As contrarians, it’s reaffirming when our views on big dividend (+11.3% yield) Prospect Capital (PSEC) evoke angry responses from some readers. For example, we were ridiculed when we bought low in 2016 in this article. And we were ridiculed again when we sold the shares (at a big profit) and also gave readers a big warning that the shares were overpriced (right before they crashed in 2017) in this article. In our view, Prospect Capital is so out of favor right now, that its valuation is again becoming attractive. In addition to reviewing some of PSEC’s risk factors, this article shares our views on why Prospect is again worth considering if you are a contrarian income-focused investor.

Business Description:

If you don't know, Prospect is a Business Development Company ("BDC") which basically means it provides financing to smaller businesses (it's essentially a portfolio of high yield loans). For reference, here is a description of the business from FactSet:

Prospect Capital Corp. is a business development company that invests in middle-market companies with an EBITDA of $5 to $150 million, revenues less than $750 million, and enterprise values of less than $1 billion primarily located in the US and Canada. The fund targets companies operating across a wide variety of industries including manufacturing, industrials, consumer services, consumer products, energy, business services, financial services, food, healthcare, and media. It invests primarily in the form of first-lien and second-lien senior loans and mezzanine debt for refinancing, leveraged buyouts, acquisitions, recapitalizations, and later-stage growth investments. It makes investments in the range of $20 to $400 million per transaction. It acquires control positions and makes co-investments. It also invests in equity and subordinated debt tranches of collateralized loan obligations.

So Hated...

Prospect Capital is "in the dog house" with many investors for a variety of reasons. For example…

- Terrible Performance is one reason PSEC is so hated. For instance, many investors are still underwater since purchasing the shares while they’ve watched the rest of the market sail higher. Here is a look at PSEC’s terrible performance over the last year.

- A 2017 Dividend Cut is another reason PSEC is so hated. Its Net Investment Income ("NII") wasn’t covering the dividend so they reduced the payment. This is a sure fire way to tick off your investor base.

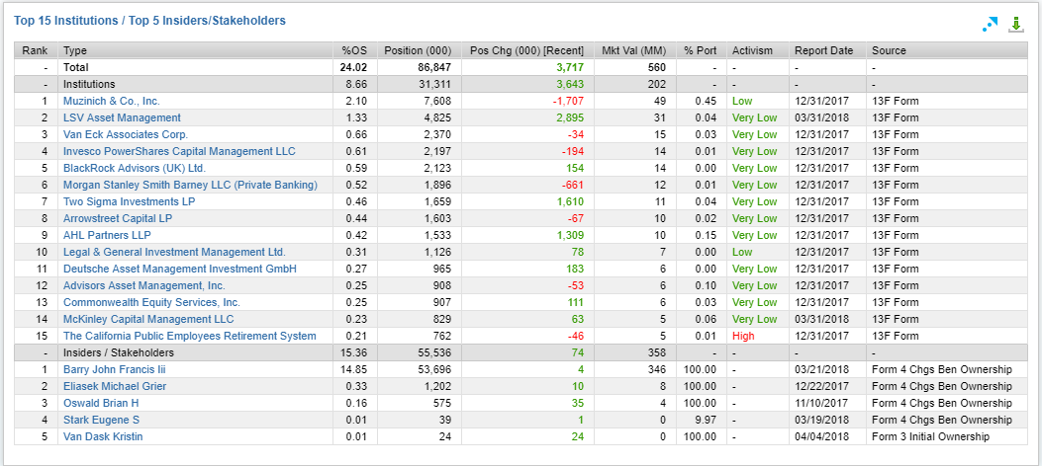

- High Short Interest is another sign of investor discontent. The short interest on PSEC (as shown in our table below) was recently as high as 8.9%, which is quite high for a low-beta high-yield security like PSEC, and especially high relative to most of its BDC peers.

- A Depressed Money Flow Index (also shown in the above table) is yet another indication that selling pressure has been intense, and investors do NOT like PSEC.

- Low Price-to-Book: Price-to-book value is one common way to benchmark BDC valuations, and the current low PSEC P/B (as shown in the following chart) is another indication that investors do not particularly like this security right now.

Why it’s attractive now...

If you are an income-focused contrarian investor, PSEC is again becoming attractive and worth considering for a variety of reasons. For example, its valuation…

- Price-to-Book value has become decidedly more attractive than it was a year ago, as shown in our previous chart above. And for more perspective, here is a graph showing where price-to-book has been for PSEC and many of its BDC peers over the last 5-years.

Price-to-book value is not the "end-all, be-all" valuation metric for a BDC, but it can be a good guidepost, and PSEC is more attractive on this metric than it was in the past.

- Dividend Coverage is another critical metric for BDC investors to consider if they’re worried about the safetfy of the dividend payments, and PSEC has improved considerably on this metric. Specifically, PSEC was paying out more in dividends than it was generating in net investment income for multiple quarters before it finally reduced the dividend. However, PSEC announced earnings Wednesday, and it was the second quarter in a row where NII exceeded the dividend payment—a very good sign.

