In case you’ve been living under a rock, Artificial Intelligence (“AI”) has been hot. Beneficiaries like Nvidia and Super Micro Computer have experienced truly incredible price rallies (thereby making lots of shareholders very happy). But the reality is, AI is not the only megatrend driving the market today (it’s not even the biggest one). In this report, we countdown our top 10 growth stock rankings, and we view them through the lens of three separate long-term megatrends (that could lead shares dramatically higher for many years to come). If you are a long-term growth investor, the ideas in this report are worth considering.

The AI Megatrend:

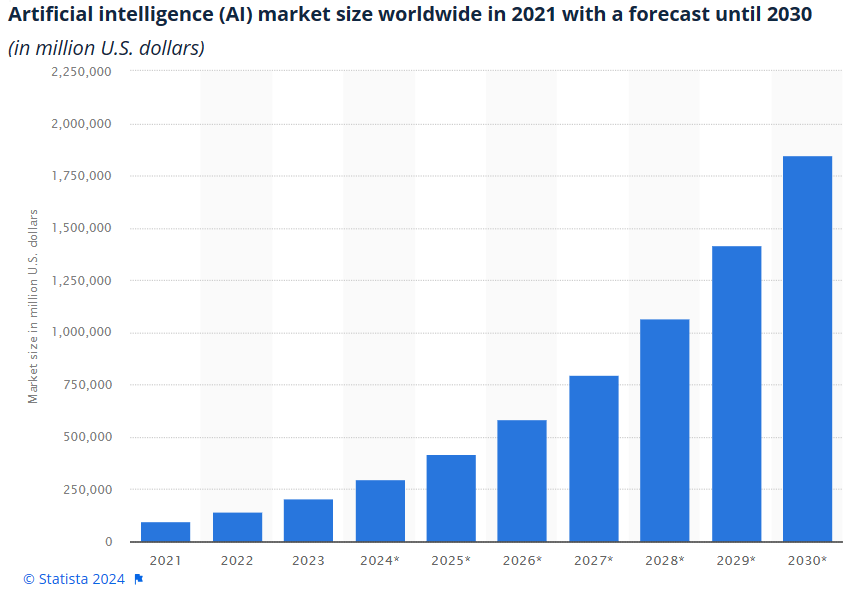

Before getting into the top 10 growth stock rankings, let’s first consider the articial intelligence megatrend. For starters, you can see an estimate (below) of just how large the AI market is expected to grow by the end of the decade.

