As 2024 begins, it is a fantastic time to be a big-yield investor. With the Fed’s interest rate hikes seemingly over (and potentially even about to reverse), and with so many big-yield opportunities that have become “too” out of favor, income-focused contrarians are salivating. In this report, we countdown our top 10 big-yield opportunities, including closed-end funds (“CEFs”), business development companies (“BDCs”), real estate investment trusts (“REITs”), dividend stocks and more. We also share data on hundreds of big-yield opportunities from across each of these categories (so you can compare and contrast for yourself). Let’s get right into it.

100 Big-Dividend REITs, Down Big

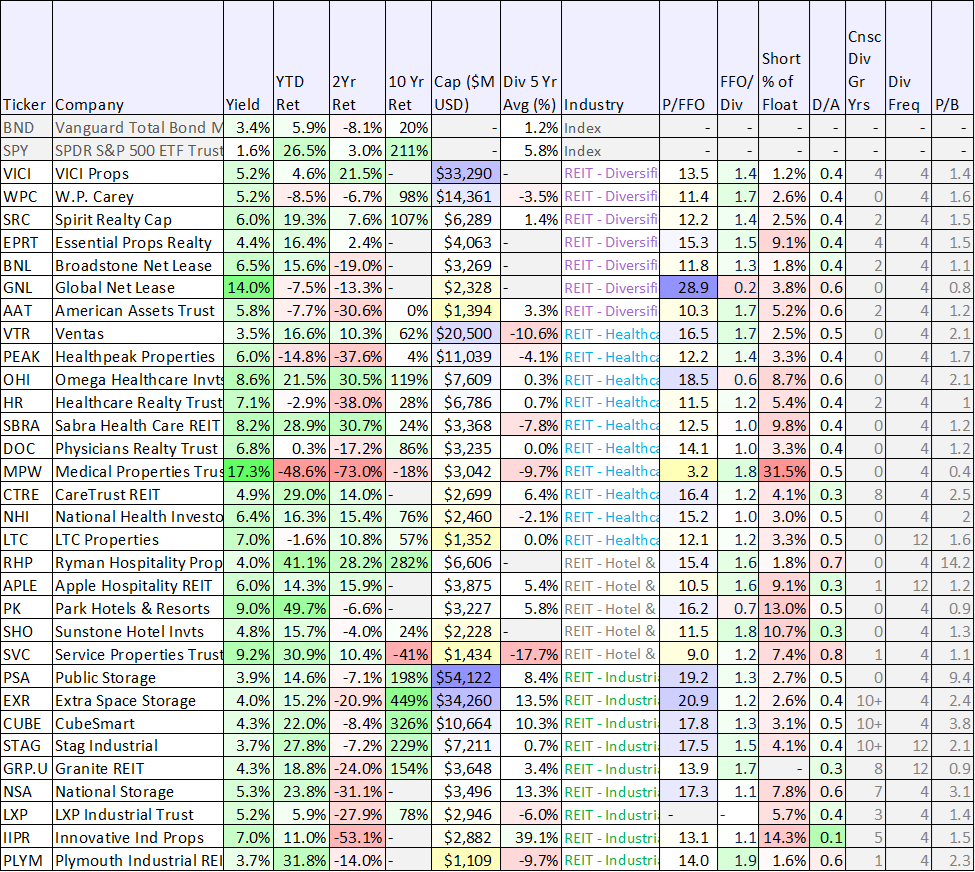

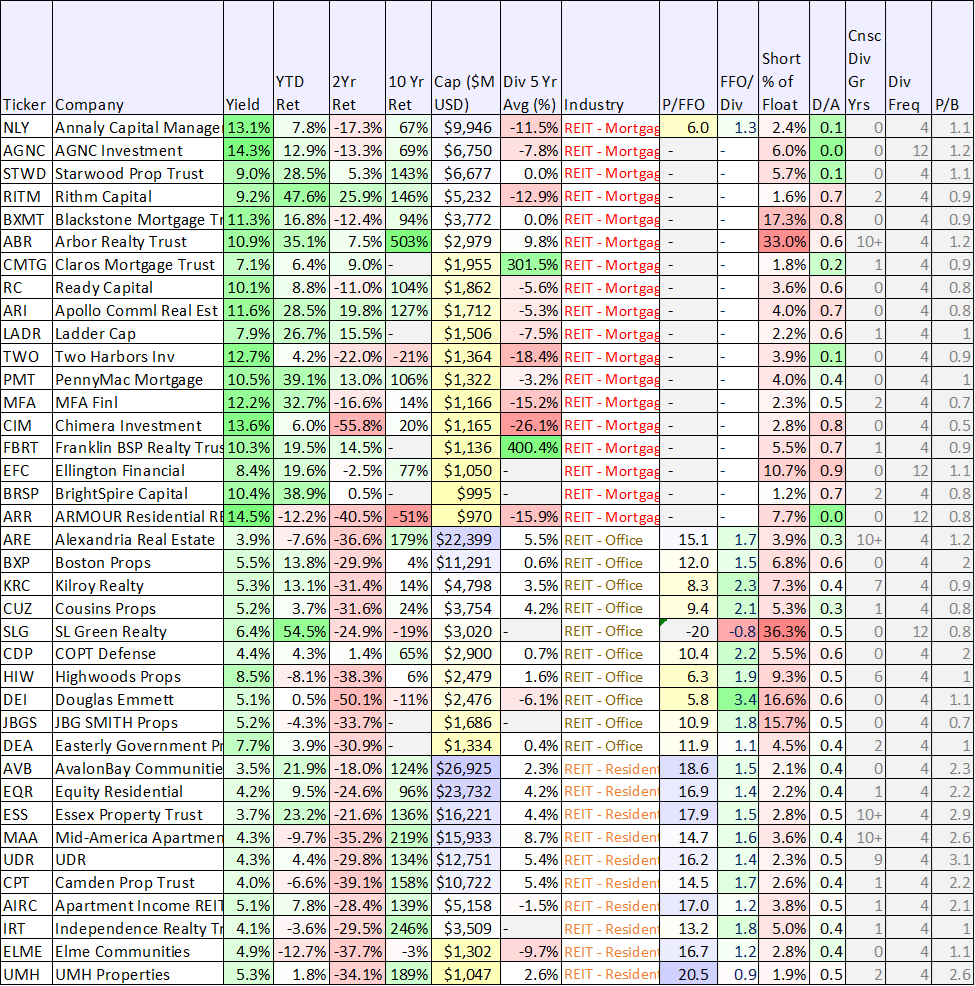

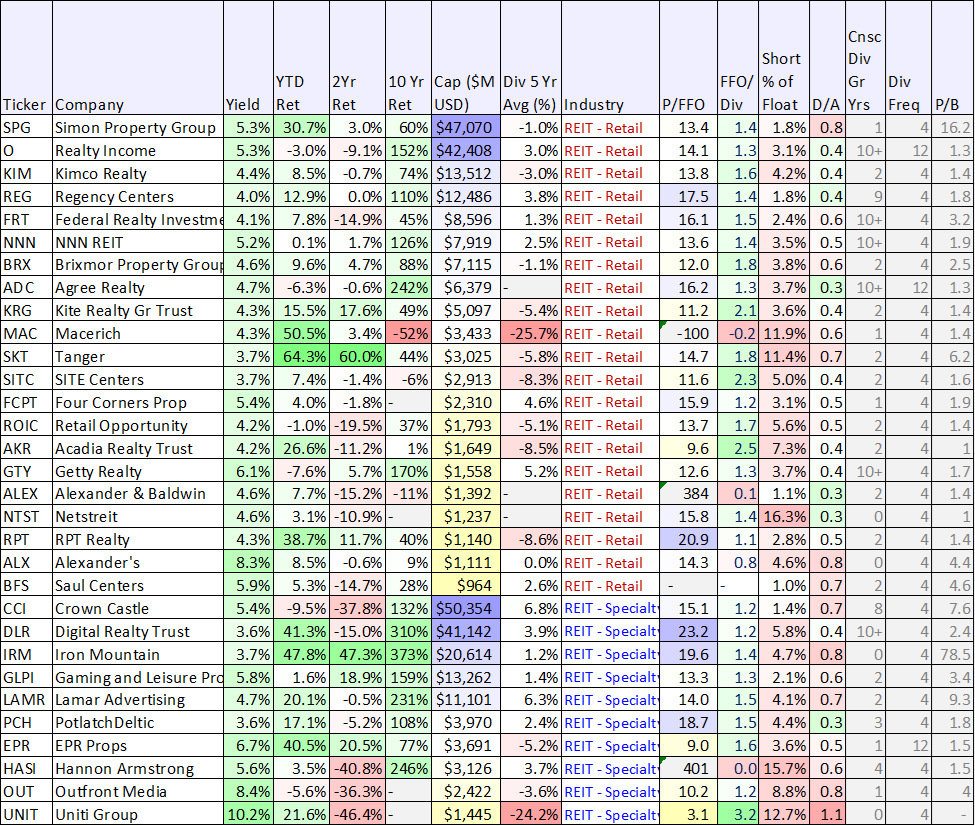

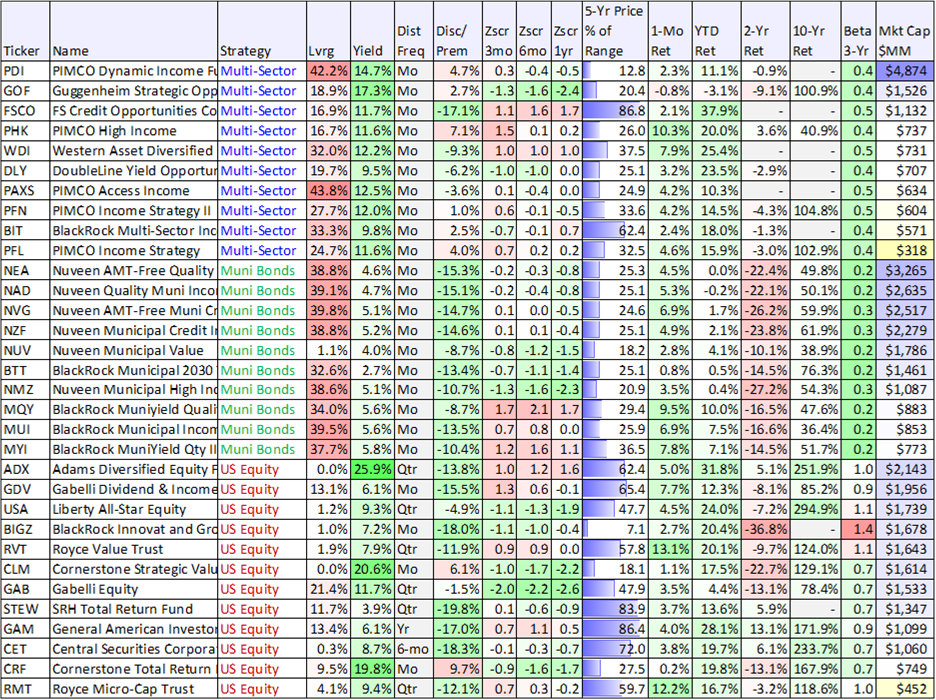

Starting with big-dividend REITs, you can see in the following table that performance for the group has been ugly over the last two years (for some sub-sectors more than others). It was the unusual 1-2-3 punch of rising interest rates, an uncertain economy and the winds of secular change (for example, work-from-home and online shopping) that have all weighed heavily on performance. For example, check out the horrendous 2-year total returns for office and residential properties in the table below.

Data as of 12/28/23, source: StockRover

And while some contrarian investors may be tempted to just buy any REIT at this point, believing a contrarian rebound is imminent, we prefer to be much more selective in our approach. So with that backdrop, let’s get into our top 10 rankings and countdown, starting with a REIT at number ten.

10. Realty Income (O), Yield: 5.3%

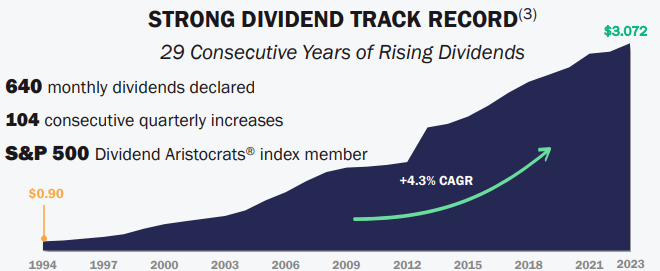

Realty Income, known as “The Monthly Dividend Company,” has paid monthly dividends for over 54 years straight. And the dividends have steadily grown over time. The company generates cash flow from over 13,250 properties, mostly owned under long-term net lease agreements with commercial (mainly retail) clients.

