IBM offers an attractive (3.5%) dividend yield, but the dividend alone is not enough if the stock can’t provide some long-term capital appreciation. In this article, we review IBM’s shrinking legacy business, its attempt at growth via “strategic imperatives,” its dividend, share buybacks, valuation, and risks. And we also provide our strong views on whether it’s time to buy or sell Big Blue.

To get directly to the point, we like IBM and we continue to own it in our Blue Harbinger Income Equity portfolio. We believe it has 25% upside, and more if its "strategic imperatives" continue down the path of success...

Overview:

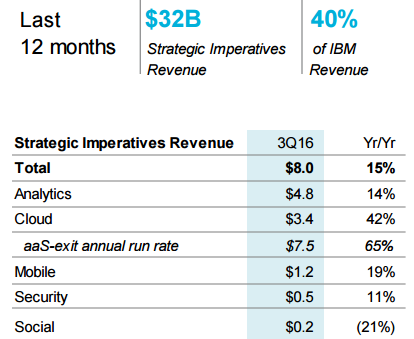

Most people recognize IBM as blue chip technology company. But what makes IBM special is its huge backlog of legacy revenues (they currently have approximately $121 billion in future revenue backlog). Unfortunately, this legacy backlog is shrinking (albeit slowly), and therefore IBM has moved towards its “strategic imperatives” to stop the bleeding and hopefully eventually return to solid growth. For reference, IBM’s strategic imperatives recently have grown to 40% of total revenue and they consist of Analytics, Cloud, Mobile, Security and Social, as shown in the following graphic.

And the strategic imperatives fall within IBM’s five main business segments:

- Global Technology Services (GTS): The Company's GTS segment offers services, including strategic outsourcing, integrated technology services, cloud and technology support services (maintenance services).

- Global Business Services (GBS): Its GBS segment provides consulting and systems integration, application management services and process services.

- Software: The software segment consists primarily of middleware and operating systems software.

- Systems Hardware: The Systems Hardware segment provides clients with infrastructure technologies.

- Global Financing: The Company's Global Financing segment includes client financing, commercial financing, and remanufacturing and remarketing.

Important to note, in its third quarter earnings release, IBM reported a “Service Revenue Backlog” of $121 billion, down from $138 billion in Q1 of 2014. This is the shrinking service revenue back log that IBM must deal with. This next chart shows the firm’s overall shrinking revenue since 2012.

This is the trend IBM is trying to reverse with its growing strategic imperatives (more on this later).

IBM’s Dividend:

IBM’s current dividend yield sits at a healthy 3.4% as shown in the following chart.

And further, IBM has plenty of free cash flow to cover this dividend payout as shown in the following table.

Share Repurchase:

In fact, IBM has been allocating additional free cash flow to repurchase its own shares ($3.4 billion over the last 12 months). And as this next chart shows the shares outstanding have been coming down significantly over the years.

The share repurchases are attractive in the sense that it is a return of capital to investors, however, it is concerning as it demonstrates IBM’s lack of significant new investment opportunities (they’d not return so much cash if they had more attractive investment opportunities).

Valuation:

From a price-to-earnings multiple, IBM has room for both multiple expansion and earnings growth. This first chart shows IBM’s historical P/E multiple, and as the chart suggests- IBM’s current valuation is not particularly overvalued- and there is room for continued price increases via multiple expansion versus its own history.

Secondly, IBM can increase its total revenues and ultimately earnings depending on the success of its growth initiatives (i.e. strategic imperatives).

Additionally, a basic discounted cash flow model suggests IBM’s stock price may have 25% upside. Specifically, we can discount IBM’s $12.9 billion in free cash flow by its 6.7% weighted average cost of capital and factor in a 1% growth rate ($12.9B/(6.7%-1%)) to arrive at an enterprise value of $226.3B. After adjusting for the $35.5B of long-term debt outstanding that leaves us with an equity value of $190.8B. Dividing by the 950.85 million shares gives us a value of $200.67 per share, or approximately 25% upside versus the current share price of $160.22.

Risks:

The two big risks for IBM are that the legacy businesses shrink faster than expected, and that competition prevents IBM from growing its strategic imperatives from growing significantly. Both of these risk are feasible, however the legacy business are intertwined within many organization that they are critical and cannot be replaced therefore giving IBM a competitive advantage that is sustainable for some time. Also, IBM’s existing business gives them a foot in the door with clients with regards to strategic imperatives. For example, IBM is able to provide hybrid cloud services (a hybrid between cloud and existing IBM mainframes that are mission critical and cannot be eliminated by organizations), and this gives IBM a great competitive advantage versus many of its peers.

Conclusion:

Despite its continuing changes to meet a changing market place, we consider IBM attractive. In fact, we consider it attractive that IBM is able to change to meet the market. Further, the dividend is very safe, and we believe the stock price can rise as well through multiple expansion and earnings growth via the company’s strategic imperatives. The legacy business is very stable (although shrinking very slowly) and it supports IBM’s attractive dividend. If you are a long-term investor that appreciates or needs a decent dividend, then IBM is worth considering. We own IBM in our Blue Harbinger Income Equity strategy, and we expect to continue to own it as the strategic imperatives drive future growth.