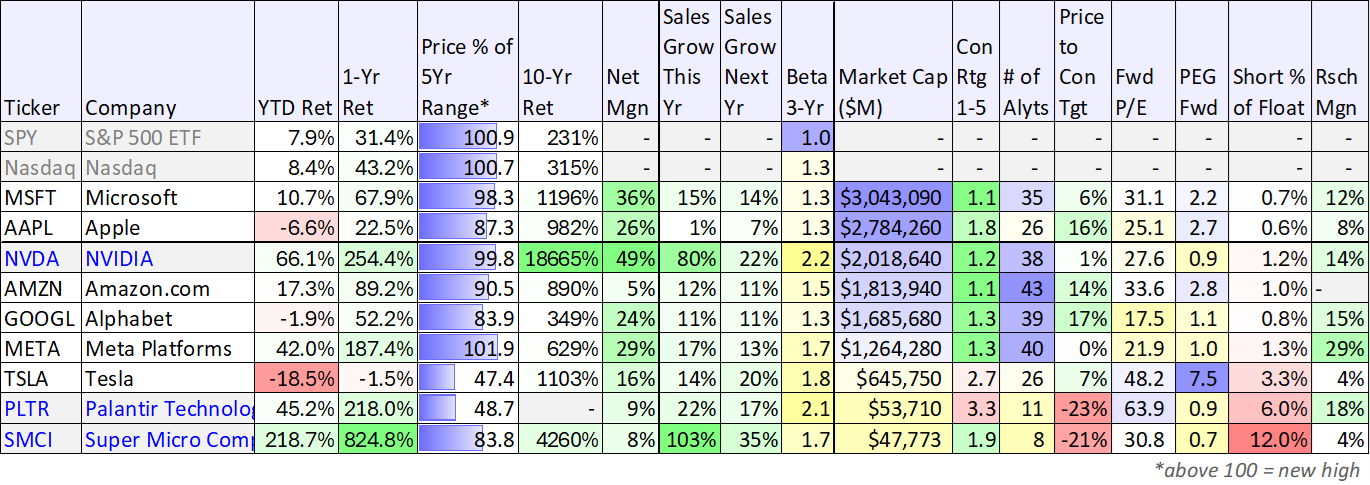

Despite the Nasdaq hitting new all-time highs this week, select disruptive growth stocks still have massive long-term upside potential, particularly certain names benefitting from the Artificial Intelligence (AI) mega trend (which, by the way, is still just getting started). In this report, we share 3 top ideas, with a special focus on “Big Data” AI stock Palantir, and then conclude with our strong opinion on investing in disruptive growth stocks at this point in the market cycle.

(data as of Friday’s close)

1. Palantir (PLTR)

Palantir shares are up over 40% this year following an outstanding quarterly earnings report in February whereby record revenue and profits were achieved (driven by demand for the company's artificial intelligence ("AI") platforms). CEO Alex Karp boasted that Palantir's results make it eligible for inclusion in the S&P 500 (a good thing). However, S&P just released its latest update for the index, and Palantir has been snubbed (Super Micro Computer (SMCI) apparently leapfrogged Palantir and received the nod instead).

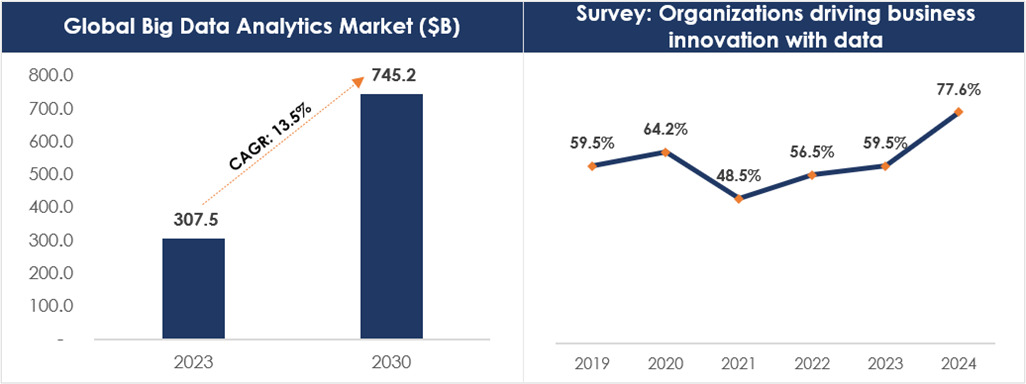

Yet despite share-price volatility, the business growth trajectory continues to accelerate (for government and commercial customers), and the company's extraordinary AIP Platform leads in a huge long-term secular market trend (i.e. Big Data Analytics).

More specifically, Palantir provides sophisticated software platforms for data analysis, leveraging advanced AI and machine learning techniques. Its software effortlessly integrates structured data like spreadsheets and unstructured data like images and social media posts into a single centralized database, enabling visualization and analysis of all information. And the long-term market opportunity continues to grow.

You can dive deep into our views on Palantir in the following full report whereby we analyze the company’s business model, market opportunity, financials, valuation, risks, and then conclude with our strong opinion on why it’s such an impressive business.

2. Nvidia (NVDA)

Jensen Huang, the CEO of Nvidia and godfather of AI, will deliver his live keynote at Nvidia’s GTC Presentation (stands for “GPU Technology Conference”) on March 18th, and it will create another opportunity to impress the market yet again (watch the teaser video here). To the dismay of conservative investors, the disruptive nature of Nvidia’s GPU chips has been so extraordinary that the shares keep climbing higher (+250% over the last year, and +2,000% over the last 5 years), yet the valuation (for example PEG ratio) remains attractively low. Nvidia shares can be extraordinarily volatile (they’ve fallen 55% or more from their all-time highs four times since 2000), but the long-term trend remains sharply higher as Nvidia leads in AI and the big-data digital revolution.

3. Super Micro Computer (SMCI)

Super Micro Computer makes servers and other hardware that houses semiconductor chips from many customers, and Nvidia is one of their biggest. SMCI shares are up +222% this year (and +837% over the last 1-year) as explosive growth in AI data is driving the business extraordinarily higher. And most recently, S&P announced Super Micro is being added to the S&P 500 index (a good thing for the shares that may send more short sellers running).

What’s more, SMCI has the capacity (and business relationships) to continue growing dramatically higher, as CEO Charles Liang explained on the January quarterly earnings call:

The exciting news is that, finally, we are entering an accelerating demand phase now from many more customer wins…

I feel very confident that this AI boom will continue for another many quarters, if not many years. And together with the related inferencing and other computing ecosystem requirements, demand can last for even many decades to come, we may call this an AI revolution.

Please note: members may access the full version of this report here:

(we currently own 6 of the 7 stocks in the report)

The Bottom Line:

Investing in disruptive high-growth stocks at this point in the market cycle (i.e. when the Nasdaq is at all-time highs) may seem like a bad idea to some investors (and low volatility investors should absolutely stay away!).

However, if you have a long-term time horizon (many years) then short and mid-term volatility should not bother you as much. Yes, these companies may suffer volatile price pullbacks at some point in the future. However, the companies listed above have tremendous long-term growth trajectory thanks to the disruptive mega-trends they are benefiting from (namely, big data and artificial intelligence).

We currently own all 3 of the stocks in this report within our Blue Harbinger Disciplined Growth Portfolio and have no intention of selling out of our positions any time soon.