In our view, despite industry challenges (such as ongoing secular shifts in the retail shopping landscape), Realty Income is attractive if you are seeking income growth and and price appreciation potential. For example, the dividend yield is big yet well covered by AFFO (adjusted funds from operations), and the valuation (Price/AFFO) is low by historical standards. Furthermore, we view Realty Income’s “growth through acquisition” strategy as prudent (especially considering it has significantly more financial wherewithal than peers).

We are currently long shares of Realty Income, and expect the share price and the dividend to both rise in the years ahead. You can read our full report on Realty Income here.

Honorable Mention:

Not officially in our top 10 ranking, we also would like to highlight another popular REIT that is worth considering.

*AGNC Investment Corp (AGNC), Yield: 14.3%

We’re including AGNC Investment Corp as an honorable mention only because we do NOT own shares (we generally stay away from mortgage REITs), but the recent opportunity has been particularly compelling considering the current wide spreads (juicy yields) on agency mortgage backed securities (the major component of this mortgage REIT’s holdings. Plus, the price-to-book value is reasonable as well (see our earlier REIT table data). We recently wrote up AGNC in detail for our members, and you can access that report here.

9. British American Tobacco (BTI), Yield: 9.8%

British American Tobacco already offered a big yield and attractive value-versus-the-price, but following this month's news of a $31.5 billion non-cash impairment (mostly related to U.S. Combustible products), the price fell, and now the value-versus-the-price and the dividend yield are both even MORE attractive. We've updated our position in BTI (in our High Income NOW portfolio) from 1.0% to 2.5% following the latest price decline, and you can read out latest full report on BTI here.

