From a psychological standpoint, investors hate volatility more than they love price gains. But in reality, short and mid-term volatility can be an investor’s absolute best friend. Why? Because fear creates opportunity. Here are four examples, including two stocks I own that have dramatically rebounded in the last 2-3 years, and two more stocks I own that could dramatically rebound higher in the next 2-3 years.

For some background, according to Psychology Today:

“The idea of loss aversion—that, to an irrational degree, individuals avoid losses more than they pursue gains—has been influential in the field of behavioral finance. It has been imputed to drive irrational levels of risk aversion and used to explain a number of market anomalies.”

And it is this fear that can create opportunities…

Meta Platforms (META):

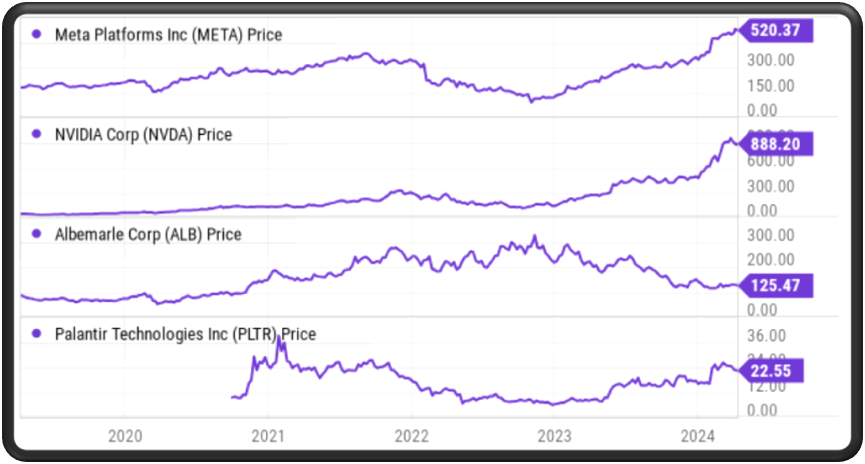

I’ve owned Meta since 2012 when it was still called Facebook. Through multiple share classes, Founder/CEO Mark Zuckerberg controls the voting rights (he basically calls all the shots), and in 2021-2022 investors believed Zuck had gone completely off the rails. He completely turned his back on the notion of profitability and was investing obscene amounts of money on the metaverse. Invetors were already afraid with the pandemic bubble starting to burst, and they put such fear-driven selling pressure on Meta shares that the stock fell more than 75%! Sadly, a lot of investors got caught up the fear, sold on the way down (or near the bottom) and missed out on the subsequent MONSTER rebound (as you can see in the chart above).

I continued to hold my shares through the whole volatility debacle, and am now enjoying the massive gains.

Nvidia (NVDA)

If you haven’t heard about how Nvidia computer chips (GPUs) are leading the Artificial Intelligence megatrend, you are basically living under a rock. As you can see in the chart below, Nvida has posted truly incredible gains over the last year as insatiable demand for its chips have driven their price (and the price of the shares) way up (see the chart above).

You’ll also notice, Nvidia shares have been quite volatile in the past. It may be hard to see in the chart because past losses (volatility) seem so small now compared to the subsequent enormous gains. But those volatile selloffs seemed like the end of the world to many Nvidia shareholders at the time and they sadly sold on the way down (and/or near the short-term bottom) and missed out on the truly enormous long-term gains.

Looking Ahead…

Albemarle (ALB)

Albemarle is a materials company that has shifted heavily into lithium in recent years (they own world-class assets) as electric vehicle demand continues to ramp (lithium is needed for EV batteries). But like all markets, lithium is at the mercy of supply-demand volatility, and it appears we may be near a low point in the cycle (where lithium prices are temporarily depessed) and the shares of Albemarle appear to trade far below where they could be in the years ahead as supply/demand volatility stablizes.

We don’t have a working crystal ball, but we won’t be a bit surprised if Albemarle is trading dramatically higher 2-3 years from now (and we are long the shares).

Palantir (PLTR)

Wall Street HATES Palantir. But they are likely being too shortsighted and not recognizing the amazing sticky growth, increasingy profitability and massive total addressable market opportunity for this “Big Data” software company with lucrative government contracts, growing commercial clients, and now benefiting further from the artificial intelligence megatrend (clients are flocking to Palantir, and the company is winning even more business).

Nonetheless, the shares have been very volatile (see chart), but we expect this quality business will continue to grow, and we won’t be surprised to see the shares trading dramatically higher in the years ahead (long Palantir).

The Bottom Line:

Investors hate volatility, and it’s well known to cause pyschological wealth-destroying mistakes. But if you are brave enough to stay focused on the long-term, volatility can be an investor’s best friend!

*Be smart people. Stay focused on your long-term goals.