If you like big income, CEFs are worth considering. In this report, we share data on over 100 big-yield CEFs (sorted by category), and then rank our five favorites (starting with number five and counting down to our top ideas).

100 Big-Yield CEFs

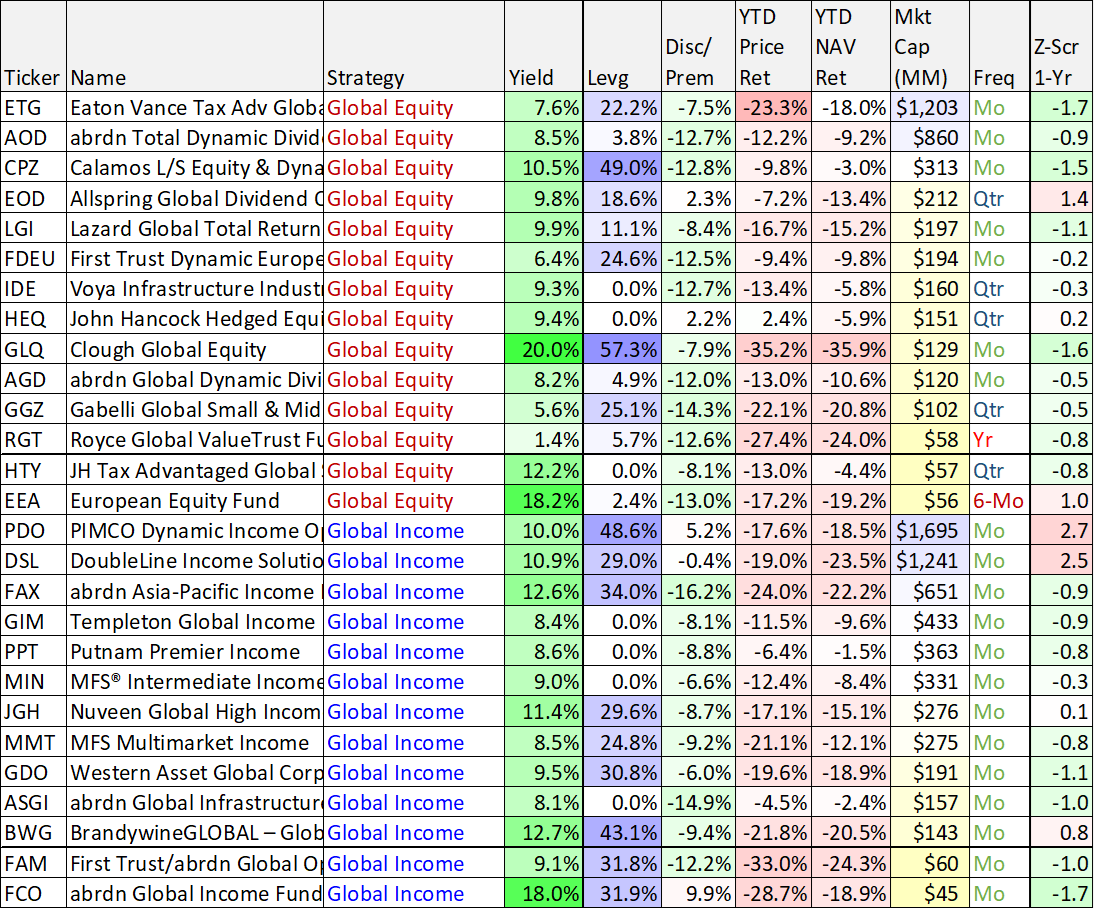

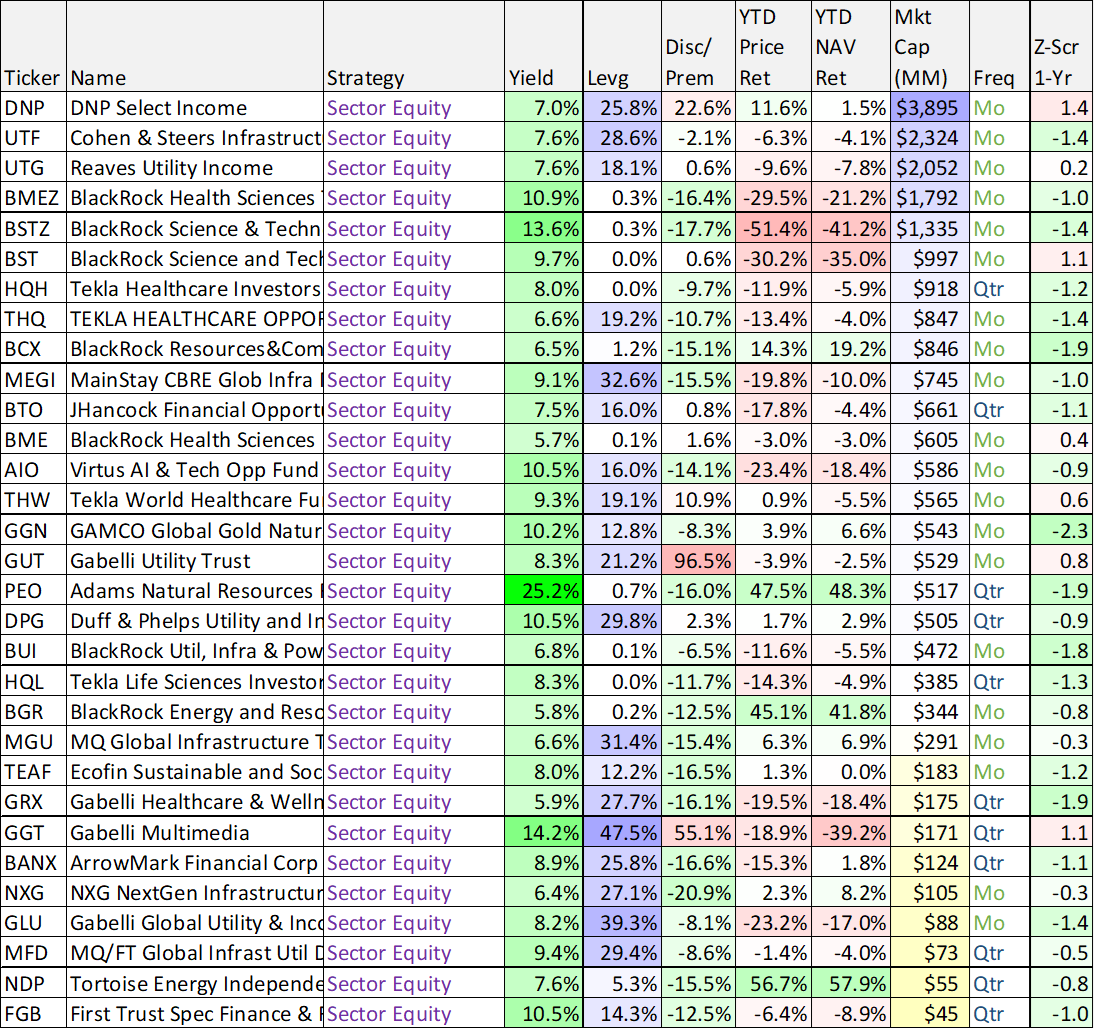

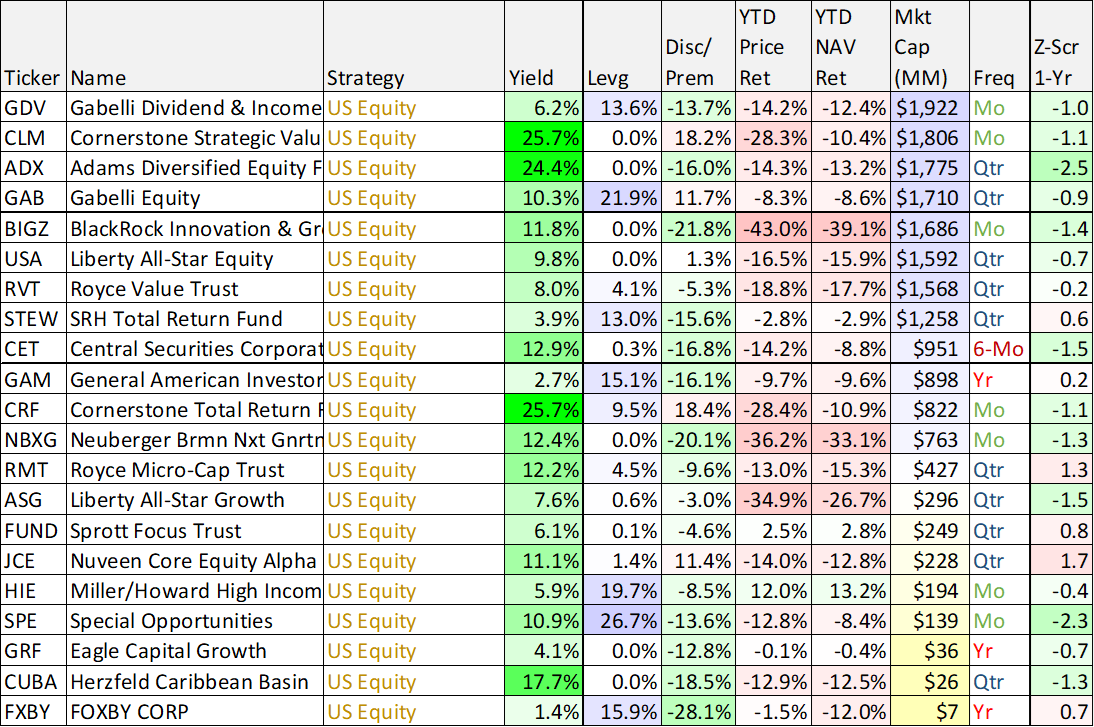

For your reference, the following table includes over 100 big-distribution CEFs, including important metrics like leverage, discounts/premiums and more. The list is organized by CEF strategies and then market caps. You likely recognize at least a few of your favorites on the list.

data as of Friday 9-Dec-22, source: CEF Connect

Our Top 5 Favorite CEFs

With that data backdrop in mind, lets get into some specific CEF opportunities, counting down our top 5 favorites.

5b. Reaves Utility Income Fund (UTG), Yield: 7.6%

If you like big monthly income and lower-share-price-volatility, you might want to consider the Reaves Utility Income Fund. For starters, it invests mostly in the Utilities Sector (common stock, preferred stock and debt), and the Utilities sector is knows for its lower volatility than other sectors of markets. Utilities stocks also generally pay higher dividends than other sectors, so this helps UTG keep its yield high with less leverage (or borrowed money) than some other funds.

Also important to note, UTG is concentrated. Unlike other CEFs that can hold hundreds (or even over 1,000) of individual securities, UTG currently holds ~44 securities. This allows the fund to pursue strong performance by putting more weight into top ideas.

Further, UTG focuses on tax-advantaged income (qualified dividends, which can reduce your tax bill if you hold UTG in a taxable account).