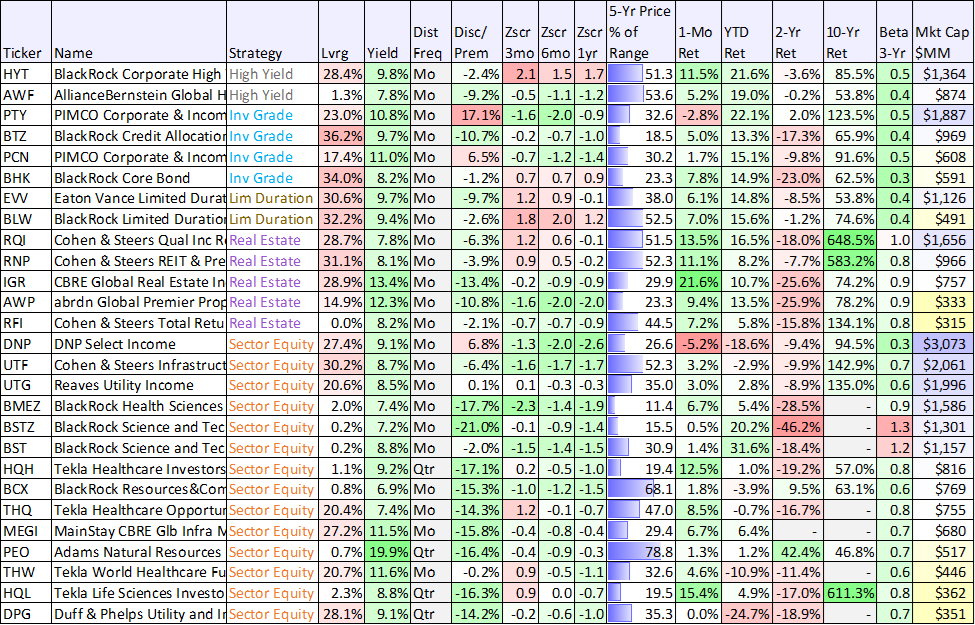

50+ Top Big-Yield CEFs

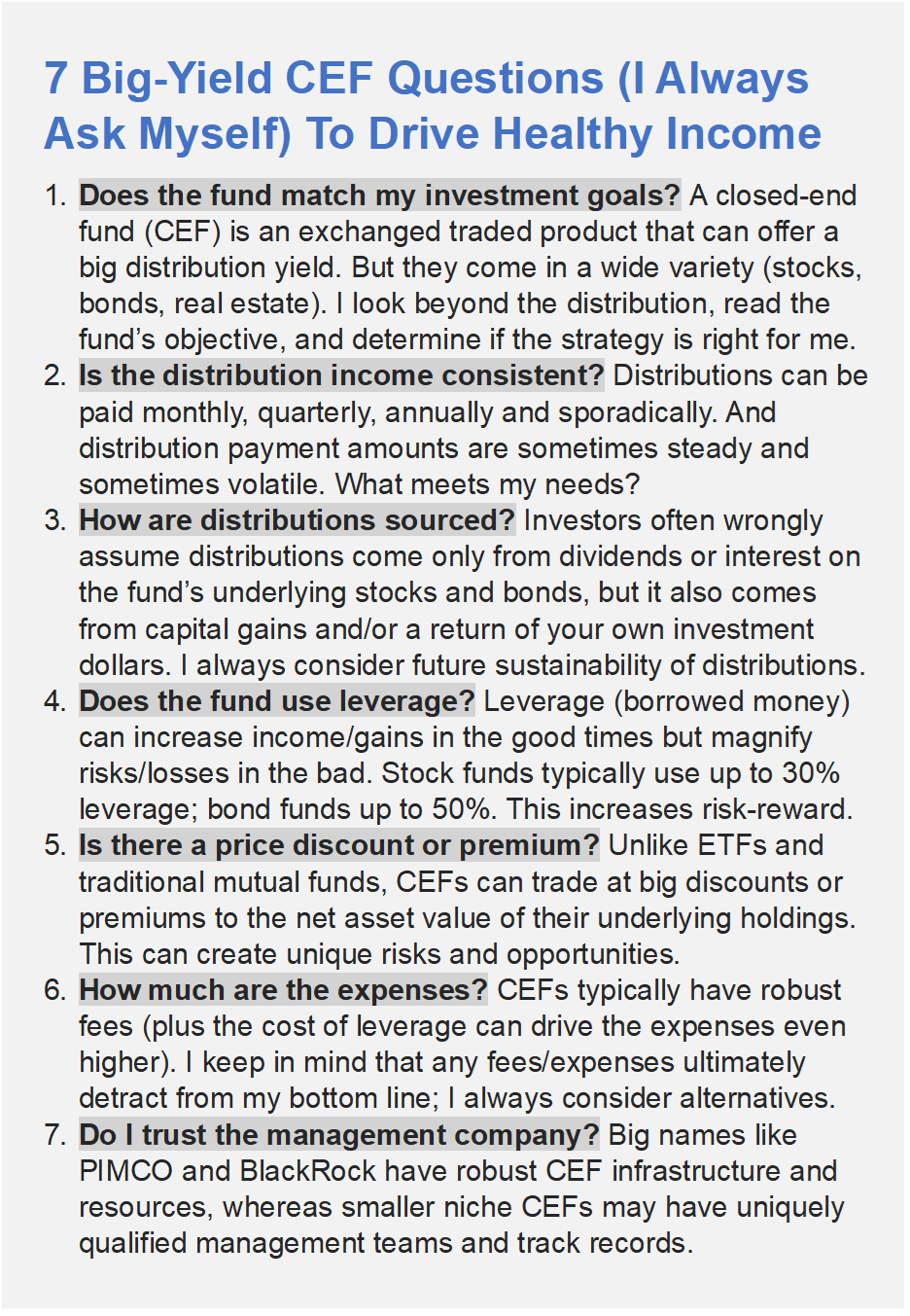

Business Development Companies (BDCs) are often another income investor favorite because of their big yields and instant diversification (they are funds, and thereby hold many individual positions within). Interestingly, CEFs can also present increased risks and opportunities based on the large premiums and discounts (versus net asset value) as you can see in the following table (we generally greatly prefer to buy things at a discount, but not always).

Data as of 12/28/23, source: StockRover and CEF Connect

You likely recognize many of the names from the above list. But before getting into the specific CEFs we like (and own), here are a few important CEF questions we always ask before investing.

So with that information in mind, let’s get into a specific top CEF idea from the list.

