This recently IPO’d business is very attractive. And the significant near-term volatility has given rise to an attractive high-income-generating options trade. The trade strategy sounds complex (i.e. “bullish vertical put spread”), but it’s not. It puts attractive upfront premium in your pocket today, it gives you a chance to pick up shares of this attractive stock at a lower price, and it gives you a little insurance on the downside (i.e. your max loss is limited). We believe this is an attractive trade to place today—and potentially over the next few trading sessions—as long as the underlying share price doesn’t move too dramatically before then.

Unity Software (U)

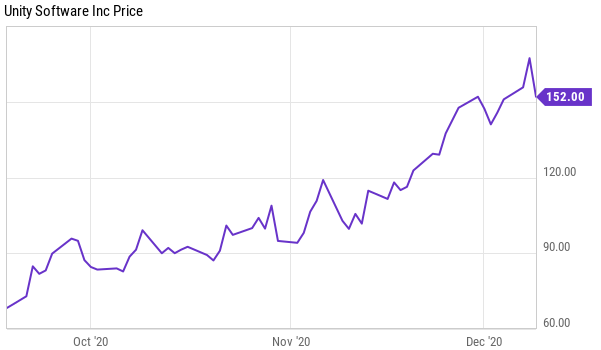

The stock we are referring to is Unity Software (U). Unity provides tools to videogame developers. The company recently completed its initial public offering in September. The business is healthy, revenue is growing rapidly, and it has a large total addressable market. We recently completed a detailed fundamental research report on Unity, and you can access that report and all its detail here. Unity’s share price has been very strong since its IPO, but the share price sold off hard yesterday (as you can see in the chart below), and this creates a nice set up for this trade (because options premium income is higher when the share price is more volatile). The shares sold off as part of a broad sell off in high sales growth names (i.e. Unity is a bit of a baby that’s temporarily been thrown out with the bathwater).

(Purple Line: Unity Software)

The Trade: “Bullish Vertical Put Spread” on Unity

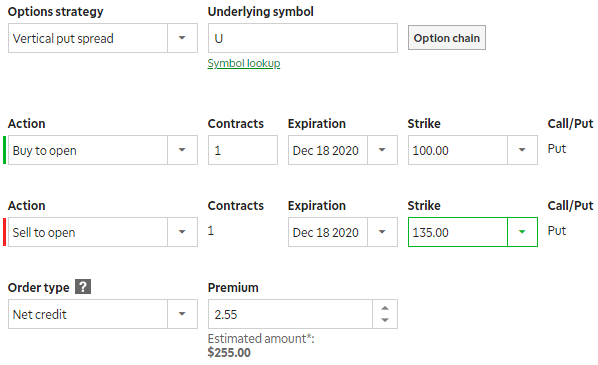

Sell AND Buy Put Options on Unity Software (U) with a strike price of $100 (sell) and $135 (buy), and an expiration date of December 18, 2020 (roughly 1 week away), and for a net premium (upfront cash in your pocket) of at least $2.55 (or $255 because options contracts trade in lots of 100). Your broker will make you keep $3,500 cash on hand (($135 - $100) x 100 (assuming you don’t want to use margin). The trade generates ~7.2% of extra income over the next 8 days (this is a lot!… $255/$3500). And this trade not only generates attractive income for us now, but it gives us the possibility of owning shares of attractive Unity at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own Unity, especially if it falls to a purchase price of below $135 (it currently trades around $152) but above $100 (if it falls below $100 we’d take the cash difference between our $100 strike put and the market price at expiration—this is basically insurance)). The trade may sound complicated, but it’s not, and your broker likely makes all the calculations and execution easy as you can see in the graphic below.

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of Unity doesn't move too dramatically before then, and as long as you’re able to generate premium (income for selling, divided by put sale strike price) that you feel adequately compensates your for the risks (currently 7.2% over the next 8 days).

Our Thesis: Unity (U)

Our thesis is simply that we believe Unity is an attractive business, and we’d be happy to pick up shares at the lower price of $135. Very specifically, Unity has consistently delivered impressive performance over the quarters (pre-IPO) with strong top-line growth along with improving margins. The company has well positioned itself as the market leader in the fast-growing gaming industry and is starting to gain traction in non-gaming industries as well.

Important Trade Considerations:

Two important considerations when dealing with options contracts are earnings announcement dates and dividends. However, neither is an issue for this trade because Unity is not scheduled to announce earnings until well after this options contract expires and it does not pay a dividend (if it did, we’d have to consider how that impacts the trade).

Conclusion:

When fear and volatility spike, so too does the upfront premium income available in the options market. In the case of Unity, there are a lot of near-term volatility caused by yesterday’s indiscriminate sell off of high growth stocks, combined with Unity’s significant share price movements since its recent IPO. However from a long-term standpoint, Unity’s business is very attractive, and the shares will likely eventually go much higher (even though the near-term share price will be volatile).

If the shares do get put to us in this trade at $135—that’s great—and we look forward to hanging on for the long-term. And if they don’t get put to us, we’re happy to keep the upfront premium income that this trade generates for us (we get to keep that income, no matter what, and in this case it is a lot!). Furthermore, not only do we have a little insurance on this trade (we put/sell the shares at $100 if they fall below that level before the options contract expires), but the insurance piece also lets us enter this trade with a lower amount of cash set aside than if we just sold naked puts (for example, we’d have to keep $13,500 of cash in our account—to avoid using margin—if we sold naked puts with a strike price of $135). The big risk is that the shares fall all the way below $100 and we sell at that level. However, there are lots of ways to win. We like this trade and we like Unity Software as a long-term investment—especially if we get the shares at a lower price.