If you like to purchase top businesses when their stocks are out of favor with the market, you may find this report interesting. We share data on 100 hated stocks divided into four very different groups: (1) Top Growth Stocks, Down Big; (2) Dividend Growth Stocks, On Sale; (3) Pandemic-Era IPOs, Now; (4) Big Yield CEFs, Discounted Prices. We then select (and review) one particularly attractive opportunity from each of the four groups. We conclude with a critically important takeaway for investors to keep in mind.

25 Top Growth Stocks, Down Big

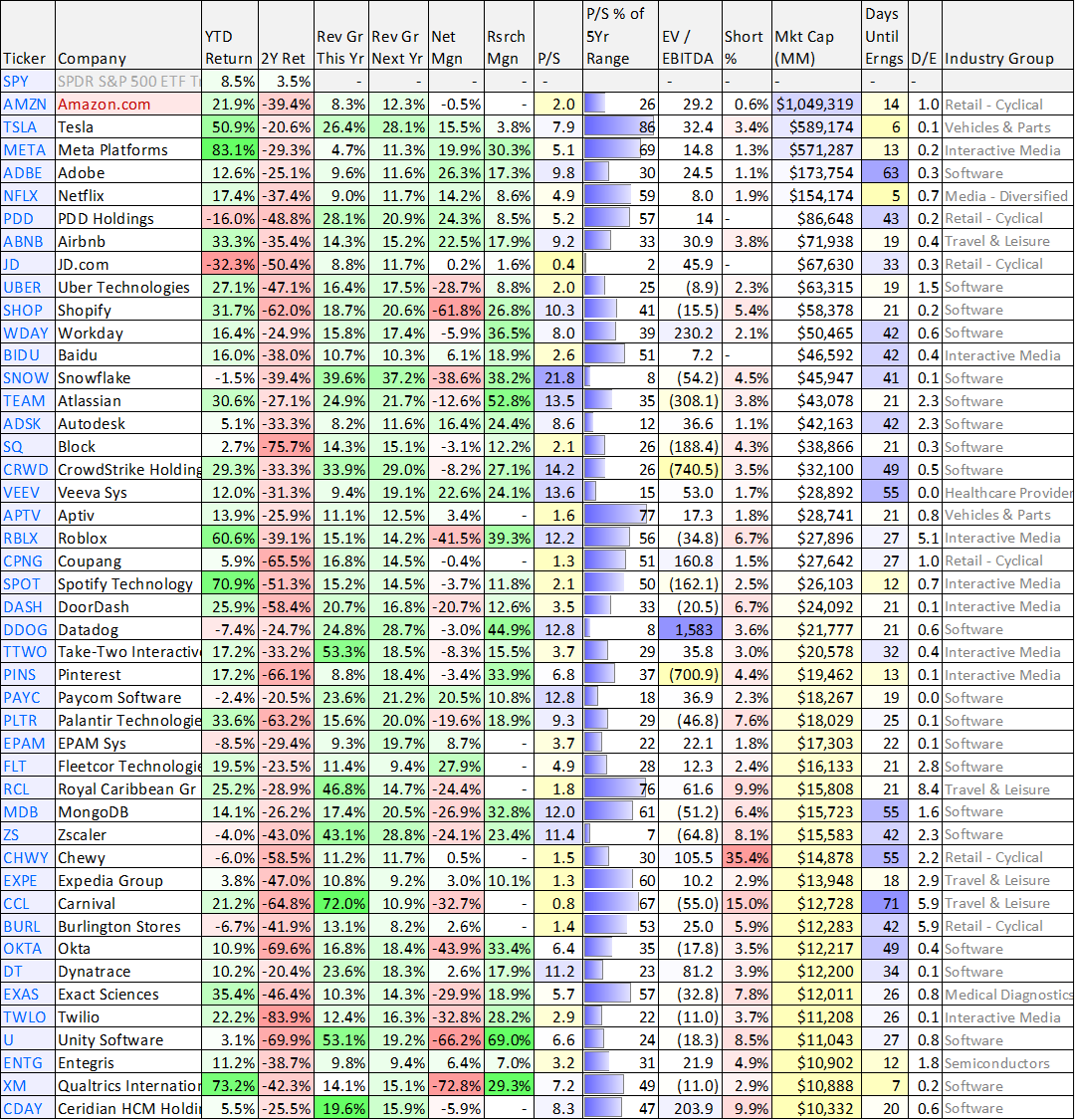

“I told you so” is the phrase that comes to mind for many value investors as growth stocks have gotten absolutely slaughtered since the heights of the pandemic. Specifically, a lot of the high revenue growth stocks that soared the most in 2020-2021 have now fallen the hardest (as stimulus and lockdowns have ended, and the economy is left with the giant sucking sound of high inflation and increased interest rates). To give you a little perspective, the following table shows 25 high growth stocks (i.e. large caps with expected revenue growth rates of at least 8% this year and next) that are down big (i.e. “hated” by the market). Specifically, you can see just how bad performance has been by reviewing the 2-year total return column (i.e. lots of ugly red!). The table is sorted by market cap.

There are a lot of other useful metrics in the above table too, such as current price-to-sales ratios as a percent of their 5-year range (i.e. almost all of these names are in the bottom 50% of their valuation range), as well as recent performance, short interest and more. We also find the “research margin” column very interesting considering a lot of these companies are