The equity shares of this big-dividend mall REIT could be a value trap, and the preferred shares aren’t appealing to us either, but the 2024 bonds are interesting considering they yield over 6%, plus they trade at an attractively discounted $0.90 on the dollar. Of course there is no assurance the price will rise back towards par anytime soon (and the discount could even increase). However, despite the growing industry headwinds, management will reduce the big-dividend on the equity shares even further just to support the bonds if they need to (debt is higher than equity in the capital structure). And in fact, management has already explained (in their November quarterly earnings announcement) that they reduced the annual dividend from $1.06 to $0.80 per share because they believe “this enhanced liquidity will help to fund value-adding redevelopment activity and debt reduction.”

The company we are talking about is…

CBL & Associates Properties (CBL)

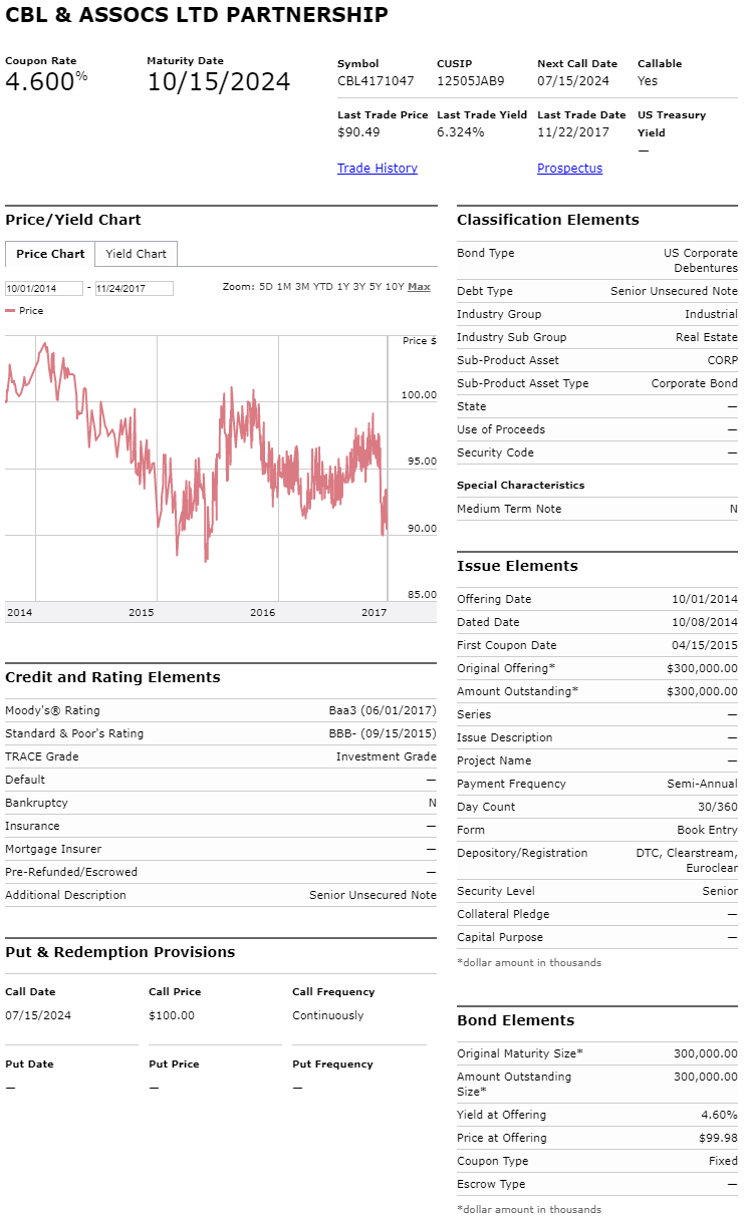

2024 Bonds, 6.3% Yield, Priced at $0.90 on the Dollar

CBL & Associates is a B-class mall owner and operator, and following this month’s announced dividend reduction, the shares are now down over 50% year-to-date.

However, rather than chasing after the equity (which may potentially be a “value trap”) we believe the bonds are interesting and worth considering because the yield is attractive (+6.3%), and the price could rebound another 6-8% in the coming months as the retail fear and panic subsides (or at least lightens up).

The Very Negative Retail REIT Narrative

The common narrative these days is that the Internet (think Amazon) is going to put all “brick and mortar” retail stores (think shopping malls) out of business. Of course this narrative is not entirely true (brick and mortar retail stores are NOT going extinct), but the Internet is hurting them from both a financial standpoint and from an investor perception standpoint (i.e. there’s been a lot of selling pressure on retail stores and the real estate companies that own them, such as CBL).

And to make matters worse, CBL is a B-class shopping mall owner and operator. In our view, it is the A-class operators (the higher-priced, prime real estate locations) that have a better chance of co-existing happily with the Internet. For example, during the quarterly call, CBL announced that they continue to experience tenant bankruptcies, and they continue to lower rents for continuing retailers (this is not good for CBL’s bottom line).

CBL’s Debt and Financial Wherewithal:

On November 6th, following the earnings announcement, S&P Global Ratings lowered its corporate credit rating on CBL & Associates to 'BB+' from 'BBB-' with a stable outlook. BB+ no longer investment grade, and (it’s non-investment grade, speculative), and this demotion helped stoke fear and selling pressure as shown in our earlier price chart. And according to research from Debt Wire:

“Higher-than-expected tenant bankruptcies, rent concessions to boost occupancy, and lower rent from renewed leases all contributed to the revenue decline in the quarter. In fact, rents on renewed leases dropped a sharp 16.1% for the three months ended Sept. 30, 2017 (-7.9% year-to-date), and we expect continued pressure on rent growth over the near to intermediate term.”

For added perspective, CBL’s debts appear reasonably well-laddered and within debt covenants, as shown in the following graphics:

However, the total debt to assets ratio (52%) is approaching the max allowable amount (60%), and this will become increasingly challenging if CBL continues to sell off some of its properties as it has been in recent years (CBL has been shedding some of its least attractive locations, as shown in the following graphic:

And importantly, despite the challenging market environment, CBL continues to generate significant funds from operations (“FFO”) and operating income to keep supporting its debt load, as shown in the following graphic.

And to put FFO into perspective, the following table shows CBL pays out only around 54% of FFO as a dividend (although FFO is shrinking through three quarters of 2017, and CBL also has high capital expenditures to maintain/support its real estate properties).

Overall, we believe CBL has the financial wherewithal to continue supporting its debt, and the recent sell-off has been somewhat overblown.

Conclusion:

We don’t currently own CBL’s 2024 bonds, but we’ve added them to our watch list, and we’re monitoring them closely. Our rationale for this "potential" purchase is simply that we believe the price has been driven too low by short-term fear, and we also believe management will continue to reduce the equity dividend (if need be) just to support these bonds (i.e. there is a lot of liquidity cushion to support this debt).