As 2024 begins, the market continues to present widely varied and dynamic investments opportunities, particularly in the growth stock space. Importantly, the macroeconomic backdrop is shifting from ultra-hawkish (i.e. the fed was aggressively hiking rates—to fight the high inflation it helped create by pumping easy money into the economy during the pandemic) to more dovish (as inflation slows and fed-funds futures now predict interest rate cuts in 2024). Without question, monetary and fiscal policies have their thumb on the scales of market performance, but not all stocks are created equally. In this report, we countdown our top 10 growth stocks for 2024, starting with #10 and finishing with our very top ideas.

Smid Cap and Short Sales Revenge:

Two common themes you will notice in this top 10 list is that the ideas are heavily concentrated in small and mid cap (“smid” cap) stocks, as well as stocks that are out of favor in the market (either performance has been very weak or the shares are heavily shorted—or both).

We believe contrarian bets on highly shorted out-of-favor stocks (particularly in the small and mid cap space) may prove particularly lucrative in 2024 (if you pick them right) as monetary policy turns more dovish (this is often the time when smid cap stocks shine).

The Magnificent 7:

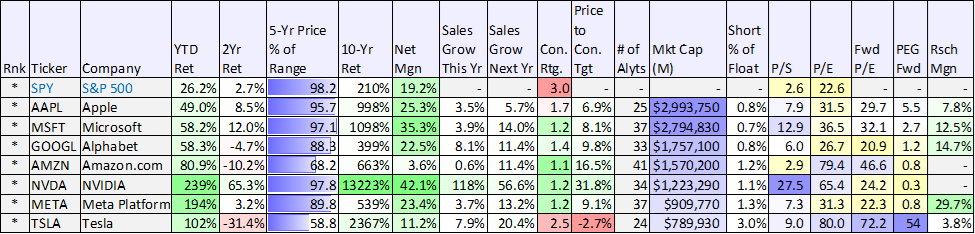

And for a little perspective, here is a look at the recent performance of mega-cap stocks (i.e. the “Magnificent 7”) which performed extraordinarily well in 2023 because they basically dominate secular trends (like the great cloud migration, internet-of-things, and the digitization of everything) and because they have the healthy profits (and cash flows) to have remained very strong and healthy a challenging increased interest-rate environment (which has hit small and mid cap stocks much harder).

data as of 12/31/2023, source: StockRover

As you can see in the table above, the 2023 returns of the Magnificent 7 were absolutely phenomenal, with 100% of them performing dramatically better than the S&P 500 (SPY). Most of the stocks sit very close to the top of their 5 year price range, while the rest of the market has largely struggled to regain the value it lost as the pandemic bubble burst (more on this later).

Worth mentioning, you can also see valuable metrics in the above table including consensus Wall Street Ratings (1 is ”strong buy,” while 5 is “strong sell”), price upside (versus price targets) and various valuation metrics (to name a few).

Rankings #10 through #6:

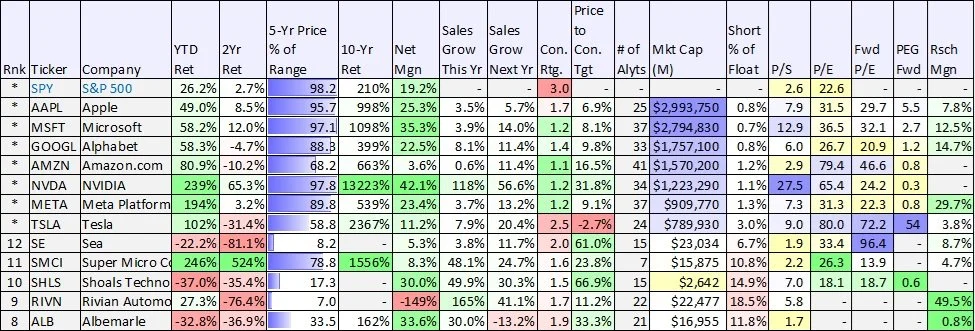

So with that backdrop in mind, let start with some data on the second tier stocks in our top 10 rankings (i.e. the names ranked #10 down to #6). For comparison purposes, you can see the same data for this group, as compared to the “Magnificent 7,” in the following table.

We’ll get into the details on each of the names on this list momentarily, but let’s first consider the high-level data.

data as of 12/31/2023, source: StockRover

As you can see, most of this first group of ranked stocks sit at prices much closer to the low end of their 5 year range (quite different than the “Magnificent 7”). Also, many of these stocks have much smaller market capitalizations and much higher levels of short interest (i.e. people betting against them). We believe this creates a nice setup for their strong rebound in 2024 as macroeconomic policies shift, and the potential for higher growth resumes (remember stock prices are generally based on forward-looking expectations, meaning the share price goes up ahead of the fundamentals—this is the opposite of economic data—which is basically almost all backward looking).

