Palantir is a software company, that is growing rapidly, and it has a massive total addressable market. It provides big data analytics solutions (ranging from data mining to visual analytics), on a single consolidated platform, thereby enabling informed decision-making. The company is having great success landing and expanding government agency contracts, but is also recently attempting to diversify into enterprise-grade commercial organizations too. In this report, we analyze Palantir’s business model, its market opportunity, financials, valuation, risks, and finally conclude with our opinion on investing.

Overview:

Co-founded by renowned tech-entrepreneur Peter Thiel in 2003, Palantir began operating as a big data analytics infrastructure provider to federal agencies including the US Department of Defense and the Central Intelligence Agency (CIA). The analytics platform assisted these agencies in making informed, real-time decisions in counterterrorism and related operations by reinforcing a blended data-driven and humanistic approach. To diversify its customer base, the company launched “Palantir Foundry” in 2016, a software platform targeted towards commercial businesses.

Palantir follows a subscription-based business model which helps in generating recurring and predictable cash flows. The company conducts its business under two operating segments namely “Government” and “Commercial”. Under the government segment, it sells its flagship software offering “Palantir Gotham”. Gotham consolidates and cleanses structured and unstructured data and makes sense of the data using Artificial Intelligence (AI) and Machine Learning (ML) algorithms to draw human-readable insights. This enables front-line analysts to make well-informed counterterrorism and related decisions. This is company’s primary segment and accounted for 61% of total revenue in Q1 2021.

Under the commercial segment, it sells “Palantir Foundry” to large commercial businesses. Foundry helps organizations in making informed data-driven business decisions including decisions around improving production and manufacturing efficiencies, operational costs, and many other areas. It caters to customers across business verticals such as healthcare, aerospace and financials. Approximately 39% of Palantir’s top-line is generated in this segment.

Geographically, Palantir derives more than half of its revenue from the US.

Large and Growing Total Addressable Market (TAM)

According to the company’s estimates, its total TAM for FY 2020 stood at $119B, consisting of $63B TAM for the government segment and $56B for its commercial segment. The company’s government segment TAM assumes a modest portion (5%) of total spending in building software and consultancy services across government related functions including defense, health, and education, for example. The commercial segment TAM is derived by considering 6,000 businesses across the globe with more than $500M in annual revenue. We believe that these estimates are conservative considering global digital transformation taking place across government and commercial sectors. As per Markets and Markets, the Big Data Analytics market is expected to grow at a 5-year CAGR of 10.6% to reach $197B by 2025. This leaves a lot of room for Palantir to grow.

Positive steps towards scalability, adapting to commercial segment needs

Despite a large and growing addressable market, Palantir’s customized platform built exclusively for a single client has raised some concerns regarding scalability of its analytics infrastructure. Unlike other Software-as-a-Service (SaaS) providers that offer plug-and-play big data analytics solutions, Palantir has a team of Forward Deployed Software Engineers (FDSEs) that spend considerable amounts of time working with customers to build a platform exclusively for them. These personalized solutions have enabled Palantir to capture large, long-term contracts with governments and large corporates. Having said that, the highly customized solutions have proven to be a roadblock in its vision to expand its presence across SMBs and middle-market businesses as these businesses require quick, cost-friendly, and easy-to-use data analytics solutions. In order to improve the scalability of its platform, the company is now adopting a more modular approach for its Foundry platform with better data integration, mobile offerings and no-code applications, to name a few. Palantir has also made several efforts including the addition of more channel partners (such as cloud service providers and system integrators) to help expand its reach in the commercial segment. In fact, Palantir partnered with IBM (IBM) last quarter and generated its first deal within 16 days of the launch.

Palantir has also recently developed its third “silent platform,” “Palantir Apollo,” in its effort to transform its business to SaaS (instead of SaaS plus consultancy), thereby improving scalability further and reducing the costs to customers by offering real-time updates remotely. This is another step in the right direction.

Source: Company’s 10-Q, Palantir Blogs

Large and sticky customer base, albeit still concentrated

Palantir follows a subscription-based business model with a dollar-weighted average contract duration of 3.7 years making cash flows more predictable. In fact, its top three customers have stayed with the company for an average of 4 years as of Q1 2021. Having said that, customer concentration is still a major risk to keep an eye on, as its top 3 customers accounted for 20% of total revenue for Q1 2021, whereas the top 20 customers accounted for 60% of top-line on a TTM basis. Moreover, its government segment (which includes numerous related agencies) contributed almost 61% of total revenue for Q1 2021 leaving company with no room for errors as a problem with one agency can negatively impact its relationship and contracts with its other governmental agencies. It is important to note that, while the company’s customers enter into long-term contracts ranging from one to five years, early termination of these contracts is possible in instances such as data leaks or poor deployment.