spending a very high portion of their revenues on “research & development” in order to keep innovating and growing their businesses. And while it’s tempting to dismiss all these stocks as losers (most of them aren’t even profitable, as per the net margin column), a few of them are very attractive. We review one example below.

1. Amazon (AMZN)

Amazon (which is down ~40% over the last two years) has a long history of frustrating financial analysts by not generating enough profits (i.e. they recently posted a loss, as per the net margin column, above). However, as the company’s newly released shareholder letter conveys once again:

“We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions.”

For some perspective, Amazon continues to generate the majority of its revenue from people buying things through its website. However, has dramatically better margins (and much higher growth rates) in its Amazon Web Services business (AWS is the leader in cloud, ahead of even Microsoft and Google) and in its burgeoning advertising business (Amazon is only just beginning to use its massive user data to sell very lucrative advertisements). Further still, Amazon’s massive research budget (i.e. the research margin of ~14% is on a truly enormous revenue base) will help the company continue to grow rapidly into new market opportunities, as it has done successfully many times in the past (remember, it started out as an online book seller).

With the shares still dramatically below their all time high, and the price-to-sales multiple near the lower end of the range (see table above), Amazon is a very attractive investment right now. We currently own shares in our Blue Harbinger Disciplined Growth Portfolio, and we previously wrote about it in great detail here.

