As the Fed continues to fret over inflation, individual businesses continue to “cope” with monetary policy uncertainty. Businesses most at risk, are those that rely heavily on capital markets (either borrowing money or issuing shares) because money policy tweaks can wreak havoc on these businesses (in both good and bad ways). Conversely, business least affected are the ones that are already quite profitable. For your consideration, here is list of 50+ top-rated PROFITABLE growth stocks as per Wall Street analysts.

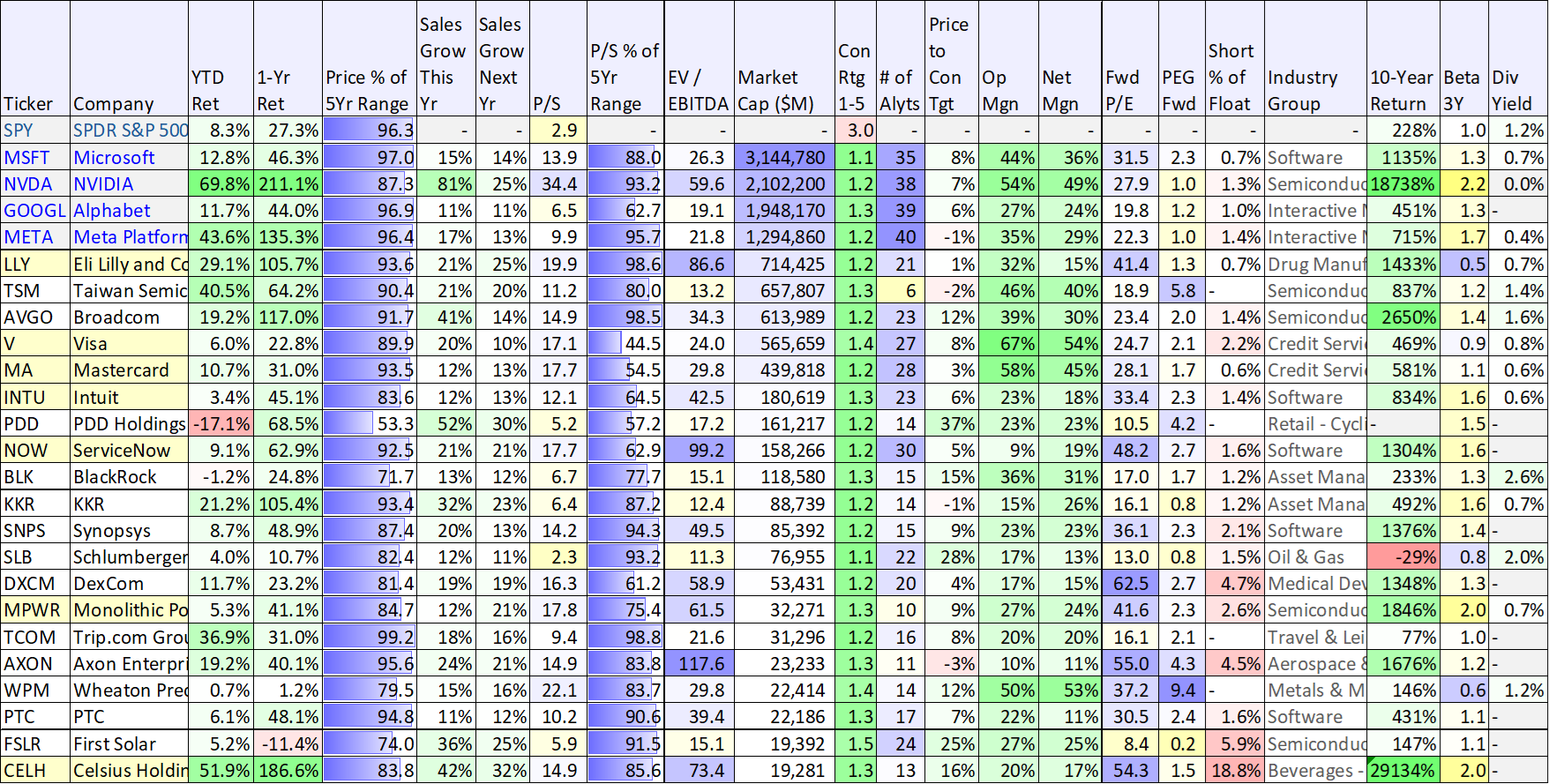

Specifically, the list includes growth stocks (minimum 10% revenue growth expectations for this fiscal year and next) that are also strongly profitable (at least 10% net profit margin) and rated “strong buy” on average by Wall Street analysts (stocks must be rated by at least 5 analysts to make the list).

