Our Blue Harbinger portfolios posted strong gains over the last month. They also delivered attractive yield, and we continue to believe they are positioned for healthy gains going forward. This report provides details on performance, and provides updates on some of the bigger movers (down and up) over the last month. For benchmarking purposes, it's worth mentioning that the S&P 500 (SPY) posted a 0.52% total return over the last month.

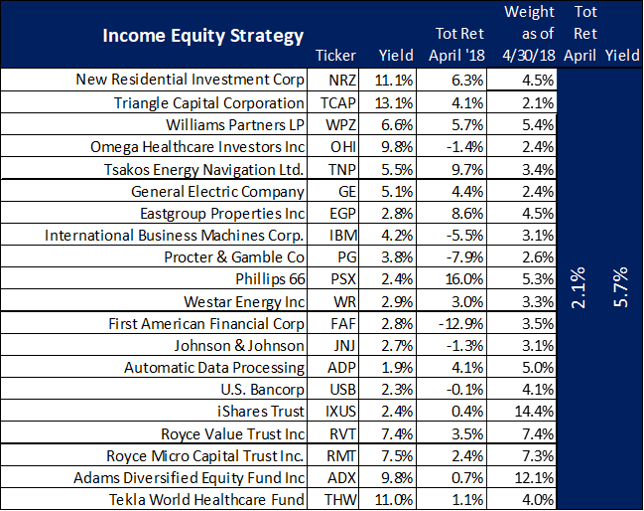

Income Equity Portfolio:

Highlights...

- New Residential (NRZ): This big-dividend mortgage REIT beat earnings expectations again when it announced earnings last week: New Residential tops estimates and payout, and that contributed to the share price increase. Management believes investments are well-positioned for rising interest rates (they pay largely fixed or capped-rate floating). And recently acquired mortgage servicer, Shellpoint, helps smooth out some of the previous challenges of working only with external services. Q1 Core earnings of $0.58 per share covers the $0.50 quarterly dividend.

- William Partners (WPZ): Williams announced earnings this past week. They missed estimates by $0.03 per share, but exceeded revenue expectations, and that caused the shares to rise. (Williams Partners misses by $0.03, beats on revenue). Q1 adjusted EBITDA was up 5% versus last year, and the company continues to be in a leading position to serve growing natural gas demand.

- Tsakos Energy Navigation: (TNP): These shares perked up last month as energy demand and prices have been on the rise. As we wrote in this article, we believe investors are incorrectly interpreting and extrapolating TNP's poor past performance, and there are multiple reasons to believe Tsakos will experience significant gains in the future, such as its improved operational efficiency, the completion of a large capex spend (which will increase future free cash flow), and indications the company is about to benefit from an upturn in the market cycle. If you are an income-focused investor, we believe Tsakos' common and preferred shares are worth considering.

- EastGroup Properties (EGP): Not surprisingly, EGP beat expectations when it announced earnings two weeks ago, and the shares have climbed significantly. This industrial REIT trades on broader REIT industry fears, but it should trade on its unique ties to the strong economy. With properties located in prime "hub" locations across the southern sunbelt of the US, EGP benefits as the economy remains strong and grows. It's more "blue chip" than other industrial REITS (such as STAG, for example).

- Phillips 66 (PSX): PSX has been long over due for some price gains, and the recent rise in energy prices has been the catalyst for this stock's large gains over the last month. Even though its midstream business is based on long-term lower volatility steady contracts, sometimes it takes some volatility across other parts of a sector (such as significant price moves in energy prices) to get the market to give a stock more of the credit it deserves. It also helps that PSX beat earnings expectations by $0.15 last week. (Phillips 66 beats by $0.15).

- First American Financial (FAF): This mortgage title insurance company met expectation when it announced earnings last week, but missed on revenues. This is a stock that has done extremely well over the last year as residential transactions have been high spurred by low rates and an improving economy. However, the prospects of higher rates from the Fed taps the breaks on FAF's market space.

Disciplined Growth Portfolio:

Highlights...

- Paylocity (PCTY): Paylocity's growth continues to be rapid as this cloud-based payroll processing company keeps delivering what small and mid-sized business need. Paylocity crushed expectation when it announced earnings last week (Paylocity beats by $0.24, beats on revenue), and it has a lot more room to run.

- Procter & Gamble (PG): If you're looking for a contrarian opportunity with an attractive dividend, P&G is worth considering. The shares are suffering a "double whammy" as the consumers staples sector has been out of favor with investors, but also as P&G's post-strategic-restructuring (they shed around 100 non-strategic brands in recent years) in not taking hold as quickly as some expected. We wrote more about P&G here.

- Facebook (FB): The popular media can keep hating on Facebook based on privacy concerns, but the advertising dollars keep coming in at an astounding pace. Facebook has also recently benefited from a "chorus of analyst price target raises" after it announced last week that it easily beats in Q1 with 50% ad revenue growth. Facebook has high margins, enormous revenue, and tremendous growth opportunities. And even if the growth does eventually slow (which it may not anytime soon), shareholder will be left holding a huge cash cow.

Balanced Portfolio (Stocks and Fixed Income):

At the end of April, the Balanced Portfolio was 60.2% Equities and 39.8% Fixed Income.

Highlights...

- AmeriGas Partners (APU): This stock missed earnings by $0.22 in January, but beat on revenues as the relatively colder winter increased demand for propane. Q2 EPS of $1.69 beat the $1.31 from last year, and tax reform has helped this company further. Management raised 2018 guidance, and the distribution is well-covered. AmeriGas did not increase its distribution as it works to recover from the previous two winters which were warmer than long-term norms.

- Skyworks Solutions (SWKS): We view this recent pullback as a buying opportunity as Skyworks' sophisticated chip making competencies will serve it well as the number and complexity of smart phones grows, and as 5g approaches. Skyworks is not a typical income security (it's yield is only 1.3%), but it can be wise to diversify into some growthier names, and Skyworks has significant long-term upside.

- Transocean (RIG) 2038 Bonds:This is one of the new bonds we purchased at the end of March, and they have already rebounded significantly since then for some nice price gains to complement the big coupon payments.