25 Dividend-Growth Stocks, On Sale

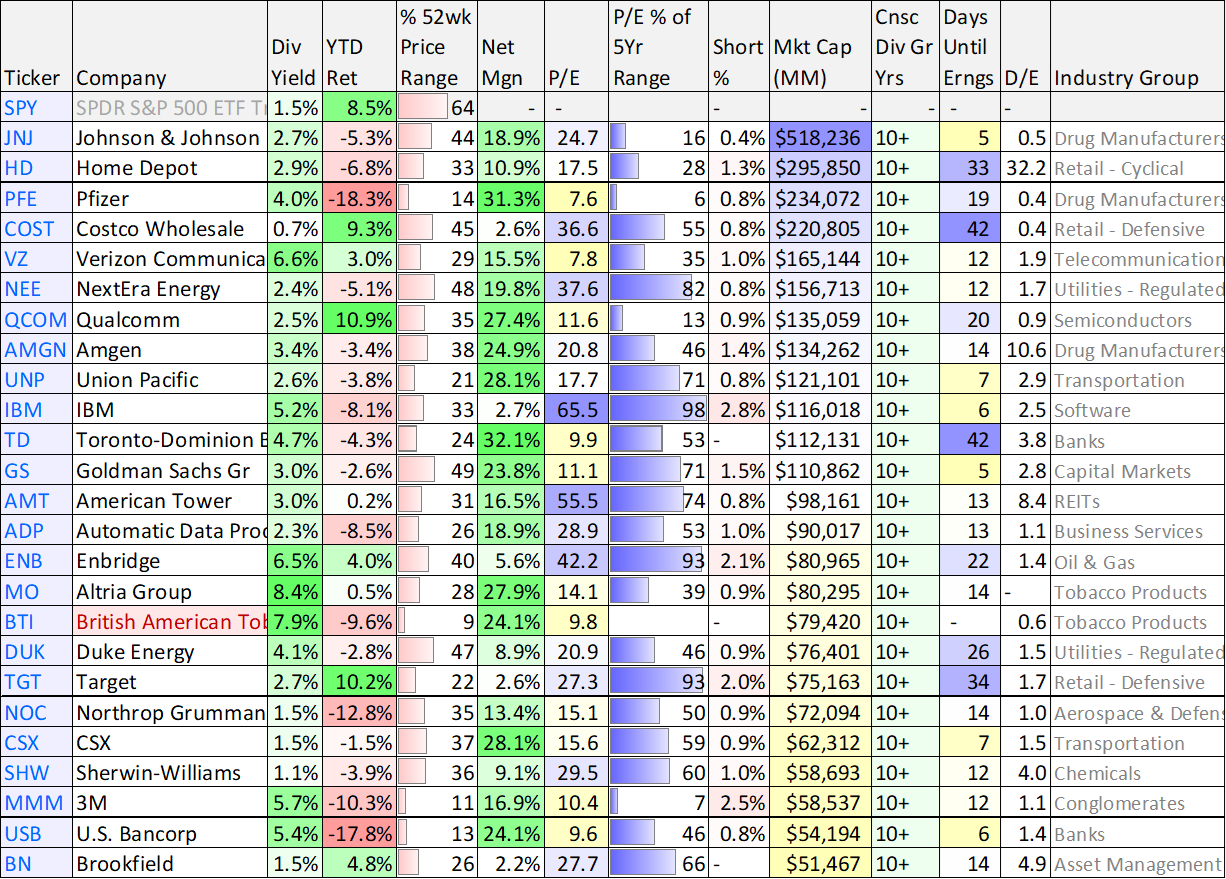

Switching gears to “dividend-growth” stocks, our next table shows 25 companies that have increased their dividend for at least 10 years in a row, but are still trading well below their 52-week highs (as per the “% of 52wk Price Range” column). Further, some of them are extremely attractive in terms of valuation. For example, you can see in the table below where each company’s current price-to-earnings ratio sits relative to its 5-year range. Now obviously there is a lot more to valuing a company beyond simply share price movements and P/E ratios, but it can be a good starting point (for identifying companies worth further research) and there is a lot of additional data in the table too.

Download an extended spreadsheet version of this table here.

And with the economy potentially heading into an ugly recession, a lot of investors sleep well at night owning companies with a track record of paying big growing dividends. And among dividend-growth stock leaders, the ones in the table above are down big (relative to their 52-week highs) and some present attractive contrarian opportunities, such as the one we describe below.

2. British American Tobacco (BTI), Yield: 7.9%

British American Tobacco is a UK-based company that sells tobacco and nicotine products to consumers worldwide. It trades in the US as an American Depositry Receipt (“ADR”), and its largest operating segment by geography is the United States. We recently wrote up BTI in detail (for our members) in this full report, but we’re sharing a few highlights below.

For starters, BTI is very profitable, but it doesn’t have huge long-term growth potential because the industry is viewed very negatively by many consumers and government regulators. Nonetheless, BTI has very high profit margins, high cash flows, a very well covered dividend, and a very wide moat (that gives it competitive advantages). Further, we view BTI as particularly compelling right now from a valuation standpoint. Specifically, the shares have significant upside from multiple expansion (i.e. the P/E should be higher).

If you are looking for a steady big-dividend grower, that also has share price appreciation potential, British American Tobacco is absolutely worth considering. We currently own shares in our High Income NOW Portfolio.

25 Top Pandemic-Era IPOs, Now

As if top growth stocks in general have not been hated enough, pandemic era Initial Public Offerings (i.e. a special breed of top growth stocks) have been absolutely abominable in terms of price performance. On one hand, if you are the company (or investment banker) that raised capital by issuing public shares when the market valuation was extremely high (i.e. during the pandemic bubble) then you did a good job (because if these companies IPO’d now—they’d raise a lot less money). But if you invested in these companies when they first became public, you are probably not happy at all.