Also, UTG’s monthly distributions (which have steadily grown over time) generally consist of investment income and long-term gains (not short-term gains or return of capital). It’s good to avoid short-term gains (because they can be taxed at a higher rate) and to avoid ROC (return of capital) because it can reduce the cost basis on your investment so you get hit with a bigger capital gains tax when you do sell your shares.

If you are looking for big, steadily-growing, monthly income sourced from a steady sector of the market and currently trading at only a very small premium to NAV, UTG is attractive and worth considering.

5a. Adams Diversified Equity Fund (ADX), Yield: 7.1%

Incredibly, ADX has been paying dividends to investors for over 80 years straight, and it is on track to continue doing so in a very healthy way. For starters, it currently trades at a large discount to NAV (slightly larger than usual) as investors have been averse to stocks (it is actively diversified across US equity sectors), thereby creating a potentially lucrative contrarian opportunity. Also, ADX doesn’t use leverage (making it less risky) and it has a lower total expense ratio than most CEFs (currently ~0.54%). Importantly, ADX pays three smaller distributions in quarters one through three ($0.05 each this year), and then a larger year-end distribution in the fourth quarter ($0.92 this year). This cadence causes all kinds of challenge for data sources, and they often misreport ADX’s distribution (both over and under the actual). In aggregate, ADX will deliver $1.07 in total distributions for 2022, thereby offering an annualized yield of 7.1% (based on its current $14.95 per share). You can read our previous full report on ADX here.

