Johnson & Johnson is an absolute dividend powerhouse having increased its dividend for more than 50 years straight. However, the company faces new and increased uncertainty risk in light of a Republican House, Senate and President-elect that seem determined to repeal (or at least modify) the Affordable Care Act (ACA). In addition to its attractive growing dividend payment (2.8%), significant long-term capital appreciation potential, and reduced risk via its large and diverse revenue base, we believe Johnson & Johnson (its pharmaceuticals segment in particular) could eventually benefit from reduced regulatory burden under a modified ACA, but is now the right time to buy?

Overview:

As shown in the following charts, Johnson & Johnson is engaged in the research and development, manufacture and sale of a broad range health care products around the world.

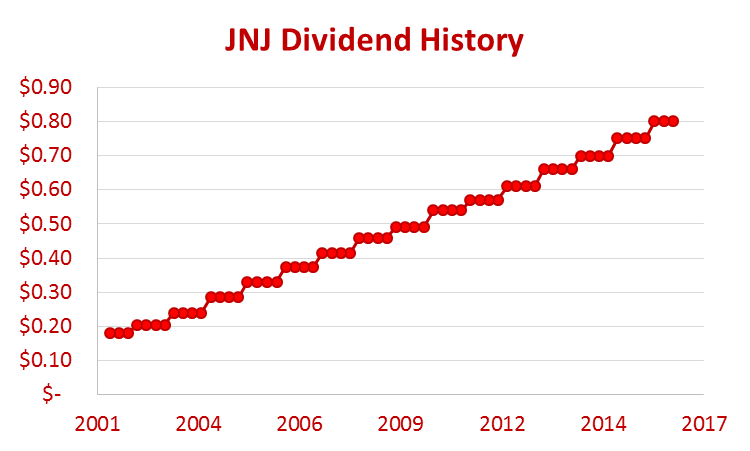

Further, Johnson and Johnson is considered a “Dividend King” for having increased its dividend for more than 50 years in a row. The following table gives an idea of the pace of Johnson & Johnson’s dividend increases in recent years.

Also worth noting, JNJ has been able to support its dividend growth with a steady stream of revenue growth as shown in the following table (more on growth later).

Further, JNJ’s strong free cash flow ($10 billion so far through the first nine months of this year) allows the company to easily cover the dividend ($6.5 billion so far this year) and continue to repurchase shares as the company sees fit (the following table shows historical shares outstanding)

More broadly speaking, Johnson & Johnson has generated $15.8 billion, $14.8 billion, $13.8 billion and $12.4 billion in free cash flow in 2015, 2014, 2013 and 2012, respectively. And the strong free cash flows allow JNJ to support its dividend, fund research and development, buy back shares, and generate returns for its shareholders.

Growth and Capital Appreciation Potential

Johnson & Johnson has significant opportunities to continue growing in the future.

For example, according to Chairman and CEO Alex Gorsky:

“Our third-quarter results reflect the success of our new product launches and the strength of our core businesses driven by strong growth in our Pharmaceuticals business. With a number of regulatory approvals, several new drug application submissions and new breakthrough therapy designations from the FDA, we are increasingly confident in our pipeline expectation of filing 10 new pharmaceutical products between 2015 and 2019, each with revenue potential over $1 billion. Our broad-based business model, strategic investments and talented colleagues position us well for continued leadership in health care.”

Ten new pharmaceutical products with revenue potential of over $1 billion each is significant, especially considering the revenue chart we showed previously showed only $71.6 billion in total revenue over the last twelve months.

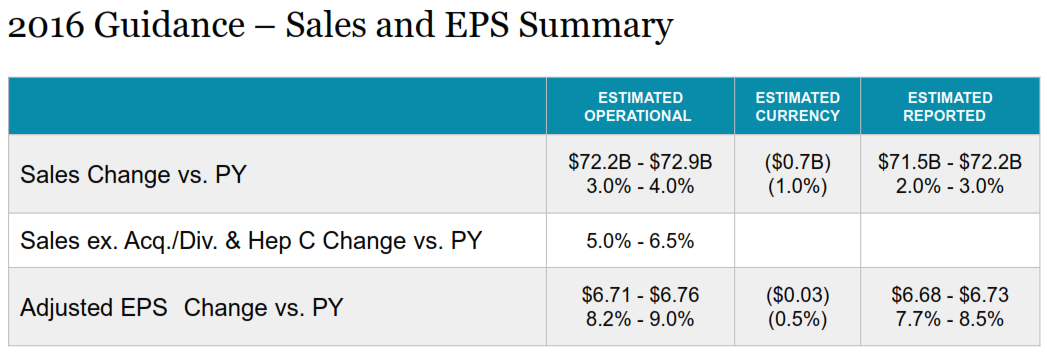

Additionally, JNJ is guiding towards continued sales growth as shown in the following table.