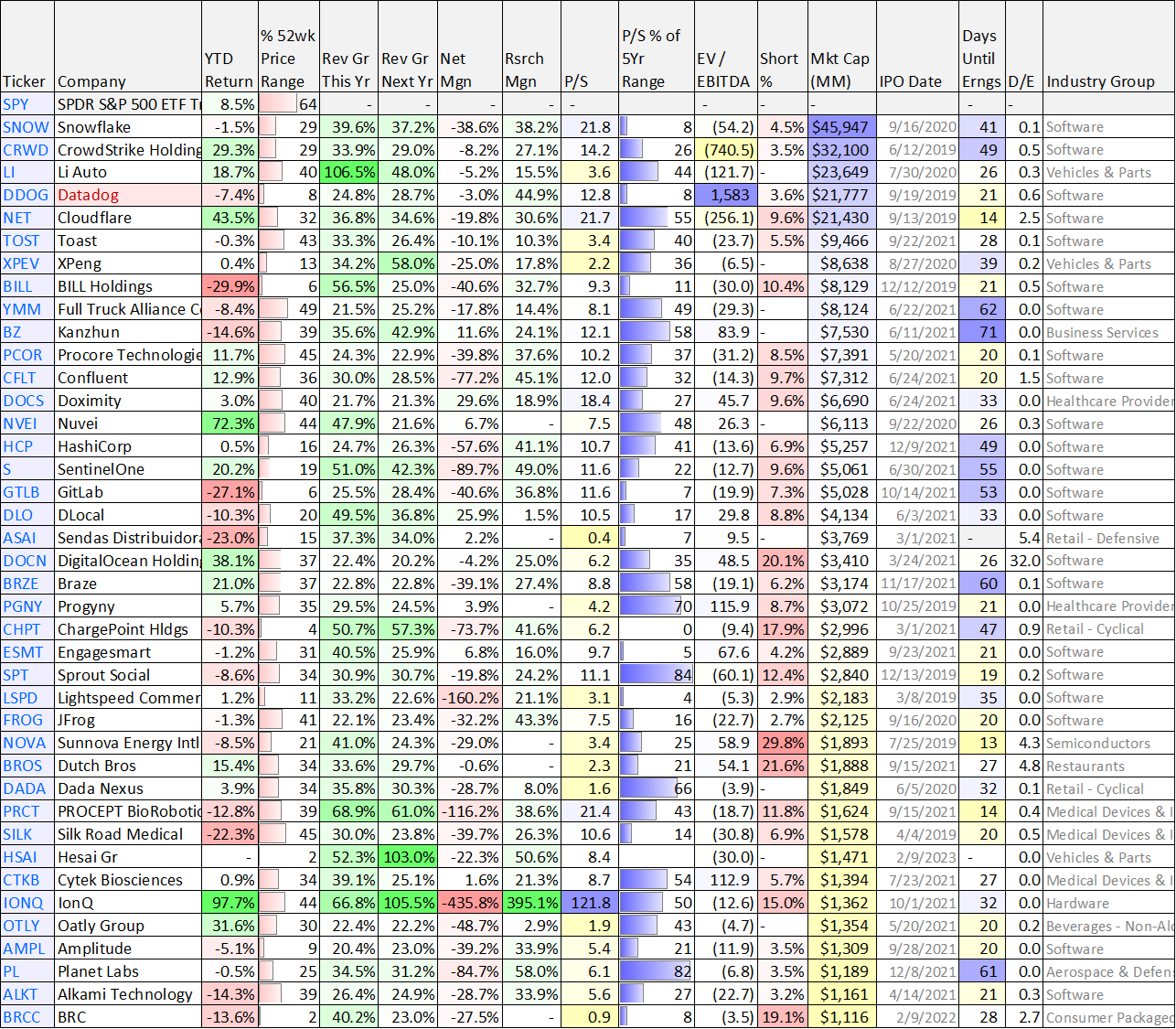

The table below includes pandemic-era IPOs (we’re using stocks with an IPO date of 2019 or later), and we required a revenue growth rate of at least 20% for this year and next (this is an extremely high growth rate, considerably higher than our earlier top growth stock table). And as you can see, performance has been absolutely terrible considering these stocks sit near the bottom of their 52-week price ranges.