4. DoubleLine Yield Opportunities (DLY), Yield: 10.3%

With a big juicy yield (paid monthly) and trading at an attractive discount to NAV (-10.7%), DLY is hard to ignore. DLY is a relatively new fund (launched in 2020), it invests in bonds (many of them high-yield) with the objective of high total returns and with an emphasis on current income. Credit spreads are somewhat elevated currently, thereby driving the price of this fund lower and creating potential price gains as markets recover. The fund is managed by famous bond investor, Jeffrey Gundlach. It also has relatively low interest rate risk (duration was recently only 2.46), which can be a good thing in a rising interest rate environment. Further still, the income has been driven from the income on the underlying securities (not necessarily capital gains or ROC), which we consider attractive. If you are looking for big steady income with the potential for healthy price appreciation, DLY is worth considering.

The Top 3:

Our top 3 big-yield CEFs are reserved for members only, and you can access the report here. The top 3 actually includes four ideas, two bond funds and two stock funds. We currently own two and are considering the third (and we’ve owned the fourth in the past). If you are looking for steady big income and price appreciation potential, these CEFs are absolutely worth considering.

The Bottom Line:

CEFs are an attractive option for income-focused investors, and we believe the top ideas on this list are highly compelling. Just remember to keep your own personal goals as the top priority when selecting investments. Prudently-diversified, goal-focused, long-term investing has been a winning strategy throughout history, and it will be this time too!