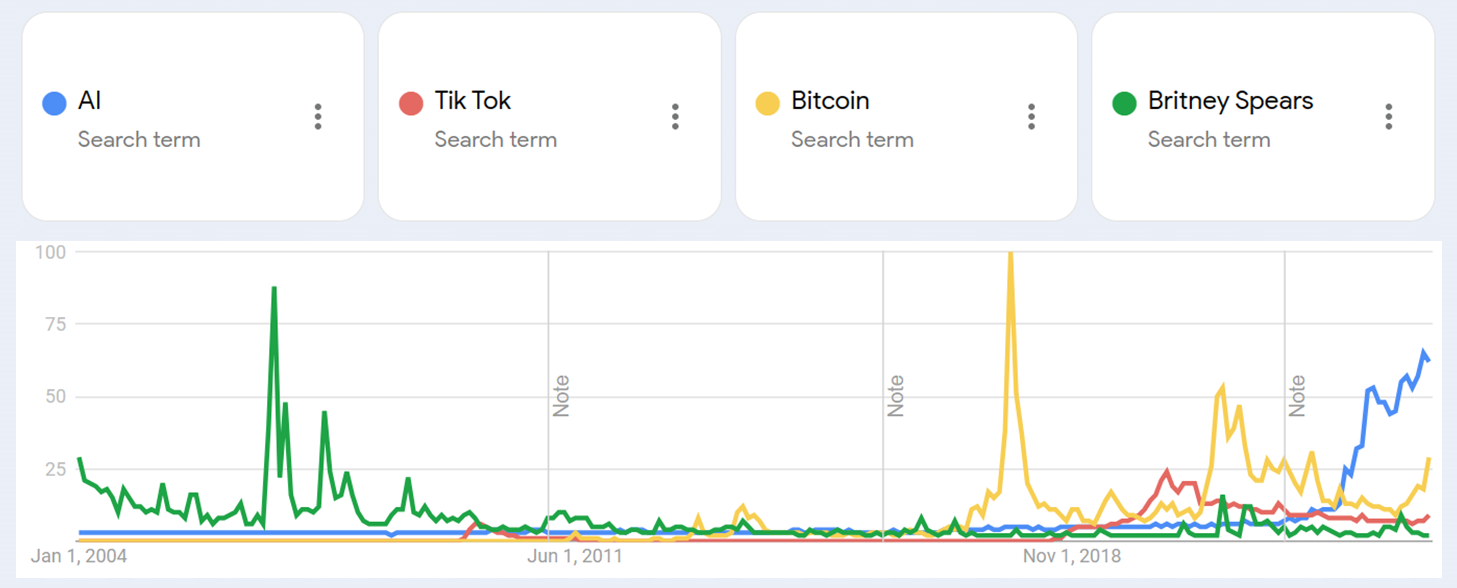

For a little more perspective, here is a look at how the term “AI” has been climbing recently among Google searches (and as compared to a few historical search terms)

In our view, AI is a much bigger deal than the other comparative search terms in the chart above, and here is what Nvidia (NVDA) CEO Jensen Huang had to say about it at a Microsoft (MSFT) Ignite conference in November 2023:

“Generative AI is the single most significant platform transition in computing history… In the last 40 years, nothing has been this big. It’s bigger than PC, it’s bigger than mobile, and it’s gonna be bigger than the internet, by far.”

