As many investors continue to lean into the notion that interest rate cuts are coming, the fed increasingly signals they’re not. Here is a look at how Growth Stocks (beloved by an entire generation of newish investors) have historically performed in different interest rate environments, plus 3 pitfalls for concerned market participants to avoid.

Interest Rates Matter (Growth Vs. Value):

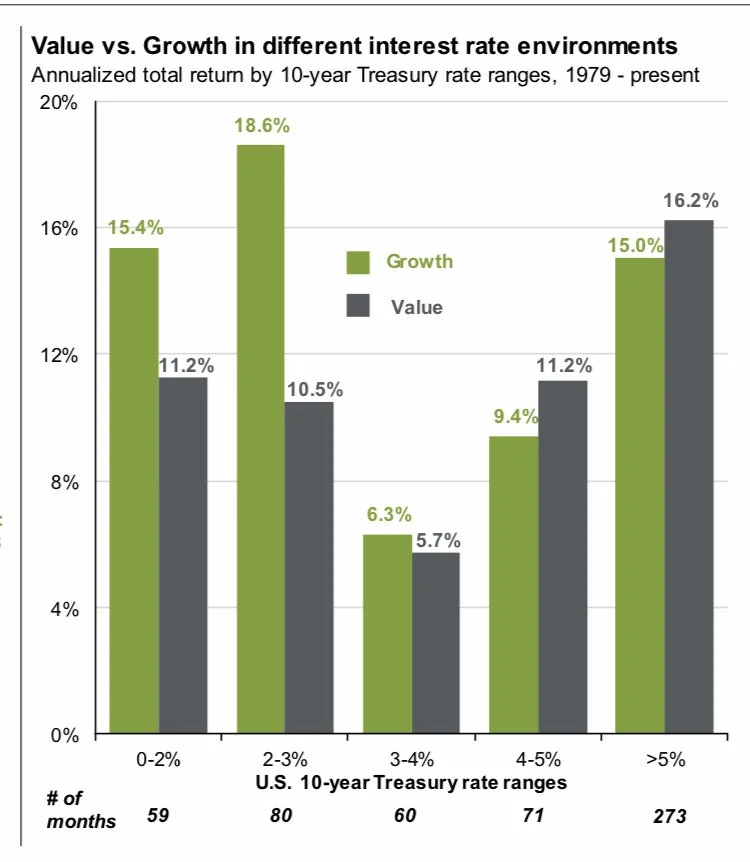

As you can see in the following chart, growth stocks historically perform better when rates are low, and value stocks when rates are high. For reference, the curent yield on the 10-year treasury is 4.63% (which puts us clearly in a value-dominated interest rate bucket, per the graph below).

But before you go upending your entire investment portfolio, here are 3 pitfalls to avoid…

1. Don’t Count on Growth Stocks to Dominate Forever:

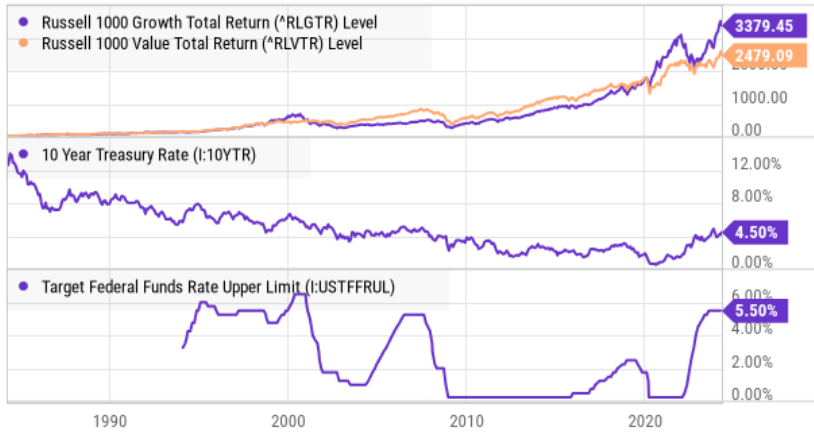

There is an entire generation of investors, that started sometime after the great financial crisis (‘08-’09), that is nearly 100% accustomed to believing growth stocks are simply better performers than value stocks..

However, the fed’s ultra-dovish (easy) low-interest-rate policies during that time period probably have a lot to do with the dominance of growth stocks over value (as you can infer from the chart above). Specifically, low rates are designed to spur the economy, particularly growth stocks (because it makes it less expensive to borrow money to fund growth when rates are low). So with rate now firmly higher, you may want to view your investments through that lens.

2. Not All Value Stocks are Created Equally:

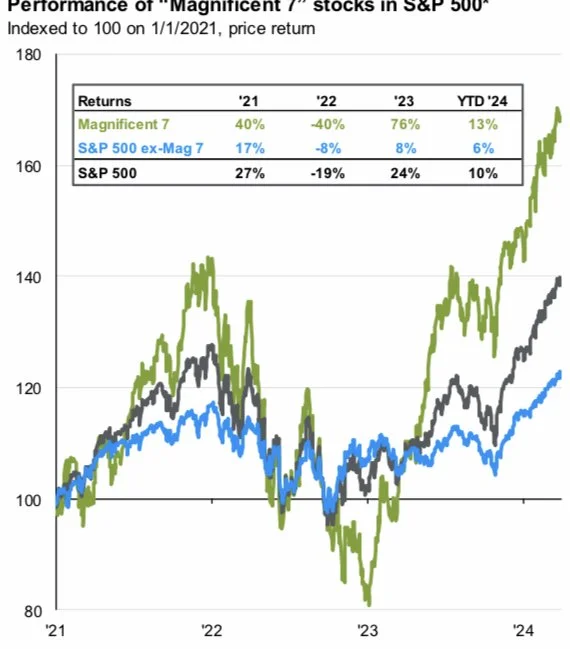

Some popular growth stocks are actually value stocks, and some are actually crap. For example, some of the popular mega cap stocks (known for high-growth) are actually value stocks based on their low valuations relative to their growth (Google and Meta come to mind). So just because mega caps (such as the “Magnificent 7”) have been so dominant, that doesn’t mean they’re all about to crash (or even pullback hard).

Whereas some popular growth stocks from across multiple market capitalizations (the ones with high revenue growth, but no profits and less-clear societal value) are actually crap (especially as higher interest rates increasingly pressure their cost to even exist).

The point here is to be selective when you invest in growth and value stocks in the current interest rate environment.

3. Don’t Lose Sight of Your Long-Term Goals:

Just because interest rates are higher, don’t going running for the hills as if the sky were falling. The truth is the economy is still relatively strong, and I personally am not willing to bet against the long-term success of the American people (and the global population for that matter).

The worst thing you could do is to allow some media fearmongers to frighten you into selling all your stocks and hiding out in cash because in the years and decades ahead, the economy (and the stocks market) are still going much higher, and (depending on your goals) you don’t want to miss out on that powerful long-term compound growth!