We initiated a new position in this rapidly growing fintech company. This article is a quick note explaining why, including its high growth rate and large market opportunity. If you are a low-volatility, income-focused investor—this report is NOT for you. However, if you are looking to add some powerful long-term growth—fintech continues to present attractive opportunities (in this case, to disrupt traditional finance and banking), and this stock is well positioned to benefit.

Upstart (UPST)

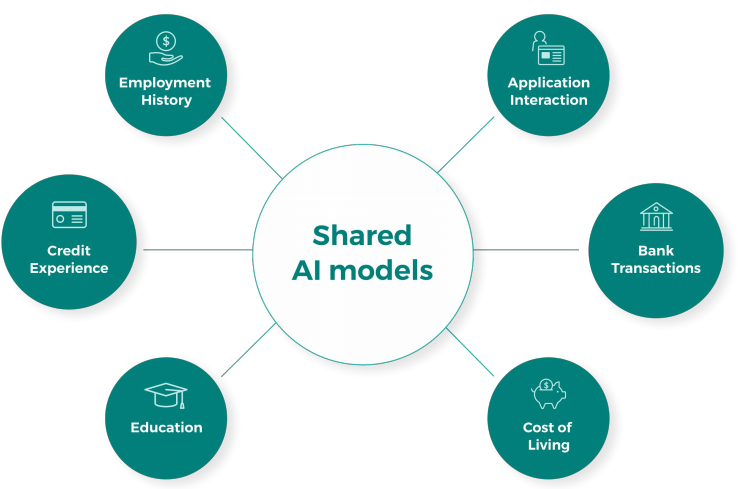

We initiated a small new position (~1%) in Upstart (UPST) in our Disciplined Growth Portfolio. Upstart is an Artificial Intelligence (“AI”)lending platform that partners with banks to “improve access to affordable credit,” and it is the only major online lender that currently goes beyond the traditional FICO score in making lending decisions.

According to the company, here are a few key highlights and advantages of Upstart:

A leading AI lending platform with scale, rapid growth and profits.

Two-sided business – connects consumers to AI-enabled bank partners .

Growth driven by continual improvement of AI models.

71% of loans instantly approved and fully automated.

97% of revenue – fees from banks or servicing with no credit exposure.

GAAP net income profitable.

Rapid Growth, Large TAM

One of the most attractive things about Upstart is its combination of rapid growth and its large total addressable market opportunity (to keep growing rapidly). Here is a look at the company’s rapid revenue growth in recent quarters.

And here is a graphic showing the company’s large total addressable market opportunity. Upstart has only just begun to tap this massive opportunity.

About the Business:

Upstart generates the majority of its revenue from referral fees (~60% of total revenues). Specifically, Upstart charges banks referral fees of 3% to 4% (of the principal loan value) when a lender opts to use that bank. Not only is this an attractive revenue source, but it is low risk because Upstart is not making the loan—the bank is (therefore the bank has all the credit risk).

Another significant portion of Upstart total revenue (~30%) comes from platform fees. Specifically, Upstart charges banks ~2% of the loan amount when the bank uses Upstart’s platform.

The remaining ~10% of total revenue comes from other servicing fees (and a small amount of interest income).

Valuation:

Upstart currently trades at an expensive price to sales ratio compared to peers. However, the valuation becomes less expensive when compared to Upstart’s outsized growth opportunity.

For example, Upstart’s P/S ratio is above peers (see above), but so is its expected growth. And on only 1-year forward P/S (see below) that valuation ratio declines.

Given the disruptive nature of Upstart’s business, combined with its high growth and large TAM, we believe the valuation remains attractive for long-term investors. The expectation is that the Upstart lending platform continues to become more mainstream and it continues to gain wider acceptance from mainstream lending institutions. Especially, as mainstream banks look to stay competitive with emerging financial technology companies, Upstarts offers an attractive business opportunity.

Leadership:

Worth mentioning, Upstart was incorporated in 2012, and it is run by co-founder and CEO, Dave Girouard. Dave was previously a big-wig at Google Enterprises. He also worked at Apple and Booz Hamilton. Having a founder-led business in another attractive quality of Upstart, in our view.

The company’s other co-founder, Paul Gu, runs Upstart’s Product and Data Science team. Again, we like founder-run businesses. Both Dave and Paul (along with other insiders) own a significant portion of the company’s business—attractive (skin in the game).

Risks:

Concentration risk is a factor for Upstart. Specifically, Credit Karma accounts for almost 1/2 of all loan origination so far in 2021. As the non-FICO fintech lending space expands, the hope is that this reliance will decline. Also important to note, the direct-to-Upstart revenue channel is growing rapidly (another very good sign).

Another risk for this stock is simply high volatility. Rapid revenue growth companies can experience significant short-term price volatility. However, we believe the long-term growth potential greatly outweighs the short-term volatility risks.

Conclusion:

Overall, Upstart is an attractive long-term business with the potential to grow dramatically in the years ahead. If you are a low-volatility-risk high-income investor—Upstart is NOT for you (it pays zero dividend and the shares are volatile). However, if you are a patient disciplined long-term investor, these shares are worth considering for a spot in you long-term prudently diversified investment portfolio.