For those of you interested in long-term capital appreciation, this reports shares a wide-variety of individual stock ideas. The model portfolio in this report is derived from a custom client portfolio we've been working on. It may help you generate ideas as you manage your own investments. Any questions, please let us know.

Long-Term Capital Appreciation:

Looking for long-term capital appreciation ideas? We’ve been working with a new client to build a custom investment portfolio that differs from the income-focused strategies that many of our readers are familiar with. This report shares an initial draft of a model portfolio that includes some very attractive long-term capital appreciation opportunities, in our view. If you’re interested in this type of strategy, please feel free to have a look, and let us know if you have any questions.

Caveats:

A few caveats upfront.

- First, this report is not intended to be a recommendation to buy or sell any specific securities. We’re just sharing this report for readers that may be interested in generating new ideas.

- Second, please understand this portfolio is constructed for only one specific portion of a larger investment portfolio. Specifically, this portfolio is separate from additional 401k and IRA holdings.

- Thirdly, notice the way this portfolio has been constructed to include allocations across market sectors in weights “somewhat” similar to those of the Russell 3000 index (this index represents 98.5% of the total US investable market cap—and we are NOT trying to match the weights exactly).

- Fourth, this strategy was designed for investors with a +20-year investment horizon, and a preference for companies that are at the forefront of technology advances, generally speaking (obviously not all of the names are technology-based--we believe it's important to have diversification across sectors for risk-management purposes).

- Fifth, you’ll notice we’ve used several ETFs (in addition to individual stocks) to gain exposure to allocations that are currently attractive, in our view.

- Sixth, you’ll notice there is overlap between this portfolio, and the holdings in our main Blue Harbinger strategies, particularly the Disciplined Growth portfolio.

Without further ado, here is a preliminary draft of the custom model portfolio to meet a specific type of client need:

We believe the investments in the above table represent highly-attractive long-term capital appreciation opportunities, if you can stomach the volatility and lower-income. Any questions, please let us know.

Four (4) More Ideas:

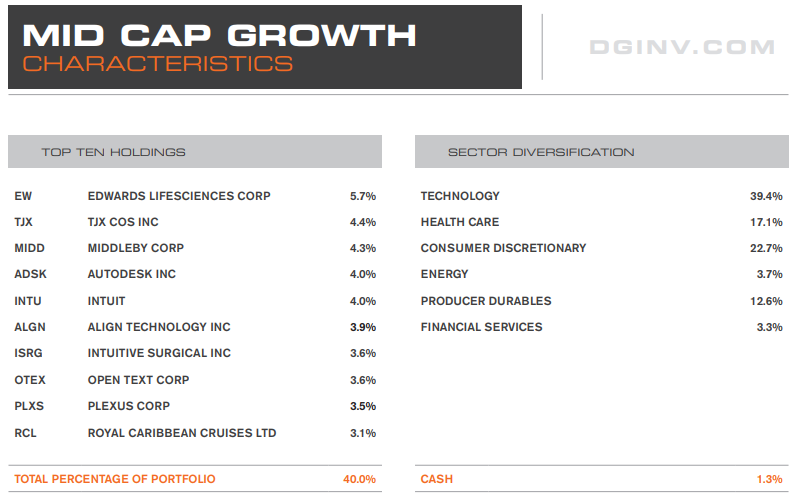

In addition to the investment ideas included in the above table, we also like to generate ideas by scouring the investment holdings of some of our other favorite professional money managers. This week we share a few ideas from Minneapolis-based Discipline Growth Investors and Seattle-based Zevenbergen Capital. Both of these organizations have managed investments for us in a past life, and we highly resect them. We haven’t dug deeply into these ideas yet, but our initial reaction is they are attractive for the type of portfolio we constructed in our table above (i.e. if you are interested in capital appreciation, and you have a long-term horizon). Here is the list.

Disciplined Growth Investors:

Edwards Lifesciences (EW)

Edwards Lifesciences Corporation is a manufacturer of heart valve systems and repair products used to replace or repair a patient's diseased or defective heart valve.

Intuitive Surgical (ISRG)

Intuitive Surgical, Inc. designs, manufactures and markets da Vinci Surgical Systems, and related instruments and accessories. The Company's da Vinci Surgical System consists of a surgeon's console, a patient-side cart and a vision system. The da Vinci Surgical System translates a surgeon's hand movements, which are performed on instrument controls at a console, into corresponding micro-movements of instruments positioned inside the patient through small incisions or ports. The da Vinci Surgical System provides its operating surgeons with control, range of motion, tissue manipulation capability and three-dimensional (3-D), high-definition ("HD") vision

Middleby Corp (MIDD): The Middleby Corporation is engaged in the design, manufacture and sale of commercial foodservice, food processing equipment and residential kitchen equipment.

Zevenbergen Capital Investments:

Celgene Corp (CELG): Celgene Corporation is an integrated global biopharmaceutical company. The Company, together with its subsidiaries, is engaged in the discovery, development and commercialization of therapies for the treatment of cancer and inflammatory diseases through solutions in protein homeostasis, immuno-oncology, epigenetics, immunology and neuro-inflammation.

Final Thoughts:

Again, this information has been provided for informational purposes only. You may or may not be able to generate investment ideas from this report for yourself. If you have any questions, or would like more information about any of the specific holdings, please let us know. If you have a long-term horizon and you can stomach the type of volatility that generally accompanies this type of strategy, we believe there are some very attractive capital appreciation opportunities in this report.