8. Cohen & Steers Quality Income Realty (RQI), Yield: 7.8%

As mentioned, REITs offer an impressive contrarian opportunity right now, considering interest rate hikes have slowed (and may reverse). What’s more, select REITs are particularly attractive, and the management team for this particular closed-end fund has established an attractive portfolio (you can view RQI’s recent top 10 holdings below).

What’s more, this fund trades at an unusually large discount to NAV (-6.3%, see our earlier CEF table, especially the negative z-scores—a good thing from a contrarian standpoint). We currently own this fund in our High Income NOW portfolio, and have written about it in the past here.

7. D&P Utility and Infrastructure (DPG), Yield: 9.1%

Sticking with our CEF theme, this $400 million dollar fund, managed by industry stalwart (Duff & Phelps) holds 44 positions, consisting mainly of utilities sector (63%) and energy stocks (25%). It has long been an income-investor favorite until this year as utilities stocks have been the worst performing sector, and a related distribution rightsizing has driven investors away in hoards. We view this as an attractive “buy low” contrarian opportunity (considering the quality of the fund’s holdings).

You can read our recent full report on DPG here, and (as members know) we did purchase shares of DPG in late September.

Municipal Bond CEFs

Worth mentioning, you may have noticed the deep discounts and historically low prices on municipal bond CEFs in our earlier CEF table. We’ll have more to say about these muni-CEFs when we get into the top 5, but just know that their income payments are generally exempt from federal income taxes (a good thing—especially if you’re in a high tax bracket) and thereby making the “tax equivalent yields” even more attractive. Muni bond CEFs offer a special opportunity right now.

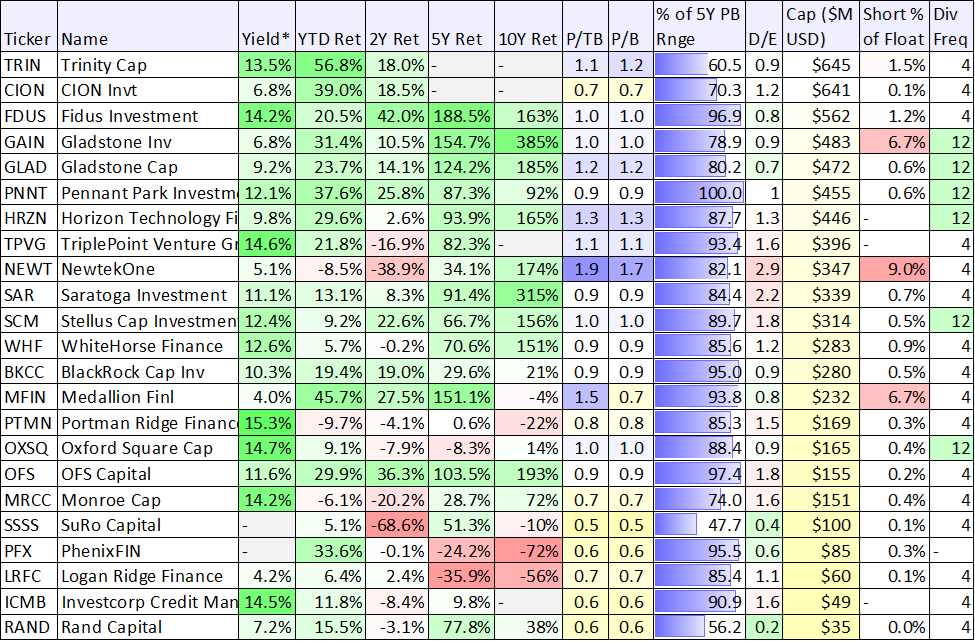

40+ Big-Yield BDCs

BDCs are another income-investor favorite because of their big steady dividend payments. Generally, BDCs provide financing (mostly loans) to smaller middle-market sized companies. And BDCs make money on the spread between their cost of capital versus the higher rate at which they lend capital to other companies.

For additional background, here is what we wrote in our previous report about BDCs:

For some high-level background, BDCs were created by Congress in the 1980s as a way to help small businesses (middle-market sized) get access to capital. BDCs invest in businesses by providing them debt and sometimes taking an equity position. BDCs can generally avoid paying corporate taxes by paying out most of their income as dividends (you generally still have to pay taxes on the dividends you receive from BDCs—if you own them in a taxable account).