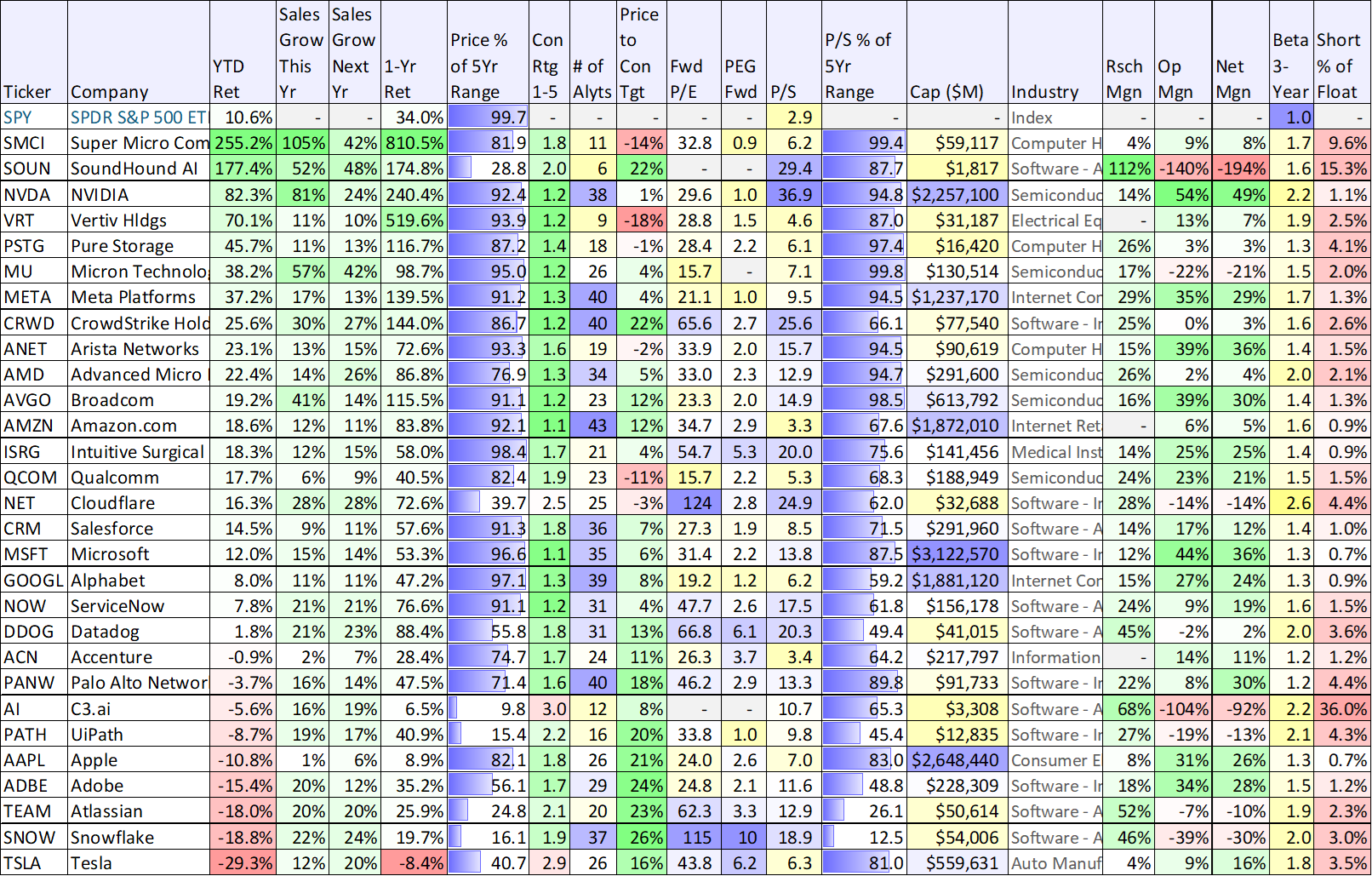

And for a little more perspective, here is some data on the recent performance of a variety of top AI stocks (you likely recognize many of the names in this table.

Data as of market close 3/28/24 (source: StockRover)

Top 10 Growth Stocks:

So with that backdrop in mind, let’s get into our top 10 growth stocks, beginning with #10, a stock benefiting big-time from AI.

10. Vertiv Holdings (VRT)

Vertiv provides digital infrastructure technology for data centers. And it continues to be an enormous AI beneficiary as data centers are where the “cloud data” powering AI is actually stored. In its most recent quarterly earnings presentation, the company explained that they are seeing:

“Continued signs that AI-related demand will provide a tailwind on pipeline and sales in 2024+. [And they] Continue to invest in capacity expansion across liquid cooling, thermal, UPS, switchgear, busbar and Modular Solutions to accommodate AI driven demand growth.”

With a healty 6.7% net profit margin, double-digit forward sales growth and trading at 4.7x sales (TTM) (not to mention a 1.5x forward PEG), Vertiv remains an attractive healthy growth story courtesy of the secular AI trend that is still just getting started.

9. Snowflake (SNOW)

Snowflake is a “big data” company, and without big data the explosive growth in AI (that the market has been experiencing) would not be possible.

However, for all the hype surrounding this big-data cloud company, the shares have been a disappointment (so far). Revenues continue to scream higher, but profits scream lower and CEO Frank Slootman has just “stepped aside” (he’s now Chairman) to allow relative company newcomer (and AI expert) Sridhar Ramaswamy to take the reigns as the new CEO. We’re optimistic about the new CEO and believe it can make a lot of sense to purchase high-growth stocks benefiting from megatrends when the they’re out of favor in the market. You can read our recent detailed report on Snowflake here:

*Honorable Metnion: Zeta Global Holdings (ZETA)

We’re including Zeta as an honorable mention because it is a strong beneficiary of AI and of the insatiable demand for inceasingly efficient advertising strategies. More specifically, Zeta is a leading omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises. You can read our detailed report on Zeta here:

