Following Tuesday’s election results, the market reacted significantly. The “Blue Chip” Dow Jones Industrials Average had its best week in 5-years (+5.4%) as investors bought industrials and banks assuming they’ll benefit from more spending, less regulations, and increased inflation under Trump. On the other hand, utilities stocks performed worst as investors fled their big-dividend, low-growth, stability. In this week’s Weekly, we provide some age-old “boring” yet sage advice on how to prepare for the next market shock, as well as three specific investment ideas that we consider attractive right now.

This first table shows the performance of the various market sectors following last week’s big election. And as we’ve described above, there have been clear winners and losers.

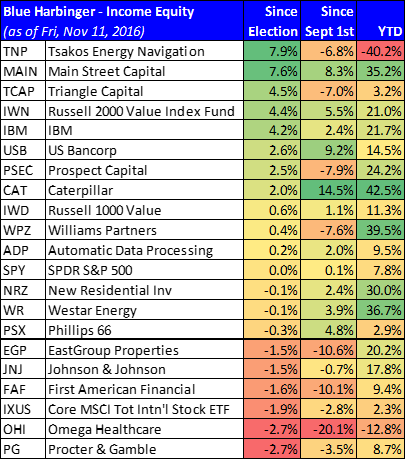

These next two tables show the performance of the Blue Harbinger Income Equity and Disciplined Growth portfolios.

Both strategies had winners and losers, but on average they held up very well relative to the overall market. The reason the strategies held up well (they both outperformed the market, on average, since the election) is because of diversification (and stock selection). Specifically, we have identified attractive stocks diversified across market sectors, so our performance will not suffer from being grossly overweight (or underweight) a specific sector during market shocks like we experienced this past week. We believe our diversified stock selection helps us deliver strong long-term results in any market. In fact, diversification is the age-old “boring” yet sage advice we described in our introduction, and it is a proven strategy for success.

Three Attractive Opportunities Right Now (Post-Election)

One group of stocks that has been in decline over the last 40-days and pulled back even more significantly since the election is real estate. As our earlier sector performance chart shows, XLRE and VNQ have declined approximately 11% since September 1st, and they’ve declined even further this last week following the election. One of the big reason for the decline is interest rates. Not only are interest rates expected to rise soon, but Trump’s aggressive growth economy is expected to force them even higher over the next market cycle. Higher rates pose challenges for real estate (and REITS) because they rely on borrowing to finance their businesses, and borrowing is becoming more expensive. Second, many investors had been chasing real estate because they felt the steady dividend payment were a good way to earn some safe, low-stability income in a challenging economy, but now that rates are rising alternative opportunities are becoming more attractive.

1. Low-Cost, Passive Real Estate Funds (XLRE and or VNQ)

As contrarians, we believe these two real estate funds (XLRE and VNQ) are attractive. They’re not only attractive because their prices have declined, but they’re attractive because, on average, we believe the diversified basket of real estate (and REIT) investments they own will continue to pay safe steady dividends that can be extremely valuable to income investors. We also believe these two passive funds in particular (XLRE and VNQ) offer a very low cost means by which to invest in real estate, and keeping costs lows is a huge advantage that will compound (in a good way) for investors over the long-term.

2. Omega Healthcare (OHI)

Omega Healthcare is a specific real estate investment trust that we consider particularly attractive, especially considering its big dividend (8.6%) and recent price declines. Not only has this REIT sold off since the start of September as the broader REIT sector (and high interest paying stocks in general) sold off, but it sold off further following the election. Omega is a healthcare REIT and it is exposed to unique risks related to healthcare and entitlement reform. We believe overly fearful investors have put too much selling pressure on this stock, and it now trades at a significantly discounted price. In particular, Omega is exposed to skilled nursing facilities which have been under significant (and only partially warranted) pressure due to regulatory form, and investors are overly fearful that more pressure could be applied now that the house and senate are controlled by the same party as the white house. In our view, Omega is a particularly attractive investment right now, and you can read our recent full report on Omega here.

3. Paylocity (PCTY)

Paylocity is an attractive growth company (it does not pay a dividend) that we own in our Blue Harbinger Disciplined Growth portfolio, and we consider it a very attractive investment opportunity following its recent stock price declines. In particular, this stock is down 25.6% since September 1st, and down 3.8% since the election. The main reason the stock price has declined is because is because Paylocity recently provided earnings guidance for the upcoming quarter that was lower than the market expected. In particular, Paylocity sees Q2 2017 EPS of $0.01-$0.03, versus the consensus of $0.04. Paylocity also sees Q2 2017 revenue of $66-67 million, versus the consensus of $68 million. Further, Paylocity sees FY2017 revenue of $296-298 million, versus the consensus of $296.2 million.

Despite the lower guidance, Paylocity just announced earnings on November 3rd that beat expectations. Specifically, Paylocity reported Q1 EPS of $0.07, $0.04 better than the analyst estimate of $0.03. Revenue for the quarter came in at $65 million versus the consensus estimate of $63.58 million. Further, Paylocity has been growing rapidly (and is expected to continue to grow rapidly) as shown in the following revenue history chart.

If you don’t know, Paylocity is a cloud-based provider of payroll and human capital management (HCM), software solutions for medium-sized organizations. We believe it offers a better, smarter, cheaper solution than the likes of industry stalwart ADP, particularly for small- and mid-sized companies. Owning this stock required patience and a long-term horizon because it is very volatile. Here is a link to our original thesis for Paylocity (from way back in September of 2015), and we believe it continues to hold true today. We continue to own Paylocity as part of our long-term Disciplined Growth portfolio.