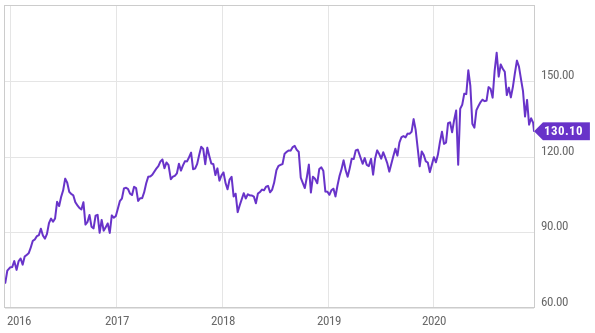

This data center REIT offers an attractive investment opportunity for investors seeking steady income along with long-term capital gains. It has raised its dividend for the past 15 years (it currently yields 3.5%) and is likely to continue to do so given strong industry tailwinds. We think there is a disconnect between business fundamentals and recent the underperformance of the shares (down ~18% over the last two months). This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion about why it’s worth considering if you are a long-term income-focused investor.

Overview:

Digital Realty Trust (DLR) is a leading REIT engaged in the business of owning, acquiring, developing and operating data centers. DLR covers the entire spectrum from colocation to enterprise to hyperscale data centers. DLR’s portfolio consists of 284 data centers, including 43 data centers held as investments in unconsolidated joint ventures. Of these, 147 are located in the US, 41 in Europe, 19 in Latin America, 10 in Asia, five in Australia and three in Canada.

DLR is well diversified geographically. North America is its largest market accounting for 62% of its total operating revenue as of 3Q20. This is followed by EMEA at 30%, APAC at 6% and Latin America at 2%.

Moreover, DLR boasts of a high quality and diversified customer base across industries ranging from cloud and information technology services, communications and social networking to financial services, manufacturing, energy, gaming, life sciences and consumer products. The top 20 customers account for just 48.4% of total rent with no single customer accounting for more than 9.0% of rent. More than 50% of its clients have investment grade or equivalent credit ratings. Overall, as you can see in the graphic below, DLR has a very strong group of customers.

(source: Company Presentation)

Digital Realty continues to expand its global presence which positions it well for future growth. During 3Q, it entered Croatia market with the acquisition of Altus IT and acquired land parcels in the EMEA region to further bolster its infrastructure. It acquired land parcels within one kilometer of its highly interconnected campuses in Vienna as well as Madrid. These strategic land holdings will provide additional capacity, enabling local and global service providers to seamlessly expand adjacent to their existing deployments.

High Switching Cost – A Competitive Advantage

Typically customers do not prefer changing data centers due to high switching costs. Digital Realty estimates that it costs customers anywhere from $15 million to $20 million to migrate to a new facility. Further, new deployment costs of around $15-$30 million create additional barriers for customers to switch. Overall, it is economically unviable for customer to switch vendors. This results in high occupancy and retention rates for DLR. As of 3Q20, the occupancy rate of DLR’s portfolio was 86% and the tenant retention rate was only slightly below its long-term historical average of ~80%. We think high occupancy and retention rates are a positive as they steady provide rental income and cash flow visibility. Moreover, nearly 93% of company’s leases contain base rent escalations that are either fixed (generally ranging from 2% to 4%) or indexed based on a consumer price index. This provides for rental income growth which allows DLR to maintain high payouts and increase dividends.

(source: Company Presentation)

A Healthy Growing Dividend

DLR has delivered 15 consecutive year of dividend increase, growing its dividend from $1.00 in 2005 to estimated $4.48 in 2020. This represents a CAGR of ~11% during 2005-2020E. At today’s price, DLR yields ~3.5%. And we are pleased with the nearly 4% increase this year, despite the challenging market conditions. Based on the 2020 consensus AFFO estimate, DLR anticipates its payout ratio to be ~81% this year. Next year, DLR expects AFFO growth in mid-single digits which should provide ample room to continue increasing the dividend payment. Further, DLR has no debt maturing until 2021 which provides it with added cash flow to not only pay its dividend but continue to raise it over time.