BDCs are subject to a variety of other stipulations. For example, they are regulated by the SEC under the Investment Company Act of 1940, their leverage is limited to approximately 2:1 debt/equity (unless an SEC exemptive order exists to exclude SBA debt) and investments are required to be carried at fair value. The majority of the board of directors must be independent, they offer managerial assistance to portfolio companies and they are subject to comprehensive disclosure requirements under the 1934 Act.

And as you can see in the following table, BDCs have performed a lot better than the REITs (we reviewed earlier) in terms of total returns over the last two years.

Data as of 12/28/23, source: StockRover

You likely recognize many of the names in the above table. Also worth mentioning, you can see the price-to-book value for each BDC (this is a common high-level BDC valuation metric, but of course there is a lot more to analyzing a BCD than simply its P/B ratio).

6. Ares Capital (ARCC), Yield: 9.6%

When it comes to BDCs, Ares Capital is the biggest ($11.2B market cap) and one of the most trusted. And its investment portfolio is well-diversified across market sectors and industries.

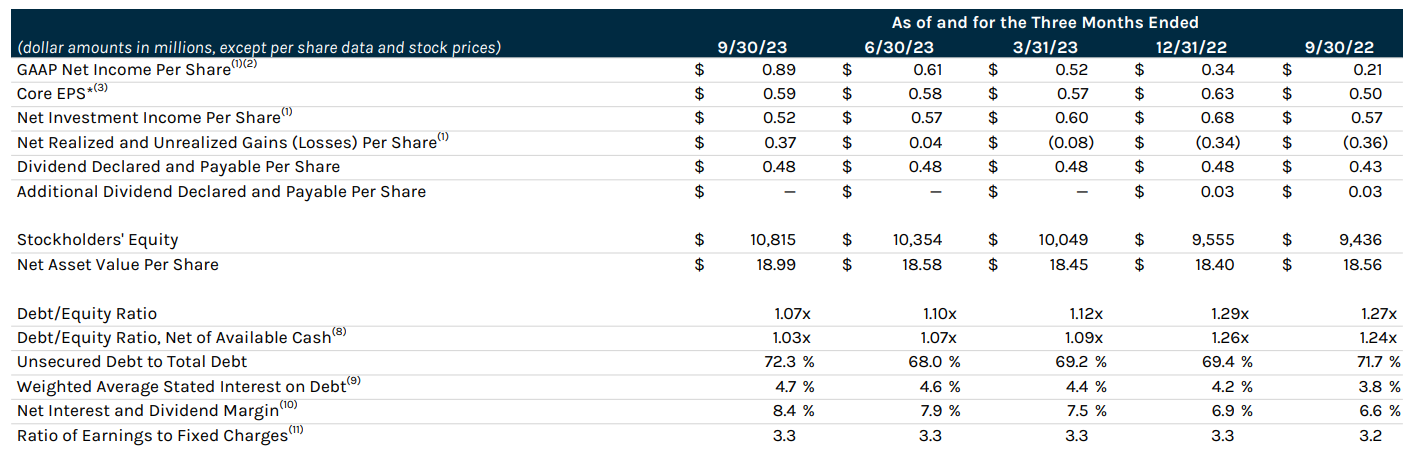

As you can see in the following table, Ares dividend continues to increase, and it is well covered by net investment income. Further still NAV continues to grow (a sign of strength and health).

We currently own shares of Ares, and we recently wrote it up in great detail here.

The Top 5

The remainder of this report is available to members only, and it can be accessed here. The top 5 actually includes 8 extremely attractive opportunities when you count one honorable mention and part a and b of two of the rankings. We also review how they fit into our prudently concentrated High Income Now Portfolio (28 holdings, 9.8% aggregate yield, much of it paid monthly).

The Bottom Line

If you are an income-focused investor, the high-income space currently offers some particularly compelling opportunities, such as those highlighted in this report (i.e. select REITs, BDCs, CEFs and more). It is the combination of subdued interest rate volatility (and potential rate cuts in 2024) and some overly negative investors that are creating many of these select big-yield contrarian opportunities. It is a great time to be a big-yield investor.

Overall, we believe disciplined goal-focused long-term investing will continue to be a winning strategy, and you can view how all of these select opportunities fit into our prudently concentrated High Income Now Portfolio here.