You’ll note the table also includes a variety interesting metrics (such as short interest and price-to-sales valuation as compared to their 5-year range). You may also recognize many of the stocks in this table (considering they were extremely loved 1-2 year ago, but now extremely hated and out-of-favor with the market).

However, some of the names in the above list are actually very attractive businesses (especially after the steep price declines), such as the one we describe below.

3. Datadog (DDOG)

Datadog went public in late 2019 (right before the pandemic hit) and it enjoyed an extraordinarily strong pandemic-era run as the price soared to over $190 per share. However, that has changed dramatically as the price now sits at only ~$67 per share.

For your information, Datadog is a performance monitoring and security platform for cloud applications, and it is benefiting from the massive ongoing secular trend of digitization and data migration to the cloud. Specifically, it is a clear leader in “Application Performance Monitoring and Observability” as per Gartner’s well-respected magic quadrant industry comparisons.

Datadog continues to generate rapid revenue growth (see table above) through its sticky SaaS business which benefits from high renewal rates and ongoing “land and expand” opportunities (especially as the digital revolution and migration to the cloud is still just getting started).

However, unlike other top growth pandemic IPOs, Datadog has not rebounded much this year because it recently lowered guidance (no big deal relative to the long-term trajectory of the business) and because it is not yet profitable (Datadog continues to spend extremely heavily on Research & Development—see earlier table for research margin—which is a good thing considering the opportunities ahead).

We previously wrote up Datadog in detail at the end of last year (you can read that report here), and we just recently added shares of Datadog to out Blue Harbinger Disciplined Growth Portfolio.

25 Big-Yield CEFs, Discounted Prices

A lot of investors indiscriminately hate closed-end funds (i.e. “CEFs”) because they generally charge high fees. However, the fees can be worthwhile for some investors considering the unique nuances of CEFs (such as the potential for attractively discounted prices versus net asset values or “NAVs—a phenomenon that does not exist for ETFs and other mutual funds) and considering CEFs can deliver investment exposures that are difficult (if not impossible) for a lot of individual investors to achieve efficiently on their own (such as certain types of bonds, low cost borrowing and even various attractive private investments). Not to mention, CEFs can deliver the big distribution payments that many income-investors seek.

