Following the results of the US elections on November 8th, there have been some clear market winners and losers. In this third installment of “Ranking the Best and Worst” (the previous two covered Big Dividend BDCs and Big Dividend REITs), we rank the post-election performance of the thirty Dow Jones stocks, offer explanations for those that have diverged, and conclude with our views on the top Dow Jones stocks worth considering.

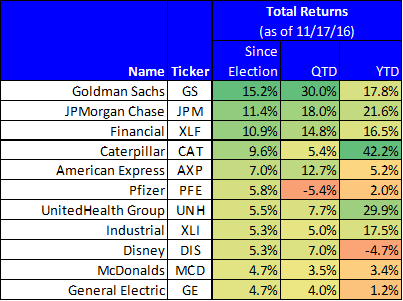

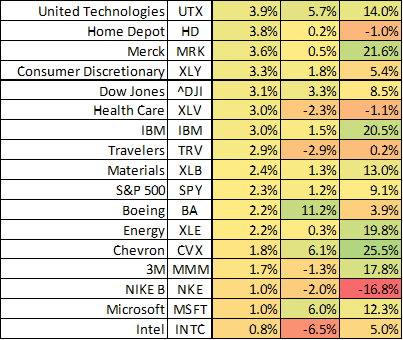

For starters, the following chart shows the recent total returns (dividends plus price appreciation) for the 30 stocks included in the Dow Jones (for reference, we’ve also included sector ETFs in the table).

Not surprisingly, four of the five best performers since the election are Financials (GS, JPM, XLF and AXP). This makes sense considering the US president-elect is expected to boost the economy with more spending, less regulation and increased inflation. This will likely lead to more rapidly increasing interest rates, higher net interest margins for banks, and more profits for Goldman Sachs, JP Morgan and American Express (and that’s exactly why those stocks rose).

The other top performer, Caterpillar (CAT), is an industrial company that will also benefit from more growth. And Caterpillar is exactly the type of company that Trump likes as we wrote back in March: Trump to Attack Amazon, Boost Caterpillar. And as expected, that is exactly how the market reacted to the election results, as shown in the following chart (i.e. on November 9th Caterpillar rose sharply and Amazon fell).

Also not surprisingly, the worst performers since the election are the big-dividend, low-volatility, interest rate sensitive stocks that investors often “hide” in when they’re afraid economic growth will be slow or non-existent (as was the case when it seemed likely Clinton would win). Specifically, the worst performer, DuPont (DFT), is a big-dividend REIT that is sensitive to interest rates due to its use of debt and because investors often use REITs as a fixed-income substitute when interest rates are low. The Utilities ETF (XLU) is also a big-dividend, low volatility security that got clobbered after the election. The story is largely the same with big-dividend, low volatility, global, non-cyclicals like Procter & Gamble (PG) and Coke (KO).

Which Dow Stocks to Consider Now?

The market reacts quickly to new information, and we generally believe it’s a bad idea to blindly chase after the sectors and stocks that have already reacted very positively to the election results. Instead, we take a contrarian view, and often prefer the stocks that have recently underperformed. We also like Dow stocks with above average dividends because that can be a signal from management that the company is financially healthy and they expect the price to rise (which would bring the dividend yield to a more normal level). For example, a preliminary screen of the 30 stocks in the above table draws our attention to names like Apple, Microsoft and Verizon because they all offer above average dividends and they have underperformed the rest of the market recently.

However, we always believe fundamental analysis should be at the core of your investment decisions, and you can review the 7 Dow Jones stocks we own here. And of course, always remember to keep your investment portfolio diversified across market sectors (i.e. try to own a couple quality stocks in each market sector) so when the next market surprise occurs you’re not left holding only the losers and missing out on the big winners.