- Return on Equity is another important metric to consider when evaluating a BDC, particularly because it takes into consideration gains and losses on sales of assets (i.e. something NII doesn’t included). And PSEC has been consistently putting up a strong ROE relative to its peers (as shown in the table earlier in this report). Similarly, PSEC’s return on invested capital is 7.8% (according to Guru Focus) which is compelling considering its weighted average cost of capital is only 6.1%.

- Higher Leverage Limits are another advantage PSEC has going for it. Specifically, legislation passed in March allows BDCs to essentially double the amount of leverage on their books, which theoretically allows them to magnify returns (see: BDCs move to boost leverage). This change is timely considering BDCs like PSEC are now underwriting safer financing deals with lower spreads/returns on invested capital because the higher yields associated with legacy financial crisis year deals have largely rolled off the books, and safer lower yield investments are more common in our current market conditions. In reality, it'll take time to increase leverage, and it'll also increase competition among BDCs for deals. Nonetheless, the higher leverage limits are attractive.

- High Inside Ownership is often viewed as a strong positive for a company, and as shown in the following chart, PSEC’s is very high.

pecifically, the CEO bought more shares after historical price drops as shown in this chart.

- Healthy Market Conditions are currently an attractive wind at PSEC’s back, but there are some nuances here to consider. For starters, as long as the economy remains strong, many of the middle market companies to which PSEC has provided financing will also remain strong and thereby be able to keep paying back their loans to PSEC, which is a good thing. However, as long as the market remains strong, credit spreads remain low, which means PSEC isn’t necessarily able to charge as high of a credit spread as they were in the financing vintage years following the financial crisis (remember these financing arrangements stay on the books for years). One silver lining is that the new regulatory increase to BDC leverage limits will theoretically allow leading BDCs like PSEC (in terms of size and resources) to leverage up lower credit spread (safer) yields thereby achieving higher returns. However, in reality this cannot happen overnight as PSEC is very careful to underwrite only attractive financing deals so as to stay out of trouble down the road if market conditions become less healthy.

Risk Factors:

Obviously PSEC faces risks, otherwise it wouldn’t offer such a high yield to investors.

- Focus on Total Returns, not just the big yield. One mistake investors make is to let Prospect's big 11.3% yield distract them from paying attention to the total return (dividends plus price appreciation). Because PSEC's yield is so big, there's been quite a significant difference between the price return and the total return, and compared to the S&P 500 (SPY), as shown in the following chart.

In particular, you can see PSEC has sold off significantly again recently as compared to the S&P 500. And importantly, be aware that the price of PSEC tends not to perform nearly as well as the rest of the market considering it pays out those big dividends. (Note: PSEC does have a DRIP dividend reinvestment program for interested investors).

- Credit Spreads could blow out, in which case PSEC’s price could get even cheaper. For example, when high yield credit spreads blew out in early 2016, BDCs like PSEC experienced steep price declines.

And just because PSEC trades at a discount to book value now, that doesn’t mean that discount can’t get bigger. Worth noting, when BDCs got cheap in early 2016, it was in large part because they sold off in sympathy with high-yield energy sector businesses which were experiencing heightened defaults as they acclimated to lower energy prices. Energy prices have been rallying significantly lately, and any reversal of this trend could cause credit spreads to again blow out thereby causing BDCs like PSEC to suffer a sympathy sell off, even though PSEC has very little exposure to the energy sector (2-3% of its business).

- External Management is another risk. Specifically, PSEC is externally managed (by investment adviser, Prospect Capital Management L.P.), and there can be conflicts of interest between the external management team and PSEC. Further, the external manager gets paid very handsomely considering PSEC is a large BDC (specifically, there is a 2% of assets base fee, plus an incentive fee based on NII). However, PSEC does also benefit from some economies of scale relative to other BDCs because, again, it is a larger BDC.

- Large Retail Investor Base is another curious risk factor to consider when investing in PSEC. Specifically, the percentage of retail investors among all of PSEC’s ownership base is unusually high (based on the know shareholders), as shown in the following chart.

A case could arguably be made that PSEC’s market price is relatively less efficient than other securities due to its large unsophisticated and emotional retail investor base and the lack of “smart money” from large institutions (to be clear, not all retail investors are unsophisticated, and most institutional investors are NOT smart in this author’s opinion because institutional investors are mostly over diversified closet-indexers that pay too much for operational expenses and allow their actions to be driven by politics and “career preservation” more so than by sound investment decisions). Nonetheless, PSEC’s share price has a tendency to slowly over react to both good and bad news, but of course no one has a working crystal ball.

Conclusion:

If you are a contrarian income-focused investor, PSEC’s share price is starting to get attractive again, in our view, for the reasons described in this article. We’ve not yet pulled the trigger on a new purchase, but the shares are high on our watch list. And if near-term volatility causes the shares of this high yield BDC to sell off much further, we could be quick to pull the trigger on a new purchase. We don’t believe it’d be a terrible idea to start building a new position now, but we’re being patient as PSEC gets increasingly attractive.

Note: You can view all of our current holdings here.