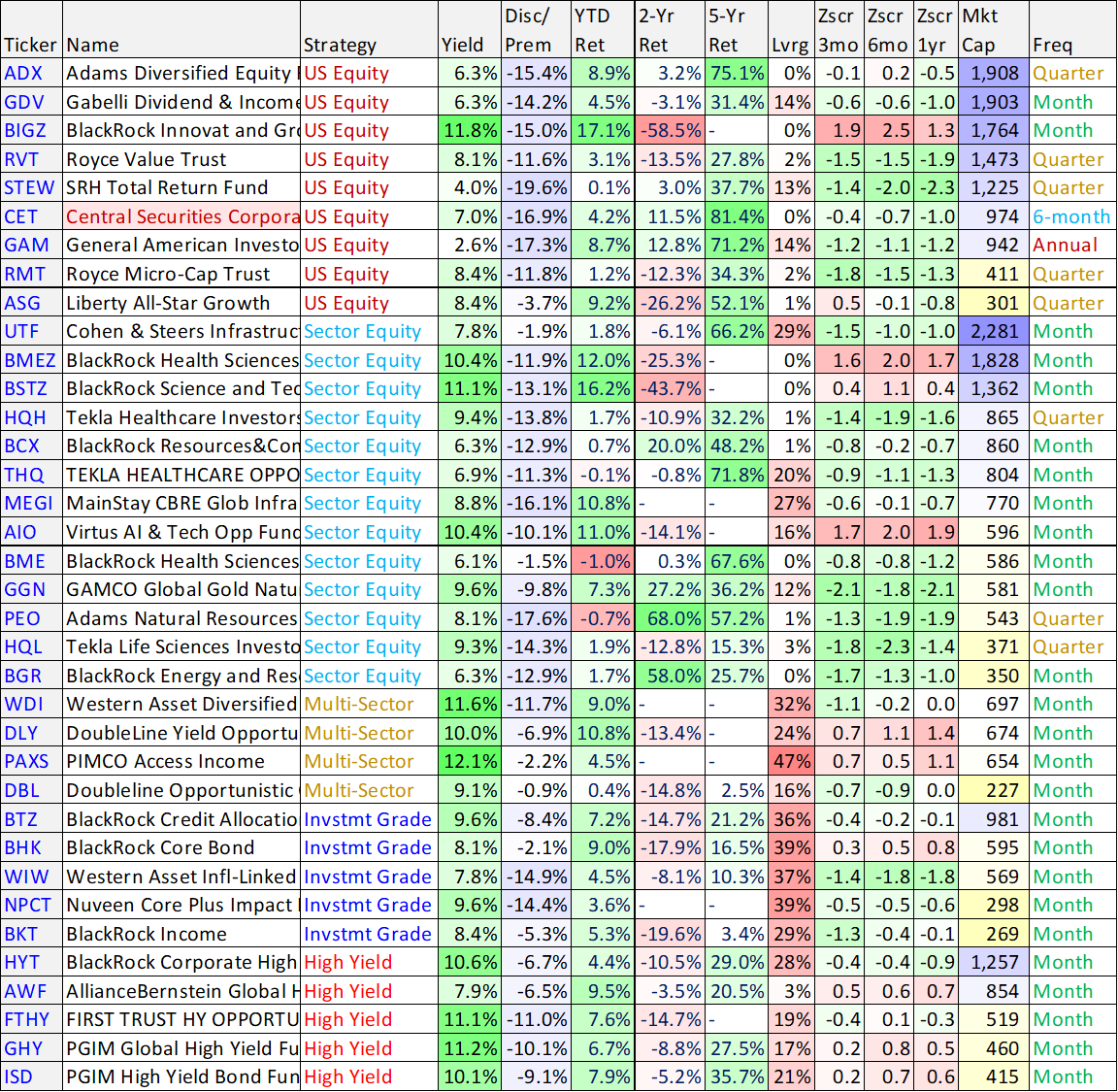

For perspective, the table below includes a list of select big-yield CEFs that currently trade at discounted prices versus NAV (as well as a variety of additional important metrics to consider). The table is sorted by strategy and then market cap.

The CEFs in the table above vary widely by strategy, but they all trade at significant discounts to NAV (see “Disc/ Prem” column). You likely recognize at least a few of your favorites in the table, as well as a few popular omissions (such as PIMCO’s many big-distribution CEFs which often trade at large price premiums to NAV). One CEF in the table that is particularly unique and attractive is Central Securities Corporation, as described below.

4. Central Securities Corp. (CET), Yield: 7.0%

Central Securities Corp (CET) is an old-school closed-end fund (it was first organized on October 1, 1929) that offers an attractive 7.0% yield and trades at a compelling 17% discount to its net asset value. We recently wrote this one up in detail for our members (you can access that report here), but we’ve included some of the important highlights below.

For starters, CET is not restricted as to the types of securities it owns (e.g., stocks, bonds), although it currently owns mostly stocks. And its largest position is a private insurance company, Plymouth Rock, at just over 22% of its net asset value.

Interestingly, Plymouth Rock is currently carried on CET’s books at a massive discount to its expected market value, so CET’s true NAV is even higher than being reported, and the discount to NAV is even bigger than being reported (especially considering the dramatic upside potential if the fund were to ever sell its stake in Plymouth Rock).

We also really appreciate CET’s low-turnover (they’re long-term investors) and prudently-concentrated strategy (they’re not a closet index fund). Not to mention, CET has a very long and consistent track record of success versus the S&P 500.

Overall, we view CET as a uniquely attractive long-term investment. Again, we recently wrote this one up in detail, and members can access that full report here.

Bottom Line: 100-Hated Stocks:

Despite macroeconomic conditions, the market continues to present attractive long-term investment opportunities, across styles. And while some investors head for the hills when things sell off, others view it as a time to be selective and contrarian. We view the four specific ideas presented in this report as compelling contrarian opportunities. And we offer many additional opportunities, that we like even more, to our members. However, at the end of the day, you need to invest only in opportunities that are right for you, based on your own personal situation. We believe disciplined, goal-focused, long-term investing will continue to be a winning strategy.