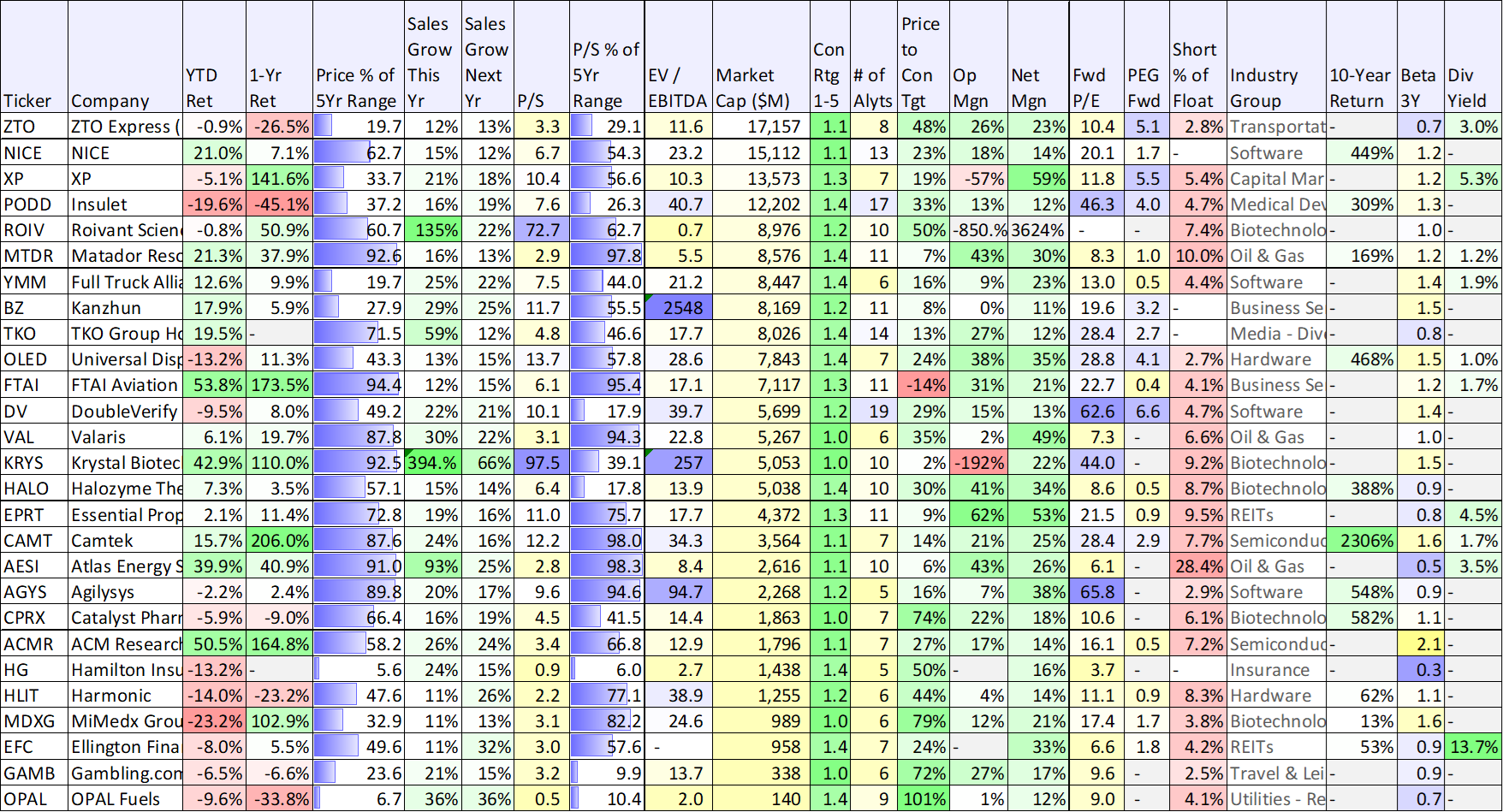

The list is sorted by market cap, so you can see the mega caps at the top, plus a few more top rated growth stocks that you are probably familiar with (I’ve highlighted a few “interesting” names in yellow) as you move down the list.

Lists like these can be “one'‘ great place to begin your search for attractive investment opportunities (for example, you can see which top growth stocks are trading at relatively attractive valuations), but deeper research than a simple screen is always required.

Further still, a lot of great businesses are excluded from lists like this because they don’t meet all the qualifications for one reason or another (e.g. not yet profitable, temporarily lower revenue growth, under-appreciated by Wall Street). We certainly own a good handful of top growth stocks that didn’t make this list.

And this is why it can be so important to read about ideas from multiple sources you trust when reasearching and analyzing your own personal current and future investment opportunities.

Hopefully you found this list (and this note) to be helpful.