Strong top-line growth momentum, led primarily by outperforming government segment

Palantir reported total revenue of $341M for Q1 2021 representing a strong 49% growth on a YoY basis. This growth was primarily driven by increased adoption of the company’s products by existing customers. The government segment grew 76% YoY to $208M with existing government customers representing over 99% of the growth in this segment. Its commercial segment also grew 19% YoY to $133M with almost 88% growth in this segment coming from its already existing commercial customers. It is important to note that despite the company’s recent efforts to diversify its customer base, the commercial segment revenues have delivered an average YoY growth of almost 20% in last three quarters, whereas the government segment revenues have grown 76% YoY, during same period. The government segment now contributes 61% of the overall revenue of the company as compared to just 48% in FY19 and 43% in FY18. Palantir expects $360M in total revenue in Q2 2021 which represents a growth rate of 43% YoY. While the overall growth has been strong, we are a bit concerned about the company’s so far mixed results in driving success in the commercial segment.

Robust liquidity and positive FCF enough to fund business investment needs

Palantir recorded $2.4B in cash and cash equivalents for Q1 2021 whereas its outstanding debt stood at just $198M. It reported $151M in adjusted free cash flow for Q1 2021. This robust liquidity will come in handy as the company plans to expand its commercial segment operations both organically and through inorganic acquisitions.

Palantir reported $117M in adjusted operating income in Q1 2021 as compared to an operating loss of $16.1M in the same quarter last year. Operating margins significantly improved from -7% in Q1 2020 to 34% in Q1 2021. While internal investments including development of Palantir Apollo and its module-based strategy helped the company in achieving more productivity, with a majority of this margin improvement being driven by increased revenue generation from existing clients that required only marginal customer acquisition investments. It remains to be seen how the company’s margins and FCF evolve as it starts generating a larger portion of revenue from new customers.

Premium valuation, despite price decline

Within a few months of its listing last year, Palantir shares soared nearly 4x, before reverting lower, currently trading at around $25, as you can see in the chart below.

source: Ycharts, data as of 17-Jun-21

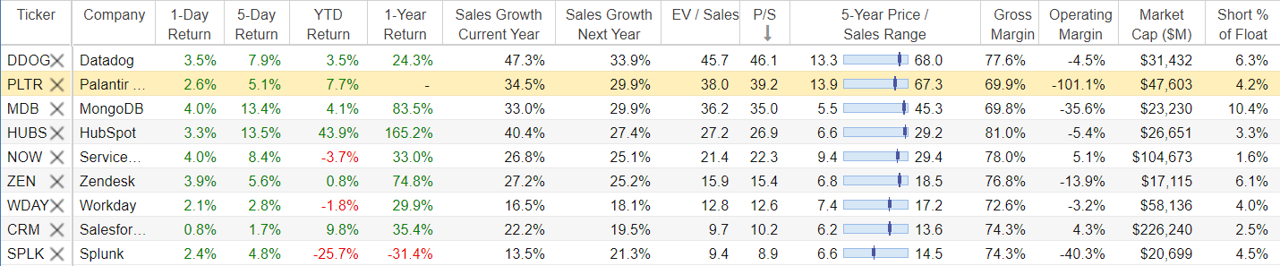

And on a price-to-sales basis, these shares look expensive relative to other high-growth software companies.

source: StockRover, data as of 17-Jun-21

However, this is where forcing yourself to ignore Wall Street’s typical short-sightedness is important. Recall Palantir’s conservative $119 billion TAM estimate (which by the way is also growing as the company expands) and compare that to its roughly $1.2 billion in revenues over the last 12 months. This leaves a ton of room for growth, which PLTR continues to successfully achieve; and recall also the stickiness of the company’s subscription business and its longer-term contracts. And for emphasis, recall the company is expanding into non-government work at an accelerating rate and with new products/platforms (Foundry and into Apollo) and while Palantir’s government work is growing even faster.

Overall, Palantir is a very high growth company with a very long runway for continued high growth for many years into the future. Of course, there are risks to Palantir’s growth, as we will review in the next section.

Risks:

Data breach related risk: Palantir derives most of its revenue from government agencies. This has led the company to work with highly confidential sets of data. Any bug in its platform architecture can cause this data to leak leading to a downgrade of its products and loss of existing and potential customers.

Customer-concentration risk: Palantir has a total of 149 customers as of Q1 2021. The fact that it derives almost 60% of total revenue from its top 20 customers and 20% of total revenue from its top 3 customers leads to high revenue concentration. Loss of any one of its big customers can significantly impact its top line and its margins.

Non-government growth risk: Palantir is making efforts to expand increasingly into no-government contract work. And while revenues are growing they are not yet as big as the government segment, not growing as fast, and face intense competition.

Conclusion:

Palantir’s current valuation is not cheap compared to peers, but it is inexpensive relative to the company’s massive long-term growth potential. Of course there are risks (as described in this report), but in our view those risks are greatly outweighed by the potential rewards (as in long-term compound growth), especially when you own Palantir within a prudently concentrated portfolio of additional top growth stock ideas (as we do). We don’t necessarily expect Palantir shares to magically quadruple over night, but over the long-term—there is a good chance these shares are eventually going to do a lot more than quadruple.