8. Super Micro Computer (SMCI)

You might think it odd to consider a stock that is already up 255% this year (see table above), but the valuation of this AI beneficiary is still quite attractive, trading at a forward PEG ratio (price/earnings to growth) of only 0.9x (very attractive). Super Micro makes servers to house microchips used for AI, and the company is benefiting dramatically from its long-standing symbiotic relationship with leading AI chipmaker, Nvidia (NVDA). We’ve been long shares of Super Micro since it traded in the $200’s (not too long ago) and we’re still comfortable owning some shares now even if it has crossed the $1,000 per share price. Basically, the company is benefiting from a situation where there is a lot more demand for its products than supply. The company is growing to increase supply, but still cannot keep up with demand (a good thing). You can read our previous full report on Super Micro, here:

The Interest Rate Megatrend

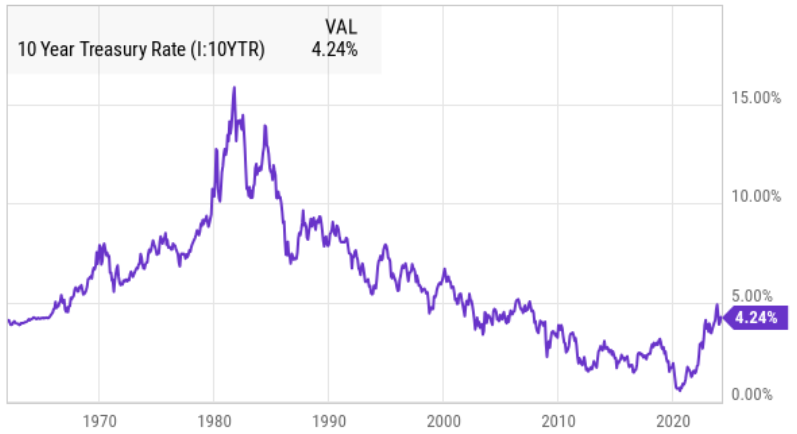

Switching back to megatends, interest rates (and monetary and fiscal policy, more generally) have a profound impact on growth stocks in particular. And the interest rate megatrend that was in place since the 1980’s (whereby interest rates kept coming down) has reverted. Interest rates are now decidedly higher, and this will absolutely impact some businesses (for example, growth stocks) dramatically more than others.

For example, after the pandemic hit in 2020, the fed almost immediately dropped interest rates to zero (and endless easy money was pumped into the economy through both monetary and fiscal policy), and the result was the share prices of unprofitable growth stocks soared to levels many of them will never achieve again. For example, check out the returns of the famous ARK Innovation ETF (ARKK) a growth and innovation fund (led by Cathie Woods) notorious for invesing in disruptive growth stocks that aren’t yet profitable.

More broadly speaking, the growth stock phenomenon following the pandemic (such as the extreme and rapid ascent of ARKK) was a magnification of the declining interest rate megatrend that was in place for decades and lifted many growth stocks higher.

What has changed now, is that easy money is evaporating (interest rates are up and the fed is unwinding its balance sheet which ballooned during the pandemic and after the 08-09 financial/housing crisis) so it becomes much easier for some stocks to grow more than others. Specifically, companies that rely on the capital markets (such as borrowing or issuing more shares) to fund growth will now face more headwinds, and big monopolistic profitable companies with ample cash flow generation can fund their own continued growth without needing to go to the capital markets.

For example, the Magnificent 6 (sorry Tesla, you’re exluded in this instance, even though we’d never count out Musk) has an insane advantage in this regard.

Top 7 Growth Stocks

Hopefully you have enjoyed the first part of this report. Our top 7 growth stocks, and the remainder of this report, is reserved for members-only, and it can be accessed here. The top 7 ideas (and one remaining megatrend) combine to form some of the most attractive growth stocks available in the market.

The Bottom Line:

Investing in top growth stocks is not for everyone (the short-term volatility can be difficult), however it can also be one of the most powerful ways to grow and compound wealth over time. In our view, the top growth stocks in this report will be further boosted by the incredible megatrends supporting them. And at the end of the day, discisiplined, goal-focused, long-term investing continues to be an extremely powerful way to succeed as an investor.