Valuation

The following historical price to earnings ratio (PE) chart for JNJ suggests the company in not particularly over- or under-valued on this measure.

There is room for PE expansion, however there is also room for earnings growth, particularly via the pharmaceutical growth initiatives described in Alex Gorsky’s quote provided earlier.

Also worth considering, the following chart shows JNJ’s dividend yield is not unreasonable versus its historical levels.

This may be indicative of management’s view that the stock is reasonably priced and will continue its steady long-term earnings and dividend growth trajectory. If management believed the stock was overvalued they may have allocated less capital to dividend payments under the impression that the stock price would lag the rest of the market eventually bringing the dividend yield to a more normal level. JNJ’s dividend is near the average Dow Jones dividend yield, and JNJ will likely increase the dividend payment soon keeping with the increase trend shown in our earlier historical dividend payment chart for JNJ.

Another way to gauge JNJ’s value is a basic discounted cash flow model. For example, starting with $15.8 billion of free cash flow in 2015, and discounting that by a 7.1% weighted average cost of capital (source) and assuming a 2.5% annual growth rate gives us an enterprise value of $343.5 billion. And adjusting for $27 billion of long-term debt gives us an equity value of $316.5 billion, or approximately $116 per share (slightly above its current market price). However, if management is able to achieve a 3% growth rate, the valuation rises to $132 per share. These estimates are useful in gauging the reasonableness of the current market price. And according to the twenty-two analyst estimates included on yahoo finance, growth is expected to exceed 3%.

Affordable Care Act Uncertainty

Stocks hate uncertainty, and health care stocks just got another healthy dose of it following the November 8th elections in the US where Republicans who are determined to repeal (or at least modify) the Affordable Care Act (ACA) won control of the House, Senate and Presidency. Health care stocks initially reacted positively, outperforming the S&P 500 as measured by the health care ETF (XLV), but have since declined creating an interesting opportunity in our view. For example, according to a recent note by Morningstar’s Damien Conover:

“If the ACA were repealed… [it] is largely a net neutral to the healthcare sector, with the drug, biotech, and insurance industries slightly benefiting…”

A key consideration is the expected positive benefits to drug companies. Pharmaceuticals is Johnson & Johnson’s largest segment, and reduced industry fees and profit restrictions could be good news for JNJ.

Prior to the election, one of JNJ’s policies has been the

“Successful implementation of the health coverage expansions of the Affordable Care Act to reach as many uninsured people as possible and to ensure that new insurance coverage continues to provide adequate access to Johnson & Johnson products.”

However, potential upcoming changes to the law create uncertainly. Similarly, the company writes in its annual report:

U.S. government agencies continue to implement the extensive requirements of the Patient Protection and Affordable Care Act (the "ACA"). These have both positive and negative impacts on the U.S. healthcare industry with much remaining uncertain as to how various provisions of the ACA will ultimately affect the industry.

And JNJ likely now faces more uncertainty related to the ACA with both the legislative and executive branches of the US federal government under the control of the same party.

Risks:

For starters, Johnson & Johnson faces lower risk than other healthcare companies in some sense because it is the largest and most diverse healthcare company in the world. This diversification and financial wherewithal decreases risk relative to peers.

However, in addition to the impacts of the ACA, JNJ faces other risks worth considering. For example, JNJ remains the subject of a variety of lawsuits which could have a material negative impact. According to the company’s annual report:

“Johnson & Johnson and certain of its subsidiaries are involved in various lawsuits and claims regarding product liability, intellectual property, commercial and other matters; governmental investigations; and other legal proceedings.”

Also worth noting, JNJ faces constantly increasing pricing pressure. JNJ notes the following in its annual report:

“The Company is aware that its products are used in an environment where, for more than a decade, policymakers, consumers and businesses have expressed concerns about the rising cost of health care.”

Further, competition is increasingly hostile according to JNJ:

“The Company also operates in an environment increasingly hostile to intellectual property rights. Firms have filed Abbreviated New Drug Applications or Biosimilar Biological Product Applications with the FDA or otherwise challenged the coverage and/or validity of the Company's patents, seeking to market generic or biosimilar forms of many of the Company’s key pharmaceutical products prior to expiration of the applicable patents covering those products.”

Also worth noting, JNJ has over $40 billion in cash on its balance sheet which could be used for acquisition of changes to the ACA create more shakeup in the industry.

Conclusion:

Overall, Johnson & Johnson is an attractive dividend powerhouse with a reasonable valuation and continued growth opportunities ahead. As long-term investors, we are not in the business of market-timing, and we continue to own JNJ in our Disciplined Growth and Income Equity portfolios. Despite the risks described previously, we believe Johnson & Johnson has less risk than other healthcare companies, and we look forward to continued dividend growth and stock price appreciation in the years ahead.