So with that information in mind, lets get into some company specifics.

Honorable Mention:

12. Sea Limited (SE)

Sea is an Internet company based out of SouthEast Asia (thus the name, SEA) and it is the only non-US company on the list (it’s headquartered in Singapore, but trades in the US).

Sea demonstrated some of the most spectacular performance you’ll ever see during the pandemic as the combination of low rates and its high fundamental revenue growth drove shares dramatically much higher.

Unfortunately for investors, when the pandemic bubble burst, Sea got hit harder than most other stocks in the market. This is when we bought shares (i.e. we initiated a position in Sea at around $38 per share in November. Our purchase price is about 1/10th of its all-time-high share price during late 2021—the height of the pandemic bubble.

Sea’s business includes:

Digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally. It offers Garena digital entertainment platform for users to access mobile and PC online games, as well as eSports operations. The company also operates Shopee e-commerce platform, a mobile-centric marketplace that provides integrated payment and logistics infrastructure and seller services. In addition, it offers SeaMoney digital financial services to individuals and businesses, including offline and online mobile wallet, and payment processing services, as well as other offerings across credit, insurtech, and digital bank services under the ShopeePay, SPayLater, SeaBank, SeaInsure, and other digital financial services brands; and payment processing services for Shopee.

As you can see in the table above, Wall Street Analysts rate Sea a “Buy” and believe the shares currently have over 60% upside.

Honorable Mention:

11. Super Micro Computer (SMCI)

A top 10 growth stock list without at least mentioning Supermicro computer would seem wrong. This company was already up huge in 2023 as it continues to benefit from the incredible growth of newly developed Artificial Intelligence (AI) technologies.

In particular, SMCI makes computer hardware that is essential for the semiconductor chips necessary for AI computing capabilities. And SMCI is special because of its very strong relationship with Nvidia (NVDA)—the leading state-of-the-art chip maker behind the lion’s share of AI right now (and likely for years to come).

You can see how well both Nvidia and SMCI have been performing in our earlier table, and we currently own shares of both.

10. Shoals Technology (SHLS)

Shoals is a hated stock. The shares are down big. Short interest is very high. And a lot of people believe the industrial solar energy solutions it provides are dramatically overhyped and overrated.

However, as you can see in our earlier table, Shoals is growing rapidly, it is very profitable and the 15 Wall Street analysts covering it rate it a “buy-to-strong-buy,” and believe the shares have 66.9% upside from here.

We own shares of Shoals (we purchased them this year), and you can review our previous write-up on the company here.

9. Rivian (RIVN)

If you have ever seen a Rivian Truck or SUV cruising down the street (or parked in a parking lot) they’re beautiful (much more attractive than Tesla’s hideous cyber truck). Furthermore, Rivian has a much higher expected revenue growth rate than Tesla (it’s a lot easier to grow when your market cap is only 2% of Tesla’s mega cap size).

Despite the high short interest, analysts rate Rivian a “buy,” and believe the shares have significant upside from here.

We recently wrote up Rivian in great detail, and you can access that full report (along with pictures of its beautiful trucks, SUVs and Amazon (AMZN) vans) here.

8. Albemarle (ALB)

If you follow the Motely Fool at fool.com (I absolutely do NOT), you’ve likely been hearing about this lithium materials company for a while. It is one of few companies in the world (and the only major US producer—for now) of lithium—used in electric vehicle batteries (for example, Teslas, Rivians and all the other EVs run on lithium batteries).

Lithium is a rare element, and demand is very high as the expected growth in electric vehicles globally is also very high in the decade ahead.

However, the market didn’t love Albemarle in 2023 as the shares fell dramatically. However, it’s an extremely profitable company already, and Wall Street rates the shares a “Buy,” and says they have 33% upside.

You can read our full report on Albemarle here.

The Top 7:

Our top 7 growth stocks are reserved for members only, and they can be accessed here. The top 7 includes a powerful list of attractive opportunities with exceptional upside price appreciation potential over the next one-year. Specifically, it includes a mix of stocks from across industries, including materials, industrials, technology and even consumer staples, to name a few. If you are looking for powerful growth stock opportunities, this list is absolutely worth considering.

The Bottom Line

Macroeconomic conditions are shifting (from hawkish to dovish) as inflation slows and the Fed is expected to reverse direction on interest rates. These conditions benefit high-growth business, some much more than others.

In this report, we have highlighted names that we believe are particularly attractive, for both company-specific and macroeconomic reasons.

However, before investing in any of these companies, you need to make sure they are consistent with your own personal investment goals. We believe disciplined, goal-focused, long-term investing will continue to be a winning strategy.