(source: Company data)

Digital Transformation Driving Steady Demand

DLR delivered solid bookings during 3Q20 driven by the accelerating global digital transformation. Bookings were driven by a record number of 130 new logos, of which 40 were sourced by InterXion. DLR also experienced strong demand across all three regions in 3Q, with Americas and EMEA accounting for 40% each, and Asia contributing the other 20%. DLR signed total bookings of ~$89 million in 3Q20, including a $14 million booking for interconnection, as well as $29 million in network & enterprise deals of 1MW or less. We believe the strong diversification of bookings highlights the strong value proposition offered by DLR.

(source: Company Presentation)

Exposed to Long-Term Secular Demand Drivers

The data center industry is poised for sustainable growth. The demand for data center infrastructure is being driven by many factors, including the explosive growth of data, rapid growth of cloud adoption and greater demand for IT outsourcing. Of these, cloud adoption remains the most significant driver for data center demand.

The majority of enterprises are moving towards private, public and hybrid cloud solutions to meet their IT needs. The overall cloud market has been growing rapidly over the past five years and is likely to continue at double digit growth supported by the major public cloud providers Amazon Web Services (AMZN), Microsoft Azure (MSFT) and Google Cloud Platform (GOOGL).

DLR’s focus in primarily on the hybrid cloud solutions market. A hybrid cloud solution allows companies to store their sensitive information on private cloud (servers) while using public cloud-based applications (such as Office 365, Salesforce) that reduce IT costs. Hybrid cloud is the largest part of the industry (almost 69% of companies deploying it) followed by public cloud (such as Amazon Web Services, Microsoft Azure). Hybrid cloud models are mostly executed using multi-tenant data centers such as the one’s provided by DLR.

The Internet of Things, 5G, autonomous vehicles and artificial intelligence are some other trends which are driving unprecedented growth of the digital economy, thereby driving demand for data centers.

Valuation:

On a Price to Adjusted Funds from Operations basis (“AFFO”) basis, DLR is reasonably priced relative to its peer group average. As seen below, DLR trades at P/AFFO multiple of 23.4x, which is almost in line with its peer group average multiple of ~22.5x. DLR’s stock price has fallen nearly 18% over the past two months despite improving business fundamentals (DLR expects mid-single digit earnings growth in 2021). We think there is meaningful room for capital price appreciation given the disconnect between market price and business fundamentals. This provides investors with an attractive entry point.

(source: Company data)

Risks:

Technology disruption: The current market environment is favorable for data center operators as enterprise and IT customers continue to outsource and decentralize their IT operations. We acknowledge that this could slow, pushing companies back to sourcing their own requirements internally, thereby decreasing demand for data center space.

Reliable Infrastructure: The business depends on providing customers with highly reliable services, including with respect to power supply, physical security and maintenance of environmental conditions. If these infrastructure components break or are rendered obsolete, it may lead to loss of customers thereby adversely impacting earnings.

Competition: DLR competes with numerous data center providers, many of whom own properties similar to DLR in the same metropolitan areas. Some competitors and potential competitors have significant advantages, including greater name recognition, longer operating histories, pre-existing relationships with current or potential customers, significantly greater financial, marketing and other resources and more ready access to capital. In addition, many competitors have developed and continue to develop additional data center space. If the supply of data center space continues to increase as a result of these activities or otherwise, rental rates may be reduced which will negatively impact operating results.

The Bottom Line:

Digital Realty is a healthy growing REIT benefiting from the accelerating growth in data (and the use of data centers). Further, the 3.5% dividend yield is also healthy and growing. Further still, fundamentals are improving and management has provided improving guidance for the quarters ahead. Yet despite these positives, the shares have underperformed, thereby providing an attractive entry point for income-focused investors that also appreciate long-term price appreciation. We are currently long shares of Digital Realty.